One of the biggest areas where straddle and strangle strategies differ is the way strike prices are used in their execution. With a straddle, the strike price of both call and put options is the same. With a strangle, the options have different strike prices for the puts and calls.

Which is more profitable straddle or strangle?

With a Short Strangle, you're going to have a little bit higher of a Probability of Profit (POP) on the trade, whereas with a Short Straddle, your probability of profit is going to be lower.

Which is better short strangle or straddle?

However, in case of a strangle you sell the call of a higher strike and the put of a lower strike. Normally, sellers prefer short strangles over short straddles as it gives them a much larger safety zone.

Which is cheaper strangle or straddle?

In a straddle you are required to buy call and put options of the ATM strike. However the strangle requires you to buy OTM call and put options. Remember when compared to the ATM strike, the OTM will always trade cheap, therefore this implies setting up a strangle is cheaper than setting up a straddle.

What is the advantage of a straddle option?

The first advantage is that the breakeven points are closer together for a straddle than for a comparable strangle. Second, there is less of a change of losing 100% of the cost of a straddle if it is held to expiration. Third, long straddles are less sensitive to time decay than long strangles.

Which option strategy is most profitable?

One strategy that is quite popular among experienced options traders is known as the butterfly spread. This strategy allows a trader to enter into a trade with a high probability of profit, high-profit potential, and limited risk.

Why is strangle better than straddle?

Straddles are useful when it's unclear what direction the stock price might move in, so that way the investor is protected, regardless of the outcome. Strangles are useful when the investor thinks it's likely that the stock will move one way or the other but wants to be protected just in case.

When should you sell a strangle?

The Short Strangle (or Sell Strangle) is a neutral strategy wherein a Slightly OTM Call and a Slightly OTM Put Options are sold simultaneously of same underlying asset and expiry date. This strategy can be used when the trader expects that the underlying stock will experience a very little volatility in the near term.

When should you buy a straddle?

Investors tend to employ a straddle when they anticipate a significant move in a stock's price but are unsure about whether the price will move up or down. A straddle can give a trader two significant clues about what the options market thinks about a stock.

What is a butterfly trade?

(1.25) A long butterfly spread with calls is a three-part strategy that is created by buying one call at a lower strike price, selling two calls with a higher strike price and buying one call with an even higher strike price.

What is the riskiest option strategy?

The riskiest of all option strategies is selling call options against a stock that you do not own. This transaction is referred to as selling uncovered calls or writing naked calls. The only benefit you can gain from this strategy is the amount of the premium you receive from the sale.

Can you lose money on a straddle?

A straddle option is a neutral position that makes money whether the underlying asset gains or loses value. It is a bet on volatility. You make money so long as the asset price changes in any direction, but stand to lose money if the asset remains relatively stable.

How do you make money from a straddle?

You can buy or sell straddles. In a long straddle, you buy both a call and a put option for the same underlying stock, with the same strike price and expiration date. If the underlying stock moves a lot in either direction before the expiration date, you can make a profit.

Are option straddles profitable?

A straddle is an options strategy involving the purchase of both a put and call option for the same expiration date and strike price on the same underlying security. The strategy is profitable only when the stock either rises or falls from the strike price by more than the total premium paid.

When should you buy a straddle?

An options straddle involves buying (or selling) both a call and a put with the same strike price and expiration on the same underlying asset. A long straddle pays off when volatility increases and the price of the underlying moves by a large amount, but it doesn't matter whether it's to the upside or the downside.

Is long straddle a good strategy?

The Strategy A long straddle is the best of both worlds, since the call gives you the right to buy the stock at strike price A and the put gives you the right to sell the stock at strike price A. But those rights don't come cheap. The goal is to profit if the stock moves in either direction.

Is strangle a good strategy?

A strangle is a good strategy if you think the underlying security will experience a large price movement in the near future but are unsure of the direction. However, it is profitable mainly if the asset does swing sharply in price.

What is a strangle and a straddle?

Straddle and strangle are the strategies for the trader of the options. These strategies help investors manage risk to some extent and generate profit by entering the options contract. In both of the strategies, the investors enter in the call and put options. However, there is a difference in the strike prices between strategies while entering into the contract.

What is a straddle in options?

The straddle is the trading strategy in options where both call and put options are purchased for the underlying asset with the same strike price and the exact date of expiry. The most significant advantage of this strategy is that there is profit on both sides of the movement’s underlying security ...

When is profit made with a strangle strategy?

It is important to note that the profit with the strangle strategy can only be made when underlying assets swing sharply in the price same as the straddle. Since strike price is not the same in this case. So, more profit is made when there is a more significant difference in the strike price and the underlying security price.

Is straddle and strangle profitable?

Further, it’s a matter of the expected situation when to use the straddles and strangle. Both strategies can be profitable if the investor successfully predicts price movement/stock volatility with accuracy.

Is strike price the same for call and put options?

It’s important to note that strike prices are different for both the call and put options. On the contrary, the strike price was the same for both call and put options in the straddle strategy.

Do strangle and straddle end up in profits?

It is important to note that not all the straddle and strangle strategies end up in the profits as there can be losses if there is no significant fluctuation in the price of the underlying assets. Let’s discuss in detail that how these strategies are implemented and the difference between them.

What is the difference between a strangle and a straddle strategy?

A straddle strategy will require that the put options and call options have the same strike price and expiration date whereas a strangle strategy will require the options to have different strike prices. What’s notable is that both the straddle and strangle methods allow an option trader or investor to earn a profit from the significant movement ...

What is a strangle strategy?

The objective of implementing a strangle or straddle is to take advantage of the movement of stock prices for a particular security. Straddles are good strategies to adopt when the investor does not know in what direction the underlying stock price may move. On the other hand, strangles are great strategies when the investor can predict in which ...

What is a strangle option?

A strangle is a different type of option strategy where the investor or trader bets or predicts that the stock price will move in a specific direction (up or down). If the investor believes that a company’s stock price will move up, then he or she would purchase the following option contracts:

What is a straddle in stock trading?

The “straddle” and “strangle” terms refer to options trading strategies intended to take advantage of the volatility or movement of the underlying stock price.

What is the disadvantage of buying strangle stocks?

The disadvantage is that the price change of the underlying stock has to be significant to earn decent profits. If you buy a strangle (or go long), here are the considerations: The advantage is that you can earn an unlimited amount of profits.

When is a straddle a good strategy?

Straddles are good strategies to adopt when the investor does not know in what direction the underlying stock price may move.

What are the disadvantages of predicting the direction of a stock?

The disadvantage is that you’ll need to adequately predict the actual movement of the stock and the stock price must move significantly in the predicted direction to earn decent profits

How Does a Strangle Works?

A strangle works when a trader holds options that are “out-of-money”. A trader must take a put and a call option but with different strike prices unlike, a straddle. The expiration date of both options should be the same. A trader can take a long or short strangle position.

What is a strangle strategy?

Straddle and strangle are two options trading strategies. These are volatility strategies. Traders can make profits with these strategies regardless of the market price movement direction. However, both strategies involve significant risks and sophisticated skills to implement correctly.

What is a straddle option?

A straddle is a trading strategy in which a trader holds both put and call options. The options should come with the same strike price, same expiration date, and of the same asset class.

What is short strangle?

In a short strangle, a trader sells a put and a call option that are “out-of-the-money”. It is suited for a trading situation if the asset’s prices do not fluctuate much. The profit is lower in a short strangle than in a long strangle.

Why do traders use straddles?

A trader can make profits with a straddle if the market prices move beyond the break-even points of the options. For a straddle to work, the prices must move sharply. Hence, the straddle strategy is useful if traders can anticipate sudden market news or market volatility.

What is a long strangle call?

In a long strangle, the call option’s strike price should be higher than the market price of the asset. And the put option’s strike price should be lower than the current market price of the asset. In a long strangle, the trader makes a profit as long as the asset’s prices move beyond the break-even points. The total loss is limited to the premium paid on both options combined.

Can you take a long position with a straddle?

Much like options trading, a trader can take a long or short position with straddles. A short straddle will work if there is not enough volatility in the price movement. A trader will make a profit as long as the prices remain between the break-even points.

What is a straddle in stock trading?

Strangles and straddles are options strategies which are available to investors. These options allow the investor to gain from a significant move which occurs either upward or downward with the price of a stock.

How much does a straddle option cost?

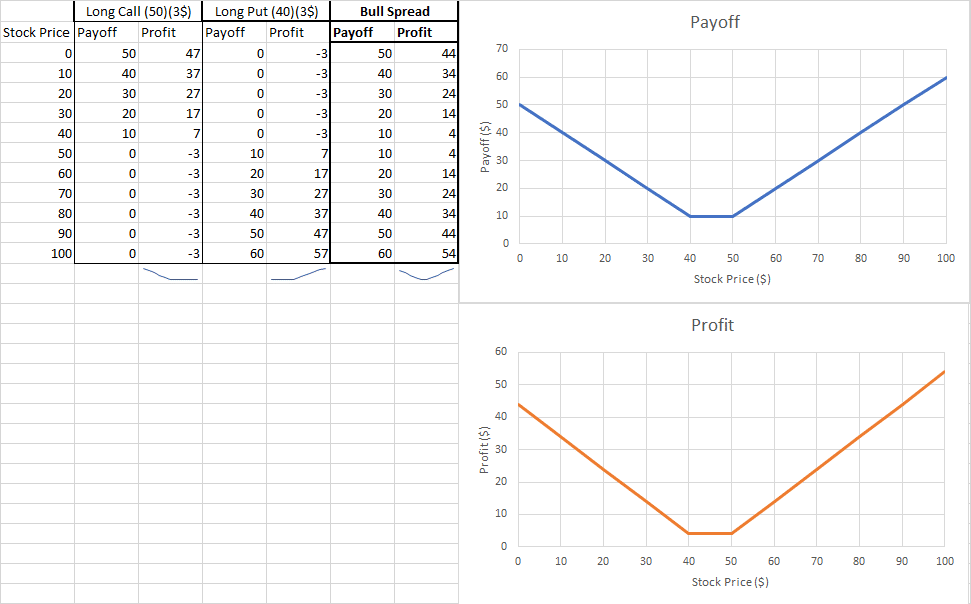

When you elect for the straddle option, you’re going to be purchasing both. That means you have a cost of $3 per share for the options. If you purchase 200 shares per option contract, your cost is now $600 for the investment.

Is it a good time to enter a straddle option?

You don’t know. That’s why now is a good time to enter into a straddle option. When the earnings results are released, then there is an excellent chance that the stock will move sharply upward or sharply downward.

Options Straddles Versus Options Strangles

Straddles offer limited risk but unlimited profit potential, while strangles have limited profit potential but unlimited risk. This is because the maximum gain or loss is defined at the trade initiation. So, if a trader is looking for ways to make money from volatility, consider these strategies.

How Options Straddles and Options Strangles May Fit Your Portfolio

Options straddles and options strangles are remarkably similar strategies. Both options strategies involve using a call and a put option on the same underlying security with the same expiration date. Where the strategies differ is in how they are set up. In an options straddle, both options have the same strike price.

Implied Volatility with Options Straddles and Options Strangles

One of the essential tools for a successful options trader is a solid understanding of implied volatility. Implied volatility measures how volatile the underlying security is expected to be and is also a gauge of market sentiment. Implied volatility can be used to create strategies that are both bullish and bearish.

Options Straddles Example

The straddle buyer is expecting a significant move in price and volatility. Specifically, the trader expects an effective action either up or down and believes they can capture that move by buying both a call and a put. So, let’s assume that our market participant is expecting a significant move to the upside, with IV rising from 12% to 20%.

Options Strangles Example

The strangle buyer is also expecting a significant move in price and volatility. Specifically, the trader expects a substantial move to the upside and believes that they can profit off the increase while protecting themselves by buying both a call and a put.

Schaeffer

Schaeffer's Investment Research, Inc. has been providing stock market publications, market recommendation services and stock option education since its inception in 1981 by founder and CEO, Bernie Schaeffer.

Which is better, short strangle or long strangle?

If you prefer a much wider range during your time in the trade, then the short strangle would be your best choice.

What is a long straddle?

Similar to a Long Strangle, the Long Straddle is a lower probability play. We have a course called “ How to Trade Options On Earnings for Quick Profits ”, that covers trading options on Earnings announcements, which is one of the key areas that we utilize these types of strategies.

Why don't we trade strangles?

We typically don’t place this type of trade on an index or an ETF because of the probability of actually making money on those symbols is very low . We trade long strangles and straddles very sparingly, and it must be done on an individual stock with the anticipation of a large price move, AND implied volatility expansion.

How much profit can you make on a straddle?

With a Straddle, we have a smaller range to make a profit in, but you can see the max profit that we can attain on this trade is a little under $8,000, if we pinned right at the short strikes.

How many ways are there to enter a strangle?

There are two ways to enter a Strangle or a Straddle:

Is a short strangle profitable?

Both short strangles and straddles have proven to be very profitable over time. It really just comes down to personal preference.

Is a short straddle better than a straddle?

When trading Short Strangles and Short Straddles, one is not necessarily better than the other. It just depends on your underlying assumption. If you think the underlying symbol is going to trade in a narrow range, then the short straddle would be the trade of choice. If you prefer a much wider range during your time in the trade, ...