Section 1245 is a way for the IRS to recapture allowable or allowed depreciation or amortization the taxpayer has taken on 1231 property. This recapture occurs at the time a business sells certain tangible or intangible personal property at a gain.

What is the difference between 1245 and 1250 depreciation recapture?

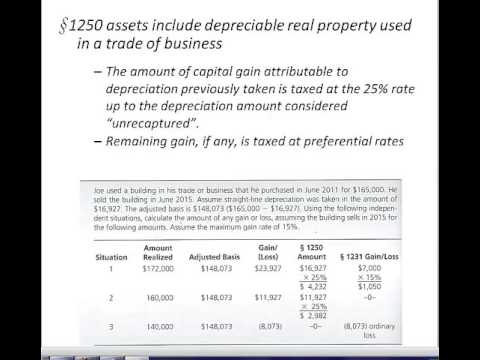

§1245 and §1250 property are not treated the same in recapture In the case of §1250 property, only accelerated depreciation taken in excess of straight-line depreciation is considered (ie for land improvements) All accelerated deprecation, §1245 or §1250, is recaptured at ordinary rates, currently 37% for individuals 25

What is the difference between Section 1245 and 1250 property?

What's the difference between Section 1250 property and Section 1245 property? Both Section 1245 property and Section 1250 property are types of Section 1231 properties. While a Section 1250 asset is real property, a Section 1245 asset is any other type of depreciable property. Click to see full answer. Subsequently, one may also ask, is rental property 1245 or 1250?

How to calculate depreciation recapture?

To calculate the amount of depreciation recapture, the adjusted cost basis of the asset must be compared to the sale price of the asset. Companies account for wear and tear on property, plant, and equipment through depreciation. Depreciation divides the cost associated with the use of an asset over a number of years.

What is 1245 property and how is it taxed?

When a business or real estate investment is sold, 1245 property that was depreciated must be recaptured. The recaptured depreciation is taxed as ordinary income up to one of the following: The allowed or allowable depreciation or amortization on the property. The gain realized on the sale or disposition.

What is depreciation recapture on section 1245 property?

§1245, Depreciation Recapture of Section 1245 Property A taxpayer who realizes a gain on the disposition of depreciable section 1245 property must recapture all or part of the gain as ordinary income to reflect the amount of depreciation or other amortization deductions allowed with respect to the property.

What is an example of 1245 property?

Section 1245 and 1250 Property Overview Personal property does not include a building or any of the structural components of a building. A few examples of 1245 property are: furniture, fixtures & equipment, carpet, decorative light fixtures, electrical costs that serve telephones and data outlets.

What is the difference between 1250 and 1245 property?

Section 1245 assets are depreciable personal property or amortizable Section 197 intangibles. Section 1250 assets are real property, where depreciable or not.

How does depreciation recapture work?

“Depreciation recapture” refers to the Internal Revenue Service's (IRS) policy that an individual cannot claim a depreciation deduction for an asset (thereby reducing their income tax) and then sell it for a profit without “repaying the IRS” through income tax on that profit.

Is 1245 property subject to recapture?

If you sell Section 1245 property, you must recapture your gain as ordinary income to the extent of your earlier depreciation deductions on the asset that was sold. Any gain up to the amount of the previously taken depreciation will be taxed at ordinary income rates.

Is a rental property 1245 or 1250?

Any depreciable property that is not section 1245 property is by default section 1250 property. The most common examples of section 1250 property are commercial buildings (MACRS 39-year real property) and residential rental property (MACRS 27.5-year residential rental property).

How much is depreciation recapture tax?

25%Depreciation recapture is the portion of your gain attributable to the depreciation you took on your property during prior years of ownership, also known as accumulated depreciation. Depreciation recapture is generally taxed as ordinary income up to a maximum rate of 25%.

Why does 1250 recapture no longer apply?

Because straight–line depreciation has been required for all depreciable realty purchased after 1986, there is no section 1250 recapture on that property, and the gain on its disposal is eligible for long–term capital gain treatment under section 1231.

Why does 1250 recapture generally no longer apply?

Why does §1250 recapture generally no longer apply? Congress repealed the code section. The Tax Reform Act of 1986 changed the depreciation of real property to the straight-line method.

How can you avoid paying back depreciation recapture?

Investors may avoid paying tax on depreciation recapture by turning a rental property into a primary residence or conducting a 1031 tax deferred exchange. When an investor passes away and rental property is inherited, the property basis is stepped-up and the heirs pay no tax on depreciation recapture or capital gains.

What triggers depreciation recapture?

Depreciation recapture is assessed when the sale price of an asset exceeds the tax basis or adjusted cost basis. The difference between these figures is thus "recaptured" by reporting it as ordinary income. Depreciation recapture is reported on Internal Revenue Service (IRS) Form 4797.

When you sell a rental property do you have to pay back depreciation?

The depreciation deduction lowers your tax liability for each tax year you own the investment property. It's a tax write off. But when you sell the property, you'll owe depreciation recapture tax. You'll owe the lesser of your current tax bracket or 25% plus state income tax on any deprecation you claimed.

What is the difference between 1245 and 1231 property?

Section 1231 applies to all depreciable business assets owned for more than one year, while sections 1245 and 1250 provide guidance on how different asset categories are taxed when sold at a gain or loss.

Is rental property 1231 or 1250?

In this process sell of properties included in this section, the gains are recorded as ordinary income. Section 1250 deals with real properties like warehouses, rental properties. The gain is taxing as per the depreciation on that property.

What is considered 1250 property?

Section 1250 addresses the taxing of gains from the sale of depreciable real property, such as commercial buildings, warehouses, barns, rental properties, and their structural components at an ordinary tax rate. However, tangible and intangible personal properties and land acreage do not fall under this tax regulation.

What type of property is land Form 4797?

If you sold property that was your home and you also used it for business, you may need to use Form 4797 to report the sale of the part used for business (or the sale of the entire property if used entirely for business). Gain or loss on the sale of the home may be a capital gain or loss or an ordinary gain or loss.

What Is Section 1245?

Section 1245 is codified in the United States Code (USC) at Title 26- Internal Revenue Code (IRC), Subtitle A-Income Taxes, Chapter 1-Normal Taxes and Surtaxes, Subchapter P-Capital Gains and Losses, Part IV-Special Rules for Determining Capital Gains and Losses, Section 1245-Gain from dispositions of certain depreciable property. This (lengthy!) taxonomy usefully informs us that Section 1245 covers the applicable tax rate for gains from the sale or transfer of depreciable and amortizable property. Let’s dig deeper to learn what kind of property is covered and what tax rate applies to it.

What happens if you sell a section 1245 property?

With this understanding, let’s look at the tax picture of a sale of section 1245 property. If section 1245 property is sold at a loss, it converts to section 1231 property for tax purposes, and the loss is ordinary (subject to netting and look-back). If section 1245 property is sold at a gain, it remains section 1245 property and, to the extent of depreciation, the gain is taxed at ordinary income rates. Once depreciation has been recaptured, it converts to section 1231 property, and any remaining gain is taxed at capital gains rates. 1

What is a 1245 property?

Section 1245 property includes any property that is or has been subject to an allowance for depreciation or amortization and that is any of the following types of property. 2. Personal property (either tangible or intangible ).

What is a 1245?

Section 1245 is a way for the IRS to recapture allowable or allowed depreciation or amortization the taxpayer has taken on 1231 property. This recapture occurs at the time a business sells certain tangible or intangible personal property at a gain. Section 1231 allows a business that sells a property to apply a higher ordinary income rate on losses ...

How much is a $100 widget depreciation?

A business owns a $100 widget and takes $75 of depreciation. The widget’s adjusted tax basis is its $100 cost minus $75 of depreciation, or $25. The business sells the widget for $150. The gain is the $150 sale price minus the $25 adjusted tax basis, or $125. Of that $125, $75 is section 1245 gain taxed at ordinary income rates, and $50 is section 1231 gain taxed at capital gains rates.

What is the purpose of IRC Section 1231?

Congress enacted IRC Section 1231 to favor businesses by allowing them to apply a lower capital gains rate on gains and a higher ordinary income rate on losses recognized from the sale of their property. 2 However, many businesses had already gotten favorable tax treatment by taking depreciation deductions on these properties. So, Congress enacted Section 1245 to recapture depreciation at ordinary income rates on properties sold at a gain.

What is the difference between a lower tax rate on capital gains and a higher tax rate on loss?

Conceptually, a lower tax rate on gain means less tax payable and a higher tax rate on loss means a larger offset of taxable income and less tax payable. For this reason, tax planning strategies seek lower capital gains rates for gains and higher ordinary income rates for losses.

How Does Depreciation Recapture Work?

Taxpayers can look at the IRS depreciation schedules to determine how much of an asset’s value they can deduct from their tax return each year. They’ll also find a term limit for those deductions. Taxpayers do this because deducting annual depreciation for expensive assets lowers their income, meaning they have to pay fewer taxes for that fiscal year. But depreciation recapture kicks in should the taxpayer ever decide to sell the asset.

How to avoid depreciation recapture?

There are ways in which you can minimize or even avoid depreciation recapture. One of the best ways is to use a 1031 exchange, which references Section 1031 of the IRS tax code. This may help you avoid depreciation recapture and any capital gains taxes that might apply. However, a 1031 exchange requires you to use the proceeds of the sale to invest in a new investment property, such as another rental building.

When to start depreciating rental property?

It can be tough to know when to start deducting depreciation for your rental investment if there are multiple major dates in your investment journey. For example, if you buy a rental property on January 10, then make the property ready for renting by April 11, and then don’t start your first tenant’s lease until May 12, which of those dates should you use for depreciation purposes? According to the IRS, you can start depreciating any rental property or investment as soon as it is “in service.” In short, the property is to be ready and available to potential tenants to use as a rental home. In the above example, your rental investment was fully ready for a tenant by April 11, even though you didn’t get a lease and someone didn’t start living in the property until May 12. Under these rules, you can start depreciation for your tax breaks on April 11.

Can you depreciate property when selling it?

In the short term, depreciation deductions can save entrepreneurs or real estate investors lots of money on their yearly taxes. However, the IRS eventually comes calling! It never forgets the value deducted from your assets and will eventually require you to pay taxes on the property once you sell it. This process is called depreciation recapture. Let’s take a closer look at depreciation recapture and break down how you can avoid it by using any profits you make from selling property or real estate in a specific way.

Is depreciation a good way to save money?

All in all, depreciation can be a great way to save money on taxes in the short term. But in the long term, it can really dig into your coffers and cause you to make much less of a profit from selling real estate or other assets than you might expect. To that end, carefully consider whether to deduct property depreciation from your taxes and make sure you understand depreciation recapture.

Can a business owner use depreciation to write off assets?

Once a business owner buys the property, they can use depreciation to write off some of its value as its value decreases with time. But the business owner still earns revenue from the asset, increasing their net income. Although depreciation recapture most often applies to the sale of real estate, it can also apply to other assets like equipment or furniture. Any capital assets are theoretically vulnerable to depreciation recapture under the right circumstances.

Can you depreciate rental property in the same year?

All these deductions can be taken during the same year in which you spend money. Just report the deductions on your Schedule E form. But remember, if you sell the rental property, the IRS will tax you on the depreciation deductions!

What is a Section 1245 Property?

According to the Internal Revenue Service Code, the definition of a Section 1245 property is any property classified as an intangible or tangible personal property and subject to depreciation or amortization. Buildings and structural components are not included. You own a Section 1245 property if:

How does depreciation recapture work?

Depreciation recapture makes you pay a higher tax rate for the amount of money you had depreciated from the property. You can avoid depreciation recapture by opting not to depreciate any properties that could be considered 1245 properties or by selling them at a loss or no-gain.

What is the difference between 1245 and 1250?

A common source of confusion when filing taxes and calculating if a property has depreciated is the difference between Section 1245 and 1250 property. These are different from one another, but both deal with different types of property. Section 1250 property is classified as assets that consist of real property used for business purposes over 12 months that are subject to depreciation that is not considered 1245 property (see examples above). As far as accounting goes, there are two methods to calculate depreciation:

What is a 1231 property?

1231 property is real or depreciable business property held for more than one year. It’s also worth noting that all Section 1250 property can be classified as 1231 property, but we will explore that a little further within this guide. If you sell the property for a loss, then you won’t have to pay depreciation recapture at all—the property reverts to a 1231 property and, like other ordinary losses, is subject to netting and lookback.

How to avoid depreciation recapture?

The easiest way to avoid depreciation recapture is to not depreciate any of your properties. If you have a property that could be considered 1245 property, then don’t claim any tax deductions on depreciation when you file your taxes.

Why should I care about Section 1245?

You might be wondering, why should I care about Section 1245 properties? If you’re a business owner, you’re probably looking for ways to reduce your company’s tax burden. Many business owners do this by claiming tax deductions on their company’s depreciating assets. After all, many assets naturally depreciate because of wear and tear over time, and capitalizing on the true nature of these assets is strongly suggested when filing taxes for a Section 1245 property.

What is not included in a 1245?

Buildings and structural components are not included. You own a Section 1245 property if: The property plays an integral role in manufacturing, production, and extraction; or providing transportation, communications, electricity, gas, water, or sewage disposal for business operations. The property is a research facility for any ...

What Is Depreciation Recapture?

Depreciation recapture is the gain realized by the sale of depreciable capital property that must be reported as ordinary income for tax purposes. Depreciation recapture is assessed when the sale price of an asset exceeds the tax basis or adjusted cost basis. The difference between these figures is thus "recaptured" by reporting it as ordinary income.

What is the maximum depreciation recapture rate for 2019?

Depreciation recaptures on gains specific to real estate property are capped at a maximum of 25% for 2019. To calculate the amount of depreciation recapture, ...

What is section 1231?

Section 1231 is an umbrella for both Section 1245 property and Section 1250 property. Section 1245 refers to capital property that is not a building or structural component. Section 1250 refers to real estate property, such as buildings and land. The tax rate for the depreciation recapture will depend on whether an asset is a section 1245 ...

How does depreciation work?

Companies account for wear and tear on property, plant, and equipment through depreciation. Depreciation divides the cost associated with the use of an asset over a number of years. The IRS publishes specific depreciation schedules for different classes of assets.

What is the recapture of realized gain?

The realized gain from an asset sale must be compared with the accumulated depreciation. The smaller of the two figures is considered to be the depreciation recapture. In our example above, since the realized gain on the sale of the equipment is $1,000, and accumulated depreciation taken through year four is $8,000, the depreciation recapture is thus $1,000. This recaptured amount will be treated as ordinary income when taxes are filed for the year.

Is $8,000 depreciated ordinary income?

In that case, the entire accumulated depreciation of $8,000 is treated as ordinary income for depreciation recapture purposes. The additional $2,000 is treated as a capital gain, and it is taxed at the favorable capital gains rate. There is no depreciation to recapture if a loss was realized on the sale of a depreciated asset.

Is depreciation taxable if equipment is sold for a gain?

For income tax purposes, the depreciation would be recaptured if the equipment is sold for a gain. If the equipment is sold for $3,000, the business would have a taxable gain of $3,000 - $2,000 = $1,000. It is easy to think that a loss occurred from the sale since the asset was purchased for $10,000 and sold for only $3,000. However, gains and losses are realized from the adjusted cost basis, not the original cost basis. The reasoning for this method is because the taxpayer has benefited from lower ordinary income over the previous years due to annual depreciation expense.

What is Section 1245 recapture?

Namely, a Section 1245 asset that refers to depreciable personalty used in a trade or business, and how long-term. The Section 1245 depreciation recapture is calculated as the lesser of any gain recognized on the sale of the asset, or the accumulated depreciation taken over the life of the asset.

What is the tax rate for Section 1231?

The general tax treatment here is the gains from the sale of a Section 1231 asset, are ultimately tax at the long-term capital gains rate of 0, 15, or 20 percent, while losses are fully deductible against ordinary income. So again, Section 1231 assets have the best of both roles.

What is Section 1231 gain?

Now, to the extent any gain a taxpayer recognizes is greater than the accumulated depreciation on the asset, then the remaining net gain is indeed a Section 1231 gain taxed at the 0, 15, or 20 percent preferential tax rate.

Is land a section 1231 asset?

If it's used for business and held long-term, it's a Section 1231 asset. However, it will not be subject to any depreciation recapture because land is not depreciable in the first place. It's non depreciable realty. The second type of Section 1231 asset is known as a Section 1245 asset.

What Is Section 1245?

Understanding Section 1245

- Section 1245 recaptures depreciation or amortization allowed or allowable on tangible and intangible personal property at the time a business sells such property at a gain. Section 1245 taxes the gain at ordinary income rates to the extent of its allowable or allowed depreciation or amortization.1

Section 1245 Property

- The IRS defines Section 1245 property as the following: Section 1245 property includes any property that is or has been subject to an allowance for depreciation or amortization and that is any of the following types of property.2 1. Personal property (either tangible or intangible). 2. Other tangible property (except buildings and their structural components) used as any of the fol…

Section 1245 Recapture Feature

- Section 1245 is a mechanism to recapture at ordinary income tax rates allowable or allowed depreciation or amortization taken on section 1231 property. Allowable or allowed means that the amount of depreciation or amortization recaptured is the greater of that taken or that could have been taken but was not.1 Going forward, this article will simplify references to depreciation and …

Section 1245 Background

- Section 1245 defines section 1245 property by telling us what it is not. This definition by exclusion confuses even tax experts. Perhaps section 1245 property will be easier to identify if we instead focus on the reason why Congress enacted section 1245. The answer boils down to the adjustment of the property’s basisby depreciation and the character of gain or loss on the proper…

Tax Picture of A Sale of Section 1245 Property

- With this understanding, let’s look at the tax picture of a sale of section 1245 property. If section 1245 property is sold at a loss, it converts to section 1231 property for tax purposes, and the loss is ordinary (subject to netting and look-back). If section 1245 property is sold at a gain, it remains section 1245 property and, to the extent of depreciation, the gain is taxed at ordinary income rat…

Example of A Sale of Section 1245 Property

- Here is an example that may help clear the fog. A business owns a $100 widget and takes $75 of depreciation. The widget’s adjusted tax basis is its $100 cost minus $75 of depreciation, or $25. The business sells the widget for $150. The gain is the $150 sale price minus the $25 adjusted tax basis, or $125. Of that $125, $75 is section 1245 gain taxed at ordinary income rates, and $50 is …