Requirements

- Home visits services (CPT codes 99341-99350) may only be billed when services are provided in beneficiary's private residence (POS 12). ...

- The service must be of such nature that it could not be provided by a Visiting Nurse/Home Health Services Agency under Home Health Benefit

- There may be circumstances where home health services and services of physician/qualified non-physician practitioners (NPPs) are performed on same day

How to setup a CPT code?

Feb 08, 2022 · What is the CPT code for home visit? Home Visits Listing – CPT codes 99341 – 99350: Home Services codes, are used to report E/M services furnished to a patient residing in his or her own private residence. What CPT code is used for a home visit? New patient CPT codes 99341 – Home visit for the evaluation and management of a new patient.

What is the code for home visit?

May 23, 2018 · Home Services CPT Code Range 99341- 99350. Codes 99341-99350 report E/M services provided in a private residence (place of service 12) and cannot be used if the patient resides in a shared living facility or group home.

How to use CPT code 99214 correctly?

Nov 15, 2021 · CPT Home Services Codes 99341 – Home visit for the evaluation and management of a new patient. 99342 – Same as above, but this is a moderate severity problem requiring 30 minutes. 99343 – Moderate to high severity problem requiring 30 minutes. 99344 – High severity problem requiring 60 minutes.

What CPT codes require a qw modifier?

4 rows · Mar 11, 2020 · Home visits services ( CPT codes 99341-99350) may only be billed when services are provided ...

What is procedure code 99348?

CPT Code 99348 Home visit for the evaluation and management of an established patient, which requires at least 2 of these 3 key components: An expanded problem focused interval history; An expanded problem focused examination; and. Medical decision making of low complexity.May 29, 2019

What does CPT code 99343 mean?

New Patient Home ServicesCPT® Code 99343 - New Patient Home Services - Codify by AAPC. Overview.

Who can bill for CPT code 99441?

The following codes may be used by physicians or other qualified health professionals who may report E/M services: 99441: telephone E/M service; 5-10 minutes of medical discussion. 99442: telephone E/M service; 11-20 minutes of medical discussion.

What does CPT code 99337 mean?

CPT code 99337 is used to reflect the domiciliary or rest home visit for the E/M of an established patient, which requires at least two of these three key components: A comprehensive interval history. A comprehensive examination. Medical-decision making of moderate to high complexity.Aug 3, 2020

What is the CPT code 99350?

CPT Code 99350: Established Patient, Home Visit (A/B MAC Jurisdiction 15)Feb 13, 2019

What is the description of CPT code 99349?

BillingCPT CodeDescription99345Level 5 new patient home visit99347Level 1 established patient home visit99348Level 2 established patient home visit99349Level 3 established patient home visit5 more rows•Apr 20, 2021

What is the difference between 95 and GT modifier?

What is the difference between modifier GT and 95? Modifier 95 is like GT in use cases, but unlike GT there are limits to the codes that it can be appended. Modifier 95 was introduced in January 2017, and it is one of the newest additions to the telemedicine billing landscape.Jun 8, 2018

What is CPT code for telehealth visit?

For these E-Visits, the patient must generate the initial inquiry and communications can occur over a 7-day period. The services may be billed using CPT codes 99421-99423 and HCPCS codes G2061-G2063, as applicable. The patient must verbally consent to receive virtual check-in services.Mar 17, 2020

What modifier is used for a telephone visit?

Physicians should append modifier -95 to the claim lines delivered via telehealth. Claims with POS 02 – Telehealth will be paid at the normal facility rate, which is typically less than the non-facility rate under the Medicare physician fee schedule.Apr 9, 2020

What is CPT code 0503F?

Use the CPT® Category II code 0503F, defined as postpartum care visit; this code will help with HEDIS data collection and offers providers a $20 incentive payment. Procedure code 0503F can be billed alone or with other qualifying CPT codes.

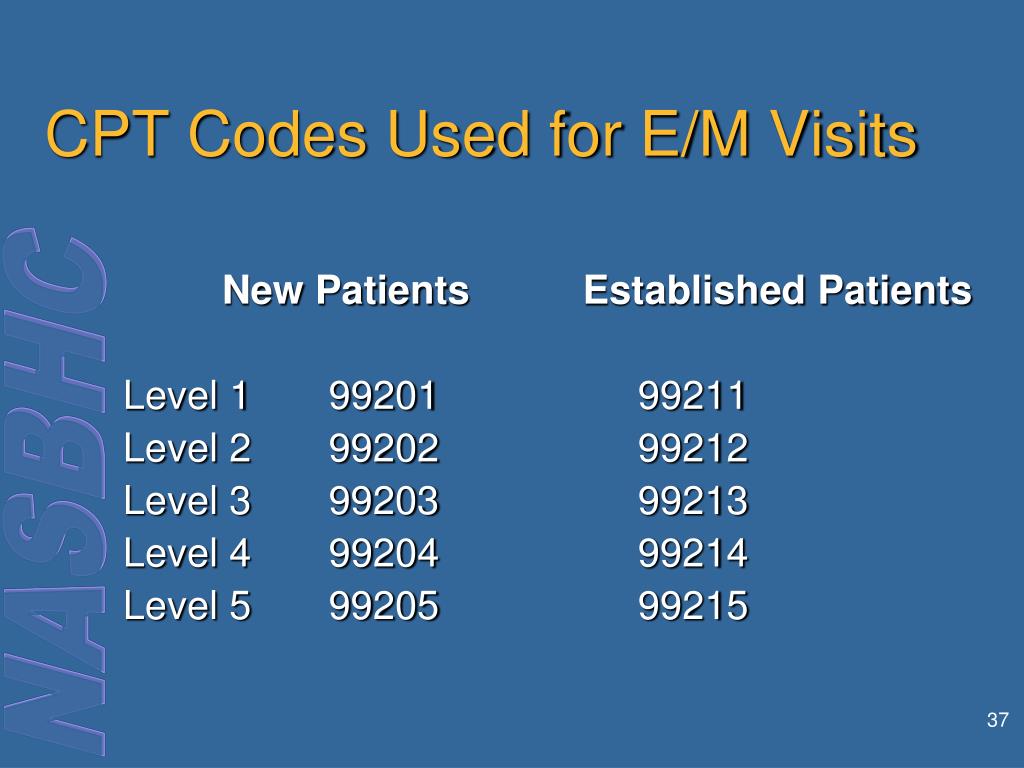

What does CPT code 99202 mean?

99202. Office or other outpatient visit for the evaluation and management of a new. patient, which requires these 3 key components: An expanded problem focused history; An expanded problem focused examination; Straightforward medical decision making.Jan 1, 2021

What does CPT code 99241 mean?

99241 – Office consultation for a new or established patient, which requires these 3 key components: A problem focused history; A problem focused examination; and Straightforward medical decision making.Oct 8, 2016

What is the CPT code for home visits?

Home visits services ( CPT codes 99341-99350) may only be billed when services are provided in beneficiary's private residence ( POS 12). To bill these codes, physician must be physically present in beneficiary's home.

What is a home visit?

Home and domiciliary visits are when a physician or qualified non-physician practitioner (NPPs) oversee or directly provide progressively more sophisticated evaluation and management (E/M) visits in a beneficiary's home. This is to improve medical care in a home environment. A provider must be present and provide face to face services. This is not to be confused with home healthcare incident to services.

Where is payment made for EKG?

Payment may be made in some medically underserved areas where there is a lack of medical personnel and home health services for injections, EKG s, and venipunctures that are performed for homebound patients under general physician supervision by nurses and paramedical employees of physicians or physician-directed clinics.

What is a NPP in medical?

Under provisions of the Balanced Budget Act of 1997, Physicians (MDs) and Qualified non-physicians Practitioners (NPPs) must be practicing within the scope of State law and may also bill for home and domiciliary visits.

Is home health covered by Medicare Part B?

Based on Consolidative Billing Regulations, no service will be covered under Medicare Part B when performed only to provide supervision for a visiting nurse/home health agency visit (s) If a beneficiary is receiving care under home health benefit, primary treating physician will be working in concert with home health agency.

What is a domiciliary care facility?

Domiciliary Care Facility - A home providing mainly custodial and personal care for persons who do not require medical or nursing supervision, but may require assistance with activities of daily living because of a physical or mental dis ability. This may also be referred to as a sheltered living environment.

Is inactive or chronic condition considered medical necessity?

The mere presence of inactive or chronic conditions does not constitute medical necessity for any setting (home, rest home, office etc.). Frequency of visits required to address any given clinical problem should be dictated by medical necessity rather than site of service.

General Information

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSARS apply.

Article Guidance

This First Coast Billing and Coding Article for Local Coverage Determination (LCD) L33817 E&M Home and Domiciliary Visits provides billing and coding guidance for frequency limitations as well as diagnosis limitations that support diagnosis to procedure code automated denials.

ICD-10-CM Codes that DO NOT Support Medical Necessity

All those not listed under the “ICD-10-CM Codes that are covered” section of this article.

Bill Type Codes

Contractors may specify Bill Types to help providers identify those Bill Types typically used to report this service. Absence of a Bill Type does not guarantee that the article does not apply to that Bill Type.

Revenue Codes

Contractors may specify Revenue Codes to help providers identify those Revenue Codes typically used to report this service. In most instances Revenue Codes are purely advisory. Unless specified in the article, services reported under other Revenue Codes are equally subject to this coverage determination.