What are the conditions of an insurance policy?

Key Takeaways

- Insurance conditions are requirements that need to be met for the coverage to be valid.

- They may address issues like how notice of a claim should be given and what the insured party should do in the event of a loss.

- Conditions are typically listed in a specific section of your policy. ...

Where to find home insurance declaration page?

Your declarations page is usually the first page of the full homeowners insurance policy. After you purchase home insurance and you go through underwriting, your insurer will likely make your dec page and policy available to you.

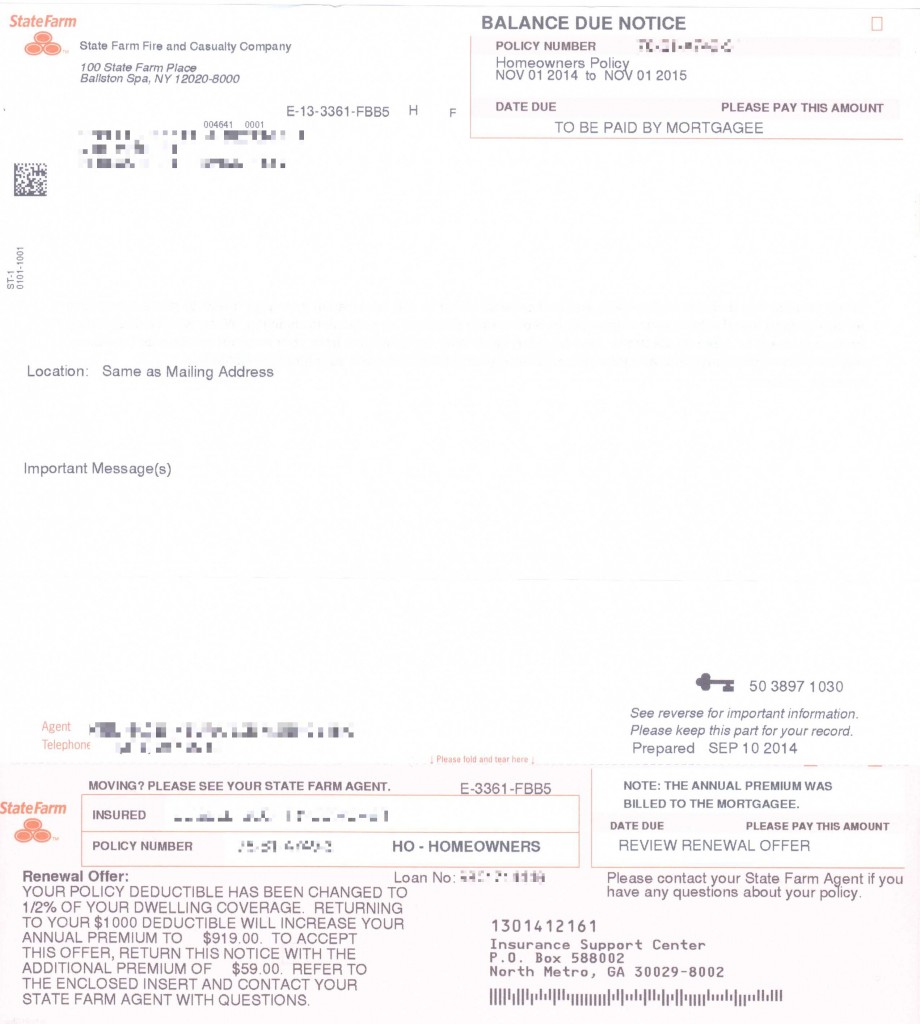

What does a declaration page look like?

- Your homeowners insurance declarations page is a brief one-page summary of your policy

- Your dec page includes your policy number, coverage amounts, premium, and deductible

- A dec page can be used as proof of insurance. It also makes re-shopping your policy easier

What is insurance Dec page?

What Is an Insurance Declarations Page?

- Named insured. At the top of the page, you will see the name and address of at least one named insured. ...

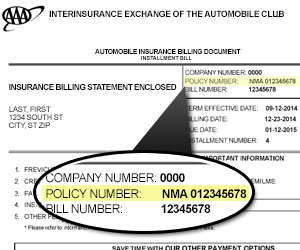

- General policy information. At the top of the page, you’ll see the policy number, policy period and billing account number. ...

- Discounts. ...

- Insured property. ...

- Coverages and limits. ...

- Policy forms and endorsements. ...

- Agent contact information. ...

Where is the declarations page of an insurance policy?

Your insurance company will usually send your insurance declarations page automatically as soon as you sign up for auto or home insurance. You'll find it at the beginning of your policy documents, which you may receive by email, fax, or regular mail.

What is a declaration page on insurance?

A homeowners insurance declarations page is a document provided by your insurance company that summarizes the coverage provided by your homeowners insurance policy. It contains all the most pertinent information regarding your home insurance.

Is declaration page same as proof of insurance?

However, a declarations page is part of your insurance policy that offers more detailed information, while a COI is a document that provides evidence of insurance.

Is the declarations page part of an insurance policy?

The Declaration Page This page is usually the first part of an insurance policy. It identifies who is the insured, what risks or property are covered, the policy limits, and the policy period (i.e. time the policy is in force).

What is the declaration page of a homeowners insurance policy?

When you purchase a homeowners insurance policy, when you renew your policy, or when you make any changes to your policy, the company will give you a document called a “Declarations Page.” The Declarations Page identifies the kinds and amounts of coverage you have and how much it will cost you.

What is a policy declaration?

Common policy declarations are a basic part of every insurance contract. They include the dates on which coverage begins and ends, as well as the amount of premium required. The premium that insurance companies charge is based on the information found in the declaration.

What is a certificate of declaration?

The certificate of declaration is necessary for the Document Verification Step of your admission. The Document verification stage is where you submit your academic transcripts to the. admissions division so that they can confirm the authentication of your papers.

How do I find my car insurance certificate?

I Can't Remember My Insurance Company – Tips for Finding OutCheck your emails. Most insurers send confirmation and essential policy details by email. ... Check your paperwork. ... Call your bank. ... Check the Motor Insurance Database.

How can I get my Allstate declaration page?

Where can I get a copy of my policy declarations page? First, please log into my account. For most policy types, you can go to the Documents section to print a copy of your policy declarations page online. You can also request copies by contacting your Allstate agency or calling 800-255-7828.

Why is the declaration page important?

A declarations page is important because it summarizes the key points about your policy. It details what you're insuring, how your coverage works, and how much it costs.

What should be on the declaration page?

Your declarations page will include the year, make, model and vehicle identification number (VIN) for each vehicle included on your policy. It will also itemize coverages for each vehicle since it's possible you might not need to carry the exact coverages and limits for each vehicle on the policy.

What does a DEC page contain?

Your insurance declaration page, also known as the dec page, summarizes the information essential to your insurance coverage. It includes your name and address, descriptions of the insured property and your premium.

How can I get my Allstate declaration page?

Where can I get a copy of my policy declarations page? First, please log into my account. For most policy types, you can go to the Documents section to print a copy of your policy declarations page online. You can also request copies by contacting your Allstate agency or calling 800-255-7828.

What is found on the declarations page of an insurance policy quizlet?

The declarations page of an insurance policy contains statements made by the insured on the application, information about the risk, and other pertinent data, such as insured's name, effective date of coverage, deductible, premium amounts, coinsurance percentage, and location of the property.

How do I get a Liberty Mutual declaration page?

Liberty Mutual After login in, the website will display the displayed screen. Select 'Manage Your Policy Online' to view policy documents, including your declaration page.

How do I get a declaration page from USAA?

How can I find my declarations page? Your declarations page is part of your Homeowners policy packet. Go to My Documents and search the year your policy started. You can also use Insurance filter to find your homeowners documents.

What is an insurance declaration page?

What’s an Insurance Declaration Page? The insurance declaration page (also called a standard declaration page or dec page) is a snapshot of what coverage you have, who is covered and how much it’s costing you. It’s provided by your insurance carrier and is usually the first page of your policy.

What is a declaration page?

The declaration page is kind of like a Wikipedia page for your insurance coverage ( except not just anyone can go in and edit it and claim the earth is flat). It also includes things like your limits of liability, deductibles, policy number, length of policy and when it went into effect.

What is deduction in insurance?

Deductible —The amount you have to pay out of pocket before your insurance company starts ponying up.

What to do if you can't find your home insurance?

If you can’t find it, reach out to them and have them send it to you. Keep in mind, too, that even if you’re bundling home and auto, the coverages are still going to be broken out into separate documents. And it’s a good idea to check for errors right after you get your coverage set up.

How long does car insurance last?

Most car insurance periods are usually for six months but sometimes can be a year. Your policy number is also listed. Drivers —This section is your go-to place to check which drivers are covered under the policy.

What is limit of liability?

Limits of liability are the maximum the carrier will pay out if something happens. For example, if you have $10,000 in collision coverage, the company won’t pay more than $10,000 if your car is totaled. Here’s an example of an auto insurance declaration page. If you’re in the market for better auto insurance coverage, ...

What does premium mean in a business?

Premium —This shows how much you’re paying.

What is the declaration page?

The first or one of the first pages you’ll find is the declarations, or “dec” page, which provides an overview of the policy. There may be only page, or several pages that are considered the declarations page. The declarations page summarizes your policy. For example, a declarations page for either a business or personal auto policy identifies ...

Why is the declaration page important?

The insurance declaration page is an important part of your insurance policy because it shows 2: The main coverages you have and what will be paid should a claim arise. The limits for the various sections of the policy. Premiums charged for the coverages you have selected and for which you’ve paid. The person (s) and/or the property that is covered.

What is a policy number?

Policy number. Policy beginning and ending dates (the policy period) Insurance company name. Insurance agency name. Policyholder name. The names of persons or organizations whose interests are also covered, such as a bank or credit union (for example, mortgages, business or car loans), or an additional policyholder.

Where does Merchants Insurance Group sell their products?

Merchants Insurance Group sells its products through a network of more than 1,000 independent insurance agents in Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, and Vermont. We sell our products through independent insurance agents because we believe they provide value to policyholders through their broad range of products and their insurance expertise.

What Is An Insurance Declarations Page?

A declarations page is a document that lists the specific information about an insurance policy. This includes the name of the policyholder, the insurance company, and the type of policy. The declarations page also lists the coverages and policy limits. It will also show the premiums and dates of coverage.

Why Is A Declarations Page Important?

A declarations page is important because it is a document that states the truthfulness of the information in the manuscript. It is also a document that can protect the author from any legal action that may be taken against them.

What Is The First Page Of An Insurance Policy Called?

The first page of an insurance policy is typically called the declarations page . This page lists the specific information about the policy, including the name of the policyholder, the insurance company, and the type of policy.

Why do you need a declaration page for your home insurance?

An insurance declarations page is helpful to reference for general policy inquiries and can be used as proof of insurance to your mortgage company to assure them you have adequate financial protection for your home. Having your declarations page on hand also makes it easier to re-shop your homeowners insurance and compare your policy with ...

What is a declaration page?

Your declarations page is a summary of your homeowners insurance policy. Also known as a “dec page”, it lists your coverage, rates, and other need-to-know information. Homeowners insurance consists of coverage for your home, personal property, additional living expenses if your home is damaged, and legal expenses — the particulars ...

What is a deductible on a home insurance policy?

Your policy deductible is the amount you have to pay out of pocket when filing a homeowners insurance claim before the insurance company covers the remainder of the loss. It will either be listed as a fixed amount, like $1,000, or a percentage, like 2% of your home’s insured value.

How long is a homeowners policy?

Homeowners insurance policy periods are typically six-month to year-long terms. If you’re looking for a better rate, Policygenius can work with you to easily compare quotes from different carriers online. Try and have your declarations page on hand to quickly compare coverage.

What is a home insurance agent?

The agent - The representative from your homeowners insurance company who manages your policy. The agent’s company address and phone number may also be listed.

What does "included" mean on a property insurance policy?

Your other property coverages — other structures, personal property, loss of use — will likely be listed as “included”, meaning that protection comes with the policy at no added cost. Your liability coverage and any additional coverage in your policy will also be listed with respective itemized premiums.

What does it mean when you file a claim on a mortgage?

Along with the named insured, your home address will also be listed. The loss payee - If you have a mortgage on your home, the loss payee on the policy will be your lender. What this means is when you file a claim, your mortgage company will be issued the check for home repairs.

What Information Is Found on The Declaration page?

- Because the insurance declaration page is specific to your policy, you’ll have one for each policy you purchase (home, auto, etc.) and the dec page will be updated with every policy change or renewal. Here’s what you can expect to find.

Who Is Listed on The Declaration page?

- Your declaration page will list the name of the insured(s)and, in some cases, third-party people or businesses associated with your coverage. For example, the mortgagee (the bank or lending institution that issues the mortgage loan) or a co-owner who lives somewhere else but is listed on the deed can be listed on your homeowners insurance declaration page. For car insurance, the l…

Is The Declaration Page Proof of Insurance?

- In most cases — especially when loans are involved — you will be required to provide proof that you’ve obtained an insurance policy. For example, your mortgage lender will require proof of insurance before you can close and move into your new home. Fortunately, obtaining that proof is easy. Your insurance declaration page contains all the information you need to prove that you ha…

Where to Find Your Declaration Page

- Your declaration page is included with the rest of your policy documents and sent any time a policy is issued, renewed or endorsed. All you have to do to find it is: 1. Sign in to your online account 2. Access your policy documents 3. Look for the document labeled Declaration Page If you’re having any trouble accessing your account or finding the right information, contact your in…