How to use audit trail in QuickBooks Desktop?

To turn the QuickBooks Audit Trail feature, follow the steps given below:

- Open the QuickBooks software and select the Edit menu.

- Choose the Preferences command from the Edit menu. A Preferences dialogue box will appear on the screen.

- From the left edge of the Preferences dialogue box, use the icon bar to select the icon for Accounting Preferences. ...

- Click on the Company Preferences tab.

How to generate trial balance report in QuickBooks?

- In your QuickBooks Online Account go to the Hamburger icon and select Reports.

- Enter " Trial Balance" on the search box. Here's how it looks like.

- If you want to have little modifications, you can click on the Customize button.

- Click Run Report .

How to report tips in QuickBooks?

- From the Lists menu, select Payroll Item List.

- Double click on the tips item.

- Click Next till you reach the Tax Tracking type page.

- See which forms the item affects and how it shows on those forms. Check out the sample below.

How to view history of all transactions in QuickBooks?

- Select the Gear icon at the top.

- Choose Account and Settings.

- Select the Billing and Subscription tab.

- Choose the View Payment History hyperlink.

Can you turn off the audit trail in QuickBooks?

Select the option to remove all of the audit trail information. If you only want to remove the audit trail, leave all of the other options cleared. Otherwise, select any additional lists, accounts, vendors or employees you want to have removed.

What is the purpose of audit trail in login?

Audit trails are used to verify and track all kinds of transactions, work processes, accounting details, trades in brokerage accounts, and more.

What should an audit trail include?

An audit trail should include sufficient information to establish what events occurred and who (or what) caused them. In general, an event record should specify when the event occurred, the user ID associated with the event, the program or command used to initiate the event, and the result.

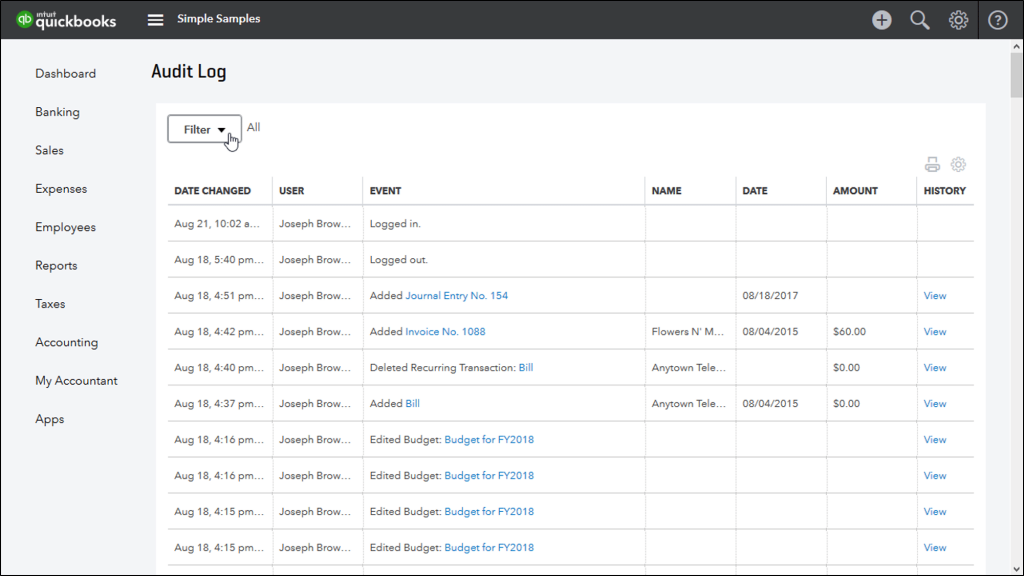

What is audit history QuickBooks?

The Audit History serves as a record of all the changes made on a specific transaction.

What is audit trail with example?

What Is an Audit Trail? An audit trail is a step-by-step record by which accounting, trade details, or other financial data can be traced to their source. Audit trails are used to verify and track many types of transactions, including accounting transactions and trades in brokerage accounts.

What are the disadvantages of using an audit trail?

The main disadvantage of audit trails is the extra work required to maintain them. This investment may be difficult to support in the case of a smaller and less-profitable business.

How do I use the audit trail in Quickbooks?

Click Reports at the top menu bar and choose Account & Taxes. Select Audit Trail. On the report screen, click Customize Report. Go to the Filter tab and search for Transaction type.

What are the four different types of audit trails?

Different types of internal audits include compliance, operational, financial and information technology audits.

What is the difference between audit trail and logging?

Logs tell you what an actor (user or entity) did. This is enough if you want to monitor who did what when. Audit Trails tell you what sequence of actions occurred in order for a certain state to be created. This is what you want if you need to confirm how and why the system or the data is in a certain state.

How do you turn off Audit Trail in QuickBooks desktop?

Remove Audit TrailGo to the File menu.Hover over Utilities and then pick Condense Data.From the Condense your company file window, select the Keep all transactions, but remove audit trail info to date radio button.Click Next, then follow the on-screen instructions.

Can the IRS ask for QuickBooks file?

You can attempt to avoid handing over the entire QuickBooks data file and instead provide the requested info in Excel spreadsheets. If you refuse to give them the requested info in an alternate format, like a spreadsheet, the IRS may subpoena the entire data file.

How do I read the Audit Trail report in QuickBooks desktop?

If you are working with QuickBooks Desktop version, then you need to access the audit log report by following these three steps: Firstly, select the Reports option. Now, click on Accountant and Taxes. And lastly, select Audit Trail.

What is the purpose of audit trail and logging generate evidence for actions?

They are used to authenticate security and operational actions, mitigate challenges, or provide proof of compliance and operational integrity. Numerous industries use versions of an audit trail to provide a historical record of progression based on a sequence of events.

What is the purpose of audit?

The purpose of an audit is the expression of an opinion as to whether the financial statements are fairly presented in conformity with appropriate accounting principles.

What is the use of audit trail in Salesforce?

Audit Trail allows security admin users to view Marketing Cloud access and activity records. Receive Audit Trail records either through Marketing Cloud Automation Studio data extracts or through REST API extracts. Retrieve Audit Trail information periodically for use in your own internal system tools.

Why are audit logs important?

Whereas regular system logs are designed to help developers troubleshoot errors, audit logs help organizations document a historical record of activity for compliance purposes and other business policy enforcement.

What is audit trail in QuickBooks?

The Audit Trail also reveals the User ID under which the entry, deletion or modification was made. The Audit Trail is a report built in the QuickBooks ReportCenter– all you have to do is click a button to generate the report.

How long after a transaction is prepared can you change the disbursement date?

For example, a company may have an expectation that no changes be made to a disbursement transaction more than 60 days after a transaction was prepared. By calculating the difference between the enter date and the last modified date, we can isolate all disbursements with changes greater than 60 days.

Can I use QuickBooks to detect fraud?

One question posed in the blog was, “So, I can use QuickBooks to prevent and detect fraud?” The answer is a definitive yes. Employers can use the audit log to detect warning signs of fraud, waste and abuse.

Learn more about the audit log

QuickBooks Online records all your financial transactions in your chart of accounts.

Use the audit log

You need to sign in as an admin to access the audit log. Ask your primary admin if you don’t see it.

Learn about users created by QuickBooks

QuickBooks automatically creates specific user profiles to track certain actions in the audit log. If you see a user you don't recognize, it’s most likely one of these. Here are some you might see:

What is audit trail in QuickBooks?

If there are multiple people using QuickBooks, the Audit Trail feature is great. The most common example is when User A modifies or deletes a transaction that had already been reconciled by User B. This breaks the reconciliation, but nobody will notice until the following month when someone tries to reconcile the previous month and the opening balance is off. A discrepancy report will immediately show which transaction was modified or deleted and the audit trail will show that it was User A who did it. This will allow to fix the issue and train User A to not repeat the mistake.

Why is audit trail important?

Needless to say that the audit trail is instrumental in preventing and identifying fraud. The mere fact of making your employees and bookkeepers aware of the existence of the audit trail will already discourage fraud, but if fraud happens, you now have your forensic tool.

Does QuickBooks leave a trail?

The implication is that ANYTHING you do in QuickBooks leaves a trail and can be identified . Which is a good thing in case you ever need to see what your bookkeeper has been doing.

What is audit trail?

Please take note that the Audit Trail is a transaction-based report. We're unable to track the changes made to your items and transactions that do not impact their accounting integrity.

Can you sort audit trail report by user?

As of the moment, there isn't an integrated way to sort your Audit Trail report by the user who entered the transaction.

Can you customize QuickBooks Desktop?

With QuickBooks Desktop, we can also design and personalize your reports to fit your business needs using the Customize feature.

Why does QuickBooks have audit trail?

QuickBooks has an internal Audit Trail record to document any changes made to each transaction in the company file. This can be very useful for your bookkeepers to record users who made changes in their transactions.

How does audit trail affect QuickBooks?

As the number of transactions in your file grows the audit trail grows by a factor of two, resulting in an increase in file size. This slows down the speed of your QuickBooks Desktop, and you may also be compelled to remove the audit trace while sharing your information with the government agencies.

How to import a dancing number in QuickBooks?

First, click the import button on the Home Screen. Then click "Select your file" from your system. Next, set up the mapping of the file column related to the QuickBooks field. Dancing Numbers template file does this automatically; you just need to download the Dancing Number Template file.

How to import a file into QuickBooks?

First of all, Click the Import (Start) available on the Home Screen. For selecting the file, click on "select your file," Alternatively, you can also click "Browse file" to browse and choose the desired file. You can also click on the "View sample file" to go to the Dancing Numbers sample file. Then, set up the mapping of the file column related to QuickBooks fields. To review your file data on the preview screen, just click on "next," which shows your file data.

How to export from QuickBooks Desktop?

You need to click "Start" to Export data From QuickBooks Desktop using Dancing Numbers, and In the export process, you need to select the type you want to export, like lists, transactions, etc. After that, apply the filters, select the fields, and then do the export.

How does Quickbooks help you?

QuickBooks help you to increase the speed of your processor by allowing you to delete the audio files from your QuickBooks files.

What factors contribute to the growing size of QuickBooks company files?

Another factor contributing to the growing size of QuickBooks company files is the accumulation of closed transactions and unused list elements.