Contribution Margin Ratio = Contribution Margin / (Selling Price per Unit * Number of Units) The contribution margin is given as a currency, while the ratio is presented as a percent. Using the contribution margin formulas - example

How do you calculate contribution margin ratio?

What is the Contribution Margin?

- Contribution Margin Formula. To calculate this ratio, all we need to look at are the net sales and the total variable expenses. ...

- Example. Good Company has net sales of $300,000. ...

- Uses. ...

- Contribution Margin Calculator

- Calculate Contribution Margin in Excel (with excel template) You can easily calculate the ratio in the template provided.

- Recommended Articles. ...

How to calculate an overall contribution margin ratio?

How to Calculate Contribution Margin?

- Determine Net Sales. The first step to calculate the contribution margin is to determine the net sales of your business. ...

- Calculate Total Variable Cost. The next step is to determine the variable costs associated with producing goods or services. ...

- Determine Contribution Margin. ...

- Calculate Contribution Margin Ratio. ...

What is the formula for calculating the contribution margin?

Formula for Contribution Margin. In terms of computing the amount: Contribution Margin = Net Sales Revenue – Variable Costs. OR. Contribution Margin = Fixed Costs + Net Income. To determine the ratio: Contribution Margin Ratio = (Net Sales Revenue -Variable Costs ) / (Sales Revenue) Sample Calculation of Contribution Margin

How do you find contribution margin per unit?

How do I calculate contribution margin in Excel?

- Total Contribution Margin = (10,000 units × $100) – (10,000 units * $65)

- Total Contribution Margin = $10,00,000 – $6,50,000.

- Total Contribution Margin = $3,50,000.

What is the contribution margin ratio?

The contribution margin ratio (CM ratio) of a business is equal to its revenue less all variable costs, divided by its revenue. It represents the marginal benefit of producing one more unit.

What is the contribution margin and unit contribution margin?

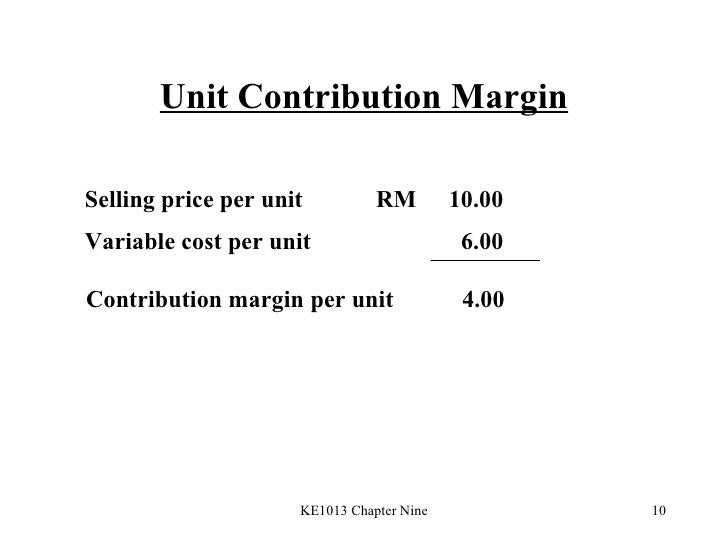

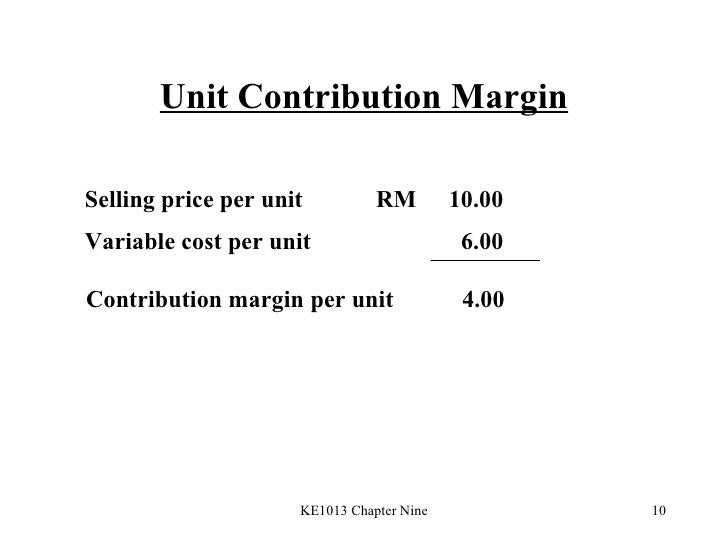

What is the Unit Contribution Margin? Unit contribution margin is the amount of the product selling price over and above the variable cost per unit; to put in simple words, it is the selling price of the product minus the variable cost that was incurred to produce the product.

How do you find contribution margin per unit from contribution margin ratio?

How to Calculate Contribution MarginNet Sales – Variable Costs = Contribution Margin.(Product Revenue – Product Variable Costs) / Units Sold = Contribution Margin Per Unit.Contribution Margin Per Unit / Sales Price Per Unit = Contribution Margin Ratio.

Is contribution margin the same as contribution margin ratio?

The contribution margin ratio is a formula that calculates the percentage of contribution margin (fixed expenses, or sales minus variable expenses) relative to net sales, put into percentage terms.

What is the contribution per unit?

Contribution per unit is the residual profit left on the sale of one unit, after all variable expenses have been subtracted from the related revenue. This information is useful for determining the minimum possible price at which to sell a product.

How do you calculate contribution margin per unit example?

Contribution margin per unit formula would be = (Selling price per unit – Variable cost per unit. These are not committed costs as they occur only if there is production in the company. read more) = ($6 – $2) = $4 per unit. Contribution would be = ($4 * 50,000) = $200,000.

What is the formula for calculating contribution margin?

The contribution margin formula is quite straightforward. All you have to do is multiply both the selling price per unit and the variable costs per unit by the number of units you sell, and then subtract the total variable costs from the total selling revenue.

What is contribution margin ratio example?

This may include items such as coffee beans, water, milk, disposable cups, and labor costs which total $4,000. In this example, the contribution margin is $10,000 - $4,000 = $6,000. The contribution margin ratio shows a margin of 60% ($6,000/$10,000). That sounds like a good result.

Why are contribution margins and contribution margin ratios important?

Analyzing the contribution margin helps managers make several types of decisions, from whether to add or subtract a product line to how to price a product or service to how to structure sales commissions. The most common use is to compare products and determine which to keep and which to get rid of.

Is unit contribution margin the same as contribution margin per unit?

Contribution margin is the amount by which a product's selling price exceeds its total variable cost per unit. This difference between the sales price and the per unit variable cost is called the contribution margin because it is the per unit contribution toward covering the fixed costs.

What is another name for contribution margin?

A business's contribution margin – also called the gross margin – is the money left over from sales after paying all variable expenses associated with producing a product. Subtracting fixed expenses, such as rent, equipment leases, and salaries from your contribution margin yields your net income, or profit.

What is contribution formula?

Formulae: Contribution = total sales less total variable costs. Contribution per unit = selling price per unit less variable costs per unit. Total contribution can also be calculated as: Contribution per unit x number of units sold.

What is the contribution margin per unit quizlet?

Unit Contribution Margin: How much each unit sold contributes toward fixed costs and profit.

What is contribution margin?

The contribution margin is the profitability on a product-by-product basis, specifically by examining the variable costs associated with each product, such as packaging materials expenses. Contribution margins are internally used to help companies source areas where they may strive to increase their profit margins on a granular basis.

How to calculate profit contribution margin?

It can be expressed as a percentage or an absolute value, but in the simplest terms, profit contribution margin = profit (sales revenue - variable costs) / Sales revenue. It’s used in several businesses as a profitability metric, to understand what portion of your revenue is redirected to your cost structure.

What is operating margin?

An operating margin is a financial metric that measures the profit margin that remains after deducting operating costs, including employee salaries, facilities costs, and monthly rent, as well as marketing and advertising costs, cost of raw materials but before paying interest or taxes. Operating margins are an indicator of the company's overall profitability.

What is the general idea of a unit sold?

The general idea is that each unit sold is a contribution towards overheads. If you make enough contribution to clear overheads then you have a profit.

When you say contribution and margin, what is the difference between the two?

The contribution is the difference between the two. If you calculate the percentage of contribution to sales price then you have gross margin.

Does change to unit cost affect margin?

Any change to unit cost will effect margin.

What Is the Contribution Margin?

It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm's costs.

Why is contribution margin important?

The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them.

Why is the contribution margin for an ink pen higher than that of a ball pen?

If the contribution margin for an ink pen is higher than that of a ball pen, the former will be given production preference owing to its higher profitability potential. Such decision-making is common to companies that manufacture a diversified portfolio of products, and management must allocate available resources in the most efficient manner to products with the highest profit potential.

Why do vigilant investors keep a close eye on the contribution margin of a high performing product relative to other products?

Along with the company management, vigilant investors may keep a close eye on the contribution margin of a high-performing product relative to other products in order to assess the company's dependence on its star performer. The company steering its focus away from investing or expanding the manufacturing of the star product, or the emergence of a competitor product, may indicate that the profitability of the company and eventually its share price may get impacted.

How much profit does doubling the number of units sold increase?

Essentially, doubling the number of units sold from 10,000 to 20,000 (two times) has increased the net profit per unit from $0.4 to $0.9 (that is, 2.25 times).

Is contribution margin the same when the number of units produced and sold has doubled?

The contribution margin remains the same , even when the number of units produced and sold has doubled. It provides another dimension to assess how much profits can be realized by scaling up sales.

Is machinery a fixed cost?

One-time costs for items such as machinery are a typical example of a fixed cost, that stays the same regardless of the number of units sold, although it becomes a smaller percentage of each unit's cost as the number of units sold increases.

What is unit contribution margin?

What is the Unit Contribution Margin? The term “unit contribution margin” refers to the dollar amount of selling price per unit earned in excess of the variable cost per unit. In other words, the unit contribution margin (UCM) measures the amount of selling price that covers those costs that are fixed in nature.

How to calculate incremental profit?

Incremental Profit = Unit Contribution Margin of Tennis Shoes * No. of Additional Units of Tennis Shoes + Unit Contribution Margin of Football Shoes * No. of Additional Units of Football Shoes + Unit Contribution Margin of Baseball Shoes * No. of Additional Units of Baseball Shoes

Why is UCM important?

The concept of UCM is very important from a company’s perspective because it indicates the minimum selling price such that the variable’s costs are covered. It forms an important part of the cost-volume-profit (CVP) analysis. In the case of positive UCM, i.e. selling price per unit is higher than the variable cost per unit, ...

What is unit contribution margin?

Unit contribution margin is the amount of the product selling price over and above the variable cost per unit, to put in simple words it is the selling price of the product minus the variable cost that was incurred to produce the product.

Why is it important to know the unit contribution margin?

It gives managers an essential insight into various aspects of the business and helps them make better-informed decisions. Again, referring to our earlier example, knowing the unit contribution margin of each of the products sold at the bakery will help the manager make several decisions.

How is the Unit Contribution Margin Helpful to a Business?

It is obtained by subtracting variable costs incurred while producing that additional unit of product from the sale of the product itself.

How to calculate total variable cost?

Total Variable Cost Total variable cost is the total of all variable costs that would change in proportion to the output or the production of units and helps analyze the company's overall costing and profitability. Total variable cost formula = number of units produced x variable cost per unit. read more

What is variable cost per unit?

Here, the variable costs per unit refer to all those costs incurred by the company while producing the product. These include variable manufacturing, selling, and general and administrative costs as well—for example, raw materials, labor & electricity bills. Variable costs are those costs that change as and when there is a change in the sale. An increase of 10 % in sales results in an increase of 10% in variable costs.

What is the contribution margin of $ 23850/300?

Contribution Margin of A = $ (23850)/ (no. of units of A sold) = $ 23850/300 = $ 79.5

How to calculate sales revenue?

Sales revenue = (Selling price)* (No. of units sold) = 150*2500

What is Contribution Margin?

Definition: The contribution margin, sometimes used as a ratio, is the difference between a company’s total sales revenue and variable costs. In other words, the contribution margin equals the amount that sales exceed variable costs. This is the sales amount that can be used to, or contributed to, pay off fixed costs.

Why is contribution margin considered a managerial ratio?

It is considered a managerial ratio because companies rarely report margins to the public. Instead, management uses this calculation to help improve internal procedures in the production process.

Why is contribution margin important?

This concept is especially helpful to management in calculating the breakeven point for a department or a product line. Management uses this metric to understand what price they are able to charge for a product without losing money as production increases and scale continues. It also helps management understand which products and operations are profitable and which lines or departments need to be discontinued or closed.

What are the components of contribution margin?

There are two main components in the contribution margin equation: net sales and variable costs. Let’s take a look at each.

What is CM formula?

For example, if management has a specific profitability target that it needs to hit in the next year, it can use the CM formula to calculate a product pricing model that will help them increase profitability.

What does it mean when a company has a low margin?

A low margin typically means that the company, product line, or department isn’t that profitable.

Why do investors use contribution margin?

Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits. For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company.

What is contribution margin per unit?

Definition: Contribution margin per unit is the dollar amount of a product’s selling price exceeds its variable costs. In other words, it’s the amount of revenues from the sale of one unit that is left over after the variable costs for that unit have been paid. You can think it as the amount of money that each unit brings in to pay for fixed costs.

Does variable cost per unit decrease with increased production?

This scenario can also change with increased production. Variable costs per unit tend to decrease as production levels rise. Fixed costs typically stay the same at all levels of production.

How to calculate contribution margin ratio?

To get the ratio, all you need to do is divide the contribution margin by the total revenue.

What is the contribution margin?

In accounting, contribution margin is the difference between the sales revenue and the variable costs of a product. It represents how much money can be generated by each unit of a product after deducting the variable costs, and, as a consequence, allows for an estimation of the profitability of a product.

What is profit margin?

Profit margin tells you the percentage of the revenue that remains after the deduction of all expenses such as taxes, interest , etc. Careful analysis of this value can provide invaluable insight into the workings of a company and point to any changes that might need to be made. Use our profit margin calculator to check this value for your company.

Why is contribution margin important?

Aside from the uses listed above, the contribution margin's importance also lies in the fact that it is one of the building blocks of break-even analysis. With that all being said, it is quite obvious why it is worth learning the contribution margin formula.

Is contribution margin a currency?

The contribution margin is given as a currency, while the ratio is presented as a percent.

Can you use margin with VAT calculator?

Use the margin with VAT calculator if you need to calculate profit margin and VAT at the same time - it's a real time-saver!