Are property taxes actually low in California?

Yes it is generally considered a low property tax state. This is mostly due to Prop 13 and how it handles property tax. So when you buy your home, the property tax in California cannot be higher than 1%. Although there are other fees that can be added on by a municipality or county. But let’s stick to property taxes.

What percent is property tax in California?

The average effective property tax rate in California is 0.73%. This compares well to the national average, which currently sits at 1.07%. How Property Taxes in California Work. California property taxes are based on the purchase price of the property. So when you buy a home, the assessed value is equal to the purchase price.

How much is tax per dollar in California?

How much is tax per dollar? The California state sales tax rate is 7.25%. This rate is made up of a base rate of 6%, plus California adds a mandatory local rate of 1.25% that goes directly to city and county tax officials. How many times is a dollar taxed? Yes you read that right: 70 cents of a dollar earned was paid out in tax to the IRS.

How much are property taxes?

Your area’s property tax levy can be found on your local tax assessor or municipality website, and it’s typically represented as a percentage—like 4%. To estimate your real estate taxes, you merely...

What city has the highest property tax in California?

AthertonTop 25 California cities with highest property taxesRankCityMedian Tax Burden1Atherton$34,9182Hillsborough$29,8303Newport Coast$28,4764Los Altos Hills$27,98521 more rows•Mar 12, 2020

Is CA property tax based on purchase price?

Although there are some exceptions, a property's assessed value typically is equal to its purchase price adjusted upward each year by 2 percent. Under the Constitution, other taxes and charges may not be based on the property's value. The Property Tax Is One of the Largest Taxes Californians Pay.

Which state has the highest property tax?

New Jersey1. New Jersey. New Jersey holds the unenviable distinction of having the highest property taxes in America yet again-it's a title that the Garden State has gotten used to defending. The tax rate there is an astronomical 2.21%, the highest in the country, and its average home value is painfully high as well.

What is the maximum property tax rate in California?

1%The proposition states that property taxes may not exceed 1% of home value. From this, we can glean that property owners pay 1% of their property's value in the way of real property taxes.

At what age do you stop paying property taxes in California?

PROPERTY TAX POSTPONEMENT PROGRAM This program gives seniors (62 or older), blind, or disabled citizens the option of having the state pay all or part of the property taxes on their residence until the individual moves, sells the property, dies, or the title is passed to an ineligible person.

Which states have no property tax?

States With No Property Tax 2022StateProperty Tax RateMedian Annual TaxAlaska$3,231$3,231New Jersey$2,530$7,840New Hampshire$2,296$5,388Texas$1,993$2,77546 more rows

Are California property taxes high?

Often, we value the community our home is in as a top priority. But financially supporting the local area, like schools and infrastructure, comes with property taxes....States Ranked By Property Tax.Rank16StateCaliforniaReal Estate Tax Rate0.76%Average Home Price$505,000Annual Property Tax$1,64450 more columns•Jun 2, 2022

Are property taxes higher in Texas or California?

The only exception that Californians need to be aware of is property tax. California's average effective property tax rate is just 0.72% – among the lowest in the country. In Texas, they'll pay 1.9%.

Which state has cheapest property tax?

HawaiiHawaii has the lowest effective property tax rate at 0.31%, while New Jersey has the highest at 2.13%.

How can I lower my property taxes in California?

One of the primary ways that you can reduce your overall tax burden, therefore, is by reducing the assessed value of your home—in other words, filing an appeal arguing that its assessed value is actually less than what the assessor assigned it.

Is property tax deductible in California?

California does not allow a deduction of state and local income taxes on your state return. California does allow deductions for your real estate tax and vehicle license fees.

Are property taxes tax deductible?

Real property taxes Homeowners who itemize their tax returns can deduct property taxes they pay on their main residence and any other real estate they own. This includes property taxes you pay starting from the date you purchase the property.

What is property tax based on?

The tax is based on the market value of a residential property on the valuation date.

How can I lower my property taxes in California?

One of the primary ways that you can reduce your overall tax burden, therefore, is by reducing the assessed value of your home—in other words, filing an appeal arguing that its assessed value is actually less than what the assessor assigned it.

What triggers property tax reassessment in California?

Completion of new construction or a change in ownership (“CIO”) triggers a reassessment to a new Base Year Value equal to the current fair market value, meaning higher property taxes.

How are property taxes paid in California?

Often, your property taxes are wholly, or partially, rolled into your monthly payment, so you will most likely never have to pay the full amount out of pocket. If you overpay throughout the year, you'll receive a refund come tax time. If you underpay, you'll receive a bill for the difference.

California Property Taxes

Property taxes in California are limited by Proposition 13, a law approved by California voters in 1978. The law has two important features. First,...

How Property Taxes in California Work

California property taxes are based on the purchase price of the property. When you buy a home, the assessed value is equal to the purchase price....

California Property Tax Rates

Property taxes are applied to those assessed values. Each county collects a general property tax equal to 1% of assessed value. That general tax is...

What is the property tax rate in California?

The average effective property tax rate in California is 0.73%. This compares well to the national average, which currently sits at 1.07%

How much property tax is allowed in California?

First, it limits general property taxes (not including those collected for special purposes) to 1% of a property’s market value. And secondly, it restricts increases in assessed value to 2% per year. These two rules combine to keep California’s overall property taxes below the national average, which in turn keeps your bills low.

What is the property tax rate in Los Angeles County?

Los Angeles County is the most populous county in both the state of California and the entire United States. The median Los Angeles County homeowner pays $3,938 annually in property taxes. Along with the countywide 0.72% tax rate, homeowners in different cities and districts pay local rates.

How to calculate property tax?

There are typically multiple rates in a given area, because your state, county, local schools and emergency responders each receive funding partly through these taxes. In our calculator, we take your home value and multiply that by your county's effective property tax rate. This is equal to the median property tax paid as a percentage of the median home value in your county.

What is the median home value in Santa Clara County?

The median home value in Santa Clara County is among the highest in the nation, at $913,000. Because of these high home values, annual property tax bills for homeowners in Santa Clara County are quite high, despite rates actually being near the state average.

What are the property tax rates in California?

In California, the property tax rate is composed of three types of levies: general tax levy, voter-approved bond indebtedness repayment, and special district assessments. The general tax levy was frozen by Proposition 13 at 1 percent of assessed property value. The bond indebtedness component refers to a repayment of state and local bonds that have been approved by the voters, usually with a favorable vote by two-thirds of the electorate. The third component refers to local districts, such as school districts and fire districts that are usually local as opposed to statewide, and for which voters must approve assessments in advance. The largest component of the tax rate is the general levy.

How to determine property tax rate?

The other is the assessed value of a property. A property tax bill is determined by multiplying the tax rate by the assessed value. In certain states, the assessed value is the fair market value of the property and is determined regularly – often on an annual basis. In California, the assessed value is the property price at the last sale plus no more than a 2 percent increase per year. This limit on assessment value required by Proposition 13, along with the limiting factors on the tax rate, has the effect of limiting annual increases in property taxes.

How is property tax calculated?

A property tax bill is determined by multiplying the tax rate by the assessed value. In certain states, the assessed value is the fair market value of the property and is determined regularly – often on an annual basis. In California, the assessed value is the property price at the last sale plus no more than a 2 percent increase per year.

What is assessed value in California?

In California, the assessed value is the property price at the last sale plus no more than a 2 percent increase per year. This limit on assessment value required by Proposition 13, along with the limiting factors on the tax rate, has the effect of limiting annual increases in property taxes.

How much is the California property tax exemption?

California real property owners can claim a $7,000 exemption on their primary residence. This reduces the assessed value by $7,000, saving you up to $70 per year. You should claim the exemption after you buy a real property, as you do not have to reapply each year.

Who Owes California Real Property Taxes?

If you own real property in California, you will be required to pay real property taxes. So, if you own any real property as an individual or business, you pay real property tax on it. Even if the real property was gifted to you through an estate or you own a rental real property, you are still required to pay it.

What are Property Taxes Used For?

The money collected by California is used for multiple public services throughout the state. It could be used for:

What is real property tax?

Real property tax systems require owners of land and buildings to pay an amount of money based on the value of their land and buildings. Within the U.S., state real property taxes vary, for instance, California real property taxes will likely differ from Wisconsin, or any other state.

What is the assessed value of real estate in California?

For instance, if you buy a real property in California, the assessed value is equal to the purchase price. The assessed value of the real property can rise with inflation every year, which is the change in the California Consumer Price Index. There’s a 2% cap on this.

When are property taxes due in California?

Real property taxes in California are due on Nov. 1 each year, if you do not pay it as part of your mortgage. If your California real property taxes are drawn monthly from your mortgage, you should have no remaining balance at this deadline.

Do you split taxes if you bought a house mid year?

If your real property was purchased mid-year, there is a chance your realtor will work it out that you and the seller split the cost of real property taxes within the calendar year. Your mortgage interest statement provides documentation if this is the case or not.

How many counties are there in California?

California has a total of fifty eight counties, and each county has a unique process for assessing and calculating property tax. If you would like to estimate the property tax on a home like yours in California, enter your most recent property valuation in the property tax estimator below.

Does California have high property taxes?

By percentage of median income. California collects relatively high property taxes, and is ranked in the top half of all states by property tax collections. Keep in mind that higher real estate taxes may be offset by lower state sales or income taxes. Higher property taxes in dollars may also be the result of higher property values ...

What Are California Real Estate Taxes Used For?

They’re a revenue anchor for public services used to maintain cities, schools, and special districts, such as sewage treatment stations, public safety services, recreation etc.

How Are Property Taxes Handled at Closing in California?

Then who pays property taxes at closing when it happens mid-year? Real estate ownership flips from the seller to the buyer at closing. And so does the obligation for remitting real estate levies. Thus, the purchaser will be reimbursing the previous owner for the after-closing piece of the levy.

What is the property tax rate?

The 1 Percent Rate. The largest component of most property owners’ annual property tax bill is the 1 percent rate—often called the 1 percent general tax levy or countywide rate. The Constitution limits this rate to 1 percent of assessed value. As shown on our sample property tax bill, the owner of a property assessed at $350,000 owes $3,500 under the 1 percent rate. The 1 percent rate is a general tax, meaning that local governments may use its revenue for any public purpose.

Who pays property taxes in California?

California property owners pay their property tax bills to their county tax collector (sometimes called the county treasurer–tax collector). The funds are then transferred to the county auditor for distribution. The county auditor distributes the funds collected from the 1 percent rate differently than the funds collected from the other taxes and charges on the bill. Specifically, the 1 percent rate is a shared revenue source for multiple local governments.

What percentage of property taxes are ad valorem?

Ad valorem property taxes—the 1 percent rate and voter–approved debt rates—account for nearly 90 percent of the revenue collected from property tax bills in California. Given their importance, this section begins with an overview of ad valorem taxes and describes how county assessors determine property values. Later in the chapter, we discuss the taxes and charges that are determined based on factors other than property value.

How does equity affect taxes?

Equity relates to how taxes affect taxpayers with different levels of income or wealth. Economists use two different standards of equity—vertical and horizontal—to evaluate taxes. Vertical equity occurs when wealthier taxpayers pay a greater amount in taxes than less wealthy taxpayers. Horizontal equity, on the other hand, occurs when similar taxpayers—those with similar incomes or wealth—pay the same amount in taxes. Under an equitable property tax system (1) owners of highly valuable property pay more in taxes than owners of less valuable property and (2) the owners of two similar properties pay a similar amount in property taxes. Put differently, an equitable system would tax property owners at the same effective rate. As we discussed in the previous section, however, property owners often are subject to different effective tax rates. Therefore, California’s ad valorem property taxes, parcel taxes, and Mello–Roos taxes often do not meet these standards of equity.

What is the ad valorem rate in California?

The California Constitution allows local governments to levy voter–approved debt rates—ad valorem rates above the 1 percent rate —for two purposes. The first purpose is to pay for indebtedness approved by voters prior to 1978, as allowed under Proposition 13 (1978). Proposition 42 (1986) authorized a second purpose by allowing local governments to levy additional ad valorem rates to pay the annual cost of general obligation bonds approved by voters for local infrastructure projects. Because most debt approved before 1978 has been paid off, most voter–approved debt rates today are used to repay general obligation bonds issued after 1986 as authorized under Proposition 42.

What is ad valorem tax?

Levies based on value—such as the 1 percent rate and voter–approved debt rates—are known as “ad valorem” taxes. Under the Constitution, other taxes and charges on the property tax bill (shown in “Box C”) may not be based on the property’s taxable value.

How does acquisition value assessment system affect property tax revenue?

Acquisition Value Assessment System Contributes to Revenue Stability. T he main reason California’s property tax revenue is stable is that the assessed value of most properties increases each year by a maximum of 2 percent. In any given year, only a small fraction of properties are sold and reset to market value. This means that real estate conditions affect a relatively small portion of the tax base each year, insulating property tax revenue from year–to–year real estate fluctuations.

What is property tax?

A property tax is a municipal tax levied by counties, cities, or special tax districts on most types of real estate - including homes, businesses, and parcels of land. The amount of property tax owed depends on the appraised fair market value of the property, as determined by the property tax assessor. Because the calculations used ...

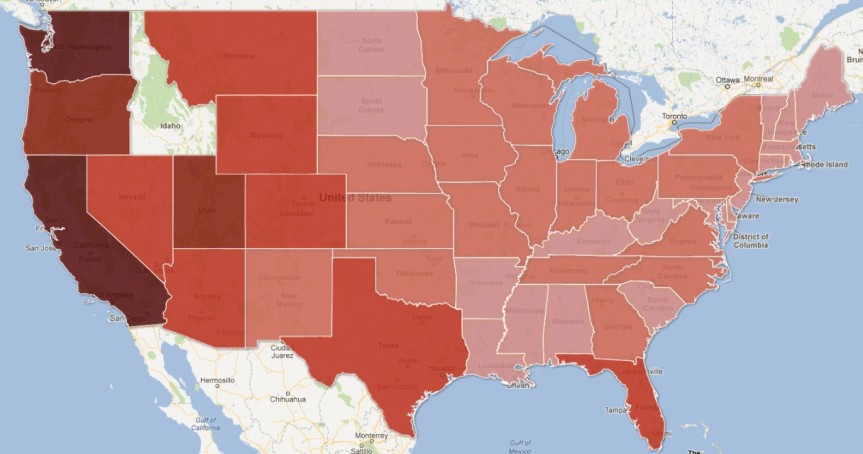

How to compare property taxes?

Because the calculations used to determine property taxes vary widely from county to county, the best way to compare property taxes on a large scale is by using aggregate data. On Tax-Rates.org, our data allows you to compare property taxes across states and counties by median property tax in dollars, median property tax as percentage of home value, and several other benchmarks.

Is property tax percentage a good comparison?

Taxes as percentage of home value can be a more useful comparison of the true property tax burden in an area, as any ranking using actual dollar amounts will be biased toward areas with high property values. You can compare the results using both of these methods with the property tax map.

What is the state tax rate for mental health services in California?

California state tax rates and tax brackets. California also assesses a 1% mental health services tax on any portion of taxable income exceeding $1 million.

How long can you stay in California for taxes?

Here are some examples of situations that can make you a California resident for tax purposes, according to the state: You spend more than nine months in California during the tax year. Your employer assigns you to an office in California for a long or indefinite period.

How much does TaxAct save?

TaxAct is a solid budget pick, and NerdWallet users can save 25% on federal and state filing costs.

How long does it take to get a California state tax refund?

If you can’t afford your tax bill and owe less than $25,000, California offers payment plans. Typically, you get three to five years to pay your bill.

Is California a part year resident?

Generally, you’re a part-year resident of California if you were a nonresident for some of the tax year. This is often the case for people who moved to California from another state. If you’re a part-year resident, you pay California state tax on all income you received during the part of the tax year you were a resident of California, ...

Is working with a tax pro easier?

Working with a tax pro has never been easier. Be as involved as you like.

Does tax software do state taxes?

Tax software will do your state taxes (though sometimes for an extra fee).