What is SDI and vdpi withholding?

California wages are subject to SDI (State Disability Insurance) or VDPI (Voluntary Plan Disability Insurance) withholding up to a specific annual amount. If the employer withholds more than this amount, the taxpayer must contact the employer for reimbursement from the employer for the excess. SDI/VP withholding is reported via Form W-2.

What is the vpdi expense for an employee?

Employees are required to pay into either the state disability insurance plan (SDI) or a plan that the employer provides through a self-insured private disability plan. That provide disability plan is the VPDI expense. The amount that is deducted is approximately 1% of the employee’s wages.

What is the difference between SDI and PFL and vpdi?

VPDI is an alternative to SDI, and the only real difference when you are doing your taxes is that SDI is potentially a local tax deduction if you itemize and VPDI isn't. PFL usually means Paid Family Leave but in this context I don't know what it means, unless it's insurance premiums paid by the employee to cover Paid Family Leave insurance.

How do I enter vpdi on my W2?

Thank you! VPDI stands for Voluntary Plan for Disability Insurance, and this can be entered by entering the Description and Amount from your Form W-2 and then selecting the category Wages for SDI, VPDI, TDI, UI, etc June 4, 2019 2:57 PM

Where are SDI and VPDI reported on W-2?

Wages subject to SDI/VPDI withholding: State wages in W-2 Box 16 plus retirement contributions in Box 12, less SUB payments in Box 14 are used by default . For part-year and nonresident returns, amounts in Boxes 12 and 14 are included in the calculation only when the postal code in the sections is CA.

What is CA VPDI on my W-2?

Voluntary Plan for Disability Insurance (VPDI) is not deductible on the federal tax return (Schedule A) per Rev. Rul. 81-194. Entering the VPDI amount on the Wages-W-2-Other Information screen will transfer the total amount to the Excess SDI/VPDI Withheld Worksheet.

What does SDI tax stand for?

State Disability Insurance taxAn SDI tax is a State Disability Insurance tax. It is a payroll tax required by select states.

What does SDI stand for on W-2?

SDI is an acronym for “state disability insurance.” Some states call it TDI for “temporary disability insurance.” Not every state has this tax, but those that do require payroll deductions that help fund short-term (generally a maximum of six months) disability benefits for workers who become disabled.

Who pays SDI in California?

Employers do not pay for State Disability Insurance (SDI) benefits. The SDI program is funded entirely through mandatory employee payroll contributions.

How do I get CASDI refund?

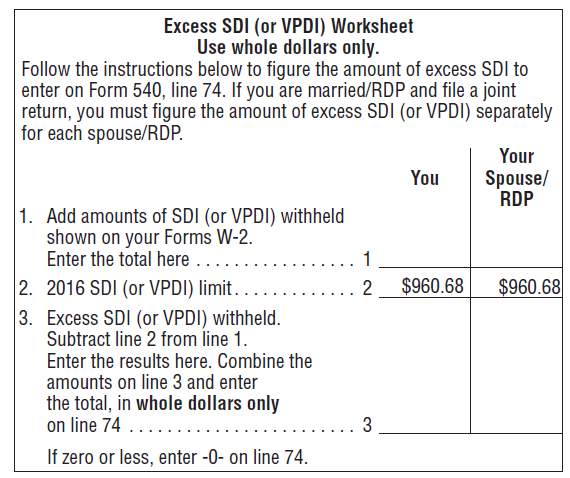

Contact the employer for a refund. To figure out the amount to enter on line 74 of Form 540 or line 84 of Form 540NR, fill out the Excess SDI (or VPDI) Worksheet....Want to get a refund of excess SDI?You had two or more employers in 2020.You made more than $122,909 in wages.SDI (or VPDI) is reported on your Form W-2.

What does SDI mean on paycheck?

State Disability Insurance (SDI) and Personal Income Tax (PIT) are withheld from employees' wages.

Why do I have to pay CA SDI?

What is CA SDI Tax Used For? In California, the funds from this mandatory payroll tax provide financial aid to employees who can't work as a result of a non-work-related physical (generally covered by Workers' Compensation benefit) or mental disability, as well as paid family leave for eligible workers.

What is the California SDI rate for 2022?

1.1 percentSDI Rate. The SDI withholding rate for 2022 is 1.1 percent. The taxable wage limit is $145,600 for each employee per calendar year. The maximum to withhold for each employee is $1,601.60.

Do I have to report SDI on my taxes?

When SDI benefits are received as a substitute for UI benefits, the SDI is taxable by the federal government but is not taxable by the State of California. You will only get a Form 1099-G if all or part of your SDI benefits are taxable.

What does SDI stand for on W-2 Box 14?

SDI = State Disability Insurance (premium) Yes, put it in your W-2 data entry, as it's deductible on your Federal return if you itemize.

What does SDI stand for on W-2 Box 14?

SDI = State Disability Insurance (premium) Yes, put it in your W-2 data entry, as it's deductible on your Federal return if you itemize.

Who is exempt from California SDI tax?

Family employees - Services provided by (1) children under the age of 18 employed by a parent or partnership of parents only, (2) spouse employed by spouse, (3) registered domestic partner employed by registered domestic partner, and (4) parent employed by son or daughter are not subject to UI, ETT, and SDI.

How is SDI tax calculated?

To compute the dollar value of the SDI tax multiply the total taxable wages for the current payroll period by the current SDI tax rate. For example, assuming the 2021 SDI tax rate of 1.2 percent, or 0.0120, an employee who receives $1,000 wages in 2021 would be subject to $12 SDI tax (1000 x 1.0120 = 1,012).

How to calculate SDI/VPDI withholding?

The calculation automatically limits line 1 of the worksheet, Total SDI/VPDI withheld, to the amount that was correctly withheld on each W-2 per state instruction. To calculate the correctly withheld amount, the wages subject to SDI/VPDI withholding is multiplied by the current-year percentage for each W-2. The lesser of that amount, or the amount actually withheld, is included on line 1 of the worksheet. Refer to the California Excess SDI/VPDI Withholding Worksheet for details of the calculation for each W-2.

Where to enter SDI/VPDI withholdings?

Note: SDI/VPDI withholdings may be entered in either Box 14 or 19. Amounts entered in these fields with a postal code of CA transfer to the federal Schedule A, line 5 and also to the California Excess SDI/VPDI Withholding Worksheet. Do not enter the same amount in both fields.

What box is SDI/VPDI subject wages?

To force an amount of SDI/VPDI subject wages different than the calculated amount, enter the amount in Local Wages, Box 18.

End of life tax planning

This is an odd question, but I’ve been fighting cancer for a while and it’s back and there’s a good chance I won’t make it more than a few more months. Unfortunately, I’ve also been out of work because cancer and have been draining retirement savings to support my family.

My parent claims all my Tuition Statement 1098-T forms that I get from my university

So at the end of each year I get a tax form called Tuition Statement 1098-T from my university that has my “payments received for qualified tuition and related expenses” and “scholarships or grants” listed on it. My mother asks for it every year to claim on her taxes and say it gives her a bit more money.

Hiring a virtual CPA

I'm interested in hiring someone from Upwork to do my taxes. My question is, what kind of qualifications should I make sure they have? If they are not from my state, is that an issue? What if they are from another country, but are licensed in the USA, is that good enough or do I need to really make sure they are licensed in my state?

What is a VDPI?

Voluntary Plan for Disability Insurance (VDPI) When it comes to California tax returns, there are a lot of questions about what expenses are deductible and what are not. One area that is often asked about is the Voluntary Plan for Disability Insurance (VDPI).

What are the benefits of SDI?

Workers covered by SDI have two benefits available to them: Disability Insurance (DI) and Paid Family Leave (PFL). These funds provide monetary support while a worker cannot earn their typical wage, either due to on-the-job injury, sick leave, maternity leave, or family medical leave.

Do you have to pay taxes on SDI?

An employee will know they need to pay taxes on SDI compensation when they receive a Form 1099-G, which will indicate whether there is an amount that’s taxable. As such, if an employee does not receive a 1099-G, they can assume they do not owe taxes on the SDI income they received.

Is VPDI deductible on Schedule A?

Let’s look at what the VDPI is and whether it’s considered deductible on Schedule A for your tax return. Despite its name, VPDI is not actually an optional expense. Employees are required to pay into either the state disability insurance plan (SDI), or a plan that the employer provides through a self-insured private disability plan.

Is VPDI taxable in California?

Generally, VPDI and/or SDI benefits are not taxable by the state of California or the IRS. The one case in which they may be taxed is when employees receive SDI benefits in place of unemployment compensation and for a person who is not eligible for Unemployment Insurance (UI) benefits only because of the disability.

Is a VPDI contribution tax deductible?

Generally, VPDI contributions are not considered tax deductible on your federal tax return. However, some individuals can take a credit if they meet the following conditions: You had two or more California employers. You received more than $118,371 in wages in calendar year 2019.

What line is excess SDI on 540?

To figure out the amount to enter on line 74 of Form 540 or line 84 of Form 540NR, fill out the Excess SDI (or VPDI) Worksheet. If married/registered domestic partner (RDP) and filing jointly, figure the amount of excess SDI (or VPDI) separately for each spouse/RDP.

Can you claim a credit for excess SDI?

If you paid more than the maximum State Disability Insurance (SDI) or Voluntary Plan Disability Insurance (VPDI) tax, you may be eligible to claim a credit for excess SDI .

Can you claim excess SDI on Form 540?

If one of your employers withheld SDI (or VPDI) from your wages at more than 1.00% of your gross wages, you may not claim excess SDI (or VPDI) on Form 540 or Form 540NR. Contact the employer for a refund.