Favorable variances are defined as either generating more revenue than expected or incurring fewer costs than expected. Unfavorable variances are the opposite. Less revenue is generated or more costs incurred.

What is the difference between favorable and unfavorable variances?

Favorable variances are defined as either generating more revenue than expected or incurring fewer costs than expected. Unfavorable variances are the opposite. Less revenue is generated or more costs incurred.

How do you calculate unfavorable variance in manufacturing?

In manufacturing, the standard cost of a finished product is calculated by adding the standard costs of the direct material, direct labor, and direct overhead. An unfavorable variance is the opposite of a favorable variance where actual costs are less than standard costs.

What is an unfavorable revenue or expense variance?

If revenues were lower than budgeted or expenses were higher, the variance is unfavorable. A typical business calculates a variety of expense and revenue variances, including: Sales volume variance and selling price variance are revenue variances, while the rest are expense variances. Variances are either favorable or unfavorable.

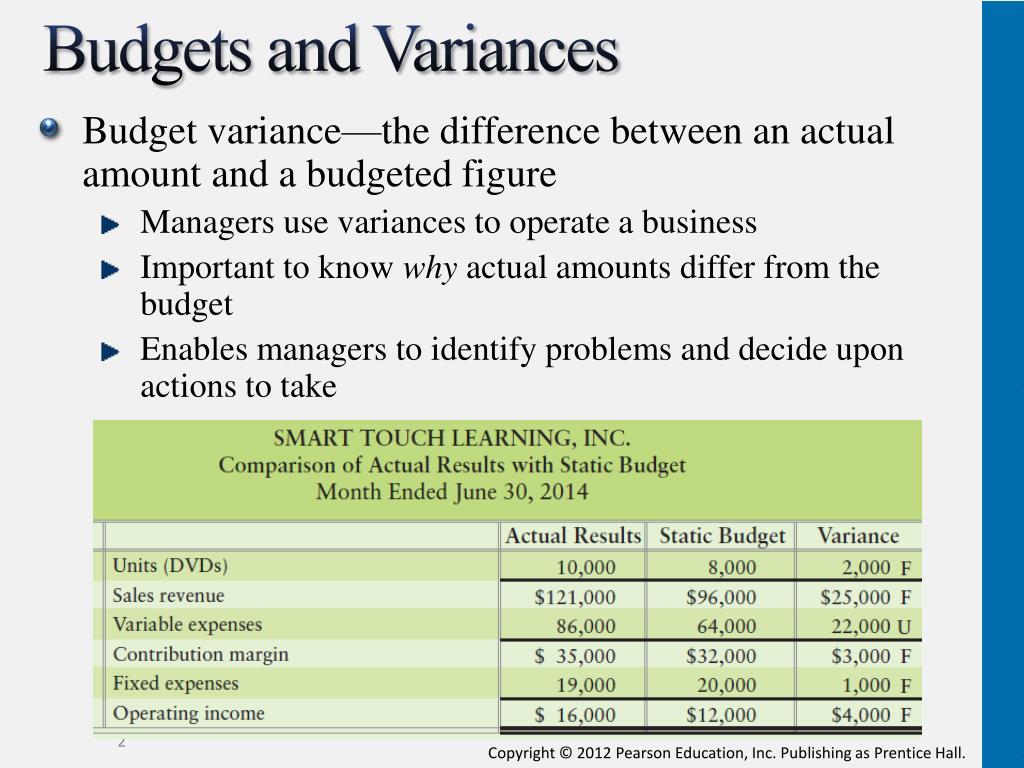

How do you compare budgeted and actual variances?

After the period is over, management will compare budgeted figures with actual ones and determine variances. If revenues were higher than expected, or expenses were lower, the variance is favorable. If revenues were lower than budgeted or expenses were higher, the variance is unfavorable.

What is the difference of favorable and unfavorable?

If revenues were higher than expected, or expenses were lower, the variance is favorable. If revenues were lower than budgeted or expenses were higher, the variance is unfavorable.

What is an unfavorable cost variance?

Unfavorable variance is an accounting term that describes instances where actual costs are greater than the standard or projected costs. An unfavorable variance can alert management that the company's profit will be less than expected.

What is Favourable cost variance?

A favorable variance occurs when the cost to produce something is less than the budgeted cost. It means a business is making more profit than originally anticipated. Favorable variances could be the result of increased efficiencies in manufacturing, cheaper material costs, or increased sales. Here's What We'll Cover.

What is the difference between favorable and unfavorable balance?

Favourable balance of tradeUnfavourable balance of trade1. If the value of exports is more than the value of imports it is called favourable balance of trade. 1. If the value of imports is greater than the value of exports it is known as unfavourable balance of trade.

What is the difference between favorable and unfavorable variances?

A favorable budget variance refers to positive variances or gains; an unfavorable budget variance describes negative variance, indicating losses or shortfalls. Budget variances occur because forecasters are unable to predict future costs and revenue with complete accuracy.

What's the difference between favorable variance and unfavorable variance?

In the field of accounting, variance simply refers to the difference between budgeted and actual figures. Higher revenues and lower expenses are referred to as favorable variances. Lower revenues and higher expenses are referred to as unfavorable variances.

What does favorable and unfavorable mean in accounting?

Favorable variances are defined as either generating more revenue than expected or incurring fewer costs than expected. Unfavorable variances are the opposite. Less revenue is generated or more costs incurred. Either may be good or bad, as these variances are based on a budgeted amount.

What is a Unfavourable variance in in terms of sales and budget?

Unfavorable budget variances refer to the negative difference between actual revenues and what was budgeted. This usually happens when revenue is lower than expected or when expenses are higher than expected.

What is an unfavorable variance quizlet?

unfavorable variance. variance that has the effect of decreasing operating income relative to the budgeted amount.

Why is the identification of favorable and unfavorable variances so important to a company?

However, profits also depend on other factors, such as raw material costs, salaries and marketing expenses. If a favorable revenue variance coincides with higher expenses, it could indicate a loss. Conversely, if an unfavorable revenue variance coincides with lower expenses, it could indicate a profit.

How do you know if quantity variance is favorable or unfavorable?

Subtract standard quantity from actual quantity When you get a negative difference, you say there's an unfavorable variance. A positive difference is called a favorable variance. So, your carrots quantity variance is an unfavorable 15 pounds.

What is a favorable variance?

Favorable Variances. Variances are either favorable or unfavorable. A favorable variance occurs when net income is higher than originally expected or budgeted. For example, when actual expenses are lower than projected expenses, the variance is favorable. Likewise, if actual revenues are higher than expected, the variance is favorable.

When is a variance unfavorable?

When revenues are lower than expected, or expenses are higher than expected, the variance is unfavorable. For example, if the expected price of raw materials was $7 a pound but the company was forced to pay $9 a pound, the $200 variance would be unfavorable instead of favorable.

What is an unfavorable variance?

Unfavorable variance is an accounting term that describes instances where actual costs are higher than the standard or projected costs. An unfavorable variance can alert management that the company's profit will be less than expected. The unfavorable variance could be the result of lower revenue, higher expenses, or a combination of both.

What is sales variance?

A sales variance occurs when the projected sales volumes of a product or service don't meet the goal or projected figures. A company may not have hired enough sales staff to bring in the projected number of new clients. A management team could analyze whether to bring in temporary workers to help boost sales efforts.

Why is there a shortfall in the price of raw materials?

The shortfall could be due, in part, to an increase in variable costs, such as a price increase in the cost of raw materials, which go into producing the product. The unfavorable variance could also be due, in part, to lower sales results versus the projected numbers.

What happens if the net income is less than the forecast?

If the net income is less than their forecasts, the company has an unfavorable variance. In other words, the company hasn't generated as much profit as they had hoped.

Why is budget important?

Budgets are important to corporations because it helps them plan for the future by projecting how much revenue is expected to be generated from sales.