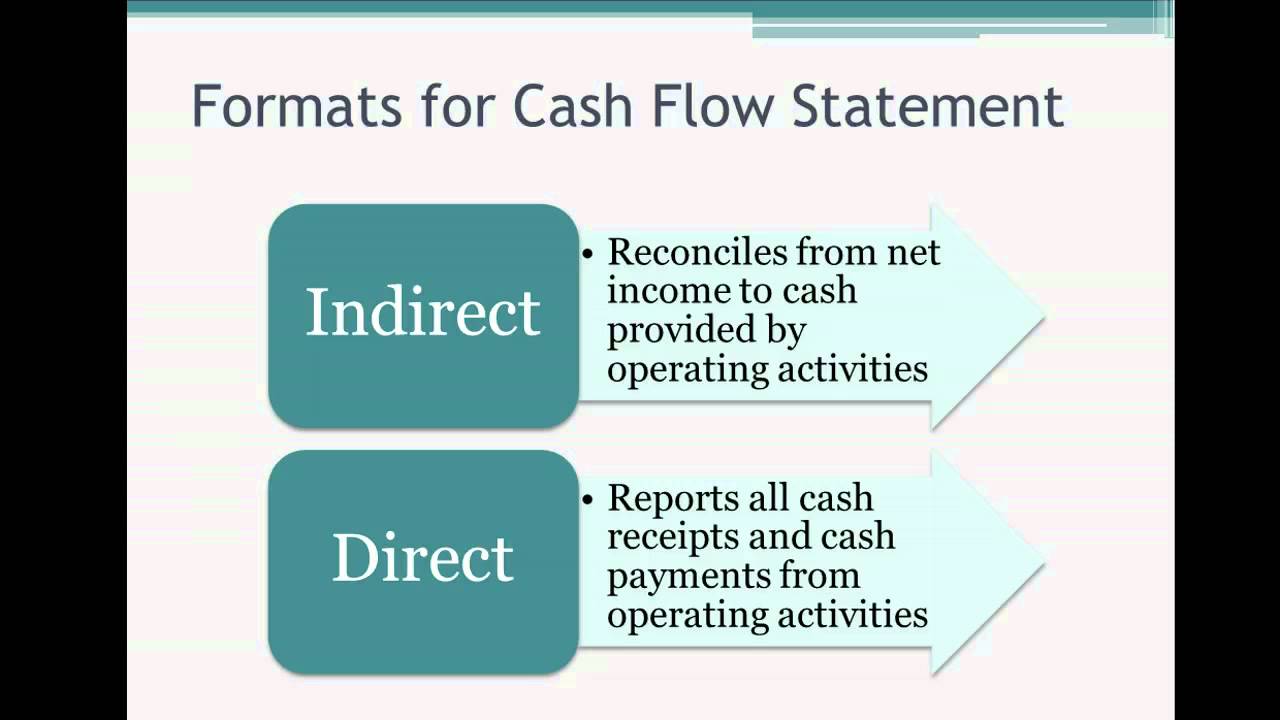

- First, the indirect method is required and the direct method is optional.

- In contrast, the information required to use the direct method may not be readily available and may be tedious and difficult to develop.

How to do an indirect or direct approach?

- Begin by communicating what the person did right to reinforce good behavior and strong performance. ...

- Empower self-coaching with open-ended questions. ...

- Offer low-key suggestions to provide subtle guidance. ...

- Show people different or other ways to do or say something by providing them with examples (lead by example). ...

- You must maintain the indirect approach. ...

What is the difference between direct and indirect?

The difference between direct and indirect speech are discussed as under:

- Direct Speech refers to the literal repetition of the words spoken by someone, using a quotative frame. ...

- Direct Speech is also called a quoted speech, as it uses the exact words of the speaker. ...

- Direct Speech is from the speaker’s standpoint, whereas indirect speech is from the listener’s standpoint.

What does direct method mean?

The direct method is one of two accounting treatments used to generate a cash flow statement. The statement of cash flows direct method uses actual cash inflows and outflows from the company's...

What does indirect and direct mean?

What does direct and indirect effects mean? Direct effects, as the name implies, deal with the direct impact of one individual on another when not mediated or transmitted through a third individual. Indirect effects can be defined as the impact of one organism or species on another, mediated or transmitted by a third. Click to see full answer.

What is the indirect method?

The indirect method is a method used in financial reporting in which the statement of cash flows begins with the net income before it is adjusted for the cash operating activities before an ending cash balance is achieved.

What is the difference between the direct and indirect methods of computing net cash flows from operating activities which method results in higher net cash flows?

The main difference between the direct and indirect cash flow statement is that in direct method, the operating activities generally report cash payments and cash receipts happening across the business whereas, for the indirect method of cash flow statement, asset changes and liabilities changes are adjusted to the net ...

Why is direct method better than indirect method?

The direct method is considered to be the more accurate of the two calculations, as it takes into account each cash transaction from the period, whereas the indirect method is largely based on estimated adjustments.

What is direct method with example?

The direct method actually lists the major cash receipts and payments on the statement of cash flows. For example, cash receipts are often listed from customers, commissions, and tenants. Cash payments are usually broken out into several categories like payments for inventory, payroll, interest, rent, and taxes.

Why use indirect method of cash flows?

A major advantage of the indirect method of cash flows is that the method provides a reconciliation between net income and cash flows. The indirect method also helps financial-statement users better understand different linkages among financial statements and is a simple way of preparing the statement of cash flows.

What is indirect method of cash flow statement?

The indirect method for a cash flow statement is a way to present data that shows how much money a company spent or made during a certain period and from what sources. It takes the company's net income and adds or deducts balance sheet items to determine cash flow.

What is direct method of teaching?

Definition. The direct method in teaching a language is directly establishing an immediate and audiovisual association between experience and expression, words and phrases, idioms and meanings, rules and performances through the teachers' body and mental skills, without any help of the learners' mother tongue.

What is direct method in statistics?

Arithmetic Mean by Direct Method This is also denoted by N. ∑i=1nfixi= Sum of the product of frequencies and corresponding observations.

Which cash flow is better?

Operating cash flow (OCF) is the lifeblood of a company and arguably the most important barometer that investors have for judging corporate well-being. Although many investors gravitate toward net income, operating cash flow is often seen as a better metric of a company's financial health for two main reasons.

What is direct and indirect method of teaching?

This is very difficult to achieve in indirect teaching....Differences between the direct teaching method and the indirect teaching method.DIRECT METHODINDIRECT METHODOral communication basedShowing material basedExplicit, clear mannerWritten instructionsMaybe a worksheet or a quizOnline essays

Why direct method is best?

Benefits for students: Direct method is a much faster and easier way to learn a foreign language. Students speak 5-6 times more. Direct method simulates real foreign environment. Language is taught naturally – via speaking.

What are the 4 methods of teaching?

There are different types of teaching methods that can be categorized into four broad types.Teacher-centered methods,Learner-centered methods,Content-focused methods; and.Interactive/participative methods.

Which method direct method or indirect method do you prefer to prepare cash flows statement?

Many accounting professionals prefer to use the indirect method, as it's simple to prepare the statement of cash flow using information from the balance sheet and income statement.

How will you calculate cash flow from operation by direct and indirect method?

Calculating Cash FlowDirect method: This method draws data from the income statement using cash receipts and cash disbursements from operating activities. ... Indirect method: This method starts with net income and converts it to OCF by adjusting for items that were used to calculate net income but did not affect cash.

What are merits of indirect method of cash flows from operations compared to direct method?

In other words, the main advantage of the indirect method is that it's easier, while the main disadvantage of the indirect method is that it lacks the transparency necessary to be entirely compliant with some of the rules and accepted procedures of international accounting.

What is the direct method of reporting cash flows from operating activities?

The direct method details where cash comes from and where it goes. In contrast, the indirect method starts with net income (for-profit entities) or the change in net assets (NFP entities), adds back non-cash expenses, removes gains and losses, and adjusts for the changes in current asset and current liability accounts.

What Is the Direct Method?

First, the indirect method is required and the direct method is optional. Third, unlike the direct method, the indirect method can be prepared from virtually any standard chart of accounts. In contrast, the information required to use the direct method may not be readily available and may be tedious and difficult to develop. As if to highlight this, most accounting software only uses the indirect method to produce a statement of cash flows.

Does the FASB require both methods?

Now that FASB has removed the requirement to show both methods when using the direct method , the only impediment is the informational requirement. Therefore, the time may be ripe for financial statement preparers to reevaluate their choice of method and reconsider the advantages and utility of the direct method.

What is indirect method?

Definition. The indirect method uses net income as a base and adds non-cash expenses. Non-cash Expenses Non-cash expenses are those expenses recorded in the firm's income statement for the period under consideration; such costs are not paid or dealt with in cash by the firm.

What is direct and indirect cash flow?

Direct and indirect are the two different methods used for the preparation of the cash flow statement of the companies with the main difference relates to the cash flows from the operating activities where in case of direct cash flow method changes in the cash receipts and the cash payments are reported in cash flows from the operating activities section whereas in case of indirect cash flow method changes in assets and liabilities accounts is adjusted in the net income to arrive cash flows from the operating activities.

What is indirect method of cash flow?

It makes the adjustments needed, i.e., adding and subtracting the variables to convert the total net income to cash amount from operations .

Which is more accurate, cash flow direct or indirect?

The accuracy of the cash flow indirect method is a little less as it uses adjustments. Comparatively, the cash flow direct method is more accurate as adjustments are not used here.

Which method makes sure to convert the net income in terms of cash flow automatically?

The cash flow indirect method makes sure to convert the net income in terms of cash flow automatically. The cash flow direct method, on the other hand, records the cash transactions separately and then produces the cash flow statement.

Which method of accounting takes cash transactions into account?

The direct method only takes the cash transactions into account and produces the cash flow from operations. The cash flow indirect method makes sure to convert the net income in terms of cash flow automatically. The cash flow direct method, on the other hand, records the cash transactions separately and then produces the cash flow statement.

Is indirect method accurate?

The cash flow statement under the indirect method is not very accurate as adjustments are being made.

What is the difference between direct and indirect?

So what’s the difference between direct and indirect? While both are ways of calculating your net cash flow from operating activities, the main distinction is the starting point and types of calculations each uses. The indirect method begins with your net income, while the direct method begins with the cash amounts received and paid out by your business. Each uses a separate set of calculations from there to get to the same finish line, revealing different details along the way.#N#Let’s look at each in turn:

What is direct method?

The direct method individually itemizes the cash received from your customers and that paid out for supplies, staff, income tax, etc. Non-cash transactions are ignored, and again a closing bank statement emerges—the same closing bank statement you’d get using the indirect method.

What is indirect cash flow?

The indirect cash flow method starts with your organization’s net income, then makes adjustments to get to the cash flow from operating activities. Those adjustments take into consideration things such as depreciation and amortization, changes in inventory, changes in receivables and changes in payables. Once you’re done with the adjustments, you end up with a final closing bank position.

Why is direct method important?

An advantage of the direct method is that it gives you more visibility into your cash inflow and outflow—something that can benefit your short-term planning, enabling you to identify and analyze any potential challenges or opportunities that might exist for future cash flow. With a better view of the past, it helps you forecast for the future.

Which method of reporting is acceptable?

There, reporting guidelines require you use one of two methods: direct or indirect. Either is acceptable according to the generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS) guidelines, though the direct method is encouraged. Still, each method has its pros and cons.

Which is easier, indirect or direct?

The indirect cash flow method is easier to prepare than the direct method because most organizations keep their records on an accrual basis.

What is the difference between direct and indirect method of preparing cash flow statements?

The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses. Under the direct method, you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. You prepare the financing and investing sections of the cash flow statement in the same way for both the direct and indirect methods.

What is indirect cash flow?

The indirect cash flow method begins with the company's net income—which you can take from the income statement—and adds back depreciation. Then, you indicate the changes in current liabilities, current assets and other sources—e.g., non-operating losses/gains from non-current assets) on the balance sheet.

What are the disadvantages of cash flow method?

One disadvantage is that this method lacks transparency. This cash flow method rarely complies with some rules or accepted procedures of international accounting.

Which method is the easiest to read?

The direct cash flow method is the easiest to understand and read because this method divides the transactions of a company into categories: negative, which includes cash outflows like employee salary and rent payments; and positive, which includes cash flows like accounts receivable payments received and cash collected from customers. In this way, the direct cash flow method is very much comparable to a bank statement.

Which method of accounting is used to prepare a cash flow statement?

Many accounting professionals prefer to use the indirect method, as it's simple to prepare the statement of cash flow using information from the balance sheet and income statement. Most organizations use the accrual method of accounting, so the balance sheet and income statement have figures consistent with this method.

Is cash flow from the operations section of the cash flow statement affected by direct method?

Out of a company's three main financial statements—cash flow statement, income statement and balance sheet—only the cash flow from the operations section of the cash flow statement is affected by the direct method, while the cash flow from the investing and financing sections will be similar regardless of whether an indirect or direct method is used.

Main Difference Between Direct and Indirect Method of SCF

- The main difference between the direct method and the indirect method of presenting the statement of cash flows (SCF) involves the cash flows from operating activities. (There are no differences in the cash flows from investing activities and/or the cash flows from financing activities.) Under the U.S. reporting rules, a corporation has the option ...

Example of The Indirect Method of SCF

- When the indirect method of presenting a corporation's cash flows from operating activities is used, this section of SCF will begin with a corporation's net income. The net income is then followed by the adjustments needed to convert the accrual accounting net income to the cash flows from operating activities. A few of the typical adjustments are: 1. Adding back depreciatio…

Example of The Direct Method of SCF

- When the direct method of presenting a corporation's cash flows from operating activities is used, the amount of net income is not the starting point. Instead, the direct method lists the cash amountsreceived and paid by the corporation. Here are a few of the more common descriptions that will be seen under the direct method: 1. Cash from customers 2. Cash paid to employees 3. …