| Nonforeign COLA Areas | 2021 | |

|---|---|---|

| COLA Rates (%) | Locality Rates (%) | |

| County of Hawaii, Hawaii | 4.42 | 19.56 |

| County of Kauai, Hawaii | 10.28 | 19.56 |

| County of Maui (including Kalawao County), Hawaii | 10.28 | 19.56 |

What was the COLA rate in 2009?

What is the difference between locality pay and cola pay?

What is the left over COLA pay?

When did the federal COLA change?

Does COLA count towards high 3?

What is the COLA for Hawaii 2022?

Links: 2022 Pay Tables pdf. Currently, COLA is set at 9.75 % for Honolulu, Kauai and Maui counties, and at 3.94 % for Hawaii County. in 2022. There is no COLA currently authorized for American Samoa.

How much is federal COLA in Hawaii?

Links: 2021 Pay Tables Currently, COLA is set at 10.28 % for Honolulu, Kauai and Maui counties, and at 4.42 % for Hawaii County.

Will federal employees get a COLA in 2022?

What is the amount of the cost-of-living adjustment? For the year 2022, annuitants who retired under CSRS will receive 5.9 percent increase and those who retired under FERS will receive a 4.9 percent increase.

What is the difference between locality pay and COLA?

COLA was tax-free. Locality Pay is taxable. Going from COLA to Locality Pay means your taxable income is higher. Not only will you be paying more taxes – but you're likely to get hit by what I call 'hidden' tax increases.

What is the 2022 COLA rate?

The latest COLA is 8.7 percent for Social Security benefits and SSI payments. Social Security benefits will increase by 8.7 percent beginning with the December 2022 benefits, which are payable in January 2023. Federal SSI payment levels will also increase by 8.7 percent effective for payments made for January 2023.

Is there a COLA increase in July 2022?

These increases will be reflected in the benefit payments scheduled to be distributed July 29, 2022. For most retirees and beneficiaries, the increase will amount to a 2 percent cost-of-living-adjustment.

Do GS employees get COLA in Hawaii?

The U.S. Government pays cost-of-living allowances (COLAs) to white-collar civilian Federal employees in Alaska, Hawaii, Guam and the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands.

Does everyone get COLA increase?

It is based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the last year a COLA was determined to the third quarter of the current year. If there is no increase, there can be no COLA.

Who qualifies for COLA increase?

All persons born within the first 10 days of any month should receive their COLA payments in the mail (or have already received them). From the beginning of 2022, COLA payments are projected to increase by 5.9% over 2021 due to the inflation adjustment. This is the largest adjustment since 1982.

What is the cost-of-living increase for 2022 for employees?

Wages and salaries increased 1.3 percent and benefit costs increased 1.0 percent from June 2022. (See chart 1 and tables A, 1, 2, and 3.) Compensation costs for civilian workers increased 5.0 percent for the 12-month period ending in September 2022 and increased 3.7 percent in September 2021.

Is COLA considered a raise?

COLA's are not raises. If you, or someone you know, is facing an early retirement because you can no longer perform your job duties, call Harris Federal Law Firm now. We can help you through the process and explain how COLA's will affect you.

How is COLA pay calculated?

How Is COLA Calculated? The government calculates the Social Security COLA by comparing the average CPI-W for the third quarter of the year in which the most recent COLA became effective to the average CPI-W for the third quarter of the current year.

Do federal employees get COLA in Hawaii?

The U.S. Government pays cost-of-living allowances (COLAs) to white-collar civilian Federal employees in Alaska, Hawaii, Guam and the Northern Mariana Islands, Puerto Rico, and the U.S. Virgin Islands.

How is COLA calculated for federal employees?

The U.S. Department of Labor calculates the change in the Consumer Price Index (CPI) for urban wage earners and clerical workers from the third quarter average of the previous year to the third quarter average for the current year.

Do federal employees get COLA?

The 2023 federal retiree cost-of-living adjustment (COLA) will be 8.7 percent for those under the Civil Service Retirement System (CSRS) and 7.7 percent for those under the Federal Employees Retirement System (FERS). This is the largest COLA in nearly four decades.

Do federal employees get cost-of-living increases?

Last year, Biden announced that civilian federal employees in 2022 would receive an across-the-board base pay increase of 2.2 percent and locality pay increases averaging 0.5 percent.

Locality Pay Fact Sheet (January 2022) COLA/Locality Pay for Federal ...

Locality Pay Fact Sheet (January 2022) COLA/Locality Pay for Federal Workers in Hawaii and other Non-Foreign Areas Background: The U.S. Government pays cost-of-living allowances (COLAs) to white-collar

Locality Pay Fact Sheet (January 2021) COLA/Locality Pay for Federal ...

Locality Pay Fact Sheet (January 2021) COLA/Locality Pay for Federal Workers in Hawaii and other Non-Foreign Areas Background: The U.S. Government pays cost-of-living allowances (COLAs) to white-collar

SALARY TABLE 2022-HI - United States Office of Personnel Management

salary table 2022-hi incorporating the 2.2% general schedule increase and a locality payment of 20.40% state of hawaii total increase: 2.92% effective january 2022

2022 GS Pay Table Hawaii - FEDweek

SALARY TABLE 2022-HI INCORPORATING THE 2.2% GENERAL SCHEDULE INCREASE AND A LOCALITY PAYMENT OF 20.40% STATE OF HAWAII TOTAL INCREASE: 2.92% EFFECTIVE

Hawaii General Schedule (GS) Pay Scale for 2022

The STATE OF HAWAII General Schedule locality region applies to government employees who work in Hawaii and surrounding areas. General Schedule employees who work within this region are paid 20.4% more than the GS base pay rates to account for local cost of living.

Your 2022 Federal Pay Raise, COLA, and Why 2021 Inflation Is Important

We are not certain what the average federal pay raise in 2022 will be in January. At the moment, it appears likely the 2022 federal pay raise will average 2.7% as President Biden has issued his “alternative pay letter” stating this amount and Congress has not been inclined to legislate a different percentage.

What was the COLA rate in 2009?

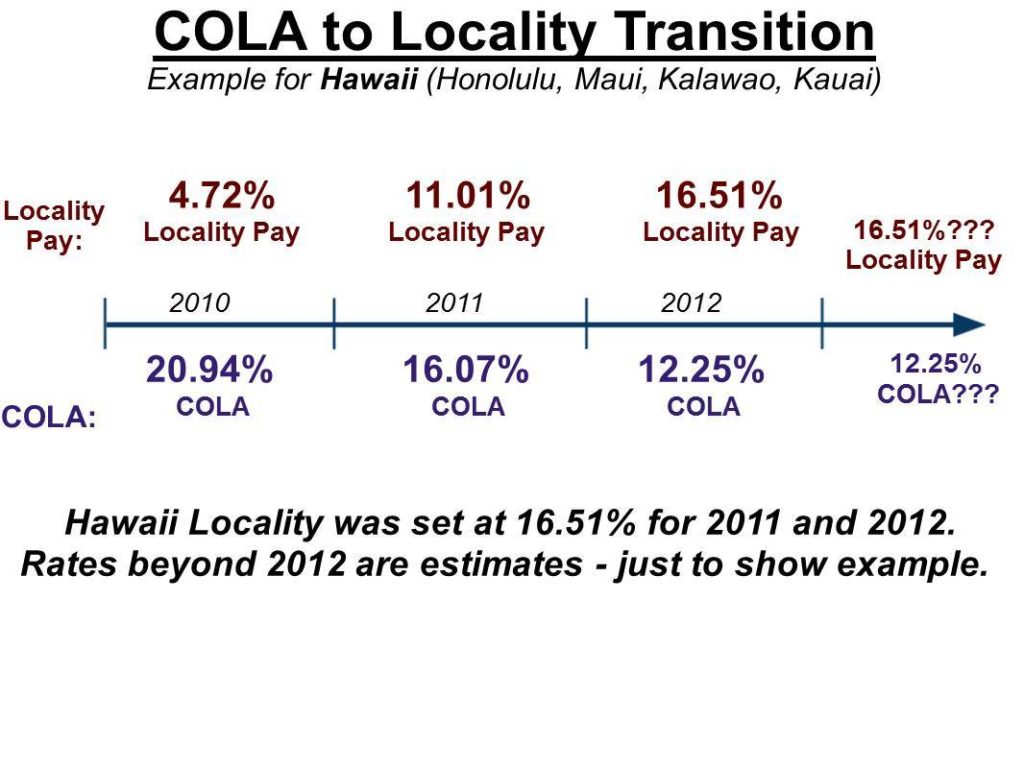

The 2009 COLA rates were frozen. The County of Hawaii COLA rate was frozen at 18%. The COLA rate for the other Counties was frozen at 25%. These frozen COLA rates play into the formula of the transition to Locality Pay.

What is the difference between locality pay and cola pay?

COLA doesn’t count towards your High 3 Salary, but it is tax-free.

What is the left over COLA pay?

The ‘left over’ COLA pay is supposed to help offset the additional taxes you’ll be paying with Locality Pay. The Federal COLA Locality Adjustment does affect the take home pay for Federal Employees. Learn more about hidden tax increases for Federal Employees in Hawaii and Other Non-Foreign Areas.

When did the federal COLA change?

Federal Employees in Non-Foreign Areas are now being transitioned from receiving COLA to Locality Pay. This change is taking place in 2010, 2011, and 2012.

Does COLA count towards high 3?

COLA doesn’t count towards your High 3 Salary, but it is tax-free. Locality Pay is taxable, but it *does* count towards your High-3 for CSRS or FERS Retirement. There is a special rule for Federal Employees who are retiring by the end of 2012 where you have the option to ‘buy back’ your COLA and have it count as Locality Pay.