Key Takeaways

- Contingent liabilities are obligations that will become liabilities if certain events occur in the future.

- To be a contingent liability, it must be possible to estimate its value and have more than a 50% chance of being realized.

- Journal entries are recorded for contingent liabilities, with a credit to the accrued liability account and a debit to the liability-related expense account.

How do you account for contingent liabilities in accounting?

Instead, the FASB requires contingent liabilities be accrued. Future costs are expensed first, and then a liability account is credited based on the nature of the liability. In the event the liability is realized, the actual expense is credited from cash and the original liability account is similarly debited.

What is contingent liability?

A contingent liability is a potential liability that may or may not occur, depending on the result of an uncertain future event. The relevance of a contingent liability depends on the probability of the contingency becoming an actual liability, its timing, and the accuracy with which the amount associated with it can be estimated.

What is the basic accounting treatment for contingent earn-outs?

As you can see, the basic accounting treatment for contingent earn-outs is similar to the accounting for other assets and liabilities under GAAP, but goes further and requires you to evaluate and record the agreement at fair value at the end of every reporting period.

What are the three financial statements for contingent liabilities?

Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are if the contingency is probable and the related amount can be estimated with a reasonable level of accuracy. The most common example of a contingent liability is a product warranty.

What is contingent liabilities and its accounting treatment?

Contingent liabilities are never recorded in the financial statements of a company. These obligations have not occurred yet but there is a possibility of them occurring in the future. So a contingent liability has no accounting treatment as such. Now such contingent liabilities have to be reviewed on a yearly basis.

Where does contingent liability appear in the financial statements?

A contingent liability is recorded first as an expense in the Profit & Loss Account and then on the liabilities side in the Balance sheet.

What is the accounting treatment for contingent asset?

According to the accounting standards, a business does not recognize a contingent asset even if the associated contingent gain is probable. A contingent asset becomes a realized (and therefore recordable) asset when the realization of income associated with it is virtually certain.

How do you journal contingent liabilities?

Assuming that the loss contingency is “probable” and can be reasonably estimated, then a journal entry should be recorded to accrue the liability. The journal entry would be to debit legal expense and credit to record the legal liability.

Is contingent liability recorded in accounting records?

Key Takeaways. A contingent liability is a potential liability that may occur in the future, such as pending lawsuits or honoring product warranties. If the liability is likely to occur and the amount can be reasonably estimated, the liability should be recorded in the accounting records of a firm.

Why contingent liability is shown in balance sheet?

The principle of full disclosure requires that all material and relevant facts concerning financial performance of an enterprise must be fully and completely disclosed in the financial statements and their accompanying footnotes. Hence, contingent liability is recorded in balance sheet as footnote.

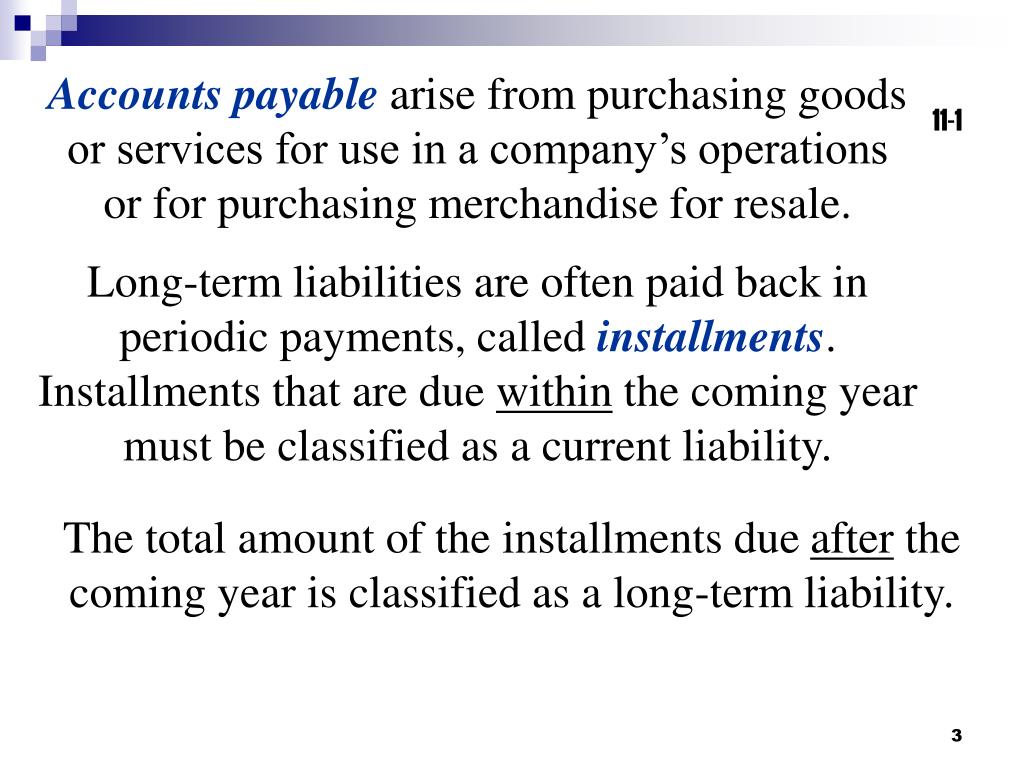

Is contingent liability a current liability?

Current and contingent liabilities are both important financial matters for a business. The primary difference between the two is that a current liability is an amount that you already owe, whereas a contingent liability refers to an amount that you could potentially owe depending on how certain events transpire.

What is difference between contingent assets and contingent liabilities?

IAS 37 Provisions, Contingent Liabilities and Contingent Assets outlines the accounting for provisions (liabilities of uncertain timing or amount), together with contingent assets (possible assets) and contingent liabilities (possible obligations and present obligations that are not probable or not reliably measurable) ...

At what point would a contingent liability become a provision?

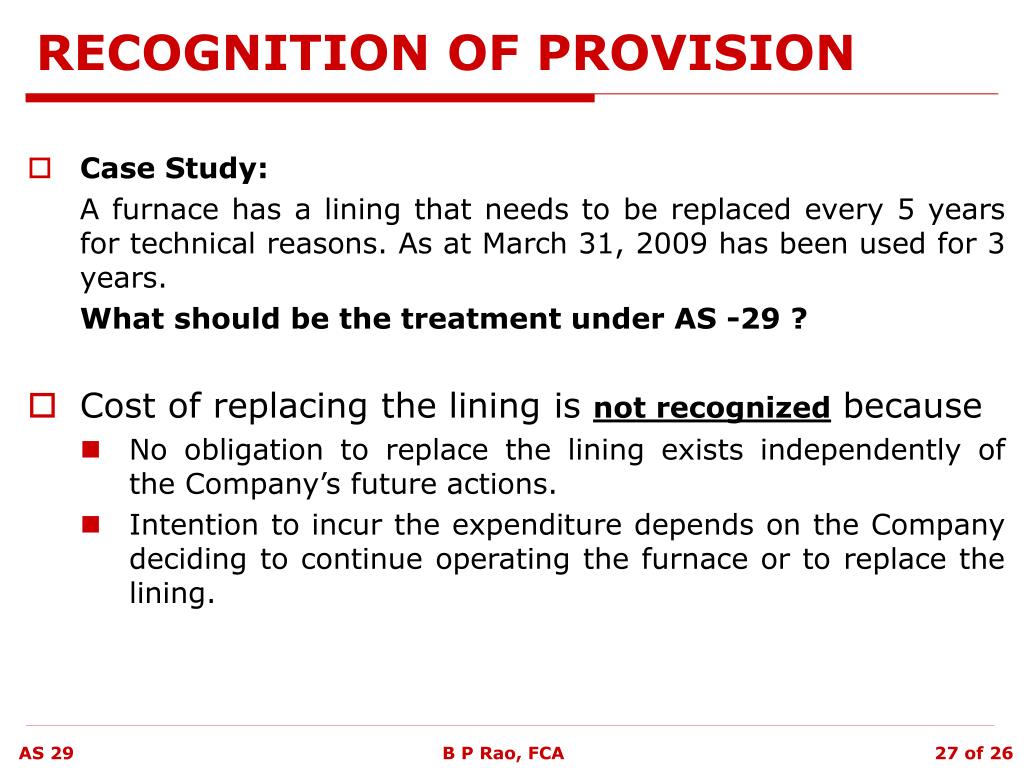

If an outflow is not probable, the item is treated as a contingent liability. A provision is measured at the amount that the entity would rationally pay to settle the obligation at the end of the reporting period or to transfer it to a third party at that time.

What are the four potential treatments for contingent liabilities?

Four Potential Treatments for Contingent LiabilitiesJournalizeNote DisclosureProbable and estimableYesYesProbable and inestimableNoYesReasonably possibleNoYesRemoteNoNoApr 11, 2019

What is the journal entry for contingent liability is not paid or payable sacrificed?

The company can make contingent liability journal entry by debiting the expense account and crediting the contingent liability account. This journal entry is to show that when there is a probability of future cost which can be reasonably estimated, the company needs to recognize and record it as an expense immediately.

Are contingent liabilities current liabilities?

Current and contingent liabilities are both important financial matters for a business. The primary difference between the two is that a current liability is an amount that you already owe, whereas a contingent liability refers to an amount that you could potentially owe depending on how certain events transpire.

Where are the contingent items disclosed in the financial statements?

A loss contingency that is probable or possible but the amount cannot be estimated means the amount cannot be recorded in the company's accounts or reported as liability on the balance sheet. Instead, the contingent liability will be disclosed in the notes to the financial statements.

When should contingent liabilities be recorded?

Rules specify that contingent liabilities should be recorded in the accounts when it is probable that the future event will occur and the amount of the liability can be reasonably estimated. This means that a loss would be recorded (debit) and a liability established (credit) in advance of the settlement.

How should a contingent liability be reported in the financial statements when it is reasonably possible?

On the other hand, if a loss becomes probable and can be reasonably estimated, your company would report a contingent liability on the balance sheet and a loss on the income statement.

Why Is A Contingent Liability recorded?

Both GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) require companies to record contingent...

Using Knowledge of A Contingent Liability in Investing

Since a contingent liability can potentially reduce a company’s assets and negatively impact a company’s future net profitability and cash flow, kn...

Impact of Contingent Liabilities on Share Price

Contingent liabilities are likely to have a negative impact on a company’s share price, as they threaten to negatively impact the company’s ability...

Recording Contingent Liabilities

Per GAAP, contingent liabilities can be broken down into three categories based on the likelihood of occurrence of each contingent event. The first...

Incorporating Contingent Liabilities in A Financial Model

Modeling contingent liabilities can be a tricky concept due to the level of subjectivity involved. The opinions of analysts are divided in relation...

What are contingent liabilities?

Contingent liabilities takes place when an outcome is uncertain in a future point of time, which may lead to debt or obligation for a corporation. These get treated through two factors- likelihood of occurrence & measurement.

Why is it important to record contingent liability?

Recording of contingent liability help in planning of different types of budget for the company.

What is GAAP compliance?

Under GAAP compliance, any potential liability losses depend on the future event which turns into actual expenses.

What is a probable contingency?

Probable contingency: These are most likely to be occur and the outcomes have to be estimated reasonably. It can be taken into an estimate when the probability is between (90-51%) and recognize an asset if you can estimate the amount fairly. If it is not rated, disclosure should be noted as liability (provision). These record an expense & an actual liability which is based on estimated amounts. Example: Warranty expenses.

What are the three categories of liabilities?

The accounting treatment for liabilities depends on the three categories: Probable, Possible and Remote. The measurement is the amount of estimable or not estimable which must be recorded and disclosed in the financial statements.

Where should contingent losses be reported?

Since the accounting principles are conservative, if management is probable and have reasonably estimated the amount of loss in that case contingent losses should be reported on the footnotes of the financial statement and on the balance sheet.

Who evaluates warranty?

The warranty of the product is evaluated by the enterprise.

How Do Liabilities Become Contingent Liabilities?

1 The concept of a contingent liability is centered around the two primary aspects of an accounting liability: that they are present responsibilities and obligations to other entities. 2

What is contingent liability?

In the Statement of Financial Accounting Standards No. 5, it says that a firm must distinguish between losses that are probable, reasonably probable or remote. There are strict and sometimes vague disclosure requirements for companies claiming contingent liabilities. 1

What is FASB Statement of Financial Accounting Standards No. 5?

5 requires any obscure, confusing or misleading contingent liabilities to be disclosed until the offending quality is no longer present. 5

When do liabilities gain contingency?

These liabilities gain contingency whenever their payment contains a reasonable degree of uncertainty. Only the contingent liabilities that are the most probable can be recognized as a liability on financial statements. Other contingencies are relegated to footnotes as long as uncertainty persists. 3

What are the three contingencies?

This is why the FASB created three categories of contingency: probable, reasonably probable and remote . Only those classified as probable can be officially recognized. 1

Does it make sense to immediately realize a contingent liability?

It does not make any sense to immediately realize a contingent liability – immediate realization signifies the financial obligation has occurred with certainty. Instead, the FASB requires contingent liabilities to be accrued. 4

Do you have to report contingent liability in GAAP?

If a contingent liability is deemed probable, it must be directly reported in the financial statements. 4 Nevertheless, generally accepted accounting principles, or GAAP, only require contingencies to be recorded as unspecified expenses.

What is contingent liability?

A contingent liability is a liability that may or may not happen. This means there is uncertainty about recording such a liability in the financial accounts. This is because the happening or not happening of a contingent liability is not in the hand of us.

How many ways are contingent liability defined?

There are two ways contingent liability can be defined. One method involves a past event and the other one a future event. Let us take a look at the definition of a contingent liability.

Why are contingent liabilities only disclosed in notes to accounts?

Contingent liabilities, on the other hand, are only disclosed in the notes to accounts because they do not meet the criteria. If the management estimates a liability is probable, that the settlement of the obligation will most likely result in an outflow of economic resources it will be recognized as a provision.

What is provision in accounting?

A provision is a liability which can only be measured using a significant degree of estimation. This means that the obligation is already present but we cannot determine the exact amount of the obligation, only an estimate can be determined. Then in such a case, we make a provision for such a liability.

What is the chance of a company not paying damages?

Q: A company is facing litigation. Their lawyers inform them that there is a 70% chance that the company will not have to pay damages, and a 30% possibility of damages arising. How should the management recognize such a liability?

Is contingent liability recorded in financial statements?

Now let’s make one thing clear. Contingent liabilities are never recorded in the financial statements of a company. These obligations have not occurred yet but there is a possibility of them occurring in the future. So a contingent liability has no accounting treatment as such.

Can an obligation arise from past events?

An obligation may arise for the company from past events also. This happens when. It is not likely that an outflow of funds will be required to discharge the contingent liabilities. No reliable estimate can be made for the legal obligation. There is no prior precedence to enable the company to make such an estimate.

When are contingent liabilities recorded?

Opposite from contingent assets, contingent liabilities are recorded into balance sheet if they are highly likely and the amount can be estimated. If both conditions do not exist, the contingent liabilities must record in the financial note.

What is contingent asset?

Contingent assets are the possible future assets which the company may or may not be able to take advantage of, it depends on any specific event that is not under company control. As the assets are not yet certain and company does not own them yet, so we cannot record the assets into the financial statement. However, we should disclose such kind of information in the financial statement note. It tells the reader that there is a possible future economic benefit that may be flowing into the company in the future.

What is contingency in business?

Contingency is an uncertain event that may or may not occur in the future. However, there are some indications that show the possibility of occurrence. The events are not under the control of the company, so the company cannot decide on the occurrence of the event.

When do contingent assets go into the balance sheet?

Contingent assets will be recorded into the balance sheet when there is a certain of the future cash flow into the company. By the time of certainty, the accountant can record the transaction. It mostly happens when the assets’ future economic benefits are not measured reliably. So we cannot record it into the financial statement. But when we can measure it reliably, it is time to record it into the balance sheet.

Do you need to record contingent liability and expense?

As the loss is highly likely to happen and the amount can be estimated. So the company needs to record the contingent liability and expense.

Do companies need to record warranty expense?

So the company needs to estimate the warranty expense and record it into the financial statement.

What are contingent liabilities?

Contingent liabilities, liabilities that depend on the outcome of an uncertain event, must pass two thresholds before they can be reported in financial statements. First, it must be possible to estimate the value of the contingent liability.

When should a company report contingent liability?

If a court is likely to rule in favor of the plaintiff, whether because there is strong evidence of wrongdoing or some other factor, the company should report a contingent liability equal to probable damages. This is true even if the company has liability insurance .

How many thresholds are required for contingent liabilities?

Contingent liabilities must pass two thresholds before they can be reported in financial statements: it must be possible to estimate the value of the contingent liability, and the liability must have greater than a 50% chance of being realized.

Why is it important to be warned about possible losses?

It's important that shareholders and lenders be warned about possible losses—an otherwise sound investment might look foolish after an undisclosed contingent liability is realized.

Do you have to include remote contingencies in financial statements?

Any probable contingency needs to be reflected in the financial statements—no exceptions. Remote contingencies should never be included. Contingencies that are neither probable nor remote should be disclosed in the footnotes of the financial statements.

Is contingent loss reflected on the balance sheet?

If the contingent loss is remote, meaning it has less than a 50% chance of occurring, the liability should not be reflected on the balance sheet. Any contingent liabilities that are questionable before their value can be determined should be disclosed in the footnotes to the financial statements.

What are contingencies in accounting?

Entities often make commitments that are future obligations that do not yet qualify as liabilities that must be reported. For accounting purposes, they are only described in the notes to financial statements. Contingencies are potential liabilities that might result because of a past event. The likelihood of loss or the actual amount of the loss is still uncertain. Loss contingencies are recognized when their likelihood is probable and this loss is subject to a reasonable estimation. Reasonably possible losses are only described in the notes and remote contingencies can be omitted entirely from financial statements. Estimations of such losses often prove to be incorrect and normally are simply fixed in the period discovered. However, if fraud, either purposely or through gross negligence, has occurred, amounts reported in prior years are restated. Contingent gains are only reported to decision makers through disclosure within the notes to the financial statements.

When is contingent loss recognized?

Question: According to U.S. GAAP, a contingent loss must be recognized when it is probable that it will occur and a reasonable estimation of the amount can be made. That rule has been in place now for over thirty years and is well understood in this country. Are contingent losses handled in the same way by IFRS?

Why are structured guidelines needed for reporting contingencies?

Because companies prefer to avoid (or at least minimize) the recognition of losses and liabilities, it is not surprising that structured guidelines are needed for reporting contingencies. Otherwise, few if any contingencies would ever be reported. U.S. GAAP in this area was established in 1975 when FASB issued its Statement Number Five, “Accounting for Contingencies.” This pronouncement requires the recognition of a loss contingency if

What is a probable loss?

“Probable” is described in Statement Number Five as likely to occur and “remote” is a situation where the chance of occurrence is slight.

How to restate a previously reported income statement?

From a journal entry perspective, restatement of a previously reported income statement balance is accomplished by adjusting retained earnings. Revenues and expenses (as well as gains, losses, and any dividend paid figures) are closed into retained earnings at the end of each year. That is where the previous year error now resides.

What is a commitment in business?

Commitments. Commitments represent unexecuted contracts. For example, assume that a business places an order with a truck company for the purchase of a large truck. The business has made a commitment to pay for this new vehicle but only after it has been delivered. Although cash may be needed in the future, no event (delivery of the truck) has yet created a present obligation. There is not yet a liability to report; no journal entry is appropriate.

Can the amount of loss be reasonably estimated?

the amount of loss can be reasonably estimated.