What are normal closing costs for refinance?

National average closing costs for a refinance are $5,749 including taxes and $3,339 without taxes, according to 2019 datafrom ClosingCorp, a real estate data and technology firm. Several factors determine how much you can expect to pay in refinance closing costs.

What is a typical closing cost for a mortgage?

What Are Typical Closing Costs? Closing costs typically range from 3%–6% of the home’s purchase price. Thus, if you buy a $200,000 house, your closing costs could range from $6,000 to $12,000.

How to decrease closing costs on home refinance?

Negotiable fees

- Loan application fees. Lenders charge a range of in–house fees to obtain a loan, and most of them can be negotiated to lower your closing costs.

- Loan origination fees. ...

- Underwriting fees. ...

- Homeowners insurance. ...

- Title insurance. ...

Is refinancing your mortgage worth the cost?

Typically, it is worthwhile to refinance if the reduction in total interest expected to be paid over the life of the loan is greater than the cost of acquiring the loan. Monitor refinance rates regularly and use Zillow’s free refinance calculator to make sure a refinance is worth it for your financial circumstances.

Is refinance worth closing cost?

If you're not eligible for the best interest rates, the cost of refinancing might not be worth it. You might also hold off on refinancing if you don't plan to keep the mortgage long. You typically want to keep the loan long enough to recoup what you paid in closing costs unless you opt for a no-cost refi.

How can I avoid closing costs on a refinance?

9 ways to reduce your refinance closing costsGet your credit in the best possible shape. ... Borrow less of your home's value. ... Avoid cash-out refinances if you can. ... See if you're eligible for a streamline refinance program. ... Work with the same title insurance company. ... Shop around with multiple lenders.More items...•

Are closing costs negotiable when refinancing?

Negotiate with your lender. During a mortgage refinancing, it's certainly possible to negotiate with your lender. This is true when it comes to closing costs and it is especially true if you choose to refinance with your current lender.

Do you have to pay out of pocket to refinance?

More often than not, you don't need to put down money to refinance your mortgage. In the typical rate-and-term refinance, which lowers your interest rate and payments and/or shortens your loan term, lenders generally look for an 80 percent loan-to-value ratio (LTV) or lower and solid credit, not money down.

Do you get penalized for refinancing?

Penalties usually cover the first few years of a loan, because, as we mentioned, those are the riskiest for the lender. So if you refinance early on, you'll trigger the prepayment penalty. The amount of the fee will differ based on the type of mortgage penalty fee you have.

How do you get closing costs waived?

How To Avoid Closing Costs When Buying A HouseNegotiate A No-Closing Costs Mortgage. ... Negotiate With The Seller. ... Comparison-Shop For Services. ... Negotiate Origination Fees With The Lender. ... Close Towards The End Of The Month. ... Check Into Army Or Union Discounts. ... Apply for An FHA Loan.

What should I watch out when refinancing?

10 Mistakes to Avoid When Refinancing a Mortgage1 - Not shopping around. ... 2- Fixating on the mortgage rate. ... 3 - Not saving enough. ... 4 - Trying to time mortgage rates. ... 5- Refinancing too often. ... 6 - Not reviewing the Good Faith Estimate and other documentats. ... 7- Cashing out too much home equity. ... 8 – Stretching out your loan.More items...

How much does a refi cost?

The average refinance closing costs increased in 2021 to $2,375 (excluding taxes), according to ClosingCorp. Generally, you can expect to pay 2 percent to 5 percent of the loan principal amount in closing costs. For a $200,000 mortgage refinance, for example, your closing costs could run $4,000 to $10,000.

How do you get closing costs waived?

How To Avoid Closing Costs When Buying A HouseNegotiate A No-Closing Costs Mortgage. ... Negotiate With The Seller. ... Comparison-Shop For Services. ... Negotiate Origination Fees With The Lender. ... Close Towards The End Of The Month. ... Check Into Army Or Union Discounts. ... Apply for An FHA Loan.

Which is better lower interest rate or lower closing costs?

The lower the loan amount, the better off you would be by choosing the low closing cost option.

Can you pay closing costs with a credit card?

Can I use my credit card to cover closing costs? Typically it's not advised that you use your credit card to cover closing costs when buying a home.

What is the current interest rate for a 15 year refinance?

Today's national 15-year mortgage rate trends For today, Thursday, October 27, 2022, the national average 15-year fixed mortgage APR is 6.48%, flat compared to last week's of 6.48%. The national average 15-year fixed refinance APR is 6.48%, down compared to last week's of 6.51%.

Why Do Homeowners Refinance?

There are four major reasons why you might want to refinance your home loan. You may want to lower your interest rate, change your loan’s term, con...

How Does Refinancing Work?

The first step is to see if you qualify for a refinance. You must already have a significant amount of equity in your home if you want to take a ca...

How Much Does It Cost To Refinance Your Mortgage?

Your Closing Disclosure tells you exactly what you need to pay at closing. Here are a few of the closing costs you might see when you refinance: ap...

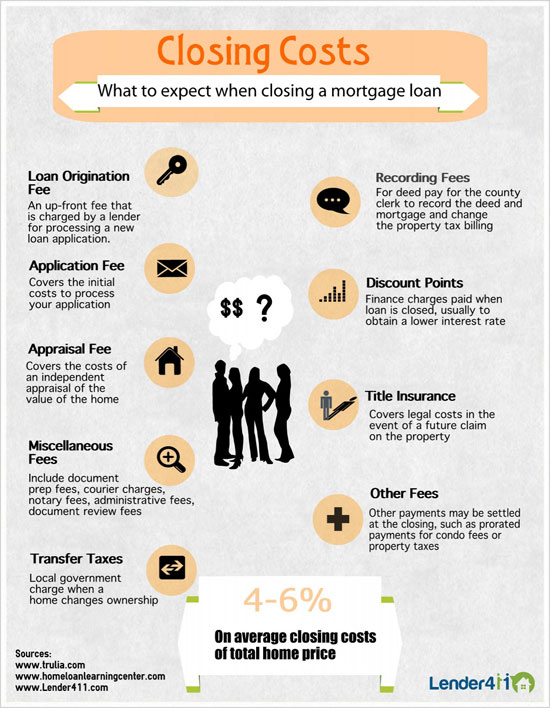

How much are closing costs?

Closing costs are typically 2–5% of your loan amount, with a smaller percentage for larger loans.

What is closing cost?

Closing costs are a collection of fees required to set up and close a new mortgage. They typically cost 2-5% of the mortgage amount for both home purchase and refinance loans.

What are average closing costs in 2022?

In 2021 (the most recent data available), the average closing costs for a single–family home were $6,837.

What is the FHA insurance premium?

FHA loan — Upfront mortgage insurance premium (1.75% of loan amount) VA loan — VA funding fee (1.4% to 3.6% of loan amount) USDA loan — Upfront mortgage insurance fee (1% of loan amount) These premiums are technically part of your closing costs on an FHA, VA, or USDA loan. But you’re allowed to roll them into the loan balance (even on ...

How much does home insurance cost at closing?

Homeowners insurance ($400-$1,000 or more) — Homeowners typically pay 6-12 months of homeowners insurance premiums upfront at closing. Before you close, you should compare insurance companies to find the lowest-cost homeowners policy for you.

What is a loan estimate?

All lenders use standard loan forms called the ‘Loan Estimate’ and ‘Closing Disclosure.’. Lenders are required to send you a Loan Estimate (LE) after you apply. This document will list your loan terms, interest rate, and every closing cost associated with the offer.

How to know if a loan is a good deal?

You can determine if this is a good deal or not by looking at the ‘break-even point’ on your new loan. That’s the point at which your monthly savings outweigh your upfront costs.

What are refinancing closing costs?

Mortgage refinance closing costs include many of the same fees you paid when you closed on your first mortgage. There isn’t a standard method to calculate refi closing costs; the amount you’ll pay depends on your lender and location.

How to calculate refinance closing costs?

One of the best ways to get an idea of how much you might pay is to use a reliable refinance calculator. You’ll get an idea of what a refinance can cost you, plus your break-even point— the amount of time it could take you to recoup those costs.

How much does a refinance cost?

Mortgage refinance closing costs typically range from 2% to 6% of your loan amount, depending on your loan size. Make sure you pay attention to these costs.

What are mortgage points?

Also known as discount points, you pay mortgage pointsto your lender at closing for a reduced mortgage interest rate. Each point equals 1% of the loan amount and can lower your interest rate by as much as 0.25%. For example, if you buy one point on a $100,000 mortgage, it will cost you an additional $1,000 to get a lower interest rate. If you were originally quoted a 3.75% rate on that loan and bought a point to get your rate down to 3.50%, you could save more than $5,000 in interest over the life of a 30-year loan term.

What is the Freddie Mac adverse market fee?

1, 2020. It’s equal to 0.5% of the loan amount and may cost the average borrower about $1,400.

How to save money on refinancing?

Try for an appraisal waiver. Ask your lender if you qualify for an appraisal waiver. If so, you can save a couple hundred dollars on your refi.

What happens if you refinanced your mortgage?

Once you’ve refinanced your mortgage, the original lender’s policy is no longer valid and you must buy a new one. If you bought an owner’s policy, though, that remains in effect. Mortgage points. Also known as discount points, you pay mortgage pointsto your lender at closing for a reduced mortgage interest rate.

How much does it cost to refinance a mortgage?

The average closing cost for refinancing a mortgage in America is $4,345. These costs may vary depending on the lender and location of the mortgaged property. Additionally, the amount you borrow will impact the cost of the refinance. Refinances advertised with "no closing costs" or "no fees" often fold those charges into the interest rate, amount borrowed, or monthly payments of the new mortgage.

How long does it take to recoup closing costs on a refinance?

In this scenario, we found that the ~1.3% interest rate differential allows you to recoup your closing costs within four years of refinancing, making this a profitable decision in the short-run. Nonetheless, we found that the benefit from refinancing was quickly eliminated once the rate lock expired, and was actually $58,000 more expensive than the original loan if left outstanding until maturity. While this isn’t necessarily indicative of future market conditions, it illustrates the risks inherent in an adjustable rate structure. The potential costs or savings from an ARM structure rely on the movement of future interest rates, which are difficult to predict.

What are the estimated refinancing costs?

Estimated refinance costs exclude property taxes, mortgage insurance and homeowner’s insurance, which are typically required before purchasing a new home but may not be relevant when refinancing a property you already own.

How does cash out refinance work?

A cash-out refinance increases your monthly payments, which adds up in terms of interest and closing costs. By cashing out on existing equity, you increase the amount owed, monthly payments, and transaction costs, assuming no changes to the term of the mortgage.

How much does private mortgage insurance cost?

Private mortgage insurance may be required if the amount borrowed exceeds 80% of the current market value of the home. This can cost between 0.05% - 1% of the loan amount per year, substantially increasing your long-term costs.

What is the local record fee?

Local Recording Fee: Local statutes require updated deeds to reflect the status of a new mortgage. This fee will vary according to the township in which your property is located.

Do closing costs exceed savings?

closing costs exceed savings. Closing costs are not the only cost incurred during a refinance. Depending on the purpose or timing of the refinance, interest expenses incurred during the amortization of the new loan can sometimes exceed the benefit of refinancing.

How much does an appraisal cost for a refinance?

Appraisal fee: Most lenders require appraisals before refinancing. Most appraisers charge $300 – $500 for their services.

Why refinance to a longer term?

Refinance to a longer term: You might want to refinance to a longer term if you’re having trouble keeping up with your payments. Going from a shorter term to a longer term gives you more time to pay back your loan and also lowers your monthly payment.

Why Do Homeowners Refinance?

You may want to lower your interest rate, change your loan’s term, consolidate debt or take cash out of your equity. Let’s take a look at each of these motives in more detail.

Why do lenders require appraisals?

Lenders require appraisals because they need to know that they aren’t loaning you more money than your home is worth. You may need to adjust the terms of your refinance if your appraisal comes back low.

What is APR in refinancing?

Always remember to compare annual percentage rates (APRs) when you consider a refinance. Your APR includes both your base interest rate and any additional fees you must pay. The bigger the difference between your base rate and your APR, the more you’ll pay in closing costs when you finalize your refinance. Just be sure that you’re comparing apples to apples regarding the type of loan you are considering when looking at APR.

Why refinance a home loan?

You may want to lower your interest rate, change your loan’s term, consolidate debt or take cash out of your equity. Let’s take a look at each of these motives in more detail.

How long do you have to live in your home to refinance?

As a general rule, you need to live in your home for at least a year to gain a financial advantage through a refinance. Next, find a lender to service your loan. You don’t need to refinance with the same company that services your current loan.

How much does it cost to close a refinance?

Average closing costs for a refinance loan come to around $5,000 but yours will be determined based on the specifics of your loan. Closing costs must always be paid.

What is included in refinancing closing costs?

When you refinance, you'll have to pay for a number of different expenses. Here are some of the refinancing closing costs you can expect.

What is refinancing a mortgage?

A refinance loan replaces your existing mortgage with a new one. Some refinancing fees are charged by lenders, such as application fees and origination or underwriting fees. You'll pay others to third parties, such as credit check fees or appraisal fees, but they are still required.

How much is closing fee on a mortgage?

Closing fee ($500 to $1,000) You may also have to pay a prepayment penalty. This depends on the type of mortgage and age of your loan. You can also decide to pay discount points to reduce your interest rate. They typically cost 1% of your loan amount and reduce your loan interest rate by 0.25%.

How much do discount points cost?

You can pay extra at closing to reduce your interest rate. You can choose to reduce your interest rate by 0.25% for each point you buy. Points generally cost 1% of your loan amount. Refinancing rates are very competitive right now and discount points could reduce your interest costs even further.

What happens if you don't pay closing costs?

If you don't pay them up front, you'll either pay a higher interest rate or the costs will be rolled into your loan. Here's what you can expect when it comes to closing costs for refinancing your mortgage.

How much does a closing cost for a house?

Average closing costs total $5,000, according to Freddie Mac. But yours may be much higher or much lower.

What is the average closing cost for a refinance?

According to data from ClosingCorp, the average home's closing costs were $5,749 in 2019.

How much does closing cost on a mortgage?

According to the Federal Reserve, typical closing costs are about 3% to 6% of your mortgage's principal.

What factors affect the price of a refinance?

One of the big factors that will influence the price you'll pay on your home's refinance is where you live. Your home's location will have a big impact on the closing costs, since your closing costs involve taxes and your home's value.

How should I pay my refinance closing costs?

Take a close look at your financial situation when deciding the best way to pay your refinance closing costs.

How much does it cost to refinance?

Homeowners typically refinance to save money. Refinancing can result in a lower interest rate and monthly payment – and it could save you thousands over the life of your loan.

What are today’s refinance rates?

Just like rates for homebuyers, mortgage refinance rates are low across all loan types right now, including rate–and–term and cash–out refinances.

Why is it important to compare upfront fees and interest rates?

Comparing upfront fees and interest rates can help you save money. And if you find a lender with a cheaper loan origination fee, application fee, or underwriting fee, this sways the negotiating power in your favor.

What is closing cost?

Closing costs are lender and third-party fees you pay when getting a mortgage. You have to pay these on a refinance, just like you did on your original mortgage. Closing costs aren’t a flat fee, though.

When do you pay prorated mortgage interest?

Interest rate: Your lender will charge prorated mortgage interest, starting from the date of closing to the first day of the following month. You’ll pay this upfront payment at closing, and your interest rate determines the exact amount

How much does a discount point cost?

Each discount point usually costs 1% of the loan balance and reduces your interest rate by about 0.25%. For example, if you pay two discount points on a $200,000 loan, you’ll pay an additional $4,000 in closing costs. Location.

How much does it cost to refinance a mortgage?

The cost to refinance a mortgage can vary depending on several factors. For example, the interest rate, credit score and loan amount. Our mortgage refinance cost calculator can help you figure out how much it will cost to refinance your mortgage.

How much of your mortgage can you deduct from closing costs?

Current U.S. Bank customers with an existing first mortgage or a U.S. Bank Personal Checking Package may be eligible for a customer credit. 1 Take 0.25% of your next first mortgage and deduct it from the closing costs, up to a maximum of $1,000 off. 2

What is the APR for a $225,000 loan?

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate (APR) of 3.946%. 4

How to contact a mortgage loan officer?

Find a mortgage loan officer. Call 855-456-7550.

Is a traditional refinance a good idea?

A Traditional Refinance might be a good option if you’re looking for a lower interest rate or a shorter term. It’s a low-cost way to get the most our of your home.

Does a smart refinance save time?

This no-cost mortgage refinancing option can save you time and money. Take advantage of a simplified application process, flexible terms and no closing costs 3 with a U.S. Bank Smart Refinance.

What are closing costs?

Closing costs are another expense to consider when shopping for a mortgage, or considering buying a house. Your closing costs can add significantly to the amount you need to buy a home, and are an expense that's separate from your down payment. Popular Articles. Average 401k balance.

How much does closing cost in 2020?

The average closing costs in 2020 were $3,470 without taxes, according to ClosingCorp data. When including taxes, that amount increased to $6,087. These costs cover underwriting, title search, and loan fees, and are on top of the down payment.

Can you get a loan without closing costs?

It is possible to get a loan without closing costs, but often, the costs roll into the life of the loan. You may find that a loan with lower or no closing costs has a higher interest rate, which could make costs higher than simply paying up front.