Retrospective restatement is correcting the recognition, measurement and disclosure of amounts of elements of financial statements as if a prior period error had never occurred.

What is a restatement in accounting?

What is a Restatement? A restatement is an act of revising one or more of a company’s previous financial statements to correct an error. Restatements are necessary when it is determined that a previous statement contained a "material" inaccuracy.

What is the difference between retrospective and prospective?

Retrospective means Implementation new accounting policies for transaction, event, or other circumstances as if it had been implemented. In other words, retrospective will effect presentation of financial statements for previous periods. While prospective means implementation new accounting policies for transaction, event,...

What is the difference between a revision and a restatement?

A revision is the correction of a reported amount in subsequent financial statements. 2 However, the previously reported financial statement need not be reissued. With a restatement, on the other hand, the error must be material, prompting a revision and the issuance of a corrected financial statement. What Is the Restatement of Torts?

What are the different types of restatement?

Types of Restatement 1 Step #1 – Non-Reliance Restatement. It is issued when there are mass errors found in the earlier period statements and thus making it tough to rely on the previous as ... 2 Step #2 – Revision Restatement. ... 3 Step #3 – Out of Period Adjustments. ...

What is retroactive restatement?

retroactive adjustment. restatement of prior years' financial statements to show financial data on a comparable basis, such as in the case of a change in reporting entity. prior period adjustment.

What is retrospective application?

Retrospective application means adjusting the opening balance of each affected component of equity for the earliest prior period presented and the other comparative amounts disclosed for each prior period presented as if the new accounting policy had always been applied. [

What does retrospectively mean in accounting?

Retrospective means Implementation new accounting policies for transaction, event, or other circumstances as if it had been implemented. In other words, retrospective will effect presentation of financial statements for previous periods.

What is retrospective application of a change in accounting policy?

Retrospective application means that the accounting records be adjusted as though the new accounting policy had always been in place, so that the opening equity balance of all periods presented incorporates the effects of the change.

What is retrospective method?

Listen to pronunciation. (REH-troh-SPEK-tiv STUH-dee) A study that compares two groups of people: those with the disease or condition under study (cases) and a very similar group of people who do not have the disease or condition (controls).

What is difference between retrospective and prospective application?

In prospective studies, individuals are followed over time and data about them is collected as their characteristics or circumstances change. Birth cohort studies are a good example of prospective studies. In retrospective studies, individuals are sampled and information is collected about their past.

What is difference between retroactive and retrospective?

Retrospective law means a law which looks backward or contemplates the past; one, which is made to affect acts or facts occurring, or rights occurring, before it comes into force. Retroactive statute means a statute, which creates a new obligation on transactions or considerations or destroys or impairs vested rights.

What are the three types of accounting changes?

Changes in accounting are of three types. They are changes in accounting principle, changes in accounting estimates, and changes in reporting entity. Accounting errors result in accounting changes too.

Why is retrospective treatment of a change in accounting estimate prohibited?

Why is retrospective treatment of a change in accounting estimate prohibited? Change in accounting estimate is a normal recurring correction or adjustment which is the natural result of the accounting period. The retrospective treatment for any type of presentation treatment for any type of presentation is not allowed.

What are the limitations for the retrospective restatement of prior period errors?

43 A prior period error shall be corrected by retrospective restatement except to the extent that it is impracticable to determine either the period-specific effects or the cumulative effect of the error.

Does a change in accounting policy require restatement?

Changes in accounting estimates don't require the restatement of previous financial statements. If the change leads to an immaterial difference, no disclosure of the change is required.

What are 5 accounting policies?

What are the 5 basic principles of accounting?Revenue Recognition Principle. When you are recording information about your business, you need to consider the revenue recognition principle. ... Cost Principle. ... Matching Principle. ... Full Disclosure Principle. ... Objectivity Principle.

What is an example of retrospective?

The definition of retrospective is looking back on something that happened in the past. When you are interviewed about past events, this is an example of a retrospective interview. An art exhibit showing an artists early works progressing to the artist's most recent works is an example of a retrospective exhibit.

What is retrospective application of law?

Retrospective operation of law therefore means application of law to facts or actions which exist even prior to the date the said law is promulgated. It takes into its ambit activities existing prior to the date of the new law and thus operates from a date earlier than the date they come into effect.

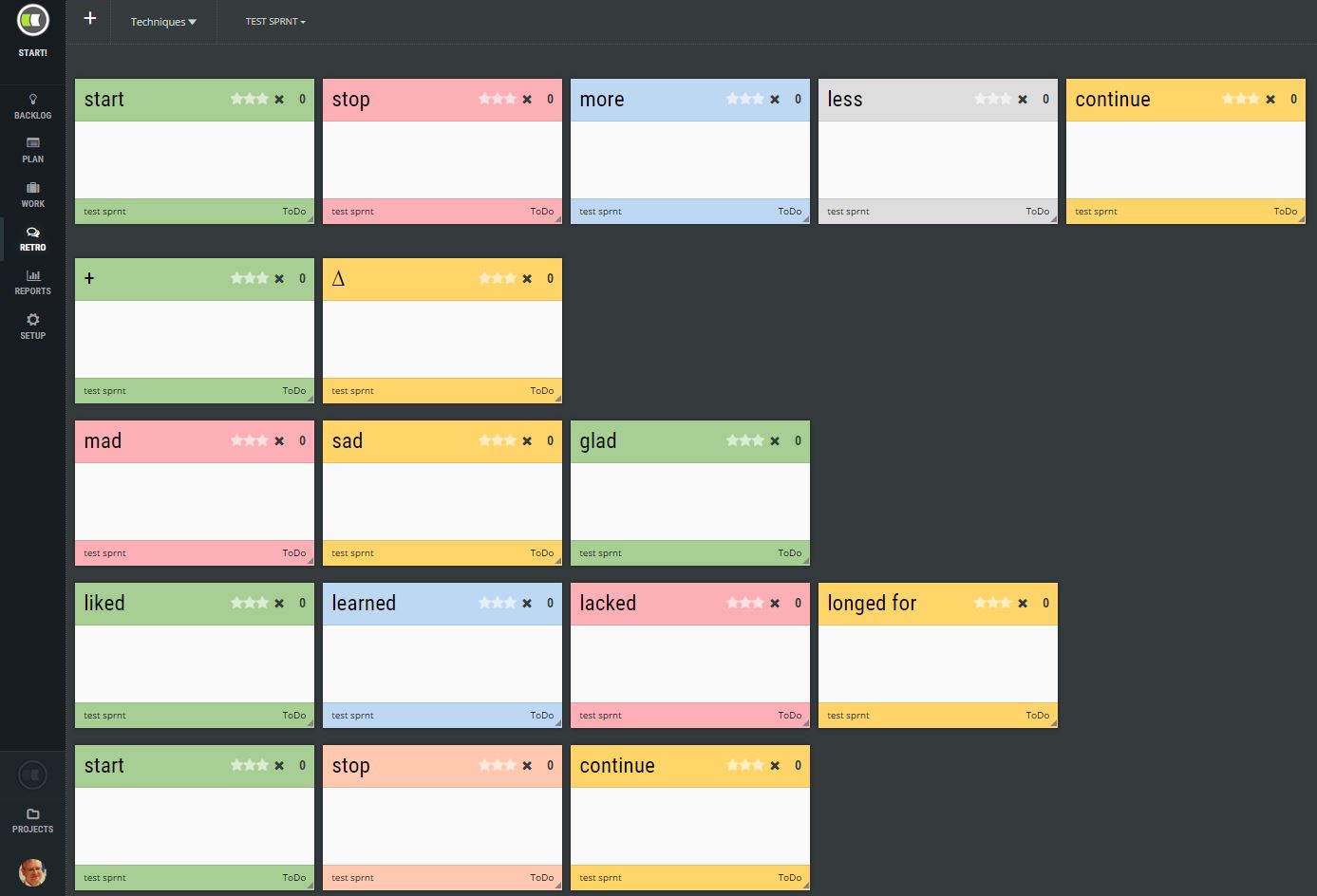

What is a retrospective in software development?

An Agile retrospective is a meeting that's held at the end of an iteration in Agile software development. During the retrospective, the team reflects on what happened in the iteration and identifies actions for improvement going forward.

What is a retrospective in UX?

Whilst there are a lot of things about agile that I don't necessarily like, one thing that I love are retrospectives, the act of looking back and learning from what has happened to avoid repeating the same mistakes. Retrospectives (done well) can be some of the most important time that a team spends together all year.

What is a restatement in accounting?

A restatement is the revision of already issued financial statements pertaining to one or more companies to correct errors with material inaccuracy happened as a result of non adhering and complying with the General Accepted Accounting Policies (GAAP), accounting mistakes, fraud or clerical errors and affecting part of the total financial statement which may require a completely new audit which may impact the future financial statements as well.

How does restatement affect audit fees?

Its cause also decides the market sentiments. If it is issued because of integrity or operational issues, the stakeholder’s trust is hit harder. Apart from all these restatements generally result in higher audit fees as the auditor has to spend extended hours to analyse the impact and nature of restatement to ensure that the audit quality is high.

Why is it important to issue a restated financial statement?

The issuance of restated financial statements is necessary so that the stakeholders get the correct picture of the company and make their decision making accordingly. It is also essential to report the errors and consider them in the statement if they are material.

Why is restatement of audit fees higher?

Apart from all these restatements generally result in higher audit fees as the auditor has to spend extended hours to analyse the impact and nature of restatement to ensure that the audit quality is high.

Is Molson Coors a restatement company?

Molson Coors Brewing Company intimated its stakeholders in February 2019 that it would be issuing restatement of the financial year 2016 and 2017. The auditors discovered material discrepancies in respect of deferred tax liabilities for income tax. The company understated income tax expense and deferred tax liability.

What is retrospective restatement?

the retrospective application, retrospective restatement or the reclassification has a material effect on the information in the balance sheet at the beginning of the preceding period.

Can prior period errors be rectified retrospectively?

This prior period error will be rectified retrospectively, i.e., current year’s financial statements will be prepared by rectifying the error when it occurred. As a result, the comparative information will be restated.

What is retrospective application?

Retrospective application – Applying a new accounting policy to transactions, other events, and conditions as if that policy had always been applied ( change in accounting policy) ( IAS 8 5 ).

When to use retrospective accounting principles?

With the retrospective application of accounting principles, the information in multi-period financial statements is more comparable from period to period. Retrospective or prospective application

When should prospective implementation be applied?

Prospective implementation should be applied if there is changes in accounting estimation. Retrospective or prospective application

When can an entity reflect the aggregate effect of all modifications that occur before the beginning of the earliest period presented?

For contracts that were modified before the beginning of the earliest period presented an entity can reflect the aggregate effect of all modifications that occur before the beginning of the earliest period presented when identifying satisfied and unsatisfied performance obligations, determining the transaction price and allocating the transaction price to performance obligations; Retrospective or prospective application

Is disclosure required for all reporting periods presented before the date of initial application?

For all reporting periods presented before the date of initial application, disclosure is not required of the amount of the transaction price allocated to remaining performance obligations, and an explanation of when that amount was expected to be recognised as revenue. Retrospective or prospective application.

What is retrospective financial statement?

In other words, retrospective will effect presentation of financial statements for previous periods. While prospective means implementation new accounting policies for transaction, event, or other circumstances after new accounting policies or estimation has been implemented.

When should retrospective implementation be applied?

Retrospective implementation should be applied if the new accounting standards or policies are required by mandatory accounting standards and the changes can produce financial statements that give more reliable and relevant information on impact of transaction , event, or other circumstances.

Can accounting policies change retrospectively?

changes in accounting policies can be happened. Example you change your inventory valuation method from FIFO into average method, so this changes accounting policies should be change retrospectively.

What is retrospective application?

Retrospective application means adjusting the opening balance of each affected component of equity for the earliest prior period presented and the other comparative amounts disclosed for each prior period presented as if the new accounting policy had always been applied. [IAS 8.22]

When must the entity restate the comparative information to correct?

Further, if it is impracticable to determine the cumulative effect, at the beginning of the current period, of an error on all prior periods , the entity must restate the comparative information to correct the error prospectively from the earliest date practicable. [IAS 8.45]

What are prior period errors?

Prior period errors are omissions from, and misstatements in, an entity's financial statements for one or more prior periods arising from a failure to use, or misuse of, reliable information that was available and could reasonably be expected to have been obtained and taken into account in preparing those statements. Such errors result from mathematical mistakes, mistakes in applying accounting policies, oversights or misinterpretations of facts, and fraud.

Do financial states of subsequent periods need to repeat?

Financial statements of subsequent periods need not repeat these disclosures.

What Is A Restatement?

Understanding Restatements

The Dangers of Restatements

Real-Life Example of A Restatement

Restatement Requirements

Special Considerations

Restatement FAQs

- What Is the Difference Between Reclassification and Restatement?

A restatement is the restatement of a revised financial statement. The restatement is purposed to correct what was previously reported erroneously. A reclassification involves correcting the classification of a transaction or entry, moving it from one ledger to another. For example, one c… - What Is the Difference Between Revision and Restatement?

A revision is the correction of a reported amount in subsequent financial statements.2However, the previously reported financial statement need not be reissued. With a restatement, on the other hand, the error must be material, prompting a revision and the issuance of a corrected financial …

The Bottom Line

Restatement Explained

Reasons to Restate A Financial Statement

Types of Restatement

Effect and Prevention

Restatement Example

Recommended Articles