What is Boston Consulting Group (BCG model) model?

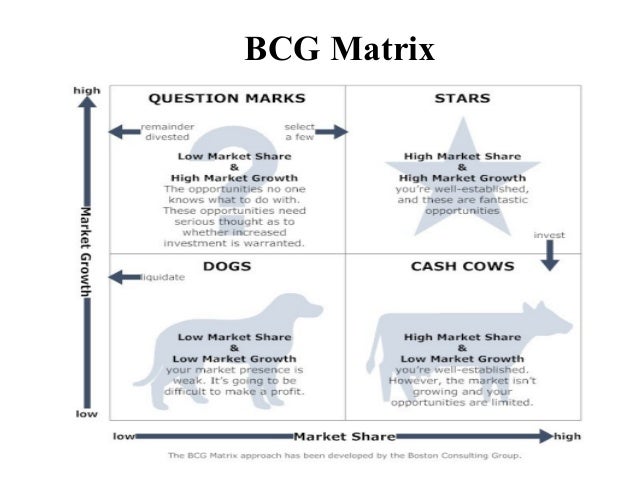

What is Boston consulting group (bcg model) Model? When using the Boston Consulting Group Matrix, SBUs can be shown within any of the four quadrants (Star, Question Mark, Cash Cow, Dog) as a circle whose area represents their size. With different colors, competitors may also be shown.

What are the limitations of the Boston Consulting Group model?

Besides helping management assess the strategic position of the Strategic Business Unit, Boston Consulting Group Model also has some limitations that could lead to miss allocation of products and subsequently lead to wrong decision making. Assessing the market share and market growth might be difficult and realistic.

What is the history of Boston Consulting Group?

It all started back in 1963 when Bruce D. Henderson founded the Boston Consulting Group (BCG) as part of The Boston Safe Deposit and Trust Company. The BCG became independent by the end of the 1970s, and it started an expansion process. In 2019, BCG made over $8.5 billion in revenues.

How are SBUs shown in the Boston Consulting Group Matrix?

When using the Boston Consulting Group Matrix, SBUs can be shown within any of the four quadrants (Star, Question Mark, Cash Cow, Dog) as a circle whose area represents their size. With different colors, competitors may also be shown. The precise location is determined by the two axes, Industry Growth as the Y axis, Market Share as the X axis.

What is the Boston group model?

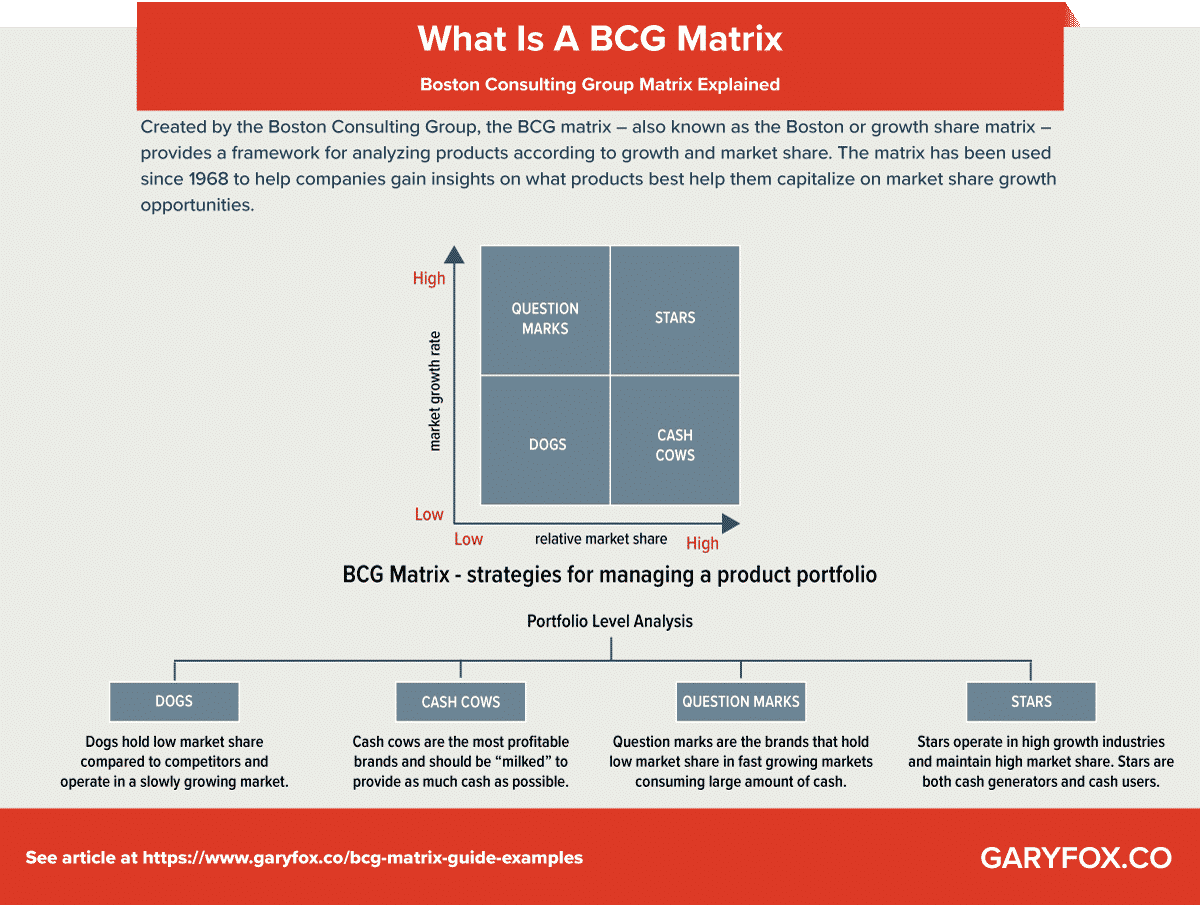

The Boston Consulting Group (BCG) growth-share matrix is a planning tool that uses graphical representations of a company's products and services in an effort to help the company decide what it should keep, sell, or invest more in.

What are the principles of the Boston Consulting Group model?

The BCG Matrix works on the principle that every company should have a portfolio containing both high-growth products requiring cash investment and low-growth products that throw off excess cash. Having both types of products will ensure long-term business success.

What are the four elements of the Boston Consulting Group model?

There are four elements in the BCG Matrix.Dogs.Cash Cows.Question Marks.Stars.

What is BCG matrix explain with example?

BCG matrix (also referred to as Growth-Share Matrix) is a portfolio planning model used to analyse the products in the business's portfolio according to their growth and relative market share. The model is based on the observation that a company's business units can be classified into four categories: Cash Cows. Stars.

What is BCG matrix and its importance?

BCG Matrix is a performance measurement tool for the products of a company. Developed by Bruce Henderson of Boston Consulting Group in the early 1970s, BCG Matrix is a strategic tool to analyse a business's portfolio on the basis of relative market share and industry growth rate.

What are the advantages of BCG?

The key benefits of the BCG matrix are: It is very simple to use and explain, as there are only two dimensions and four quadrants. It is a reputable and long-standing strategic model that has proved to be robust over time and significant changes in the competitive environment.

What is BCG matrix What are its uses and limitations?

It is the most renowned corporate portfolio analysis tool. It provides a graphic representation for an organization to examine different businesses in it's portfolio on the basis of their related market share and industry growth rates. It is a two dimensional analysis on management of SBU's (Strategic Business Units).

What is Boston Consulting Group?

Boston, Massachusetts, U.S. Boston Consulting Group (BCG) is a management consulting firm founded in 1963. BCG is one of the three most prestigious employers in management consulting, known as MBB or the Big Three. BCG's alumni hold various top management positions in the world economy.

What is the Boston Consulting Group's product portfolio matrix?

The Boston Consulting group's product portfolio matrix (BCG matrix) is designed to help with long-term strategic planning, to help a business consider growth opportunities by reviewing its portfolio of products to decide where to invest, to discontinue or develop products. It's also known as the Growth/Share Matrix.

What is the horizontal axis of the BCG matrix?

The horizontal axis of the BCG Matrix represents the amount of market share of a product and its strength in the particular market. By using relative market share, it helps measure a company’s competitiveness. The vertical axis of the BCG Matrix represents the growth rate of a product and its potential to grow in a particular market.

What are the quadrants of the BCG matrix?

In addition, there are four quadrants in the BCG Matrix: 1 Question marks: Products with high market growth but a low market share. 2 Stars: Products with high market growth and a high market share. 3 Dogs: Products with low market growth and a low market share. 4 Cash cows: Products with low market growth but a high market share.

What is the BCG matrix for dogs?

The BCG Matrix: Dogs. Products in the dogs quadrant are in a market that is growing slowly and where the product (s) have a low market share. Products in the dogs quadrant are typically able to sustain themselves and provide cash flows, but the products will never reach the stars quadrant. Firms typically phase out products in ...

How are question marks funded?

Investments in question marks are typically funded by cash flows from the cash cow quadrant. In the best-case scenario, a firm would ideally want to turn question marks into stars (as indicated by A). If question marks do not succeed in becoming a market leader, they end up becoming dogs when market growth declines.

What is sustainable growth rate?

Sustainable Growth Rate The sustainable growth rate is the rate of growth that a company can expect to see in the long term.

What are the different types of statistical models?

Some common types of statistical models are Correlation Test, Regression model, Analysis of Variance, Analysis of Covariance, Chi-square, etc.

What is cross validation?

Cross-Validation: This technique is used in order to validate the model performance, and can be executed by dividing the training data into K parts. During cross validation execution, the K-1 part can be considered as training ser and the rest made out part acts as a test set. Up to K times, the process is repeated and then the average of K scores is accepted as performance estimation.

Why are statistical models used?

Apparently, over a specific set of data, statistical models are utilized to identify interferences on a relatively small set of data for understanding the nature of underlying data.

Why is cross validation important?

A process of cross-validation is conducted in order to check the data’s probity that makes sure the ML model doesn’t overfit (memorize) or underfit (having not sufficient data to learn) to the provided amount of data.

When a data expert implements different statistical models to the data to examine, understand and decipher the information more?

When a data expert implements different statistical models to the data to examine, understand and decipher the information more imperatively, through this approach, the data expert identifies connections among variables, makes prophecies, and visualizes data that can be used and leveraged even by any non-analyst.

How does bagging affect prediction?

Bagging: It decreases the variance of prediction through producing extra data for training out of actual dataset by implementing “combinations with repetitions” for creating multi-step of the equivalent size as of original data. In actuality, the model predictive strength can’t be improved by enhancing the size of the training set, but the variance can be reduced, closely adjusting the prediction to an anticipated upshot.

What is Boston Consulting Group?

Definition: Boston Consulting Group develops a matrix that could help the management of the company to assess the position of the strategic business unit and develop the right strategy to maintain and improve business units or products. In a large business corporation, there are many types of products, division and business units ...

What happens if new competitors come into the market?

If new competitors come into the market, the company still retains the old and keeps recruiting new customers since their services and product quality are good. Maybe a survey on customer satisfaction should be deployed.

Who is the founder of BCG?

BCG has been able to expand globally also thanks to its recognized brand, and the ability of its founder (Bruce Henderson) to leverage on a model where ownership was distributed, thus enabling a fast expansion. At the same time, the BCG trademarks and ideas shaped the consulting world for decades. Among its most recognized trademark ideas ...

What is the BCG matrix?

Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.

How much is BCG worth in 2019?

By 2019, BCG reached $8.5 billion in revenues. To gain a bit of context, Accenture and Deloitte would reach $43.2 and $46.2 billion, while smaller management consulting firms like Bain and Company and Kearney reached $4.5 billion and $1.3 billion respectively.

What was BCG used for in the 1990s?

By the 1990s, all the big brands and companies were relying on BCG to execute complex projects, from post-merger integrations, process optimization, and the restructuring of IT systems.

What is a GAMMA team?

The GAMMA team comprises profiles such as Analytics Software Engineers, Machine Learning Engineers, Analytics Architects, and many other profiles able to handle and interpret a large amount of data.

Did management consulting firms lose their relevance?

That time though was gone, when the web took over, those management consulting firms also lost some of their relevance and while their bottom lines have still grown, as those companies still have major corporate clients.

Did BCG acquire Kernel Analytics?

For instance, in 2019 , BCG acquired Kernel Analytics and it integrated it within its BCG Gamma services. As BCG CEO, Rich Lesser said at the time “BCG GAMMA is one of the most exciting parts of our business, and we expect the market for tailored AI solutions to continue growing rapidly. As we further expand our capabilities, this acquisition will help us to continue enabling our clients to deliver on their ambitions,”

What is the Boston Consulting Group's product portfolio matrix?

The Boston Consulting Group ’s product portfolio matrix (BCG matrix) is designed to help with long-term strategic planning, to help a business consider growth opportunities by reviewing its portfolio of products to decide where to invest, to discontinue or develop products. It’s also known as the Growth/Share Matrix.

What is BCG matrix?

The BCG Matrix, otherwise known as the growth share matrix, is a portfolio management framework that helps companies decide how to strategically manage a portfolio of products or services. THE BCG Matrix.

Is M&S still the UK's market leader?

M&S was known as the place for ladies underwear at a time when choice was limited. In a multi-channel environment, M&S lingerie is still the UK’s market leader with high growth and high market share. Example: Food. For years M&S refused to consider food and today has over 400 Simply Food stores across the UK.

Can you apply the BCG model to other areas?

You can also apply the BCG model to areas other than your product strategy.