The three major functions of accounting are:

- The collection and storage of data concerning a business’s financial activities. ...

- To supply information that can be used for managerial reports, financial statements, strategic planning and decision-making.

- To provide controls that effectively, efficiently and accurately record and process data.

What are the main objectives of accounting?

- The pricing of the product to achieve the maximum possible profit. ...

- Taking decisions when you have a shortage of funds to maximize the profit so that the status can be improved.

- Helping to make decisions where the organization may need to acquire additional financing. ...

- Accounting can also be helpful in deciding on a non-performing product or service.

What is the basic purpose of accounting?

What Is the Purpose of Accounting?

- RECORDING TRANSACTIONS. The primary role of accounting is to maintain a systematic, accurate and complete record of all financial transactions of a business.

- BUDGETING AND PLANNING. ...

- DECISION MAKING. ...

- BUSINESS PERFORMANCE. ...

- FINANCIAL POSITION. ...

- LIQUIDITY. ...

- FINANCING. ...

- CONTROL. ...

- LEGAL REQUIREMENTS. ...

What are the functions of an accounting system?

- identification,

- recording,

- classification and

- summarization of transactions

- ascertainment of results

- exhibition of the financial position of an organization

- communication of necessary information derived from an interpretation

- analysis of the interested parties, including the management.

What is accounting and why it matters for your business?

What is Accounting and Why it Matters For Your Business A simple definition of "accounting" Accounting is how your business records, organizes, and understands its financial information. You can think of accounting as a big machine that you put raw financial information into—records of all your business transactions, taxes, projections, etc.—that then spits out an easy-to-understand story ...

What is the main function of accounting?

The main functions of accounting are to store and analyze financial information and oversee monetary transactions. Accounting is used to prepare financial statements for a company's employees, leaders, and investors. Accounting also functions to ensure the payment of funds into and out of a company. Accounting creates a fiscal history ...

Why is accounting important?

An important function of accounting is to track business spending in relation to income. Just like managing your personal finances, accountants record expenses and payments to keep an accurate and up to date record of the company's funds.

What is an accountant?

An accountant is a business professional responsible for processing and tracking financial data within a company. Accountants store and analyze financial information. They actively track all funds entering and exiting a company, making sure everything is documented and accurate. They may work individually or as a team depending on the size and needs of a business.

What is payroll accounting?

Payroll. Accountants deduct employee wages from company funds for paychecks. They are also in charge of managing employee benefits if they are paid out of an employee's income. Accounting may help decide how employees are compensated for their work based on how wages affect the company's profits.

Why do accountants work?

They seek to protect the company's assets from internal and external fraud, specifically through cybersecurity. An accountant may specialize in securing digital financial data or hire an outside business to protect the company's funds. They also scrutinize financial data to make sure an employee is not mismanaging or embezzling funds for company or personal gain.

Why do accountants need to report?

Accountants then use these systems to analyze how a business is handling its finances. They report profits and losses so managers and investors can see how a business is functioning.

What is a CPA?

Accountants who earn a Certified Public Accountant (CPA) certification can conduct audits of businesses or act as a consultant and trainer to others in their field.

What are the functions of accounting?

The functions of accounting include the systemic tracking, storing, recording, analysing, summarising and reporting of a company's financial transactions. Through the functions of the accounting department, the company can maintain a fiscal history that they can make accessible for audits.

What is an accountant?

An accountant is a business professional who handles the financial matters of companies. They may work on their own or as part of an accounting team in the company's accounting department. Their work involves keeping track of the company's incoming and outgoing funds and gathering, storing and processing financial data.

Jobs in accounting

As a qualified accountant, you may be able to work in the following roles:

Types of Accounting

Accounting refers to the business process that systematically and comprehensively records business events and transactions and translates them into financial data. The data provided by this function enables business leaders to make informed decisions.

What is financial accounting?

As mentioned above, financial accounting is a type of accounting that deals with the recording of transactions that are needed for the preparation of trial balance and final accounts of the company. The primary functions of accounting are to track, report, execute, and predict financial transactions.

Principles of Financial Accounting

The functions and objectives of financial accounting are based on a set of principles. Five important accounting principles referred to as generally accepted accounting principles (GAAP) are listed below:

Why is financial accounting important?

With the understanding of financial accounting comes the question of its importance in running a business. The objective of the financial accounting function is to generate statements containing important financial data that provide insights into the financial stability of the business.

Functions of accounting

All companies use accounting to report, track, execute and predict financial transactions. Accounting department functions revolve around storing and analysis of financial information and overseeing monetary transactions. To simply explain the functions of accounting in business, we can say that it creates a fiscal history for any company.

Conclusion

A high degree of accuracy, consistency, and security is required to handle financial and accounting functions. Manual methods of financial accounting cannot provide the accuracy and consistency required in handling sensitive financial data. Automating the functions of accounting helps businesses save time and money and ensures the accuracy of data.

What is the main goal of accounting?

The main goal of accounting is to accurately record and report an organization’s financial performance.

Why is accounting important?

Accounting is important, as it keeps a systematic record of the organization’s financial information. Up-to-date records help users compare current financial information to historical data. With full, consistent, and accurate records, it enables users to assess the performance of a company over a period of time.

What is accounting in business?

What is Accounting? Accounting is a term that describes the process of consolidating financial information to make it clear and understandable for all stakeholders and shareholders. Shareholder A shareholder can be a person, company, or organization that holds stock (s) in a given company.

What is the purpose of accounting standards?

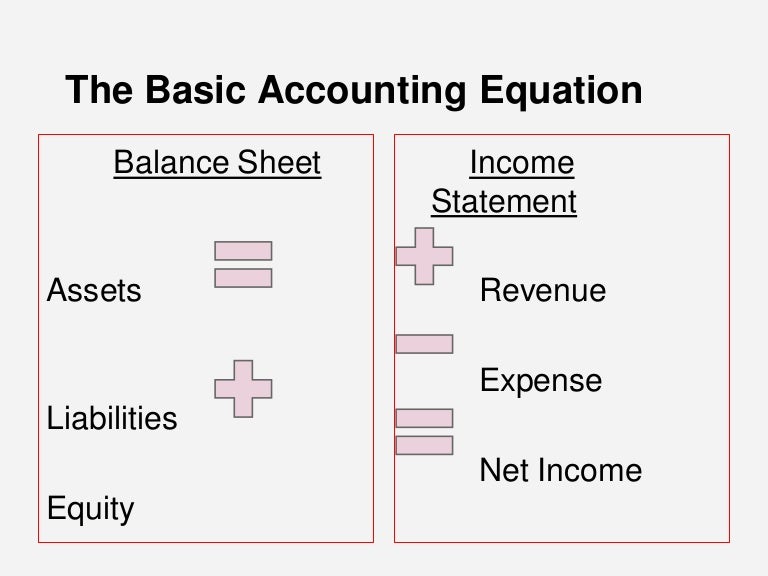

Accounting standards improve the reliability of financial statements. The financial statements include the income statement, balance sheet, cash flow statement, and the statement of retained earnings. Statement of Retained Earnings The statement of retained earnings provides an overview of the changes in a company's retained earnings ...

What are the two types of accounting?

Types of Accounting. Accounting can be classified into two categories – financial accounting and managerial accounting. 1. Financial Accounting. Financial accounting involves the preparation of accurate financial statements. The focus of financial accounting is to measure the performance of a business as accurately as possible.

What is a lender in accounting?

Lender A lender is defined as a business or financial institution that extends credit to companies and individuals, with the expectation that the full amount of. , and other creditors are the primary external users of accounting information.

What is the purpose of standardized financial statements?

Internal Revenue Service (IRS) and the Canada Revenue Agency (CRA), use standardized accounting financial statements to assess a company’s declared gross revenue and net income.

What are the functions of accounting?

The three major functions of accounting are: 1 The collection and storage of data concerning a business’s financial activities. The information is gathered from source documents, recorded first in journals then posted to ledgers, either manually or with accounting software. 2 To supply information that can be used for managerial reports, financial statements, strategic planning and decision-making. 3 To provide controls that effectively, efficiently and accurately record and process data.

Why is accounting important?

Accounting plays a critical role in business. Comprehensive record-keeping ensures the ability to provide accurate financial reports, which may be required during an audit, for quarterly reports to investors or lending institutions. Everything from annual or quarterly tax filings to audits and applications for credit will likely require detailed financial statements. It’s only by the maintenance of careful accounting records that this information can be readily available when needed.

What is the difference between financial accounting and management accounting?

This differs from financial accounting in that management accountants provide guidance as to how to run a business. On the other hand, financial accountants provide reports that indicate how well the business is being run. Overall, both management and financial accountants follow the same golden rules of accounting and must adhere to the same industry standards and general accounting principles.

How many entries should you make in a financial transaction?

By consistently following this principle, you should always make two entries for every financial transaction. The second golden rule of accounting states that you should debit what comes in and credit what goes out. This is, in essence, the same as rule number one, but it is not used for personal accounts.

What is the collection and storage of data concerning a business's financial activities?

The collection and storage of data concerning a business’s financial activities. The information is gathered from source documents, recorded first in journals then posted to ledgers, either manually or with accounting software.

What is journal accounting?

The book used to track financial transactions is called a journal. Today, you might prefer to use accounting software, but the term “journal” still appears frequently, even in electronic accounting. Furthermore, the basic principles are the same. A transaction is a financial event that needs to be documented.

What is the book used to track financial transactions called?

Traditionally, financial record-keeping was done manually. The book used to track financial transactions is called a journal.

What is an Accounting Team?

An accounting team is a group of people in a business that control the financials and ensure the business is operating according to different rules and regulations. The accounting team's goal is to help the business grow and succeed.

9. Chief financial officer (CFO)

The chief financial officer is responsible for performing the following tasks:

Why is accounting important?

The accounting department plays a vital role in running a business as it helps in tracking both revenue (money in) and expenses (money out) while ensuring compliance with all statutory requirements. Additionally, it also provides quantitative financial information to management, lenders, investors, and other stakeholders, who use it for making informed business decisions.

What is the function of accounting department?

Functions of Accounting Department. Business Transactions A business transaction is the exchange of goods or services for cash with third parties (such as customers, vendors, etc.). The goods involved have monetary and tangible economic value, which may be recorded and presented in the company's financial statements. read more.

What is an accounting manager?

Accounting Manager/ Chief Accountant/ Accounting Supervisor: These managers are responsible for maintaining and reporting all the financial transactions. They also establish and enforce the accounting principles based on the auditing policy and statutory requirements.

What is the role of an accountant in an accounting department?

Accountant: The Accountants play a vital role in an accounting department as they are involved in the measurement and interpretation of all the financial information.

What is account receivable?

Account Receivables Accounts receivables refer to the amount due on the customers for the credit sales of the products or services made by the company to them.

What is payroll function?

It is solely responsible for the payroll function Payroll Function Payroll refers to the overall compensation payable by any organization to its employees on a certain date for a specific period of services they have provided in the entity. This total net pay comprises salary, wages, bonus, commission, deduction, perquisites, and other benefits. read more. They have to ensure that all the employees get paid timely and accurately. Additionally, the department should also make sure that employee taxes are assessed accurately, and the payments are made timely to the state and federal authorities.

What is OPEX in accounting?

To keep track of costs incurred by the company costs and advise the modification of existing operations with the intent to reduce operating costs Operating Costs Operating expense (OPEX) is the cost incurred in the normal course of business and does not include expenses directly related to product manufacturing or service delivery. Therefore, they are readily available in the income statement and help to determine the net profit. read more.