Deductible Expenses in a Sole Proprietorship

- Business Expense Overview. As a sole proprietor, you only pay income tax on your net profit, which is equal to total earnings less all allowable deductions for business expenses.

- Timing of Deductions. ...

- Home Office Deduction. ...

- Separating Business from Personal. ...

Can a LLC be taxed as a sole proprietor?

Many LLCs choose to be taxed as a sole proprietorship to avoid this double taxation. Note that, regardless of the choice regarding federal taxation, the entity remains an LLC registered under state law. That is, you don't lose limited liability protection by choosing to be taxed as a sole proprietorship by the IRS.

How to pay taxes as a sole proprietor?

Sole proprietors file need to file two forms to pay federal income tax for the year. Firstly, theres Form 1040, which is the individual tax return. Secondly, theres Schedule C, which reports business profit and loss. Form 1040 reports your personal income, while Schedule C is where youll record business income.

What sole proprietorship taxes should I know about?

The IRS refers to sole proprietorships as “pass-through” entities, meaning business revenues pass through the company and are taxed as personal income. Because the government considers a sole proprietorship and its founder to be the same entity, sole proprietors must file their annual tax payments by submitting an IRS Form 1040.

What are the tax benefits of a LLC vs a sole proprietorship?

LLC taxes are very similar to sole proprietor taxes, so your LLC will reap all the same tax benefits . Most of these tax benefits are in the deductions you're able to claim. LLC taxes may be more difficult to file than sole proprietorship taxes, and they also tend to be a little more costly.

What is deductible in a sole proprietorship?

In addition to health insurance, common deductions include equipment, utilities, subscriptions, travel, and capital assets. If you operate your business out of your home, you can likely claim the home office deduction. Certain everyday expenses, such as rent and utilities, can be deductible.

Are there tax benefits for sole proprietorship?

One of the advantages of a sole proprietorship is its simplicity. You do not separate taxes for your business, you simply report all of your business income and losses on your personal income tax return. But with that simplicity comes personal liability for legal judgments, taxes, and debt.

How do you claim sole proprietorship on taxes?

As a sole proprietor you must report all business income or losses on your personal income tax return; the business itself is not taxed separately. (The IRS calls this "pass-through" taxation, because business profits pass through the business to be taxed on your personal tax return.)

Is it better to file as a sole proprietor or LLC?

One of the key benefits of an LLC versus the sole proprietorship is that a member's liability is limited to the amount of their investment in the LLC. Therefore, a member is not personally liable for the debts of the LLC. A sole proprietor would be liable for the debts incurred by the business.

Do sole proprietors pay taxes twice?

While the owners of sole proprietorships are not subject to double taxation, they are considered self-employed workers and are subject to self-employment taxes. The IRS says that self-employment taxes include a tax of 10.4 percent that goes toward Social Security and a tax of 2.9 percent that goes toward Medicare.

Can a sole proprietor write off a vehicle?

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. If a taxpayer uses the car for both business and personal purposes, the expenses must be split. The deduction is based on the portion of mileage used for business.

What is the single biggest disadvantage of a sole proprietorship?

The biggest disadvantage of a sole proprietorship is that there is no separation between business assets and personal assets. This means that if anyone sues the business for any reason, they can take away the business owner's cash, car, or even their home.

What is one of the tax disadvantages of a sole proprietorship?

Sole proprietorships bring many advantages, including operational flexibility and a simple tax structure. However, you face a number of disadvantages as well, including unlimited personal liability, the self-employment tax, a potentially higher income tax, difficulty in raising capital and limited duration.

What are the advantages of sole proprietorship?

Sole proprietorship – advantages and disadvantagesyou're the boss.you keep all the profits.start-up costs are low.you have maximum privacy.establishing and operating your business is simple.it's easy to change your legal structure later if circumstances change you can easily wind up your business.

Do sole proprietors pay taxes twice?

While the owners of sole proprietorships are not subject to double taxation, they are considered self-employed workers and are subject to self-employment taxes. The IRS says that self-employment taxes include a tax of 10.4 percent that goes toward Social Security and a tax of 2.9 percent that goes toward Medicare.

What is sole proprietorship tax?

Sole Proprietorship Taxes Defined. For tax purposes, a sole proprietorship is a pass-through entity. Business income “passes through” to the business owner, who reports it on their personal income tax return. This can reduce the paperwork required for annual tax filing.

What taxes do sole proprietors pay?

But it’s important to understand which sole proprietorship taxes you’ll pay. Sole proprietors are responsible for paying: Federal income tax. State income tax, if this applies in your home state. Self-employment tax. Federal and state estimated taxes.

What form do sole proprietors file to pay federal taxes?

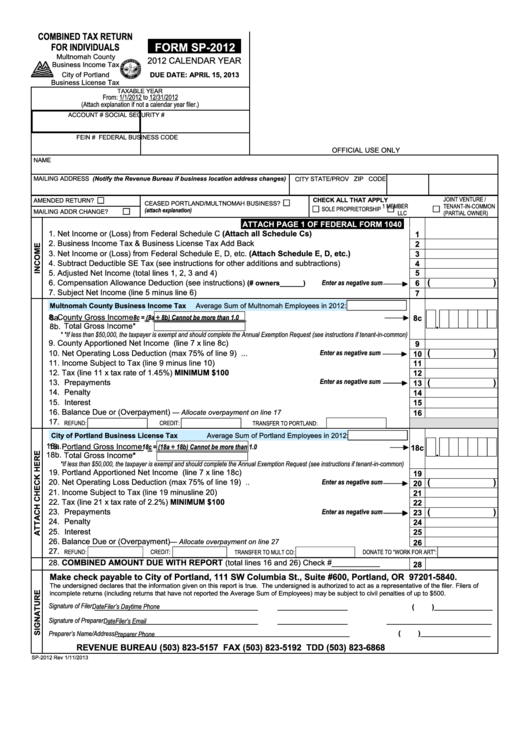

Federal and State Income Tax. Sole proprietors file need to file two forms to pay federal income tax for the year. Firstly, there’s Form 1040 , which is the individual tax return.

What is the difference between a 1040 and a C?

Secondly, there’s Schedule C, which reports business profit and loss. Form 1040 reports your personal income, while Schedule C is where you’ll record business income. Your tax bracket and the amount of income tax owed are based on your combined income from both Form 1040 and Schedule C.

How much is self employed tax?

Here’s how the self-employment taxbreaks down for 2019: 12.4% goes t0ward Social Security tax, on up to the first $132,900 of your income. 2.9% goes toward Medicare tax.

What is the Medicare tax rate for self employment?

Altogether, the self-employment tax rate is 15.3%. If your total income is more than $200,000 as a single filer or $250,000 if you’re married and file jointly, you’ll pay the Additional Medicare Tax of 0.9%. These amounts are reported on Schedule SE each year when you file your federal tax return.

Do you have to pay Medicare tax if you are self employed?

If you’re a sole proprietor who’s completely self-employed, you’re responsible for paying this sole proprietor tax yourself.

How do tax credits help sole proprietorships?

Tax credits are a way sole proprietorships can save money on business taxes by engaging in certain activities. Tax credits are taken out of your tax return before your taxable income is calculated to directly reduce the amount of tax you owe. Each tax credit has a specific form you must use after your business has spent money on the activity. Some common business tax credits include:

What is the self employment tax rate?

The self-employment tax rate is 15.3%, including 12.4% for Social Security and 2.9% for Medicare. The Social Security part is capped each year at a specific amount. The Medicare part is not capped, and there is an Additional Medicare Tax of 0.9% for yearly income above a specific amount. 6

What is excise tax?

Excise taxes are imposed on certain types of business goods, services, and activities. For example, there are excise taxes on indoor tanning services, sports wagering, and many types of fuels. The IRS has a list of common excise tax forms and publications .

How much is FICA tax?

Employee Social Security and Medicare taxes, called FICA taxes, are paid by both the employee and the employer. The total tax is 15.3% of the employee’s gross pay. You must withhold 7.65% from the employee and pay the other 7.65% as the employer. The employee withholding is capped each year, but the employer portion is not. 9

Which states don't have income tax?

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don’t have an income tax. New Hampshire doesn't tax earned income (including sole proprietorship income), but it does tax interest and dividends at 5%. 5

Is a sole proprietorship a separate entity from its owners?

Sole proprietorships are not separate from their owners for tax, liability, and debt purposes.

Do you have to pay quarterly taxes if you are self employed?

In this case, you must make quarterly estimated tax payments if you expect to owe tax of $1,000 or more for the year from all sources. 8

How much can you deduct from a sole proprietorship?

The Tax Cuts and Jobs Act of 2017 set up a new tax deduction for pass-through entities (like sole proprietorships) which allows you to deduct up to 20% of net business income earned as an additional personal deduction.

What are some popular tax deductions for sole proprietorships?

You can find a comprehensive list of all the tax deductions available to sole proprietors in our Big List of Small Business Tax Deductions. Some of the more popular ones among small business owners include:

What is Schedule C for sole proprietorship?

Sole proprietors use Schedule C to tell the IRS about their business’ income and expenses for that tax year.

What is part 2 of a tax return?

Part II, Expenses is where you’ll list all of the deductions you’re taking this year . You’ll need an income statement to fill this part out too.

How much is standard mileage deduction?

Beginning January 1, 2019, the standard mileage deduction is $0.58 per mile.

What is Schedule C on 1040?

In addition to filing a personal tax return ( Form 1040) you’ll have to file Schedule C, ‘Profit or Loss from Business (Sole Proprietorship),’ which is a two-page schedule of Form 1040 that looks like this:

Do sole proprietors pay taxes?

Sole proprietors are taxed as individuals, just like they were before they started the business. They report their income and expenses on their personal tax returns, rather than on a separate business tax return like a corporation would.

What are deductible expenses?

Though certainly not an exhaustive list, some common deductible expenses include rent payments to lease office or retail space, advertising costs, equipment, supplies, salaries you pay to employees and amounts paid to independent contractors.

Is there a separation between a business and a personal business?

Separating Business from Personal. Since there isn’t a legal separation between you and your business in a sole proprietorship, you’re personally liable for all debts and obligations of the business, which includes the payment of income taxes.

Do sole proprietors report income on taxes?

When you earn income through a sole proprietorship, you report it on a tax return a little differently than an employee reports wages. The Internal Revenue Service still expects to see all business earnings on a 1040, but unlike an employee, you separately report business income on a Schedule C. One of the main benefits of filing a Schedule C is the long list of deductible expenses you can report to reduce the income tax you owe.

Is every business expense deductible?

Not every deductible business expense you incur will be entirely deductible on your next tax return. The tax code has created a separate category of expenses called “capital expenses” that are deducted over a number of years through depreciation.

What is sole proprietorship in business?

A sole proprietor is an unincorporated business which is owned and run with no distinction between the business and the owner. The owner is entitled to all profits earned by the business, but also incurs any loss and liabilities incurred by the business.

What is the cheapest type of entity?

Sole proprietors are the cheapest type of entity, when it comes to operational costs. They are also the least complex of the legally recognized business structures. They are exempt from mandatory state registration laws and don’t require formal paperwork. They don’t require a tax filing separate from the owner’s personal filing, and they don’t shield the owner from any incurred liability.

Can a sole proprietor hire employees?

Yes, a sole proprietor can hire employees as long as they registered an EIN (employer identification number) with the IRS. If the sole proprietor is not hiring employees, they can use their social security number in place of the EIN.

Can a sole proprietorship use a company name?

No, when registering the trade name a sole proprietorship cannot use the name “company” or any abbreviation of the word to represent their business. They can also not use the words incorporation, corporation, limited liability corporation, limited, limited liability company, limited liability partnership or any abbreviation of the aforementioned words in the trade name.

Do sole proprietors have to file taxes?

Many of the tax advantages are in regards to the paperwork: in a sole proprietorship, there are much simpler and straightforward tax requirements and individuals are not required to file for an EIN, employer identification number, with the IRS. Sole proprietors are taxed as a pass-through entity, which means all business gains and losses are reported on the owner’s personal tax return, which prevents the need for complicated business filings along with unique personal filings. An added bonus is that some sole proprietors can take advantage of the 20% deduction available through the Tax Cuts and Jobs Act of 2017, which allows business owners to deduct 20% of a business’ income from their taxes.

Can a sole proprietorship be changed to an LLC?

It is possible for a sole proprietorship to change to an LLC (Limited Liability Corporation). In order to do so, the owner must file articles of organization with the secretary of state in the state the business operates in. They must also refile your DBA (Doing Business As certificate) to maintain the trade name and apply for a new EIN with the IRS. The owner should also contact the city or county and inform the proper officials that the business is now operating as an LLC.

What are some examples of tax deductible startup costs?

Examples of tax-deductible startup costs include market research and travel-related costs for starting your business, scoping out potential business locations, advertising, attorney fees, and accountant fees. The $5,000 deduction is reduced by the amount your total startup cost exceeds $50,000.

Who is eligible for a 1040 deduction?

Independent contractors and pass-through businesses are eligible for the deduction. They report their percentage of business income on a Schedule C: Profit or Loss from Business that accompanies the Form 1040: U.S. Individual Tax Return.

What is a local lobbying expense deduction?

Local lobbying expenses deduction. Deduction of settlement or legal fees in a sexual harassment case, when the settlement is subject to a nondisclosure. A review of the most common self-employed taxes and deductions is necessary to keep you up to date on any necessary changes to your quarterly estimated tax payments.

When does the restaurant tax deduction expire?

This provision is effective for expenses incurred after Dec. 31, 2020, and expires at the end of 2022. 12 .

What is the self employment tax rate?

This includes freelancers, independent contractors, and small-business owners. The self-employment tax rate is 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare. 5

Is self employment tax a deduction?

It is important to note that the self-employment tax refers to Social Security and Medicare taxes, similar to FICA paid by an employer. When a taxpayer takes a deduction of one-half of the self-employment tax, it is only a deduction for the calculation of that taxpayer's income tax.

Is a business car trip tax deductible?

When you use your car for business, your expenses for those drives are tax-deductible. Make sure to keep excellent records of the date, mileage, and purpose for each trip, and don't try to claim personal car trips as business car trips.