How to compute contribution margin?

You can calculate contribution margin in three forms:

- In total

- Per unit

- As a ratio

How to calculate an overall contribution margin ratio?

How to Calculate Contribution Margin?

- Determine Net Sales. The first step to calculate the contribution margin is to determine the net sales of your business. ...

- Calculate Total Variable Cost. The next step is to determine the variable costs associated with producing goods or services. ...

- Determine Contribution Margin. ...

- Calculate Contribution Margin Ratio. ...

How do you calculate total contribution margin?

- Total Contribution Margin = (10,000 units × $100) – (10,000 units * $65)

- Total Contribution Margin = $10,00,000 – $6,50,000

- Total Contribution Margin = $3,50,000

How to figure out the contribution margin?

- Some variable costs, such as the cost of raw materials, may have increased; the price may have been beaten down by competitors, and so on.

- Here’s an example, showing a breakdown of Beta’s three main product lines.

- Now, this situation can change when your level of production increases.

How do I calculate contribution margin percentage?

How Do You Calculate Contribution Margin? Contribution margin is calculated as Revenue - Variable Costs. The contribution margin ratio is calculated as (Revenue - Variable Costs) / Revenue.

What is a contribution margin percentage?

The contribution margin ratio is the difference between a company's sales and variable expenses, expressed as a percentage. The total margin generated by an entity represents the total earnings available to pay for fixed expenses and generate a profit.

What is the formula to calculate contribution?

Formulae: Contribution = total sales less total variable costs. Contribution per unit = selling price per unit less variable costs per unit. Total contribution can also be calculated as: Contribution per unit x number of units sold.

How do you calculate percentage contribution in Excel?

Enter the formula =C2/B2 in cell D2, and copy it down to as many rows as you need. Click the Percent Style button (Home tab > Number group) to display the resulting decimal fractions as percentages. Remember to increase the number of decimal places if needed, as explained in Percentage tips. Done! : )

Why do we calculate contribution ratio?

The contribution margin ratio takes the analysis a step further to show the percentage of each unit sale that contributes to covering the company's variable costs and profit.

How do you calculate a 30% margin?

How do I calculate a 30% margin?Turn 30% into a decimal by dividing 30 by 100, which is 0.3.Minus 0.3 from 1 to get 0.7.Divide the price the good cost you by 0.7.The number that you receive is how much you need to sell the item for to get a 30% profit margin.

Why is contribution margin ratio important?

Contribution margin is helpful for determining how sales, variable costs, and fixed costs all influence operating profit. It gives business owners a way of assessing how various sales levels will affect profitability. It can be calculated at the unit or total level and can be expressed in dollars or as a percentage.

Examples of Contribution Margin Formula (With Excel Template)

Let’s take an example to understand the calculation of the Contribution Margin formula in a better manner.

Explanation

Contribution margin is the amount left-over after deducting from the revenue, the direct and indirect variable costs incurred in earning that revenue. This left-over value then contributes to paying the periodic fixed costs of the business, with any remaining balance contributing profit to the owners.

Relevance and Uses of Contribution Margin Formula

Contribution margin is used by companies in their decisions regarding their operations. It is applied in various ways by the firm/individual for different levels of decision making.

Recommended Articles

This has been a guide to the Contribution Margin formula. Here we discuss How to Calculate Contribution Margin along with practical examples. We also provide Contribution Margin Calculator with a downloadable excel template. You may also look at the following articles to learn more –

Contribution Margin Definition

Investopedia contributors come from a range of backgrounds, and over 20+ years there have been thousands of expert writers and editors who have contributed.

What Is the Contribution Margin?

The contribution margin can be stated on a gross or per-unit basis. It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm's costs.

The Formula for Contribution Margin Is

The contribution margin is computed as the difference between the sale price of a product and the variable costs associated with its production and sales process.

What Does the Contribution Margin Tell You?

The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products.

Contribution Margin Example

Say a machine for manufacturing ink pens comes at a cost of $10,000. Manufacturing one ink pen requires $0.2 worth of raw materials like plastic, ink and nib, another $0.1 goes towards the electricity charges for running the machine to produce one ink pen, and $0.3 is the labor charge to manufacture one ink pen.

Uses of Contribution Margin

The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them.

Example Calculation of Contribution Margin Ratio

CM ratio = (total revenue – cost of goods sold – any other variable expenses) / total revenue

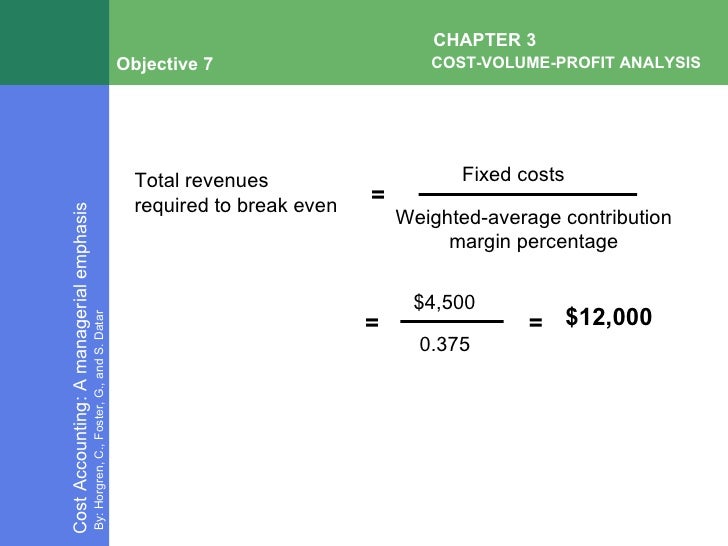

Breakeven Analysis

The contribution margin is not necessarily a good indication of economic benefit. Companies may have significant fixed costs that need to be factored in.

Download the Free Template

Enter your name and email in the form below and download the free template now!

More learning

CFI is the official global provider of the Financial Modeling and Valuation Analyst designation Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career.

What is contribution margin?

Definition: The contribution margin, sometimes used as a ratio, is the difference between a company’s total sales revenue and variable costs. In other words, the contribution margin equals the amount that sales exceed variable costs. This is the sales amount that can be used to, or contributed to, pay off fixed costs.

Why is contribution margin considered a managerial ratio?

It is considered a managerial ratio because companies rarely report margins to the public. Instead, management uses this calculation to help improve internal procedures in the production process.

What is CM formula?

For example, if management has a specific profitability target that it needs to hit in the next year, it can use the CM formula to calculate a product pricing model that will help them increase profitability.

What does it mean when a company has a low margin?

A low margin typically means that the company, product line, or department isn’t that profitable.

Why do investors use contribution margin?

Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits. For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company.

Is a high margin better than a low margin?

High vs. Low Contribution Margin. A high margin is almost always a better sign than a low margin because this means one of two things: either the company’s variable costs are very low or the company is able to sell its product for much more than its variable costs.

Do you report variable costs on a general purpose statement?

Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common.

Definition

Contribution margin ratio (CM ratio) is the ratio of contribution margin to net sales. It tells what percentage of sales revenue is available to cover fixed cost and generate profit.

Formula

Contribution margin ratio is calculated by dividing contribution margin figure by the net sales figure. The formula can be written as follows:

Examples

The total sales revenue of Black Stone Crushing Company was $150,000 for the last year. The fixed and variable expenses data of the last year is given below:

What does contribution margin ratio mean?

The contribution margin ratio tells business leaders whether the product is creating enough money to cover both fixed expenses and administrative overhead so that a company breaks even . When the margin is low, it suggests that the price point of the product is too low and that the product will not generate enough profit over time to help the company break even.

Why is the contribution margin ratio also known as the unit contribution margin?

Because the contribution margin ratio provides insight into the profit derived from the sale of products (or units), it is also known as the unit contribution margin. The equation for calculating this margin, in simplest terms, is:

Why is contribution margin excluded?

Because the contribution margin depends on costs that fluctuate with sales, many other costs are excluded from the calculation of contribution margin, including fixed costs such as direct labor. The number arrived at after all of those concerns are addressed is the contribution margin.

What factors contribute to gross margin?

Typically, several factors contribute regularly to the costs calculated in the gross margin, including the cost of direct materials, direct labor, and both variable and fixed overhead.

Why do business leaders use contribution margin?

Business leaders use the contribution margin to tell them how much a product is contributing to the profits of a company. At a glance, leaders can interpret the contribution margin to evaluate the profit potential of a product and determine how the product's sales can support the company with regard to covering fixed costs.

Do fixed costs change with increased or decreased sales volume?

When discussing costs to a business, fixed costs during the normal course of business do not change with increased or decreased sales volume while variable costs do. Costs that are static, such as salary, are fixed costs, although they may become a smaller percentage of unit costs as more products are produced.

Is contribution margin higher than gross margin?

Consequently, because the fixed overhead costs are not included in contribution margins, these margins are always higher than the gross margins .

What is contribution margin?

The contribution margin is when you deduct all connected variable costs from your product’s price, which results in the incremental profit earned for each unit. This shows whether your company can cover variable costs with revenue. The contribution margin is normally shown in monetary terms.

Why is contribution margin important?

Contribution Margin is an important element of understanding the profitability of the products in your business. Whether you use the services of a professional accountant or choose to use an online calculator to work out your company’s contribution margin ratio, it’s important to have an understanding of how to calculate this valuable financial ...

What is a low contribution margin product?

However a low contribution margin product may be deemed as a sufficient outcome if it uses very little resources of the company to produce and is a high volume sale product.

Examples of Contribution Margin Formula

Explanation

- Contribution margin is the amount left-over after deducting from the revenue, the direct and indirect variable costs incurred in earning that revenue. This left-over value then contributes to paying the periodic fixed costs of the business, with any remaining balance contributing profit to the owners. Hence, we can calculate contribution margins by deducting the total variable cost fr…

Relevance and Uses of Contribution Margin Formula

- Contribution margin is used by companies in their decisions regarding their operations. It is applied in various ways by the firm/individual for different levels of decision making. 1. By using the contribution margin, the firm uses in break-even analysis. The breakeven point for a firm is when the revenue of the firm equals its expenses; also, we ...

Recommended Articles

- This has been a guide to the Contribution Margin formula. Here we discuss How to Calculate Contribution Margin along with practical examples. We also provide Contribution Margin Calculator with a downloadable excel template. You may also look at the following articles to learn more – 1. Simple Interest Rate Formula 2. The formula for Marginal Cost 3. Calculator for …