Long-term capital gains are those you earn on assets you’ve held for more than a year. The current capital gains tax rates under the new 2018 tax law are 0%, 15% and 20%, depending on your income. However, that rate doesn’t apply to all assets. Jun 10 2019

How do you calculate long term capital gains tax?

Now let’s assume the following associated expenses:

- $10,000 in closing costs upon purchase of the rental property,

- $10,000 for a roof replacement,

- $25,000 for new plumbing, and

- $50,000 in commissions and fees upon sale of the rental property.

How to calculate long term capital gain?

- The type of investment.

- Type of gain (whether short or long-term).

- Cost inflation index of the year of purchase.

- Cost inflation index of the year of sale.

- Difference between the purchase price and sale price.

- Time between the purchase and sale.

- Purchased index cost.

- Long-term capital gain without indexation.

- Long-term capital gain with indexation.

Do you have to pay long term capital gains tax?

You can sometimes make a low-tax year occur on purpose in retirement by choosing which accounts to take withdrawals from each year. 0% capital gains rates apply only to long-term capital gains on assets you've held for more than one year. If you hold assets for one year or less, your capital gains are taxed at your income tax rate. 3

What is the AMT rate for long term capital gains?

Under the regular tax system, someone with AMT taxable income of $200,000 would typically pay a 15% tax rate on the long-term capital gain. That would result in an additional $150 in tax. With the AMT, you have to consider the impact of the reduction in the exemption.

What is the long term capital gains tax rate for 2020?

Motley Fool ReturnsLong-Term Capital Gains Tax RateSingle Filers (Taxable Income)Heads of Household0%$0-$40,000$0-$53,60015%$40,000-$441,450$53,600-$469,05020%Over $441,550Over $469,050Dec 7, 2019

What is the tax rate for long term capital gains in 2021?

2021 Long-Term Capital Gains Tax RatesTax Rate0%15%Filing StatusTaxable IncomeSingleUp to $40,400$40,401 to $445,850Head of householdUp to $54,100$54,101 to $473,750Married filing jointlyUp to $80,800$80,801 to $501,6001 more row•Jul 12, 2022

What is today's capital gains tax rate?

2022 Capital Gains Tax Rate ThresholdsCapital Gains Tax RateTaxable Income (Single)Taxable Income (Head of Household)0%Up to $41,675Up to $55,80015%$41,675 to $459,750$55,800 to $488,50020%Over $459,750Over $488,500

What is the long term capital gains tax rate 2022?

Long-term capital gains come from assets held for over a year. Short-term capital gains come from assets held for under a year. Based on filing status and taxable income, long-term capital gains for tax years 2021 and 2022 will be taxed at 0%, 15% and 20%.

What would capital gains tax be on $50 000?

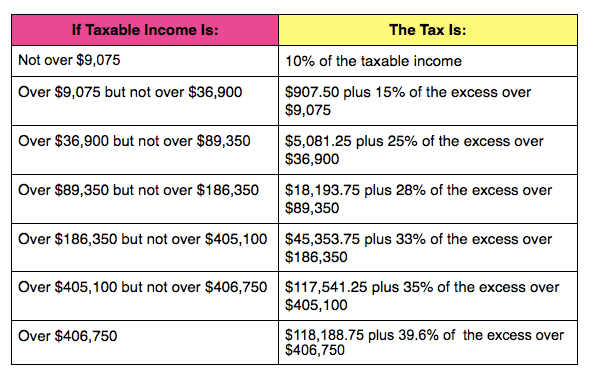

If the capital gain is $50,000, this amount may push the taxpayer into the 25 percent marginal tax bracket. In this instance, the taxpayer would pay 0 percent of capital gains tax on the amount of capital gain that fit into the 15 percent marginal tax bracket.

How do I avoid capital gains tax?

How to Minimize or Avoid Capital Gains TaxInvest for the long term. ... Take advantage of tax-deferred retirement plans. ... Use capital losses to offset gains. ... Watch your holding periods. ... Pick your cost basis.

How do you calculate long-term capital gain?

In case of short-term capital gain, capital gain = final sale price - (the cost of acquisition + house improvement cost + transfer cost). In case of long-term capital gain, capital gain = final sale price - (transfer cost + indexed acquisition cost + indexed house improvement cost).

How do you calculate long-term capital gain on a stock?

The long-term capital gain will be the difference between the selling price of the asset and the actual cost of the acquisition, which is Rs 100 (Rs 300 – Rs 200). Example 3: You have purchased an equity share on 01 February 2017 at Rs 200. The fair market value as of 31 January 2018 was Rs 250.

Do capital gains count as income tax brackets?

Short-term capital gains are taxed as though they are ordinary income. Any income that you receive from investments that you held for less than a year must be included in your taxable income for that year.

What's the capital gains tax on $100000?

Instead, the criteria that dictates how much tax you pay has changed over the years. For example, in both 2018 and 2022, long-term capital gains of $100,000 had a tax rate of 9.3% but the total income maxed out for this rate at $268,749 in 2018 and increased to $312,686 in 2022.

How do you calculate long-term capital gain?

In case of short-term capital gain, capital gain = final sale price - (the cost of acquisition + house improvement cost + transfer cost). In case of long-term capital gain, capital gain = final sale price - (transfer cost + indexed acquisition cost + indexed house improvement cost).

Is capital gains added to your total income and puts you in higher tax bracket?

And now, the good news: long-term capital gains are taxed separately from your ordinary income, and your ordinary income is taxed FIRST. In other words, long-term capital gains and dividends which are taxed at the lower rates WILL NOT push your ordinary income into a higher tax bracket.

Do capital gains count as income tax brackets?

An individual's ordinary income level has an impact on the tax rate that is applied for long-term capital gains. However, the reverse does not apply and the amount of capital gains recognized in a given year does not impact an individual's ordinary income tax bracket.

What is the maximum threshold of capital gain to claim complete tax exemption?

Complete tax exemption is offered only on long term capital gains of up to Rs 1 lakh. LTCG of above Rs 1 lakh is taxable at 10%.

What is the LTCG gain definition for equities?

LTCG on equities is realized when the assets are sold at least after 12 months of their purchase. The LTCG on equities is nil if the capital gain i...

When gains from selling units of debt mutual funds categorized as LTCG?

For debt mutual funds, LTCG is realized when the holding period is at least 36%.

How much tax do I need to pay on STCG?

STCG on equities are taxed at 15% and on any other type of asset class, STCG is applicable as per the taxpayer’s income tax slab.

What is long term capital gains tax?

What is long-term capital gains tax? Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. The long-term capital gains tax rate is 0%, 15% or 20% depending on your taxable income and filing status. They are generally lower than short-term capital gains tax rates.

What is the capital gains tax rate?

The capital gains tax rates in the tables above apply to most assets, but there are some noteworthy exceptions. Long-term capital gains on so-called “collectible assets” are generally taxed at 28%; these are things like coins, precious metals, antiques and fine art. Short-term gains on such assets are taxed at the ordinary income tax rate.

How long can you hold an asset?

Whenever possible, hold an asset for a year or longer so you can qualify for the long-term capital gains tax rate, since it's significantly lower than the short-term capital gains rate for most assets. Our capital gains tax calculator shows how much that could save.

Do you pay taxes on 529s?

Roth IRAs and 529s in particular have big tax advantages. Qualified distributions from those are tax-free; in other words, you don’t pay any taxes on investment earnings. With traditional IRAs and 401 (k)s, you’ll pay taxes when you take distributions from the accounts in retirement.

Can you deduct capital loss on your taxes?

If your net capital loss exceeds the limit you can deduct for the year, the IRS allows you to carry the excess into the next year, deducting it on that year’s return.

Do you have to pay capital gains tax on 529?

That means you don’t have to pay capital gains tax if you sell investments within these accounts.

Long-Term Capital Gains Taxes

Long-term capital gains are taxed at lower rates than ordinary income, and how much you owe depends on your annual taxable income.

Short-Term Capital Gains Taxes

If you’ve held an asset or investment for one year or less before you sell it for a gain, that’s considered a short-term capital gain. In the U.S., short-term capital gains are taxed as ordinary income. That means you could pay up to 37% income tax, depending on your federal income tax bracket.

What Is a Capital Gain?

A capital gain happens when you sell or exchange a capital asset for a higher price than its basis. The “basis” is what you paid for the asset, plus commissions and the cost of improvements, minus depreciation.

Exceptions to Capital Gains Taxes

For some kinds of capital gains, different rules apply. These include capital gains from the sale of collectibles (like art, antiques and precious metals) and owner-occupied real estate.

What Is the Net Investment Income Tax?

For people earning income from investments above certain annual thresholds, the net investment income tax comes into play. Net investment income includes capital gains from the sale of investments that haven’t been offset by capital losses—as well as income from dividends and interest, among other sources.

What is the tax rate for long term capital gains?

In other words, if your long-term capital gains bring your taxable income $1 over the level for the 25%-35% bracket, only $1 will be taxed at 15%, and the rest of your long-term capital gains will be taxed at 0%.

What is the difference between capital gains and capital losses?

When you sell a capital asset, the difference between the amount you sell it for and your (cost) basis, which is usually what you paid for it, is a capital gain or a capital loss. Capital gains are offset again capital losses, so your net capital gain/loss is the key figure to use in your tax planning. If your capital losses are more ...

What is capital gain?

When you sell a capital asset like a stock or a home you own, the difference between the amount you sell it for and what you paid for it (cost basis) is classified as a capital gain or a capital loss. Capital gains and losses are further classified as long-term or short-term, depending on how long you held the investment before you sold it. If you have held the asset more than one year, your capital gain or loss is classified as long-term. If you held the asset for one year or less, your capital gain or loss is considered short-term. Based on the duration of asset ownership and the tax filers personal tax rate, you can calculate their capital gains tax rate.

How much can you deduct for capital losses?

If your capital losses are more than your capital gains, you can claim a capital loss deduction in your tax filing. Your allowable deduction is $3,000 ($1,500 if you are married and filing separately) and can be claimed against your ordinary income.

How long do you have to sell back stocks?

So make sure at the end of year, to sell some “losses” up to $3,000. You can always buy back the stocks after 30 days (to avoid the wash rule discussed below), and thereby reduce your overall cost basis. Dividends paid out of the earnings and profits of a corporation – are generally ordinary income to you.

What are some examples of capital assets?

Almost everything you own and use for personal or investment purposes is a capital asset. Examples are your home, investment properties, stocks, options or bonds held in your personal account. When you sell a capital asset, the difference between the amount you sell it for and your (cost) basis, ...

Can you deduct losses from a wash sale?

You (or your spouse) cannot deduct losses from sales or trades of stock or securities in a wash sale. A wash sale occurs when you sell or trade stocks or securities at a loss and within 30 days before or after the sale you: – Buy substantially identical stock or securities.

What Is Capital Gains Tax?

A capital gains tax is a tax you pay on the profit made from selling an investment.

Capital Gains Tax Rates for 2021

The capital gains tax on most net gains is no more than 15 percent for most people. If your taxable income is less than $80,000, some or all of your net gain may even be taxed at zero percent.

How to Reduce Your Capital Gains Tax Bill

There are several ways to legally reduce your capital gains tax bill, and much of the strategy has to do with timing.

What is the tax rate for long term capital gains?

The tax rate on most taxpayers who report long-term capital gains is 15% or lower. 2. President Biden is reportedly proposing to raise taxes on long-term capital gains for individuals earning $1 million or more to 39.6%.

How long are capital gains taxable?

Long-term capital gains are derived from assets that are held for more than one year before they are disposed of. Long-term capital gains are taxed according to graduated thresholds for taxable income at 0%, 15%, or 20%.

Why is it important to keep investments long term?

Advantages of Long-Term Capital Gains. It can be advantageous to keep investments longer if they will be subject to capital gains tax once they’re realized. The tax rate will be lower for most people if they realize a capital gain in more than a year.

What is the capital gain on a house after the $250,000 exemption?

After applying the $250,000 exemption, they must report a capital gain of $150,000. This is the amount subject to the capital gains tax. In most cases, significant repairs and improvements can be added to the base cost of the house. These can serve to further reduce the amount of taxable capital gain.

How long do you have to live in your home to exclude capital gains?

The first $250,000 of an individual’s capital gains on the sale of your principal residence is excluded from taxable income ($500,000 for those married filing jointly) as long as the seller has owned and lived in the home for two of the five years leading up to the sale.

What is capital gain in 2021?

Updated May 14, 2021. When you sell a capital asset for more than you paid for it, the result is a capital gain. Capital assets include stocks, bonds, precious metals, jewelry, and real estate. 1 The tax you’ll pay on the capital gain depends on how long you held the asset before selling it. Capital gains are classified as ...

Which states do not have capital gains tax?

8. The following states have no income taxes, and therefore no capital gains taxes: Alaska. Florida.