Full Answer

Does Kaiser insurance have cheaper plans?

That includes individual/family, Medicare, Medicaid and group health insurance. Most Kaiser insurance plans are health maintenance organization (HMO) plans, and this type of health insurance only covers in-network care and generally has cheaper monthly costs.

How much is Kaiser insurance per month?

The monthly cost of Kaiser insurance ranges from about $300 to more than $1,000 per month based on factors such as your age and plan coverage level. Based on available policies in California.

What are the pros and cons of having Kaiser insurance?

The Good

- Positive Customer Reviews

- Easy to View Plan Options

- Variety of Health Insurance Plans

- Charitable Health Insurance

- Unique Provider Network Approach

- Member Services and Resources

- Additional Tools and Perks

- Customer Service

How much Kaiser Health Insurance?

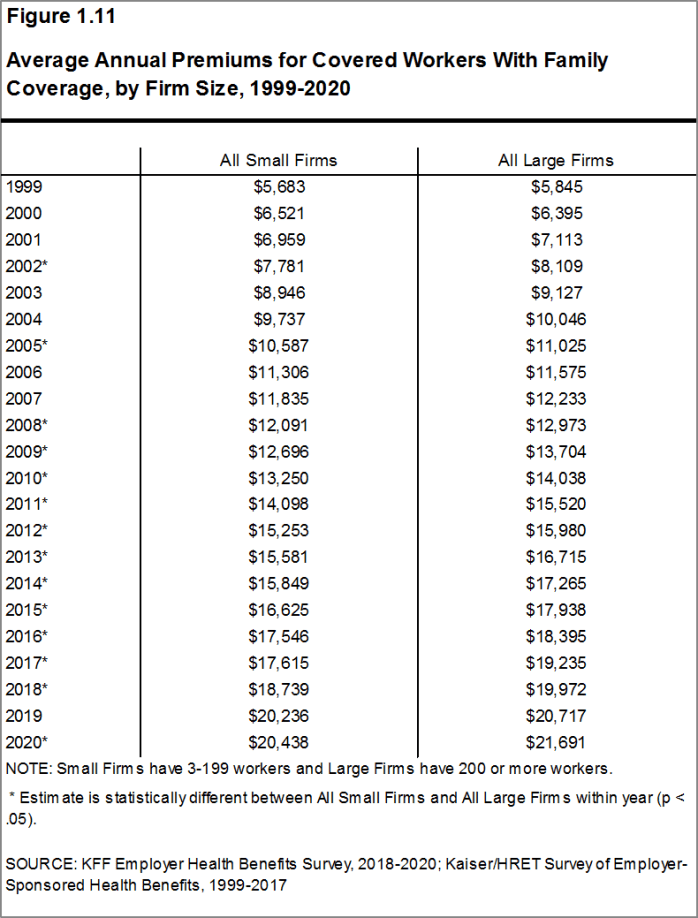

What Is The Average Cost For Kaiser Insurance? According to the Kaiser Family Foundation (KFF), the average premium for a single policy in 2020 was $622. The monthly amount is $50, or $7,470 per year. A family policy costs $1,778 on average. The monthly amount is $50 or $21,342.

See more

Is Kaiser an expensive insurance?

The monthly cost of Kaiser insurance ranges from about $300 to more than $1,000 per month based on factors such as your age and plan coverage level.

What are Kaiser premiums?

Kaiser Permanente HMO PlanLevel of CoverageTotal Bi-Weekly Premium CostBi-Weekly Employee ContributionSelf$319.88$89.90Self plus 1 dependent$639.76$409.78Self plus 2 or more dependents$905.26$675.28

Is Kaiser public or private insurance?

Oakland, California, U.S. Kaiser Permanente is one of the largest nonprofit healthcare plans in the United States, with over 12 million members. It operates 39 hospitals and more than 700 medical offices, with over 300,000 personnel, including more than 87,000 physicians and nurses.

Why is Kaiser Permanente cheaper?

Kaiser Permanente opened its doors to the public in 1945 -- and offered health coverage that was considerably less expensive than conventional insurers like Blue Cross. The strategy worked because it owned and operated its own hospitals and clinics and directly employed physicians.

How much is health insurance a month?

The average national monthly health insurance cost for one person on an Affordable Care Act (ACA) plan without subsidies in 2022 is $438.

How much does health insurance cost?

In 2020, the average national cost for health insurance is $456 for an individual and $1,152 for a family per month. However, costs vary among the wide selection of health plans.

Can I go to any hospital with Kaiser insurance?

As a Kaiser Permanente member, you're covered for emergency and urgent care anywhere in the world. * Whether you're traveling in the United States or internationally, this brochure will explain what to do if you need emergency or urgent care while away from home.

Is Blue Cross better than Kaiser?

Kaiser vs. Kaiser and Blue Shield both offer excellent health insurance plans. If you want an HMO plan, we recommend Kaiser. If you want a PPO plan, we recommend Blue Shield.

Is Kaiser healthcare good?

The BBB gives Kaiser Permanente an A rating. The company has closed just seven complaints in the past three years, all related to billing issues or problems with coverage. NCQA reflects very high customer satisfaction ratings for Kaiser Permanente. All reviewed plans are rated as high-performing.

Which is the best health insurance?

Best Health Insurance Plans in IndiaHealth Insurance PlansEntry Age (Min-Max)Reliance Critical illness Insurance18-55, 60, & 65 years (as per the SI)Royal Sundaram Lifeline Supreme Health Plan18 years & aboveSBI Arogya Premier Policy3 months – 65 yearsStar Family Health Optima Plan18-65 years20 more rows

Is Kaiser or United Healthcare better?

Choosing a carrier for your Medicare insurance coverage is highly personal and depends largely on the available selection in your area and the specific benefits you value most. In our comparison, we found UnitedHealthcare to have the advantage over Kaiser Permanente in terms of plan availability, selection and cost.

Can Kaiser cover out of state?

As a Kaiser Permanente member, you're covered for emergency and urgent care anywhere in the world.

How do I pay my monthly Kaiser premium?

Note: For members with a Kaiser Permanente Individual and Family Plan purchased from a health insurance exchange, you may enroll in automatic monthly payments by visiting kp.org/premiumbill. Please note that you must first create an online account on kp.org before setting up automatic payments.

How do I pay for Kaiser Covered California?

Pay by Phone. (855) 634-3381. ... Pay Online. For first-time payment: log in to your CoveredCA.com account and follow the payment instructions. ... Pay by Phone. (855) 836-9705. ... Pay by Phone. (844) 926-4524. ... Pay by Phone. (800) 539-4193 (TTY: 711) ... Pay by Phone. (844) 524-7370. ... Pay by Phone. (855) 270-2327. ... Pay by Phone. (800) 772-5327.More items...

Are health care premiums deductible?

If you buy health insurance through the federal insurance marketplace or your state marketplace, any premiums you pay out of pocket are tax-deductible. If you are self-employed, you can deduct the amount you paid for health insurance and qualified long-term care insurance premiums directly from your income.

Is Kaiser healthcare good?

The BBB gives Kaiser Permanente an A rating. The company has closed just seven complaints in the past three years, all related to billing issues or problems with coverage. NCQA reflects very high customer satisfaction ratings for Kaiser Permanente. All reviewed plans are rated as high-performing.

How to pay for a doctor's visit?

You may be asked to pay before, during, or after your visit. Here’s what you can usually expect: 1 When you check in, you’ll be asked to make a payment for most scheduled services. 2 During your visit, you might get services you didn’t schedule, like X-rays or blood tests. These could have extra costs. 3 After your visit, you’ll get a bill if the total cost of your care is more than what you paid at your visit.

What is a coinsurance plan?

A coinsurance is a percentage of the full cost of a service.

Charitable Health Coverage

You may qualify for our Charitable Health Coverage if you don’t qualify for public or private coverage like Medicaid/Medi-Cal. Read about program requirements in your state.

Employers and administrators

Check out our competitive plans and custom programs for businesses of all sizes.

How many people have Kaiser health insurance?

More than 12.2 million Americans had health coverage through Kaiser in 2019. Plans are offered in many areas around the United States. Many of Kaiser’s plans are 5-star rated, which is the highest rating for a Medicare Advantage plan. Kaiser Permanente has been operating in the United States since 1945.

What are the benefits of Kaiser?

What Medicare Advantage Plans Does Kaiser Offer in 2021? 1 Kaiser Permanente offers Medicare Advantage plans and a supplement Advantage Plus plan that includes dental, vision, and hearing benefits. 2 More than 12.2 million Americans had health coverage through Kaiser in 2019. 3 Plans are offered in many areas around the United States. 4 Many of Kaiser’s plans are 5-star rated, which is the highest rating for a Medicare Advantage plan.

What is Medicare Advantage?

Medicare Advantage, or Medicare Part C, is an alternative to original Medicare where Medicare contracts with a private insurance company to provide services to Medicare members. Medicare Advantage plans will provide Medicare Part A and Part B coverage as well as some additional services.

Does Kaiser offer hearing aids?

Kaiser will provide one routine hearing exam a year , as well as one routine eye exam per year. However, eyewear, hearing aids, and other related exams are offered under their Advantage Plus plans. Many plans also offer SilverSneakers programs, which are preventive fitness and wellness programs.

Does Kaiser Medicare cover blood pressure?

You’ll still receive hospital and medical benefits from a Kaiser Medicare Advantage plan. Preventive care services. These benefits are often offered at no to low cost, including blood pressure, cholesterol, and colorectal cancer screenings (for adults older than age 50). Basic hearing and vision services.

Our thoughts

Kaiser Permanente has frequently been named as one of the best health insurance providers in the country. Rankings on both HealthCare.gov and Medicare.gov give plans 4 to 5 stars, which is consistently higher than many other major insurance companies.

Where is Kaiser Permanente available?

Kaiser Permanente offers health insurance plans in eight states and the District of Columbia. This includes areas on the Pacific Coast, in the Mid-Atlantic region and more. If Kaiser isn't available in your state, consider one of our other best-rated health insurance companies.

Health insurance plan options

Kaiser Permanente offers health insurance for all categories of consumers. That includes individual/family, Medicare, Medicaid and group health insurance.

Cost of Kaiser insurance

The monthly cost of Kaiser insurance ranges from about $300 to more than $1,000 per month based on factors such as your age and plan coverage level.

Customer reviews and complaints

Kaiser Permanente receives top-tier scores across several different metrics, showing that it's a company that provides strong coverage and great customer service.

Frequently asked questions

Kaiser Permanente is one of the best-rated health insurance companies, earning top scores for its customer service, preventive care and overall plan experience.

Methodology and sources

Cost comparisons were developed using 2021 public use files from the Centers for Medicare and Medicaid Services (CMS). Calculations were based on provider, location, age and plan tier. Ranking data was sourced from separate CMS public use files.

What is Medicare for 65?

Based on your answers, you might want to explore Medicare. Medicare is a federal health insurance program that covers millions of Americans. The plans are designed for people 65 and over, and for people with certain qualifying disabilities or conditions.

Is Kaiser Permanente Medicare a federal insurance?

Yes No. Thank you! Based on your answers, you might want to explore Medicare. Medicare is a federal health insurance program that covers millions of Americans. The plans are designed for people 65 and over, and for people with certain qualifying disabilities or conditions. Our Kaiser Permanente Medicare health plans provide quality care ...

How much more expensive is a cesarean birth than a vaginal birth?

Cesarean births are abdominal surgeries — they increase recovery time, extend hospital stays, and cost approximately 50% more than vaginal births. 7 Since all surgeries carry risks, the least invasive option is preferred — but there has been a significant increase in C-section deliveries over the past few decades.

Who is Kari Carlson?

Kari Carlson, MD, is a doctor of obstetrics-gynecology at Kaiser Permanente Redwood City Medical Center. She joined Kaiser Permanente in September 2003. Dr. Carlson has an undergraduate degree in American history from Princeton University and attended medical school at the University of California, Davis. She completed her residency at Kaiser Permanente in Santa Clara.

Is maternity insurance expensive?

Overall, maternity claims are one of the most common and expensive health care costs for businesses .² But on top of medical costs, there are indirect costs to consider — like unexpected time away from work and short- and long-term disability — that can come up during or after pregnancy. Then there’s the unpredictability of costs.