Where can I find Reo listings?

HUD Home Store is the listing site for HUD real estate owned (REO) single-family properties. This site provides the public, brokers, state and local governments and nonprofit organizations a centralized location to search the inventory of HUD properties for sale. In addition, registered real estate brokers and other approved organizations can ...

Can a listing agent buy their own Reo listing?

Your listing contract is not with the agent, but with the broker. If the agent wishes to buy it for their own then it is perfectly legal as long as proper disclosures are made to all parties.

Is a Reo the same as a foreclosure?

REOs and FORECLOSUREs are not the same thing, however an REO is only produced as a result of an unsuccessful foreclosure, in which a buyer for the property cannot be found, and so the mortgage lender repossesses the property to sell separately. Which Is Better?

What exactly is a REO property?

Real Estate Owned (REO) is residential property that a lender becomes an owner of after they complete a foreclosure and take possession of the property. As a homebuyer, you might see properties listed as real estate owned, REO, or bank-owned, which all mean the same thing. Below are the facts you must know about buying an REO.

What does REO stands for?

Real estate ownedReal estate owned (REO) is property owned by a lender, such as a bank, that has not been successfully sold at a foreclosure auction. A lender—often a bank or quasi-governmental entity such as Fannie Mae or Freddie Mac—takes ownership of a foreclosed property when it fails to sell at the amount sought to cover the loan.

What happens when you REO?

Once the lender reaches an agreement with the tenants of this REO occupied home, and it is vacated, it can go up for sale. Banks will typically put an REO occupied house up for sale as soon as it's vacant, as to get it off their books quickly.

What does REO mean in appraisal?

What is a Real Estate Owned Property? Real Estate Owned property appraisals necessitate unique parameters in their appraisal report. More specifically, REO properties are acquired by a lending company for the purpose of investment or via foreclosure of mortgage loans.

How do I find REO properties in my area?

8 Ways to Find REO Properties in 2021Use the Local Multiple Listing Service (MLS) The first place you can find REO listings is in the MLS. ... Search on Bank Websites. ... Contact Lenders Directly. ... Public Records. ... Government Agencies. ... Leverage Your Real Estate Network. ... Do a Drive-By. ... Visit the Mashvisor Property Marketplace.

What happens if REO property is occupied?

If the property is occupied, the servicer or REO management company might offer a cash-for-keys deal to induce the tenant or foreclosed homeowner to vacate the home before completing an eviction.

What is reverse REO?

A reverse repo is a short-term agreement to purchase securities in order to sell them back at a slightly higher price. Repos and reverse repos are used for short-term borrowing and lending, often overnight. Central banks use reverse repos to add money to the money supply via open market operations.

What is the value of REO?

REO VALUATION means a valuation of the fair market value of the REO Property, as determined by (i) an appraisal of such REO Property conducted by an appraiser, which appraisal and appraiser meet the criteria specified by FNMA, FHLMC and HUD in connection with the origination of Mortgage Loans and which appraisal was ...

What is a HomeSteps property?

HomeSteps® is the Freddie Mac sales unit responsible for marketing and selling Freddie Mac real estate owned (REO) homes to homeowners and investors. HomeSteps manages every stage of the REO process, from handling title issues after foreclosure to working with local listing agents to facilitate a sale.

What is First Look program?

Launched in 2009, the First Look Program promotes owner occupancy and neighborhood stabilization. Providing individuals, families, and nonprofits with a longer amount of time to find adequate financing should help keep owner occupants living in these homes.

How do banks sell repossessed houses?

How Do Banks Sell Repossessed Houses? After a bank repossesses a property, it has two main ways of selling it. The first option is to hire an estate agent to put it on the open market. Alternatively, the bank may opt to auction the property off.

How do you buy a bank owned home in California?

7 Steps on How to Buy a Foreclosed Home in CaliforniaStep 1: Get Pre-approved for a Mortgage. ... Step 2: Hire a Real Estate Agent (Optional) ... Step 3: Search for Foreclosed Homes. ... Step 4: Submit Offers or Make Your Bid. ... Step 5: Secure Your Property. ... Step 6: Get the Home Appraised. ... Step 7: Close the Sale.

How do I find the power of my home sale in Ontario?

0:002:33Fundamentals: How do I find Power of Sale Properties on MLS®? - YouTubeYouTubeStart of suggested clipEnd of suggested clipSome clients say you know you want power of sales anywhere in Ontario. So you have the interiorMoreSome clients say you know you want power of sales anywhere in Ontario. So you have the interior button if it's a GTA use that if you want to use a map feel free to use the map.

What does it mean to foreclose on a loan?

Foreclosure is a process that begins when a borrower fails to make their mortgage payments. When a home is foreclosed upon, the lender typically repossesses and attempts to sell the house. This happens because mortgage loans are secured by real estate, meaning your home is used as collateral.

What is REO asset management?

What Is an REO Asset Manager? As a Real Estate Owned (REO) asset manager, you handle clients' real estate assets and focus on buying and selling properties. You manage investors' properties and work with real estate agents to ensure your clients earn a profit on their property.

Why do short sales usually occur?

Short sales usually occur when a homeowner is in financial distress and has missed one or more mortgage payments.

What is a HUD home?

A HUD home is a foreclosure where the owner had an FHA loan they defaulted on. The home is then sold by the U.S. Department of Housing and Urban Development (HUD). HUD home sales typically close within 60 days of a winning bid. The sale and closing process on all HUD homes is uniform nationwide.

Why Foreclosure Auctions Don’T Always Work

Many foreclosure auctions fail to bring in any bids. Banks or other mortgage lenders do not set foreclosure prices according to the home's market v...

When Foreclosures Become REO Properties

Once a property becomes an REO, the lender will prepare the house for sale, including removing the occupants, clearing liens on the property, and d...

Making An Offer on A Real Estate Owned Home

Buying an REO is a complex process. You will have to be a savvy negotiator to purchase the home at a price you want.An offer on an REO listing shou...

What is REO in real estate?

Real Estate Owned (REO) is residential property that a lender becomes an owner of after they complete a foreclosure and take possession of the property. As a homebuyer, you might see properties listed as real estate owned, REO, or bank-owned, which all mean the same thing.

Why is it important to get pre-approved for a REO?

But it’s especially important in an REO purchase because you need to be able to close quickly to compete with investors who are often seeking REOs, and because selling banks require a pre-approval letter to even submit an offer on an REO. It’s easy to connect with a local lender to get pre-qualified.

How long does it take to get a response on a REO?

The bank will require that the offer is accompanied by your lender’s pre-approval letter. It used to take a month or more to get a response on an REO offer, but banks have gotten much quicker.

Do REOs sell for less than other homes?

REOs don’t necessarily sell for less than other homes. Banks hire local real estate agents to sell their REOs, which means they’re marketed like any other listing. Banks will negotiate like any other seller, but their local listing agents will manage the negotiations, and their price methodology will be based on comparable sales in the neighborhood. If the home isn’t in good condition relative to recently sold similar homes nearby, that will help you negotiate as a buyer.

What Is Real Estate Owned (REO)?

Real estate owned (REO) is property owned by a lender, such as a bank, that has not been successfully sold at a foreclosure auction. A lender—often a bank or quasi-governmental entity such as Fannie Mae or Freddie Mac—takes ownership of a foreclosed property when it fails to sell at the amount sought to cover the loan. 1

What do real estate agents negotiate with REO?

Real estate agents negotiate the commission they will receive for selling REO properties with the REO specialist. To help ensure a smooth closing, buyers should also search public records to ensure that all liens associated with a property have been paid.

What is a REO specialist?

A bank's REO specialist manages its REO properties by marketing the properties, reviewing any offers , preparing regular reports on the status of properties in the bank's portfolio, and tracking down deeds. The REO specialist also works closely with the bank's in-house or contracted property manager to ensure properties are secure and winterized or to prepare a property for vacancy. The REO specialist undertakes these job functions to help the bank liquidate its properties quickly and efficiently.

How do banks sell REOs?

Banks attempt to sell their REOs using a real estate agent or by listing the properties online.

Do banks sell REO properties?

However, banks typically sell REO properties "as is," meaning the bank will not make any repairs prior to selling. These properties are often in disrepair, so it's crucial to have a thorough inspection and be prepared to make (and pay for) necessary renovations.

Why buy REO property?

The big benefit to buying an REO property is that lenders and major mortgage investors are trying to get something out of a property that has been foreclosed on and hasn’t sold at auction. Therefore, they’re often much more flexible on cost and you can get a deal.

What is REO in foreclosure?

Properties unsold at the foreclosure sale are referred to as REO. If the property fails to sell at the specific price, it becomes REO inventory.

What Is A Real Estate Owned Property?

A typical real estate owned listing has failed to sell during the foreclosure process and is now owned by a mortgage lender, bank or the mortgage investor. Buying an REO property is done through an REO agent or an auction platform. Properties are sold “as-is” and often discounted to sell as quickly as possible.

What happens if a mortgage investor does not manage the REO?

In these instances, the mortgage lender would have to be contacted to purchase through the auction platform or listing agent.

Why is real estate a good investment?

Real estate owned properties in the possession of lenders and mortgage investors can be the source of a good deal on a home because a lender is highly motivated to get rid of it. They’re also somewhat less risky than tax foreclosures from an investment standpoint. On the other hand, while you may get a deal, these homes are often sold as-is, so you need to be prepared to make repairs. Make sure to work with an experienced agent who can guide you.

What happens if a property goes into foreclosure?

The property goes into foreclosure. When this happens, a foreclosure sale is held on a specific date for a specific price. If there is no successful purchaser of the property, the lender or the investor on the loan takes over management of the property. If the property is occupied, the occupant will be evicted.

Why are homes foreclosed on?

Properties are typically foreclosed on because a person falls behind on their mortgage. If you don’t have money for the mortgage payment, you often don’t have money for upkeep. Additionally, if you know you’re being foreclosed on, there’s not the usual incentive to keep the home in good repair.

What is REO property?

What Are REO Properties? Real estate owned properties are homes that have fallen under the ownership of a mortgage lender or investor. There are several ways this can happen, but a home doesn’t automatically become REO once a lender takes possession.

What is REO in real estate?

Real estate owned (REO) properties are homes that have fallen under the ownership of a mortgage lender or investor, typically because the property failed to sell at auction. There are multiple reasons why this might happen, the biggest one being that the home went into foreclosure.

How Does A Property Gain REO Status?

Although REO properties often arise out of the foreclosure process – when a homeowner is unable to make their mortgage payments or pay property taxes – the terms “REO” and “foreclosure” aren’t synonymous.

What is REO status?

REO status might also be the result of a home being given back to the lender after the previous owner moved out or passed away at the end of a reverse mortgage. If the heirs are unwilling to pay off the mortgage balance, refinance the home or sell it themselves, they have the option of giving the property back to the lender or investor.

What is warranty deed?

In most home sales, there is typically a general warranty deed. A general warranty deed tells you a couple of things: 1 The seller has the right to sell you the property as they currently own it. 2 There are no other legal issues or claims to the property by anyone other than the seller.

Why won't my lender pay for repairs on my REO?

The lender usually won’t pay for the repairs because they don’t want to spend any more money than they already have on the property.

How long do banks hold on to REO?

Large banks may prefer to make a loan and hold onto it for 15 or 30 years rather than selling it to mortgage investors and including it in a mortgage-backed security (MBS). In these cases, the banks may have their own online listings where you can search through for REO properties they’ve repossessed.

What is an REO property?

The most common definition of an REO (Real Estate Owned) is a property that has gone into foreclosure and didn’t sell during auction. If the foreclosed home doesn’t sell, the ownership defaults to the original bank or lender. Some other cases of REO status may include when an owner moves out or passes away, for example.

Advantages and disadvantages of buying an REO property

Because the lender is motivated to sell, they price REOs competitively — so, there’s a better chance that you’ll get the house at a discounted price.

How to finance an REO property

The most popular way to finance an REO property is the same way you would finance a regular home purchase — with a mortgage. Some buyers will get prequalified for a mortgage rate with the lender selling the REO property to both expedite the process and let the lender know they are serious about the offer.

What is an REO property?

Bank-owned or REO properties are foreclosed homes that were repossessed by lenders. Fannie Mae and Freddie Mac, the government-sponsored enterprises that purchase mortgages from lenders, also have REO properties. The term "real-estate owned" comes from an accounting term — "other real estate owned" — used on bank financial statements. Nonbank mortgage companies sell all the mortgages they originate and don't own REO properties.

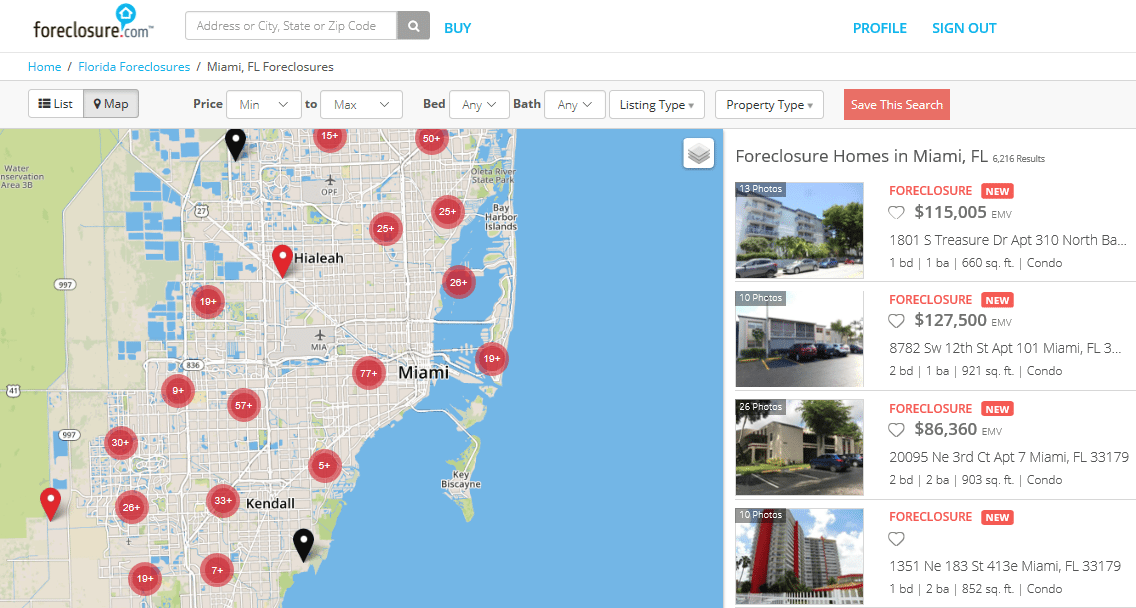

What websites show REO properties?

Specialty real estate listing websites. Websites and companies that connect buyers with foreclosed properties, such as Auction.com, Hubzu and RealtyTrac, show listings for REO properties.

How to get help with a mortgage?

To get help, you will need to contact the mortgage servicer that collects payments. See an alphabetical list of mortgage servicers with contact information.

How to find bank owned properties?

Bank-owned properties are for sale in virtually every city. You can find them through: 1 Real estate agents. Bank-owned properties are on the Multiple Listing Service (MLS), the database that real estate agents use to see and post listings of homes for sale. 2 Bank websites. Some banks let you search for real-estate owned properties on their websites. 3 Specialty real estate listing websites. Websites and companies that connect buyers with foreclosed properties, such as Auction.com, Hubzu and RealtyTrac, show listings for REO properties.

How to make an offer on a foreclosed home?

Work with your real estate agent to make an offer. Lenders generally price foreclosed homes at market value, so don't expect deep discounts. After you make an offer, it may take longer to complete negotiations than with a traditional owner because multiple people at the lender may need to give approval.

What happens if a house doesn't sell at auction?

If the house doesn't sell at auction, the bank takes possession of the property and sells it to traditional home buyers or real estate investors. A home can also become bank-owned if the lender accepts a deed in lieu of foreclosure.

What is a renovation mortgage?

A renovation mortgage lets you get one home loan to combine the cost of improvements and the purchase price.

What is REO property?

An REO property, or real estate owned property, is a bank-owned home that failed to sell at auction after the owner defaulted on its mortgage. The process of becoming an REO property transpires this way: The homeowner (borrower) fails to make the mortgage payments on the property. The lender begins the foreclosure process.

What is REO investment?

From an REO investment perspective, this means targeting specific geographic regions that have high foreclosure rates. And while these numbers can fluctuate and are prone to change, here are four U.S. regions that, according to RealtyTrac, may offer real REO property potential for a real estate investor.

What happens when a homeowner fails to make a mortgage payment?

The homeowner (borrower) fails to make the mortgage payments on the property. The lender begins the foreclosure process. The lender submits a notice of default. The borrower continues to fail to make payments. The lender issues a notice of sale. The borrower fails to produce the lender requires.

What happens when a lender issues a notice of sale?

The borrower fails to produce the lender requires. The property is put up for public auction. The house fails to sell at auction. The lender takes possession of the property. The lender sells the house to traditionally to home buyers or investors.

Which state has the highest foreclosure rate?

Trenton/Newark: New Jersey is the state with the highest foreclosure rate, and with nearly 10% of all homes vacant, these two metro areas have plenty of inventory to choose from.

Can you find REO deals before the competition?

Armed with information and a supply of investing energy, you can find REO deals before the competition does, which might give you the patience and skill for your next deal.

Is RealtyTrac a free foreclosure service?

Pre-Foreclosure Listing Service: Unlike the sources mentioned above, using a service such as RealtyTrac — which aggregates foreclosure and pre-foreclosure properties in one location — is not a long-term free option. But the initial expense is little when compared to the long-term profit potential these foreclosure properties can bring.