The Core Strategy is the default, no-frills, low-fee MySuper product available to members. Default insurance cover. REST Super's default insurance cover automatically includes death, total and permanent disability cover, and long-term income protection.

Full Answer

How is my super invested in the core strategy?

When you first join Rest Super or Rest Corporate, your super will automatically be invested in the Core Strategy, unless you tell us otherwise. Achieve a balance of risk and return by investing in both growth assets and defensive assets.

What is the core strategy of rest?

REST Core Strategy 1 Calling for Paris-alignment. REST has not demonstrated any evidence that it has called on any specific company to alter its strategy to bring it into line with the climate goals ... 2 Scenario analysis. REST has not disclosed any climate change scenario analysis. 3 Climate voting record. ... 4 Latest news about super

What is the asset allocation for the core strategy option?

Asset allocation: For the Core Strategy option, the asset allocation will vary year to year within the ranges shown in the brackets. This also means the allocation to defensive assets and growth assets will vary from time to time. The overall allocation to growth assets and defensive assets may vary by +/- 10% from the allocation shown.

What is Rest core strategy?

A balance of growth and defensive assets, with a focus on growth assets (can range between 60-75% growth assets) consisting of shares and debt (both Australian and overseas), property, infrastructure, cash and other asset classes. *Important information about the 'Actual vs Objective returns' chart.

What Superfund is rest?

Rest is an award-winning, profit-to-member super fund with low fees.

What does rest stand for REST Super?

Retail Employees Superannuation TrustRetail Employees Superannuation Trust (REST), also called REST Super or Rest Super, is an Australian industry superannuation fund established in 1988.

Is rest a good performing super fund?

Rest has 1.8 million members, most of whom are in the industry fund's default product. Rest's default product was classified by APRA as “poor performing” with “deteriorating investment returns”, as its results over the past three years (2018-2021) were worse than over the past seven years (2014-2021).

What is the best super fund in Australia?

AustralianSuperThe Best Overall – AustralianSuper It's Balanced Fund received the Finder award for the best Australian super fund in 2021 and has been one of the strongest performing super funds of all time.

Is REST Super an industry super fund?

Is Rest an industry fund? Yes. Rest is an industry fund run to benefit its members, with low fees and competitive long term performance. Rest doesn't pay commissions to financial planners which means more money for you when you retire.

How much super Should I have at 40?

So, what are the current average balances for different age groups?Average super balance by age225 – 29$25,173$21,77430 – 34$51,175$42,24035 – 39$83,723$66,61140 – 44$121,119$92,6805 more rows•Jul 1, 2022

Can anyone join REST Super?

Rest Super A product with a MySuper offering and default insurance cover (subject to eligibility). Anyone can join.

Does REST Super have TPD?

Rest believes affordable and quality insurance is an important part of your super. We care about looking after you - that's why we offer death, total and permanent disability (TPD) and income protection (IP) cover to our members.

Is Rest core strategy good?

Rest's strong track record in delivering competitive investment performance for its members has seen its Core Strategy ranked No. 1 for long-term performance more times than all other super funds put together when compared to similar options of other funds surveyed monthly over rolling 10 year periods*.

Is REST Super or AustralianSuper better?

Looking at their investment allocation, AustralianSuper Balanced has more exposure to international shares than Rest Core Strategy and is slightly higher risk overall. Rest Core Strategy has a greater allocation to lower-risk, defensive assets than AustralianSuper.

Is REST Super self managed?

There are 180,000 employers that contribute to the REST super fund. REST is an industry super fund, which means it does not pay contributions / commission to financial advisers. REST is run to profit it's members.

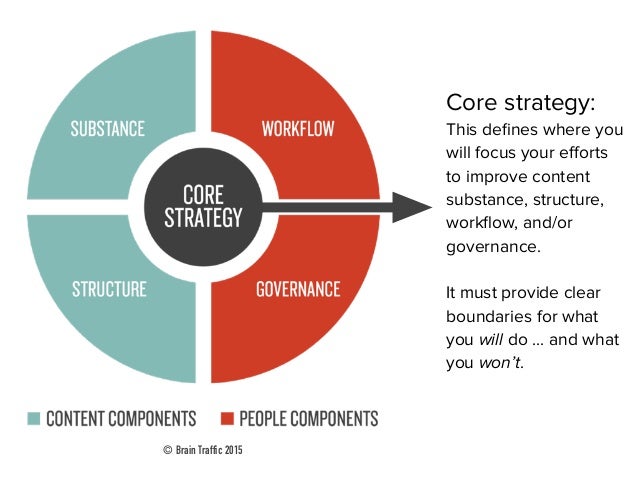

Core Strategy

Achieve a balance of risk and return by investing in both growth assets and defensive assets.

Balanced

Achieve a balance of risk and return by investing in approximately equal proportions of growth assets and defensive assets.

Balanced - Indexed

An indexed based investment in a mixture of growth and defensive assets.

Capital Stable

Provide a stable pattern of returns whilst maintaining a low probability of a negative return in any one year.

Diversified

Achieve strong returns over the longer term by investing in a diversified mix of assets weighted towards shares and other growth assets.

High Growth

Maximise returns over the long-term by investing predominantly in growth assets.

Sustainable Growth

A diversified portfolio with enhanced environmental, social and governance investment characteristics weighted towards growth assets.

REST super performance and fees

You'll automatically be invested in the Core Strategy when joining, which is the default MySuper option, however you're able to switch investment options at any time after joining the fund.

Compare up to 4 providers

The information in the table is based on data provided by Chant West Pty Ltd (AFSL 255320) which is itself supplied by third parties. While such information is believed to be accurate, Chant West does not accept responsibility for any inaccuracy in such information.

What investment options are available with REST Super?

REST Super offers 3 different ways to invest your super, with 13 different options in total. You can choose one or a combination of different options to create your portfolio.

What insurance is available with REST Super?

REST Super offers a single insurance option which will be automatically applied to your account.

How do I join REST Super?

If you've decided to select this fund you can apply online by clicking the green "Go to Site" button at the top of this page.

Alison Banney

Alison Banney is the banking and investments editor at Finder. She has written about finance for over 8 years, with her work featured on sites including Yahoo Finance, Money Magazine and Dynamic Business. She has previously worked at Westpac, and has written for several other major banks including BCU, Greater Bank and Gateway Credit Union.