- For the cost method, a treasury stock account is created

- In other words, treasury stock is a reduction in the stockholder’s equity section

- You may reissue shares of treasury stock.

- If you reissue shares of treasury stock for more than what it cost you to reacquire them, then the gain is recorded in paid-in capital.

How do you calculate treasury stock?

Shares of D.R. Horton Inc. (DHI) sank 5.8% in afternoon trading Friday, enough to pace the S&P 500's decliners, as the continued rise in Treasury yields and mortgage rates weighs heavily on the home-builders sector.

How to calculate average treasury stock paid?

- 150 shares at $100

- 250 shares at $200

- 100 shares at $300

Is treasury stock a debit or credit?

Treasury stock is credited for the full amount. If the retirement stock revaluation price is lower than the basis, the transaction is shown as a debit to common stock at the basis price. A credit is made to paid-in capital for the amount under the basis and a credit is made to treasury stock at the basis price.

How to use treasury stock method to calculate diluted shares?

Where:

- n = shares from options or warrants that are exercised

- K = Average exercise share price

- P = Average share price for the period

How do you find the cost of treasury stock?

Divide the treasury stock's total cost by the number of shares to calculate the average price the company paid for its treasury stock. Continuing the example, divide $1 million by 100,000 to get a $10 average price per share of treasury stock.

What are the two methods of accounting for treasury stock?

There are mainly two methods of accounting for treasury stock: the cost method and the par value method.

When treasury share is accounted for by the cost method?

Under the cost method, the purchase of treasury stock is recorded by debiting treasury stock account by the actual cost of purchase. The cost method ignores the par value of the shares and the amount received from investors when the shares were originally issued.

What does treasury stock at cost mean?

Definition. The financial accounting term treasury shares accounted for at cost refers to a process that treats the acquisition of treasury stock as the first step in a two-step transaction. The second step in the transaction involves the reissuance of the treasury stock back into the marketplace.

What is cost method?

What is the Cost Method? The cost method of accounting is used for recording certain investments in a company's financial statements. This method is used when the investor exerts little or no influence over the investment that it owns, which is typically represented as owning less than 20% of the company.

What is the difference between cost method and par value method?

The difference is that the par value method reduces the equity accounts directly, though preserving the distinction of treasury shares until actually retired, whereas the cost method temporarily reduces stockholders equity through a contra equity account listed separately on the balance sheet.

How do you record the purchase of treasury stock?

The company can record the purchase of treasury stock with the journal entry of debiting the treasury stock account and crediting the cash account. In this journal entry, the par value or stated value of the stock, as well as the original issued price, is not included with recording the purchase of the treasury stock.

How do you record treasury stock on a balance sheet?

Under the cost method of recording treasury stock, the cost of treasury stock is reported at the end of the Stockholders' Equity section of the balance sheet. Treasury stock will be a deduction from the amounts in Stockholders' Equity.

How do you record treasury stock journal entries?

The company can record the sale of treasury stock with the journal entry of debiting the cash account and crediting the treasury stock account when the sale price equals its cost. Opposite to the purchase, the sale of treasury stock increases both total assets and total equity.

Is treasury stock part of retained earnings?

Because treasury stock is stated as a minus, subtractions from stockholders' equity indirectly lower retained earnings, along with overall capital. However, treasury stock does directly affect retained earnings when a company considers authorizing and paying dividends, lowering the amount available.

What is the difference between common stock and treasury stock?

Common shares are Equity Shares of the Company and not the preferred stock of the Company. They only represent the equity shareholding of the Company. In comparison, Treasury shares may be a repurchase of equity shares or preference shares.

When treasury shares are sold at a price above cost?

a reduction of total shareholders' equity. When treasury shares are sold at a price above cost: C. paid-in capital is increased.

Cost Method of Treasury Stock: Definition

The cost method is based on the assumption that the acquisition of treasury stock is essentially a temporary reduction in stockholders’ equity that will be reversed when the shares are reissued. It is widely used due to its simplicity.

Cost Method of Treasury Stock: Explanation

When shares are acquired, the Treasury Stock account is debited and the Cash account is credited. When the shares are reissued, Cash is debited for the proceeds and Treasury Stock is credited for the amount paid out originally.

Can treasury stock be resold?

Treasury stock can be retired or held for resale in the open market. Retired shares are permanently canceled and cannot be reissued later.

Is Treasury Stock good or bad?

Treasury stock consists of shares issued but not outstanding. Thus, treasury shares are not included in earnings per share or dividend calculations, and they do not have voting rights. In general, an increase in treasury stock can be a good thing because it indicates that the company thinks the shares are undervalued.

Is treasury stock a debit or credit?

Under the cost method of recording treasury stock, the cost of treasury stock is reported at the end of the Stockholders' Equity section of the balance sheet. (At the time of the purchase of treasury stock, the corporation will debit the account Treasury Stock and will credit the account Cash.)

What happens when you sell treasury stock?

Here's what happens when a company sells treasury stock. Companies primarily pay out profits to shareholders by declaring dividends. When shares are bought back, the shares go into the "treasury stock" line on the balance sheet. Sometimes, companies buy back stock only to sell it at a later date.

Why would a company buy treasury stock?

Treasury stock is often a form of reserved stock set aside to raise funds or pay for future investments. Companies may use treasury stock to pay for an investment or acquisition of competing businesses. These shares can also be reissued to existing shareholders to reduce dilution from incentive compensation plans.

How do I calculate common stock?

So the formula for calculation of common stock is the number of outstanding shares is issued stock minus the number of treasury shares of the company.

What are the journal entries when the treasury stock is sold?

If the corporation sells any of its treasury stock for less than its cost, the cash received is debited to Cash, the cost of the shares sold is credited to Treasury Stock, and the difference ("loss") is debited to Paid-in Capital from Treasury Stock (so long as the balance in that account will not become a debit

What is the cost method?

Cost method is one of the two methods of accounting for treasury stock, the stock which has been bought back by the issuing company itself. The other method is called the par value method.

When treasury shares are later reissued, is the treasury stock account

When treasury shares are later reissued, the treasury stock account is credited for the cost at which they were purchased, cash account is debited for the amount actually received and if the amount received on reissuance of treasury stock is:

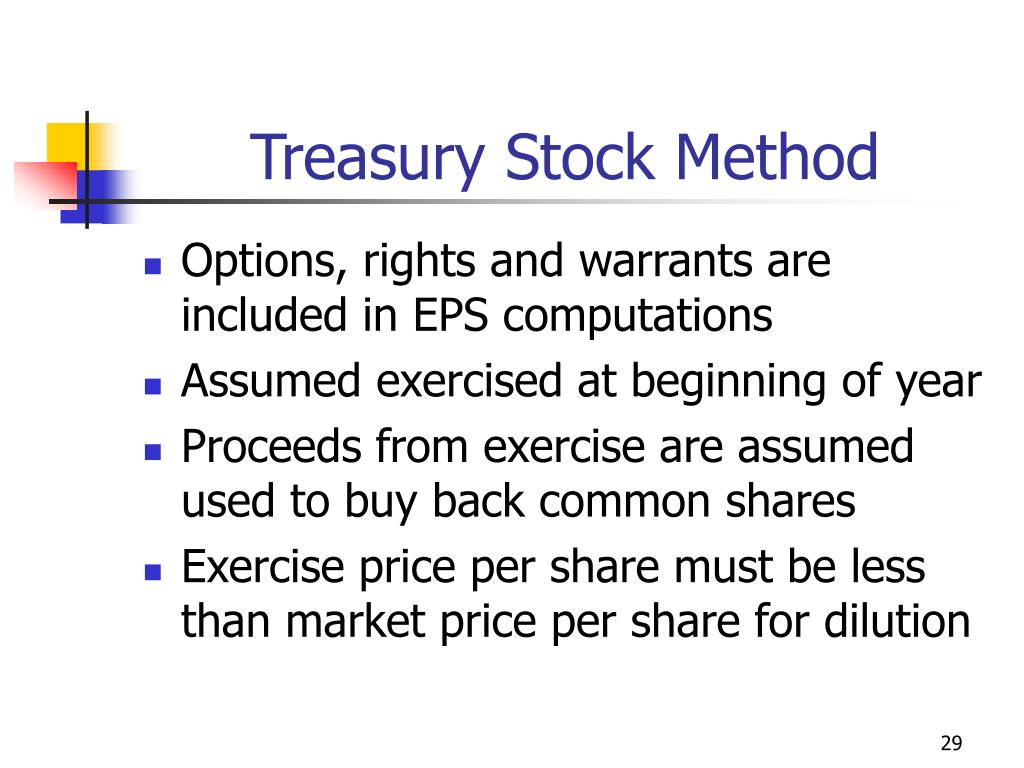

What is a stock option writer?

A seller of the stock option is called an option writer, where the seller is paid a premium from the contract purchased by the stock option buyer. and warrants. These allow investors who own them to buy a number of common shares at a price below lower than the current market price.

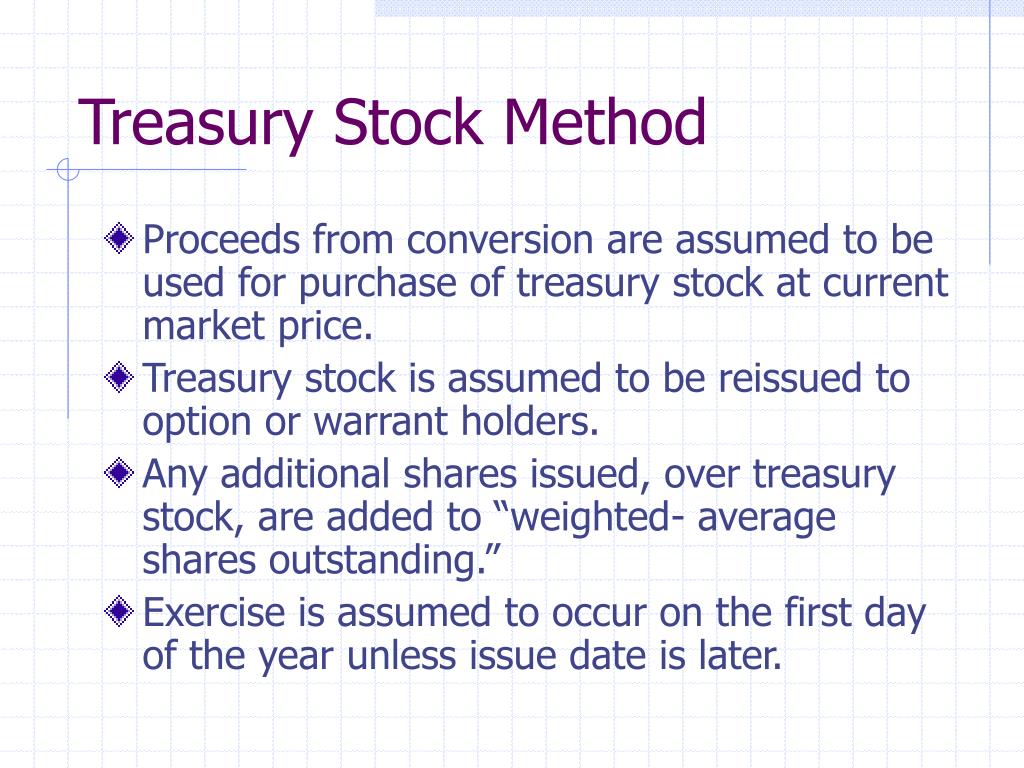

When repurchased common shares, what is the exercise date assumed?

When exercising warrants and options, the exercise date assumed is the start of the reporting period.

What is the treasury stock method?

The treasury stock method states that the basic share count used in calculating a company's earnings per share (EPS) must be increased as a result of outstanding in-the-money options and warrants, which entitle their holders to purchase common shares at an exercise price that's below the current market price.

When to use Treasury Stock?

To comply with generally accepted accounting principles (GAAP), the treasury stock method must be used by a company when computing its diluted EPS. This method assumes that options and warrants are exercised at the beginning of the reporting period, and a company uses exercise proceeds to purchase common shares at the average market price ...

Treasury Stock Method Example

During 2006, KK Enterprise reported a net income of $250,000 and had 100,000 shares of common stock. During 2006, KK Enterprise issued 1,000 shares of 10%, par $100 preferred stock outstanding.

Examples

Let us look at how Colgate has accounted for such Stock Options while calculating the diluted EPS.

What next?

If you learned something new or enjoyed the post, please leave a comment below. Let me know what you think. Many thanks, and take care. Happy Learning!

What is the cost method of treasury stock?

The cost method of treasury stock is the most commonly used method of accounting for treasury stock. In this method of accounting for treasury stock , a separate treasury stock account is established. Any shares that are bought back are recorded in the treasury stock account with the full amount paid for repurchase. The repurchase of shares is viewed as a temporary reduction in shareholders’ equity. The treasury stock account is kept active until the sales are resold.

What is Treasury stock?

Treasury stock is an account created for any shares that are repurchased by a company only if the company intends to resell those shares. If the company plans to retire these shares, treasury stock accounts are not created. Companies may have different reasons to reacquire their shares and can be reacquired using different methods. There are two methods of accounting for treasury stock, the cash method and the par value method. Both methods have different ways of treating reacquisitions and resale of shares.

What is the difference between par value and cost method of accounting for treasury stock?

Under the cost method of accounting for treasury stock, the company records the full payment made for the repurchase of shares in the treasury stock account. On the other hand, under the treasury stock par value method of accounting for treasury stock, the company only records the par value of the stock in the treasury stock account. Any excess paid for the shares above the par value is set off against the additional paid-in capital account first and any remaining amount is set off against the company’s retained earnings.