How to recognize revenue for a long-term contract?

In theory, there is a that refers to a method in which all of the revenue and profit associated with a project is recognized only after the completion of the project. In addition to the completed contract method, another way to recognize revenue for a long-term contract is the percentage of completion method.

How do you calculate revenue recognition in accounting?

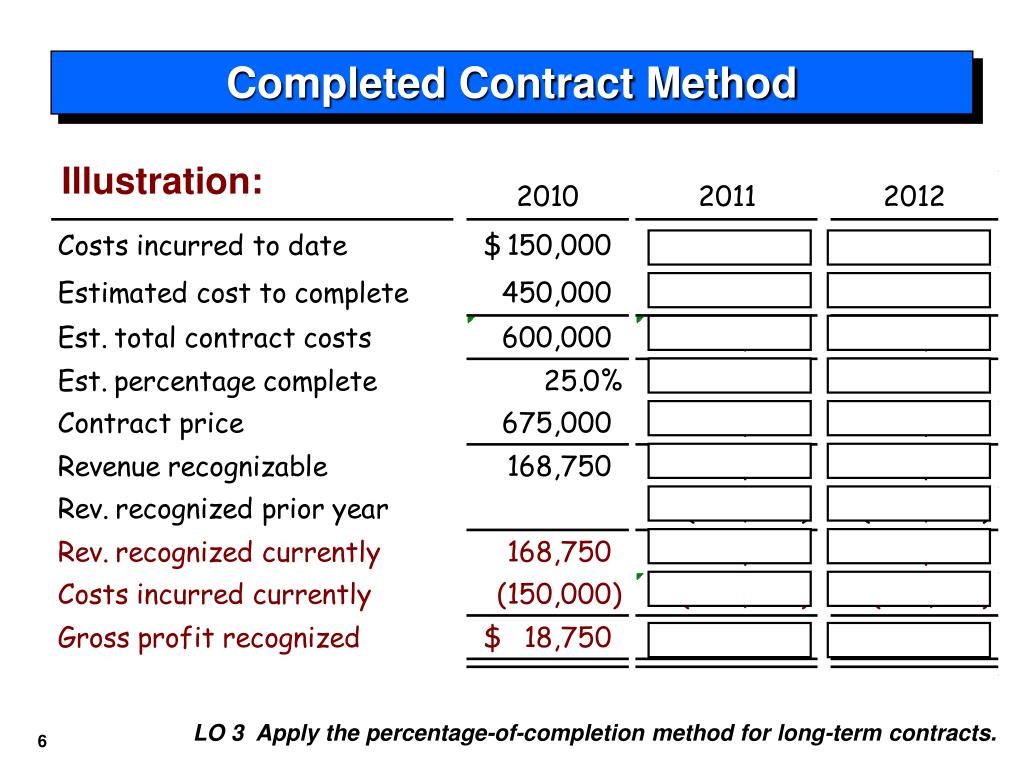

The revenue is recognized yearly as a percentage of work completed during that year. Revenue to be recognized = (Percentage of Work Completed in the given period) * (Total Contract Value) read more. However, in the completed contract method, the yield will be considered only after the completion of the project.

What is the completed contract method of accounting?

The completed contract method of accounting is the practice of deferring all revenue, expenses, and gross profits until the completion or substantial completion of the project. This is a more straightforward and conservative approach than other accounting methods.

Who should use the completed contract method?

, engineering companies, and other businesses that mainly generate revenue on long-term contracts for projects. The completed contract method defers all revenue and expense recognition until the contract is completed.

How revenue is recognized under completed contract method?

The revenue is recognized yearly as a percentage of work completed during that year. Revenue to be recognized = (Percentage of Work Completed in the given period) * (Total Contract Value) read more. However, in the completed contract method, the yield will be considered only after completing the project.

What is the completed contract revenue recognition method Why do we need this approach?

The completed contract method allows all revenue and expense recognition to be deferred until the completion of a contract. CCM accounting is helpful when there is unpredictability surrounding when the company will be paid by their customer and uncertainty regarding the project's completion date.

Is completed contract method allowed under ASC 606?

Where the completed contract method looks at contracts, however, ASC 606 looks at performance obligations. Additionally, contractors who wish to take advantage of tax deferral benefits from point-in-time transfers, they may need to make sure that their contracts provide the appropriate conditions for that method.

When should completed contract method be used?

The completed contract method is used when there is uncertainty about the collection of funds due from a customer under the terms of a contract. Since revenue and expense recognition only occurs at the end of a project, the timing of revenue recognition can be both delayed and highly irregular.

Who must use completed contract method for tax?

In general, under Sec. 460, taxpayers with long-term construction contracts are required to use the percentage-of-completion method to determine their reportable income.

Who can use completed contract method for tax?

Using the completed contract method, the taxpayer does not recognize revenue until the contract is completed and accepted by the customer. Except for home construction contracts, CCM can only be used by small contractors for contracts with an estimated life that does not exceed 2 years.

Can you use completed contract method for GAAP?

Under U.S. generally accepted accounting principles, the PCM is the preferred method for contract accounting, and GAAP places a number of conditions and restrictions upon its use. GAAP also allows the completed contract method, in which a contractor don't recognize expenses or revenues until the contract is finished.

Is completed contract method allowed under IFRS?

IFRS bans the completed contract method. It allows the percentage of completion method under certain conditions. Otherwise, you only recognize revenue on any recoverable costs you incur. IFRS also allows contracts to be combined or segmented but applies different criteria than does GAAP for this purpose.

What are the two methods of revenue recognition for construction contracts?

Under current accounting for construction contracts, revenue recognition is accounted for using two basic methods: (1) the percentage-of-completion method where revenue, costs, and profits are recognized each accounting period as the contract progresses to completion (using the input or output methods such as cost-to- ...

What is the difference between percentage of completion method and completed contract method?

In contrast to the completed-contract method, the percentage-of-completion provides that revenues, costs, and gross profits be recognized through the income statement as the project is being completed instead of all at the end.

What is it called when a contract is completed?

A contract that has been fully performed by all parties is referred to as an executed contract; a contract that has not be fully performed is an executory contract.

What is complete contract in cost accounting?

The completed contract method of revenue recognition is a concept in accounting that refers to a method in which all of the revenue and profit associated with a project is recognized only after the completion of the project.

For what reasons should the percentage of completion method be used over the completed contract method?

The percentage of completion method must be used if the revenues and costs of a project can be reasonably estimated and the parties involved are expected to be able to complete all duties.

Which revenue recognition method recognizes revenue when the client makes payment on the billing?

Cash method recognizes revenue when a progress billing to the client is made.

What is contract completion?

Contract Completion means when the entire Work has been performed to the requirements of the Contract Documents.

What is the difference between percentage of completion method and completed contract method?

In contrast to the completed-contract method, the percentage-of-completion provides that revenues, costs, and gross profits be recognized through the income statement as the project is being completed instead of all at the end.

What Is the Completed Contract Method (CCM)?

The completed contract method (CCM) is an accounting technique that allows companies to postpone the reporting of income and expenses until after a contract is completed. Using CCM accounting, revenue and expenses are not recognized on a company's income statement even if cash payments were issued or received during the contract period.

When a contract has a short-term end date and most of the revenue is likely to be recognized when the?

If a contract has a short-term end date and most of the revenue is likely to be recognized when the project is completed. When a project may be subject to potential hazards that might delay its completion. When there's uncertainty in forecasting the completion date of a project.

What is the cash method of accounting?

The cash method recognizes revenue when cash is received from clients, and expenses are recorded when they're paid. Although the cash method might be straightforward, it can delay recording revenue and expenses until the money is earned or paid out.

Why is CCM accounting important?

CCM accounting is helpful when there's unpredictability surrounding when the company will be paid and when the project will be completed. Since revenue recognition is postponed, tax liabilities might also be postponed, but expense recognition, which can reduce taxes, is likewise delayed.

Why is deferring revenue and expenses important?

By deferring the recognition of revenue and expenses until the end of the project, the company might put itself at risk of higher tax liabilities. For example, let's say a project is estimated to take three years to complete and tax laws change, leading to an increase in the business tax rate. The tax liability would be higher under the completed contract method versus using the percentage of completion approach since some of the revenue would have already been recognized.

What is accrual accounting?

Accrual accounting is typically the most common method used by businesses, such as large corporations. However, some small businesses use the cash method, which is also called cash-basis accounting. The completed contract method does not require the recording of revenue and expenses on an accrued basis.

What is percentage of completion?

The percentage of completion method allows the revenue and expenses to be attributed to each stage of completion. However, both parties involved must be reasonably certain that they can complete their obligation of the contract.

Free Accounting Courses

Similar principles will apply in the case of multiple successive transfers described in paragraph , , or of this section involving the contract. Home construction contracts have obvious tax advantages, in that the recognition of income can be deferred for years, especially for large projects involving the construction of many housing units.

How Does The Completed Contract Method Ccm Work?

Even if payments are received while the project is in progress, no revenues are recorded until its completion. The completed-contract method is a conservative way of accounting for long-term undertakings and is used for certain types of construction projects.

Accounting For Construction Contracts Under The Percentage Of Completion Method

There’s no need to estimate costs when using the completed contract method since those costs are readily apparent at the end of the contract. As compared to the percentage of completion method, higher net income is generally reported in the completed contract method.

What Is The Completed Contract Method Ccm?

The court also determined that none of the contracts involved a general contract or subcontractor relationship. CCM is an accounting method that enables the small business to defer revenue and expenses until the completion of a project for income tax purposes.

Understanding Percentage Completion And Completed Contracts

Logger’s management expects that the entire facility will be complete in just two months. Given the short duration of the project, Logger elects to use the completed contract method.

When is revenue recognized?

Overall, revenue is recognized for performance obligations based on when “transfer of control” occurs. This is essentially when the work becomes the customer’s to own and have use of it. And that may take place either over time (think: PCM) or at a single point-in-time at the end (think: contract completed). In either case, transfer of control will usually be determined by the contract language — not by how the contractor wants to recognize revenue. Transfer of control, in turn, will be what dictates how the contractor is to recognize revenue.

What Is the Completed Contract Method?

The completed contract method is a rule for recording both income and expenses from a project only once the entire project is complete. This contrasts with the percentage-of-completion method (PCM), which recognizes a portion of revenue as the contractor completes the contract.

Why do contractors use the completed contract method?

The completed contract method has certain advantages for some contractors. For one, it allows contractors to defer income for tax purposes. If a project won’t be completed until the following year, the company won’t have to pay tax on that revenue this year. Additionally, the completed contract method is designed to prevent contractors from accidentally recording “phantom revenue” on more unpredictable projects — that is, earned income they thought they would get but may not end up collecting.

What happens if a contract falls through?

If the contract were to fall through, the contractor would still be able to make another use of the asset and wouldn’t yet have the enforceable right to payment.

When to report revenue from a contractor?

When it comes to reporting revenue from their projects, contractors have typically had a few options: when they’re paid, when they bill and when they’re done. That last option has generally been known as the “completed contract method,” and while it may seem like one of the simpler methods available, it has its own pros and cons — as well as new wrinkles through the updated revenue recognition standards called “ASC 606.”

Does Jones Realty pay for build it?

until the paint dries and the keys change hands. Therefore, during construction progress, Jones Realty doesn’t gain anything from the work done. Under the contract, they pay Build-It periodically for progress completed, but there’s no transfer of control yet. Accordingly, as with the completed contract method, Build-It holds the value of their billings on their balance sheet before they can recognize it on their income statement.

Does a contractor get paid for a completed contract?

Of course, that doesn’t mean the contractor who uses the completed contract method doesn’t get paid. They’ll continue to bill and receive payment, much like they would under a different revenue recognition method. The difference is that, until the contract is complete, they’ll keep those amounts on their balance sheet rather than on their income statement.

When is revenue recognition required?

It is the concept in accounting for the revenue recognition wherein all the revenues and the profits associated with the project is to be recognized only when the project has been finished or completed. Mainly this method is followed if a company is uncertain about the dues collection from the customer under the contract.

Why is the completed contract method used?

The completed-contract method of accounting helps to reduce the cost fluctuations associated with the long term projects. This method also motivates the contractor to apply cost and time-saving methods for the completion of the project as the compensation of the contractor does not change with the actual time taken to finish the project.

What is the percentage of completion method?

Percentage Completion Method The percentage of completion method is an accounting method for recognizing revenue and expenses for long-term projects that span over more than one accounting year. The revenue is recognized yearly as a percentage of work completed during that year. Revenue to be recognized = (Percentage of Work Completed in the given period) * (Total Contract Value) read more

Why is the completed-contract method of accounting important?

The completed-contract method of accounting helps to reduce the cost fluctuations associated with the long term projects.

What is completed contract approach?

Under the completed contract approach, companies have to report the cost and revenue incurred based on the actual results. It helps the company in avoiding the errors which can be caused when estimation is made on various aspects like in case of the percentage completion method.

What is the effect of the completed contract method on the working capital?

The completed-contract method results in deferred tax liability as it requires paying taxes on the income earned only after the completion of the project. This payment of tax deferment and corresponding tax benefit deferment can have a negative or positive effect on the working capital.

What is the principal advantage of revenue reporting?

The principal advantage is that the revenue reported is based on the actual results and not based on the estimates.

What is a completed contract?

Completed-contract method is a revenue recognition method in which the company does not recognize revenue and profits until the contract is complete. This method is common in long-term contracts such as construction, which often face uncertainties associated with raising funds. Furthermore, companies will defer their tax obligations for the coming period until the contract is completed.

When is a contract completed?

The contract is completed when all parties agree, and the company sends or submits the results to the contractor. As compensation, the company receives payment.

Why are revenue and expense trends smoother under IFRS?

Because this standard allows companies to recognize revenues and expenses during the construction period.

Why does the income statement show a surge in revenue?

However, under the GAAP method, the income statement may see a sudden surge in revenue and expenses, especially if the company completes a large number of contracts in the same period. Because it recognizes both revenue and expenses at the end of the contract. That will produce sharp balance sheet fluctuations.

When can companies use GAAP?

Under US GAAP and IFRS, companies can use this method when results cannot be measured reliably. However, both differ in recognizing revenue and expenses related to the contract.

Does a company need to estimate construction costs?

Furthermore, the method allows companies to avoid estimation errors as in the percentage completion method. The company does not need to estimate construction costs. These costs will be seen at the end of the contract as in US GAAP or incurred during construction as in IFRS.

Does a company report profits during a contract?

Furthermore, under IFRS, the company recognizes revenue equal to costs incurred during the period. Therefore, the company does not report profits during the contract.

How does the completed contract method work?

Once the project is finished, the billings and costs will be pushed to their income statement. Even if payment is received through progress billings, those will not be factored into the final income statement until the end of the project. But, if the contractor becomes aware that the contract will end in a loss, it should be recorded on the income statement as soon as possible.

What is the most popular accounting method in the construction industry?

Construction Contract. The completed contract method is one of the most popular accounting methods in the construction industry. It’s the preferred method for short-term contracts and residential projects because of its simplicity and the ability to shift costs and tax liability to the end of the project.

What should contractors think about before choosing a contractor?

Contractors should think carefully about their long term business goals and tax liabilities before choosing. Here are two of the biggest factors construction businesses might want to consider when assessing the completed contract method of accounting.

What is the risk of multiple contracts ending at the same time?

This can cause a significant fluctuation of expenses and revenue in the balance sheet. To those outside the company, this could be seen as a sign of inconsistency and risk, which can make securing bonding or acquiring financing particularly tricky.

How long does a small contractor contract have to be completed?

This requires that the contract is estimated to be completed within two years, and the contractor’s annual gross receipts don’t exceed $25M over the previous three years (this was raised from $10M in 2018).

Can a construction company claim revenue?

Since the construction company doesn’t claim any revenue until the completion of the contract, the tax liability is deferred to the end of the tax year. This can also backfire if a construction business isn’t careful. If the company is expecting tax breaks, those will also be deferred until the end of the contract.

Can you defer taxes on construction projects?

By using the completed contract method for construction accounting, businesses benefit from tax deferment. It won't be an option for all projects, though.

What is the percentage of completion method?

The percentage of completion method is viewed as a continuous sale. As such, it is considered that both the buyer and the seller have enforceable rights. The buyer carries the right to implement specific performance requirements in the contract while the seller has the right to ask for payments based on fulfilling these requirements.

What are the risks associated with completed contract accounting?

The risks associated with completed contract accounting include increases in tax rates and missing tax incentives. Percentage of completion may shield companies from fluctuations and make it easier to show revenue.

When to use percentage of completion?

The percentage of completion method must be used if the revenues and costs of a project can be reasonably estimated and the parties involved are expected to be able to complete all duties. 2 4 Further, this method is vulnerable to fraud and underreporting of a milestone period, so accounting practices must be closely reviewed.

Is it necessary to estimate the cost of a project?

Under the completed contract method it is not necessary to estimate the costs of the project as all of the costs are known at the time the project is completed. This prevents inaccurate estimates, which can be costly.

Can a business change its accounting method?

It is necessary to fully understand the chosen method, as each differs, especially concerning taxes. Once selected, the method cannot be changed without special permission from the Internal Revenue Service (IRS). 1

Is the completed contract method conservative?

Still, even with these risks, the completed contract method is the most conservative accounting method for companies working on long-term contracts.

What Is The Completed Contract Method (CCM)?

- The completed contract method defers all revenue and expense recognition until the contract is completed. The method is used when there is unpredictability in the collection of funds from the customer. It is simple to use, as it is easy to determine when a contract is complete. In addition, under the completed contract method, there is no need to e...

How The Completed Contract Method (CCM) Works

Requirements For The Completed Contract Method

Completed Contract vs. Percentage of Completion Method

Advantages and Disadvantages of The Completed Contract Method

- The completed contract method allows all revenue and expense recognition to be deferred until the completion of a contract. CCM accounting is helpful when there is unpredictability surrounding when the company will be paid by their customer and uncertainty regarding the project's completion date. Businesses have multiple options when recognizing re...

Example of Completed Contract Method

- Typically, the completed contract method is reserved for certain situations since the revenue recognition is often delayed and unpredictable. As a result, there are a few instances when CCM accounting might be helpful: 1. If a contract has a short-term end date and most of the revenue is likely to be recognized when the project is completed 2. When a project may be subject to poten…