How to record cash receipts in accounting?

Cash receipts accounting steps 1 Make a cash sale#N#Before you can record cash receipts, you need to make a cash sale. When making a cash sale, be sure... 2 Record the cash receipt transaction#N#Your cash receipts journal should have a chronological record of your cash... 3 Create the sales entry More ...

What is the bookkeeping entry for cash receipts?

The business has a cash receipt of 500 from a customer relating to a sales invoice already posted to the sales ledger and accounts receivable (trade debtors) control account. The cash receipts transaction is shown in the accounting records with the following bookkeeping entries: Cash Receipt Journal Entry.

What is the received cash on account journal entry?

For example, suppose a business provides design services and has received cash of 4,000 from a customer. The cash receipt needs to be credited to the customers accounts receivable account. The received cash on account journal entry will be as follows. Cash has been received by the business and needs to be debited to the asset account of cash.

How do you enter accounts receivable in accounting?

In practice the entry to the accounts receivable would be a two stage process. The amount would be posted to the sales ledger, to the individual account of the customer, and then the control totals in the sales ledger would be posted to the accounts receivable control account. Cash came into the business from the customer.

What do we record in cash receipts journal?

A cash receipts journal is used by companies to record all cash received from any source. This includes cash sales, receipt of funds from a bank loan, payments from customer accounts, and the sale of assets. Below you can see an example of a typical cash receipts journal.

What is the account credited for a receipt of cash on account?

accounts receivable balanceThe cash receipt would be recorded when you actually pay cash or check to the manufacturer. They would reduce the receivable balance outstanding, and increase the cash balance (debit the cash account, credit the accounts receivable balance).

What is cash receipts from customers?

Cash receipts are the collection of money (cash) from your customers. These increase the cash balance recognized on a company's balance sheet. They can be generated by either sales or collections. Cash receipts can be a tricky concept to understand.

How do you record cash receipts?

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer's accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

How do you Journalize received cash from clients on account?

Debit the cash account for the amount paid by the client. For instance, a company that receives $1,000 in advance from a client must record a $1,000 debit to the cash account. This entry illustrates that the company's cash account has increased by $1,000.

Is a cash receipt a credit or debit?

Make The Sales Entry Cash sales are reported in the sales journal as a credit and the cash receipts journal as a debit. For example, a $500 cash sale is a $500 debit in the cash receipts journal and a $500 credit in the sales journal.

What is a cash receipt transaction?

A cash receipt is a printed acknowledgement of the amount of cash received during a transaction involving the transfer of cash or cash equivalent. The original copy of the cash receipt is given to the customer, while the other copy is kept by the seller for accounting purposes.

Received Cash on Account Journal Entry

The accounting records will show the following bookkeeping entries for the cash received on account from the customer:

Accounting Equation For Received Cash on Account Journal Entry

The accounting equation, Assets = Liabilities + Owners Equity means that the total assets of the business are always equal to the total liabilities...

Popular Double Entry Bookkeeping Examples

Another double entry bookkeeping example for you to discover. 1. Goods Withdrawn For Personal Use 2. Accrued Salaries 3. Services on Account 4. Cas...

When recording cash receipts, increase, or debit, what is the balance?

When recording cash receipts, increase, or debit, your cash balance. Recording cash receipts offsets the accounts receivable balance from the sale. If you have a cash sale, you are responsible for recording a cash receipt. The following payment methods are considered cash sales:

How to record cash receipts in small business?

Record the cash receipt transaction. Create the sales entry. 1. Make a cash sale. Before you can record cash receipts, you need to make a cash sale. When making a cash sale, be sure to keep all receipts.

What are cash receipts?

You record cash receipts when your business receives cash from an external source, such as a customer, investor, or bank. And when you collect money from a customer, you need to record the transaction and reflect the sale on your balance sheet. When you collect money from a customer, the cash increases (debits) your balance sheet.

How to record cash payments in sales journal?

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer’s accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

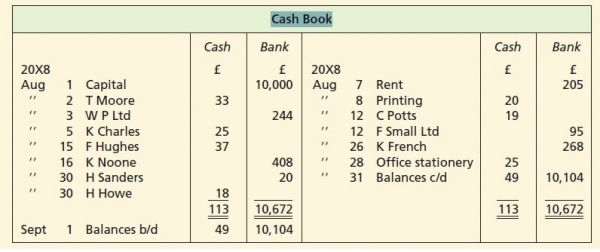

What is a cash receipt journal?

Cash receipts journal. Your cash receipts journal manages all cash inflows for your business. Record all of your incoming cash in your journal. Your cash receipts journal typically includes cash sales and credit categories. In your journal, you will want to record: The transaction date. Notes about the transaction.

What do you need to keep when making a cash sale?

When making a cash sale, be sure to keep all receipts. The sales receipts provide proof that the sale took place. Sales receipts typically include things like the customer’s name, date of sale, itemization of the products or services sold, price for each item, total sale amount, and sales tax (if applicable).

What is Patriot's accounting software?

Need a fast and affordable way to track your business’s transactions? Patriot’s accounting software lets you streamline the way you record your income and expenses. Start your self-guided demo today!

What is a cash receipt?

A cash receipt is a statement of the amount of cash received in a cash sale transaction. It is created with multiple copies for record-keeping purposes.

What is account receivable?

Accounts Receivable: This account is created to reflect the changes in credit sales. It records the customer reference as well as the amount received against receivables.

What is cash transaction?

Cash transactions can include spontaneous cash sales or accrual cash transactions recovering receivables. Cash entries are generated for cash sales or recovery of accounts receivable for credit sales.

What is a receipt used for?

It is issued for all cash transactions received from customers. It is used to record the cash sales of products or goods. The receipt records the cash amount and customer name to create the journal entry.

Why is a cash receipt journal important?

A cash receipt and a cash receipt journal are important for any business for maintaining its cash accounts. A cash receipt journal helps a business in maintaining cash flow records, journal entries, accounts receivable, bank account reconciliation, and preparation of financial statements.

What is cash in accounting?

Cash: It denotes the total cash amount received for the transaction. The account is debited to show the cash received entry.

How long does it take to get a cash transfer?

Other cash transactions can include payment through a card or immediate bank transfer. A bank transfer can take a few days to complete.

What is the entry to accounts receivable?

In practice the entry to the accounts receivable would be a two stage process. The amount would be posted to the sales ledger, to the individual account of the customer, and then the control totals in the sales ledger would be posted to the accounts receivable control account.

How do you show the Cash Receipt?

The cash receipts transaction is shown in the accounting records with the following bookkeeping entries: