Definition of Sliding Commission Wage

- Basic Definition. A sliding commission is a payment to sales staff at varying percentages, depending on the amount of sales.

- Comparison with Other Types. ...

- Increasing or Decreasing Sliding Scale. ...

- Negotiable Price. ...

- Other Considerations. ...

- 2016 Salary Information for Wholesale and Manufacturing Sales Representatives. ...

What is sliding scale commission in insurance?

Sliding Scale Commission. Definition. A ceding commission that varies inversely with the loss ratio under the reinsurance agreement. The scales are not always one to one: for example, as the loss ratio decreases by 1 percent, the ceding commission might only increase by 50 basis points.

What happens to the ceding commission when the loss ratio decreases?

The scales are not always one to one: for example, as the loss ratio decreases by 1 percent, the ceding commission might only increase by 50 basis points.

What is ceding commission in insurance?

In writing business, the cedant incurs a lot of expenses for example acquisition costs like agency/Broker commission, taxes, administration/managment costs and the like. To cover for these costs, the Reinsurer reimburses the cedant for the expenses incurred by offering what is known a “ceding commission”.

What is the difference between provisional commission and loss ratio?

Since the loss ratio can only be determined at the end of the year, a provisional commission is set at the start of the year which varies between a Maximum and Minimum Rate.

What is the meaning of sliding scale commission?

Sliding Scale Commission — a ceding commission that varies inversely with the loss ratio under the reinsurance agreement. The scales are not always one to one: for example, as the loss ratio decreases by 1 percent, the ceding commission might only increase by 50 basis points.

How do you make a sliding scale for commission?

1:052:33How to make a 3 level sliding commission rate calculator - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo in the formulas. I go if D 5 equals greater than 5,000 then 1250. If if F 7 is greater than $50MoreSo in the formulas. I go if D 5 equals greater than 5,000 then 1250. If if F 7 is greater than $50 $50,000 and d8 + f7 x f8.

What is a sliding percentage?

A sliding commission contrasts with a fixed commission, which always pays the same percentage. For example, a company paying a fixed commission pays 20 percent on the dollar amount of all sales. A company paying a sliding commission pays a salesperson 20 percent if her sales fall below $100,000 in a certain time frame.

What does sliding mean in retail?

The sliding of merchandise means that the cashier passes merchandise through the checkout without ringing a price.

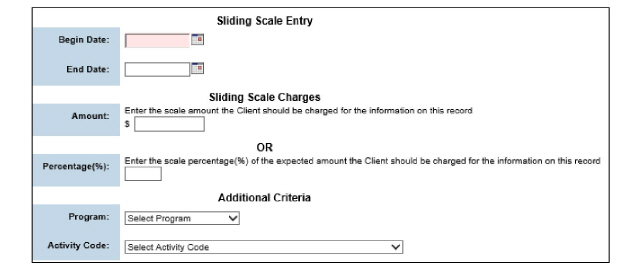

What is sliding scale calculation?

A sliding scale is a term in economics used to describe a scale where prices, taxes or wages change based on another factor such as gross sales, a cost-of-living index or income level.

How do you calculate sliding commission in Excel?

First, the formula checks where the sales value lies on the sliding scale table. So, the formula loops through the entire range until it finds the appropriate range. Next, we multiply the value by the sales figure. Thus, we get the sliding commission value in Excel.

How do you make a sliding scale?

13 Steps to Creating a Sliding Fee Scale for Your Healthcare Practice (Worksheets)Step 1 – Determine Usual and Customary Fees. ... Step 2 – Add Up Expenses. ... Step 3 – Set Your Salary. ... Step 4 – Break It Down. ... Step 5 – Estimate Client Numbers. ... Step 6 – Find Your Minimum Fee. ... Step 7 – Set Your Schedule.More items...•

What is another word for sliding scale?

In this page you can discover 6 synonyms, antonyms, idiomatic expressions, and related words for sliding-scale, like: related rates, adjusted scale, variable scale, ratio, rate and relationship.

Can you make a sliding scale in Excel?

Once you are in Design mode, you can click the “Scroll Bar” control. Your cursor will change to a + as you move off the control toolbox and you can then click and drag to draw a slider on your spreadsheet. Now right-click on the slider you've just drawn and select Properties from the menu of options that appears.

How do you count money as a cashier?

By preparing to count the money, all large bills, checks and coupons and food stamps (if any) are removed and put to the side. Next, the person counting the money counts it back to its "starting amount." The starting amount is the amount of money that was in the drawer at the beginning of the shift.

How can cashiers avoid shortages?

How can cashiers avoid shortages?Make sure to assign appropriate accountability: As a business, you will need to hold the cashier accountable for errors. ... Beef up security: If you suspect an employee of being dishonest or stealing, install cameras so that you can review transactions and the employee's actions.More items...•

How do you balance a cashier drawer?

Tips for balancing drawersHave one person per drawer. When it comes to your cash drawer, the fewer people who access it, the better. ... Assign duties. ... Utilize sales reports. ... Deposit cash during the day. ... Look out for consistent discrepancies.

What is sliding scale commission?

Definition of "Sliding scale commission". Percentage that has an inverse relationship to the loss experience on the business brought in. For example, if a ceding company laid off better risks that resulted in better and more profitable business for the re insurer, it would get a higher commission.

What is disposition of a claim?

disposition of a claim or policy benefit. Policies may specify time limits for payment of claims or benefits and designate various methods of settlement at the option of the insurer or the ...

Joseph Iranya, Dip CII Follow

We have seen what proportional and non-proportional Reinsurance is. We know the types of Reinsurance that fall under these two categories. But how are the Reinsurance Premiums for these treaties determined?

Ken Kan

Deficit carried forward 3 years - If year1 is 700 loss, year 2 is not applicable PC, year 3 is 600 profit, year 4 is 400 profit. Which is the 1st year?

Viktoriia Pochynkova

How then, if Reinsurer have already paid the PC for the certain UW Year in previous accounting years (AY's) but in current AY is Deficit? Obvious no PC due, but should in this case Cedent refund the already paid PC in the full amount? P.s. Condition Deficit carry forward for 3 years.

Bo Jiang

Yes, that is in theory possible. However, it means the cedant will get less provisional commission upfront as the Reinsurers will need factor the potential 'refund' in advance.