Risk impact assessment, or risk impact analysis, is the process in which developments are assessed based on probability and consequences. The results of this analysis are subsequently used to prioritise the identified risks, and to add the risk to the risk impact probability chart.

What are the different types of risk analysis?

- Systematic Risk – The overall impact of the market

- Unsystematic Risk – Asset-specific or company-specific uncertainty

- Political/Regulatory Risk – The impact of political decisions and changes in regulation

- Financial Risk – The capital structure of a company (degree of financial leverage or debt burden)

What are the methods of risk analysis?

- Set the goal for risk analysis

- Collect data to identify risks

- Add values to risks

- Identify highest-priority risks

- Develop a plan to mitigate these risks

- Follow through with the plan

- Review the effectiveness of the plan

What is meant by risk analysis?

What is risk analysis? Risk analysis is the process of identifying and analyzing potential issues that could negatively impact key business initiatives or projects. This process is done in order to help organizations avoid or mitigate those risks.

How to write a risk analysis report?

You can discuss the risks by breaking them down as follows:

- Risk Number – provide a unique number to each risk. ...

- Category – identify a set of categories and place each risk into its own category.

- Detail – use this section to describe the risk in detail and how it relates to the requirements as identified in the Request For Proposal.

What is a risk impact?

Impact risk is the likelihood that impact will be different than expected, and that the difference will be material from the perspective of people or the planet who experience impact.

How do you measure the risk impact?

Assess the probability of each risk occurring, and assign it a rating. For example, you could use a scale of 1 to 10. Assign a score of 1 when a risk is extremely unlikely to occur, and use a score of 10 when the risk is extremely likely to occur. Estimate the impact on the project if the risk occurs.

What is a risk impact statement?

It is the expression of the likelihood and impact of an event with the potential to affect the achievement of an organization's objectives.” 1 As a result, a risk statement in a Corporate Risk Profile, for example, would describe the event and the potential impact (positive or negative) of that event on achieving an ...

What is the purpose of impact analysis?

Impact assessment focuses on the effects of the intervention, whereas evaluation is likely to cover a wider range of issues such as the appropriateness of the intervention design, the cost and efficiency of the intervention, its unintended effects and how to use the experience from this intervention to improve the ...

What are the 4 types of risk?

The main four types of risk are:strategic risk - eg a competitor coming on to the market.compliance and regulatory risk - eg introduction of new rules or legislation.financial risk - eg interest rate rise on your business loan or a non-paying customer.operational risk - eg the breakdown or theft of key equipment.

What are 3 ways to measure risk?

Investors can measure risk in many different ways including earnings at risk (EAR), value at risk (VAR), and economic value of equity (EVE).

What are 4 stages of risk control?

The 4 essential steps of the Risk Management Process are: Identify the risk. Assess the risk. Treat the risk. Monitor and Report on the risk.

How do you write a good risk analysis?

Writing a risk assessment is normally carried out in a five-step process:Step 1 – Identify all potential hazards. ... Step 2 – Identify who could be harmed and how this could happen. ... Step 3 – Evaluate the risk and decide on control factors. ... Step 4 – Record and implement your findings. ... Step 5 – Review and update regularly.

What is a RPN in FMEA?

Formula: The Risk Priority Number, or RPN, is a numeric assessment of risk assigned to a process, or steps in a process, as part of Failure Modes and Effects Analysis (FMEA), in which a team assigns each failure mode numeric values that quantify likelihood of occurrence, likelihood of detection, and severity of impact.

How do you perform impact analysis?

How to Conduct a Business Impact Analysis?Step 1: Scope the Business Impact Analysis. ... Step 2: Schedule Business Impact Analysis Interviews. ... Step 3: Execute BIA and Risk Assessment Interviews. ... Step 4: Document and Approve Each Department-Level BIA Report. ... Step 5: Complete a BIA and Risk Assessment Summary.

What is included in an impact analysis?

The business impact analysis report typically includes an executive summary, information on the methodology for data gathering and analysis, detailed findings on the various business units and functional areas, charts and diagrams to illustrate potential losses, and recommendations for recovery.

What is impact analysis tools?

The Investment Portfolio Impact Analysis Tool was developed to enable financial institutions to holistically identify and assess the impacts associated with their investment portfolios. It requires users to input data about the nature, content and context of their portfolios.

How do you measure risk in a project?

Steps to perform a project risk assessmentStep 1: Identify risks. Analyse potential risks and opportunities. ... Step 2: Determine probability. ... Step 3: Determine the impact. ... Step 4: Treat the risk. ... Step 5: Monitor and review the risk.

What is the impact of risk on organizations?

Risk is the main cause of uncertainty in any organisation. Thus, companies increasingly focus more on identifying risks and managing them before they even affect the business. The ability to manage risk will help companies act more confidently on future business decisions.

What is risk probability and impact assessment?

The probability assessment involves estimating the likelihood of a risk occurring. The impact assessment estimates the effects of a risk event on a project objective. These impacts can be both positive and negative; i.e., opportunities and threats.

What is the difference between risk and impact?

Risk assessments analyze potential threats and their likelihood of happening, a business impact analysis explains the effects of particular disasters and their severity.

What is Risk Analysis ?

The risk analysis consists of listing the possible events, evaluating any and all probability that the project developed will go wrong if that event occurs, from this analysis you carry out a survey of the impacts and consequently develop preventive measures, that is, if something goes wrong what will I do to correct, or mitigate that impact.

What is Risk Analysis for?

anticipate and reduce the effect of harmful outcomes from adverse events;

Benefits of Risk Analysis

For business success, organizations must understand the risks associated with using their systems, thus effectively and efficiently protecting their assets and information. Risk analysis can help organizations to:

6 Steps to Risk Analysis

Assessment survey, where you can document specific risks or threats in each department;

What Is Risk Analysis?

Risk analysis is the process of assessing the likelihood of an adverse event occurring within the corporate, government, or environmental sector. Risk analysis is the study of the underlying uncertainty of a given course of action and refers to the uncertainty of forecasted cash flow streams, the variance of portfolio or stock returns, the probability of a project's success or failure, and possible future economic states.

Why do risk analysts work?

Risk analysts often work in tandem with forecasting professionals to minimize future negative unforeseen effects. All firms and individuals face certain risks; without risk, rewards are less likely. The problem is that too much risk can lead to failure. Risk analysis allows a balance to be struck between taking risks and reducing them.

What is quantitative risk analysis?

Quantitative risk analysis uses mathematical models and simulations to assign numerical values to risk.

What is value at risk?

Value at risk (VaR) is a statistic that measures and quantifies the level of financial risk within a firm, portfolio, or position over a specific time frame. This metric is most commonly used by investment and commercial banks to determine the extent and occurrence ratio of potential losses in their institutional portfolios. Risk managers use VaR to measure and control the level of risk exposure. One can apply VaR calculations to specific positions or whole portfolios or to measure firm-wide risk exposure.

Why is risk assessment important?

Risk assessment enables corporations, governments , and investors to assess the probability that an adverse event might negatively impact a business , economy , project, or investment. Assessing risk is essential for determining how worthwhile a specific project or investment is and the best process (es) to mitigate those risks. Risk analysis provides different approaches that can be used to assess the risk and reward tradeoff of a potential investment opportunity.

How to summarize outcomes?

The outcomes can be summarized on a distribution graph showing some measures of central tendency such as the mean and median, and assessing the variability of the data through standard deviation and variance . The outcomes can also be assessed using risk management tools such as scenario analysis and sensitivity tables. A scenario analysis shows the best, middle, and worst outcome of any event. Separating the different outcomes from best to worst provides a reasonable spread of insight for a risk manager.

How can risk be reduced?

Many risks that are identified, such as market risk, credit risk, currency risk, and so on, can be reduced through hedging or by purchasing insurance. Almost all sorts of large businesses require a minimum sort of risk analysis.

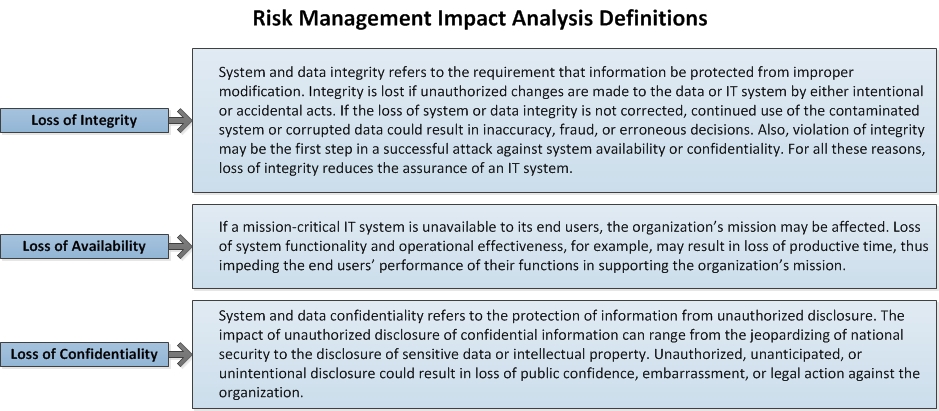

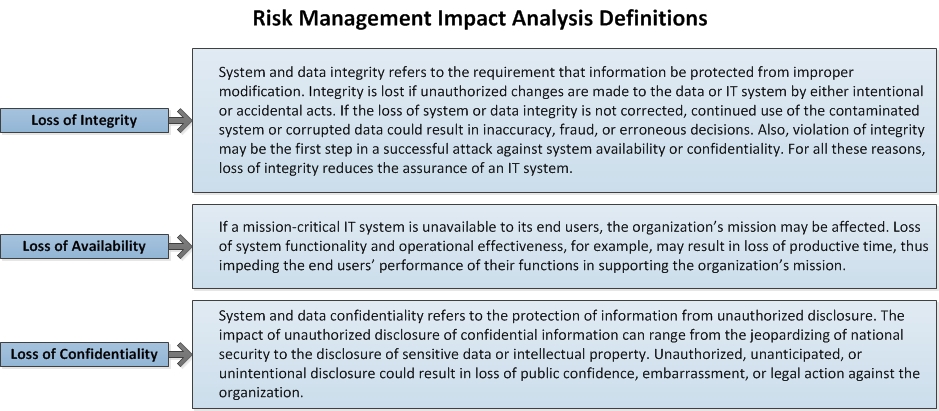

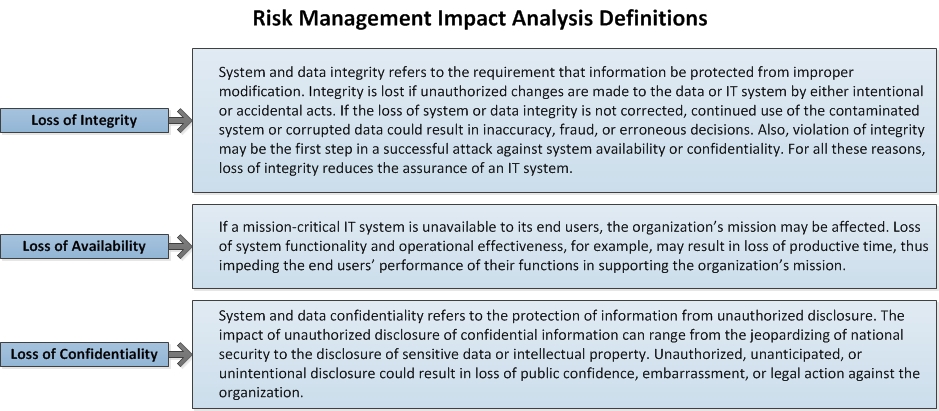

What is risk impact?

Risk impact is an estimate of the potential losses associated with an identified risk. It is a standard risk analysis practice to develop an estimate of probability and impact. The following are common types of impact.

What is risk to the environment?

Risks to the environment such as estimates of potential damage to an ecosystem.

What is impact assessment?

Impact assessment means assessing a risk’s impact if the risk were to become reality. The central question is: if the risk were to occur, would this be catastrophic for the project or activity? Or would it be a minor inconvenience? An effect assessment is usually carried out by the risk manager, and by the people who have the right knowledge to estimate the risks and establish the impact. The impact assessment is also assigned a score of 3, 2 or 1.

What are Risk Impact Probability Charts?

A Risk Impact Probability Chart is a tool used to visually display the results of risk and impact assessments. It is an essential visual tool for risk management, and consists of several criteria. To understand how exactly this tool works, we must first understand what risk impact means and what risk probability means.

What is the red color in the risk matrix?

The top right contains the risks that have a high impact, and that will most likely happen. In the Risk Impact Probability chart, or risk matrix, this group of risks is usually denoted with a red colour.

What are medium risks?

The risks with a low impact but high probability are medium risks. These risks are often given the colour orange in the matrix. The probability that the risk occurs is high, but the impact the risk will have is most likely ...

What is risk probability?

Risk probability refers to determining the probability of a risk occurring. This probability is generally based on historical information. Is there a certain frequency with which the problem occurs? When determining the probability of a risk, a score is usually assigned to the risk, such as 3, 2, 1. 3 represents a high risk, 2 an average risk, and 1 a low risk.

What is the first option to respond to a risk?

The first option is to respond to a risk by accepting the risk as it exists and refraining from any action. This strategy is often used for risks with a low impact or a low probability.

Why is rationale important in risk assessment?

The rationale helps to communicate the meaning of a certain abstract risk to the stakeholders.

What is risk analysis?

Risk analysis is the process that figures out how likely that a risk will arise in a project. It studies the uncertainty of potential risks and how they would impact the project in terms of schedule, quality and costs if in fact they were to show up. Two ways to analyze risk are quantitative and qualitative.

What is the second piece of risk analysis?

The second piece is performing the quantitative risk analysis , and what that is, it’s a process for numerically analyzing the effect of those risks on the project . The benefit of that is it helps support in decision-making to reduce the project uncertainty.

What are the risks of a project?

Through qualitative and quantitative risk analysis, you can define the potential risks by determining impacts to the following aspects of your project: 1 Activity resource estimates 2 Activity duration estimates 3 Project schedule 4 Cost estimates 5 Project budget 6 Quality requirements 7 Procurements

What is qualitative risk analysis?

The qualitative risk analysis is a risk assessment done by experts on the project teams, who use data from past projects and their expertise to estimate the impact and probability value for each risk on a scale or a risk matrix.

What is risk identification?

Risk identification is also a risk management process, but in this case it lists all the potential project risks and what their characteristics would be. If this sounds like a risk register, that’s because your findings are collected there. This information will then be used for your risk analysis.

What is risk management?

(if not, more in a bit.) Risks are anything that can potentially disrupt any component of your project plan, such as your scope, schedule, costs or your team. Since every project is unique, no two projects are likely to have the same risks.

What is risk register?

So as a reminder, the risk register identifies all the risks, the impacts, the risk response, and the risk level. We’re ultimately looking at what the potential impacts to the activity resource estimates, the activity duration estimates, possibly the schedule, the cost estimates, budgets, quality, and even the procurements.

What is Risk Assessment?

A risk assessment identifies all of the risks that have the potential to impact your organisation’s operations. It seeks to quantify both the impact and the forward likelihood of potential events. A risk assessment is therefore greatly concerned with the possible causes of disruption, from which likelihood is then derived. It’s a valuable tool for recognising threats and taking action to minimise risks to an acceptable level.

Is ISO 22317 a BIA?

However, with the introduction of the BIA-focused ISO 22317, there's a risk that some business continuity professionals may be struggling to distinguish between these two related disciplines.

Can BIA be conducted without risk assessment?

Whereas BIA can be conducted without risk assessment, risk assessment can’t reasonably occur without some form of BIA : risk assessment should use BIA to quantify and prioritise the risks it finds. The ‘siloing effect’ of ISO and other standards that are being adopted by organisations worldwide can result in confusion.

What is impact analysis?

A business impact analysis is a great tool to assess risk and set up a plan of recovery if and when it occurs. That sounds like a project. ProjectManager is a cloud-based project management software that helps you plan your business impact analysis and monitor and report on it when you need to execute it.

Why is impact analysis important?

The reason that every business should include a business impact analysis is that it’s a part of any thorough plan to minimize risk. All businesses can be disrupted by accidents and emergencies. These can include a failure of suppliers, labor disputes, utility failures, cyber-attacks, ...

What is due diligence in business impact analysis?

With the due diligence of a business impact analysis in hand, a business has a well-thought-out plan of action to recover from adversity. It gives management more confidence in their decisions and judgments when responding to these events.

How to do a business impact analysis?

The first step is to initiate the process by getting approval from senior management for the project. To begin, define the objectives, goals and scope of the business impact analysis. It should be clear about what the business is seeking to achieve. Then it’s important to form a project team to execute the business impact analysis.

What are the scenarios that could potentially cause losses to the business?

Scenarios that could potentially cause losses to the business are identified. These can include suppliers not delivering, delays in service, etc. The list of possibilities is long, but it’s key to explore them thoroughly in order to best assess risk.