- The budget, which remains constant, regardless of the actual output levels is known as Fixed Budget. ...

- Fixed Budget is static in nature while Flexible Budget is dynamic.

- Fixed Budget operates in only one activity level, but Flexible Budget can be operated on multiple levels of output.

What is the difference between flexible budgeting and zero-based budgeting?

Flexible budget accounting is meant to shift with the activity needs of the business. The most important features of a flexible budget are that it is dynamic and easily adjustable. Zero-based budgeting is basically starting from zero on each budget, and then justifying all relevant needs and costs for the new budget.

What is flexible budget?

On the contrary, Flexible Budget can be understood as the budget created for different production levels or capacity utilization, i.e. it changes in accordance with the activity level.

When do you use a fixed budget?

Therefore, fixed budgets are mostly useful only for fixed expenses since such expenses remain constant at all levels of output. Moreover, fixed budgets may also be used by some service companies or for some administrative functions such as engineering, accounting, and purchasing. When is a flexible budget desirable?

What is the difference between fixed budget and static budget?

Differences based on Definition: A fixed budget, also known as a static budget, is a financial plan based on the assumption that particular amounts of commodities will be sold during a specific period. Fixed budgets, in other words, are dependent on a predetermined volume of sales or revenue.

What is the difference between fixed and flexible?

This article was all about the topic of Difference between Fixed and Flexible Exchange Rate, which is an important topic for Commerce students....Difference between Fixed and Flexible Exchange Rate.Fixed RateFlexible Exchange RateFixed rate is determined by the central governmentFlexible rate is determined by demand and supply forcesImpact on Currency10 more rows•Aug 6, 2021

What is the difference between fixed budget and cash budget?

The importance of the cash budget lies in the fact that this tells an organization on how and when to plan for cash surpluses or deficits. Flexible budget is a budget in which the expenses adjust to the level of sales or output - in contrast, a fixed budget is one which does not vary with the level of sales or output.

What's a fixed budget?

A fixed budget is a financial plan that is not modified for variations in actual activity. It is the most commonly-used type of budget, because it is easier to construct than a flexible budget.

What is a flexible budget?

A flexible budget adjusts based on changes in actual revenue or other activities. The result is a budget that is fairly closely aligned with actual results. This approach varies from the more common static budget, which contains nothing but fixed expense amounts that do not vary with actual revenue levels.

Why flexible budget is better than fixed budget?

The greatest advantage that a flexible budget has over a static budget is its adaptability. In the real world, change is real and it is constant. A flexible budget can handle that reality and better position a company for the challenges of the marketplace. Fixed versus variable expenses in a flexible and static budget.

Where is fixed budget used?

Fixed budgets may be used for projects involving fixed appropriations for specific programs, such as capital expenditures, advertising and promotion, and major repairs.

What are the features of fixed budget?

Definition of fixed Budget A fixed budget is prepared for single level of activity. The performance report is prepared by comparing data from actual operations. Fixed budget do not change when production level changes.

What is a cash budget?

A cash budget is an estimation of cash inflows and outflows over a specific period of time. Cash budgets are useful in that they can be produced for long-term and short-term goals, sometimes for as little as one week.

What are the two types of variable budgets?

You can break variable expenses into two sub-categories: necessary and discretionary. The necessary portion of variable expenses are things like gas for your car, your electric bill, and your monthly food budget.

Why have a fixed budget?

A fixed budget allows a business to measure both short-term and long-term budgets. The fixed budget allocates a set amount of money towards essentials such as overhead costs. Any money left over at the end of the month (or any other period you review your budget) is your profit.

What are the different forms of cash budget?

Short-term cash budget vs. When classifying cash budgets, people commonly divide them into two categories. A short-term cash budget covers a period measured in weeks or months, while a long-term cash budget covers a period of years. A cash budget of one year is occasionally referred to as an intermediate cash budget.

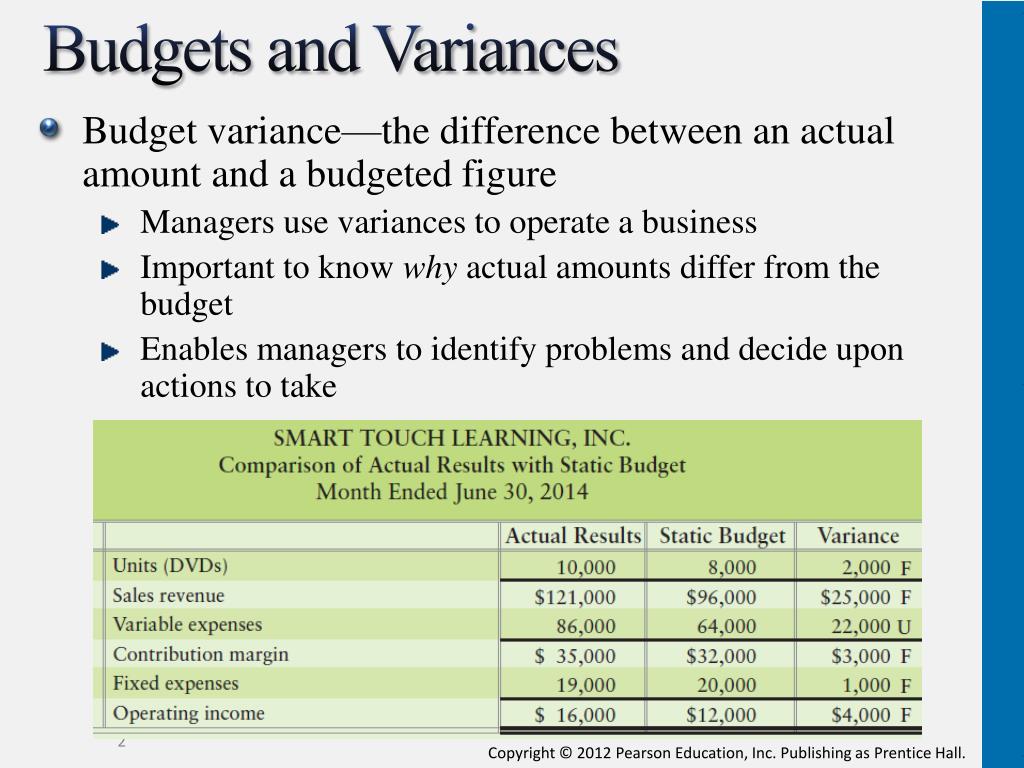

What is the difference between a fixed budget and a flexible budget?

The following are the major differences between fixed budget and flexible budget: 1 The budget, which remains constant, regardless of the actual output levels is known as Fixed Budget. The flexible budget is a budget which can be easily adjusted according to the output levels. 2 Fixed Budget is static in nature while Flexible Budget is dynamic. 3 Fixed Budget operates in only one activity level, but Flexible Budget can be operated on multiple levels of output. 4 Fixed Budget is based on the assumption, whereas Flexible Budget is realistic. 5 Fixed Budget is inelastic, as it cannot be re-casted as per the actual output. Conversely, the Flexible budget is elastic because it can be easily adjusted according to the volume of the production. 6 Flexible Budget proves more accurate to evaluate the performance, capacity and efficiency of the activity level compared to Fixed Budget.

Which is more accurate, fixed or flexible budget?

Flexible Budget proves more accurate to evaluate the performance, capacity and efficiency of the activity level compared to Fixed Budget.

What are the two types of budgets in cost accounting?

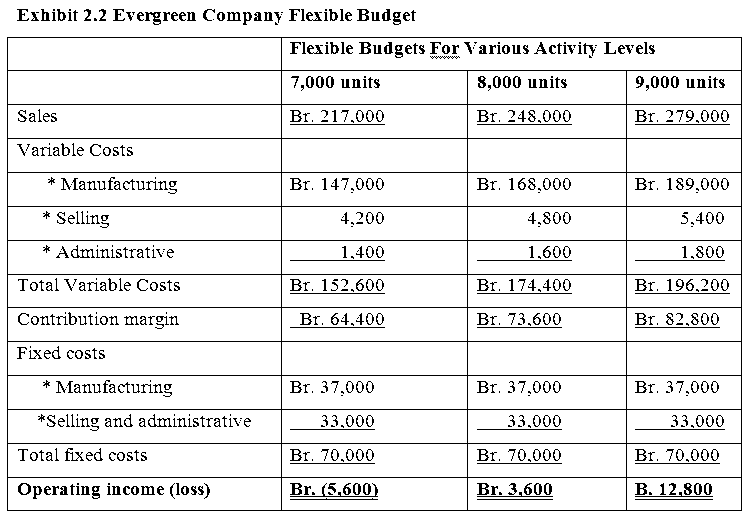

Based on the Capacity, there are two types of budgets prepared in cost accounting, namely, fixed budget and flexible budget. Fixed Budget is a budget that remains constant, irrespective of the levels of activity, i.e. the budget is created for a standard volume of production. On the contrary,

What are the three segments of a flexible budget?

While preparing a flexible budget, first of all, the costs are divided into three major segments, namely: fixed, variable and semi-variable where semi- variable costs are further classified into fixed and variable cost, and then the budget is designed accordingly.

Why is fixed budget important?

Fixed Budget helps the management to set the revenues and expenses for the period, but it lacks accuracy because it is not always possible to correctly determine future needs and requirements. Further, it operates only on a single activity level under only one condition.

What is fixed budget?

Fixed means firm or stable, and budget is an estimate of economic activities of the business. So in this way, Fixed Budget refers to an estimate of pre-determined incomes and expenditures, which once prepared, does not change with the variations in the activity levels achieved. It is also known as Static Budget.

When one is working on a budget, should he/she have a thorough knowledge of the differences between?

When one is working on a budget, he/she should have a thorough knowledge of the differences between fixed budget and flexible budget, to give desired results.

What is fixed budget?

A fixed budget can be defined as a roadmap laid down by the management at the beginning of any financial period which draws an estimate of various activities like sales , production etc. along with required costs/ revenue figures.

How does a fixed budget work?

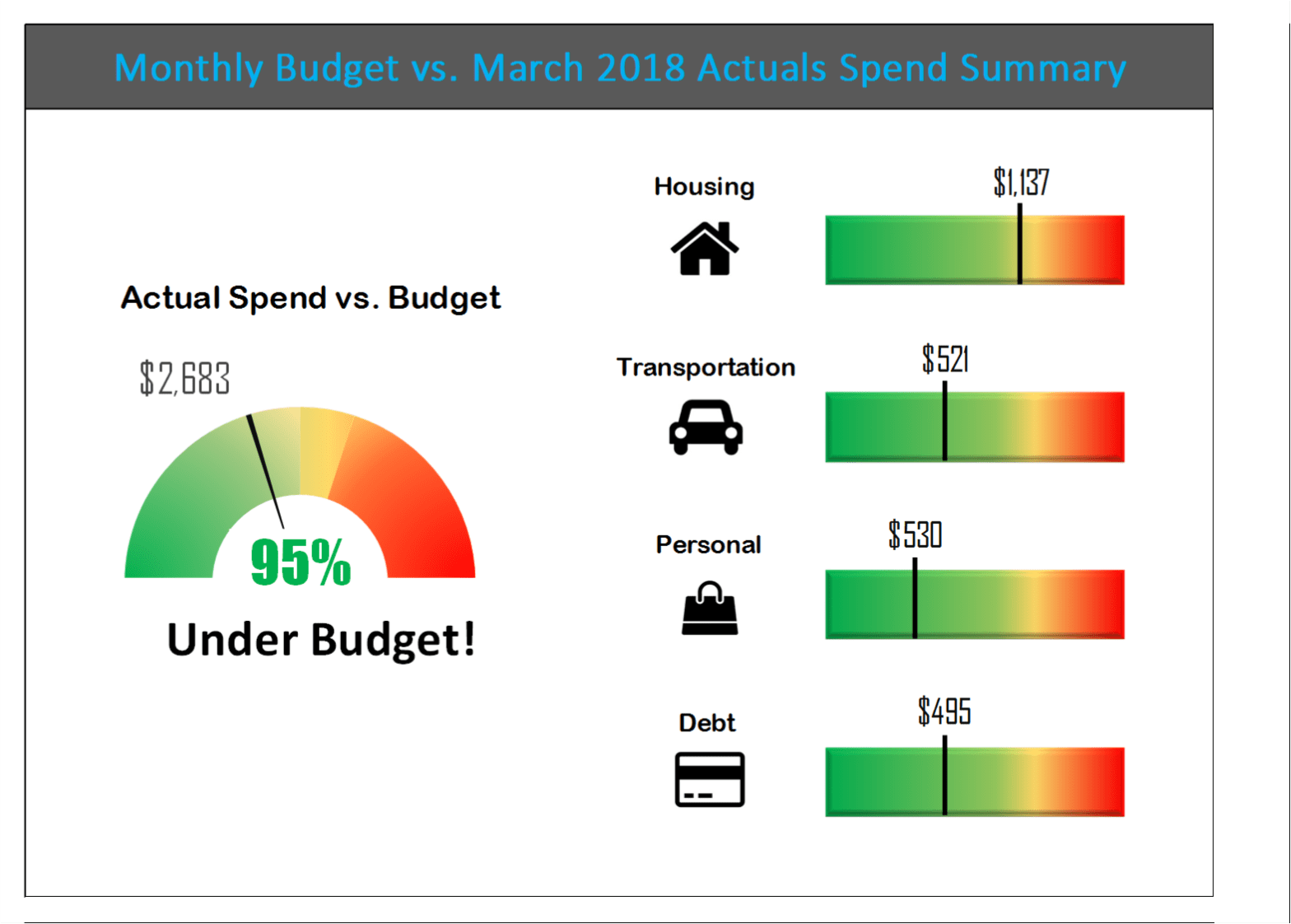

A fixed budget aids a business to attain optimal performance by checking revenues, sales and expenses. By comparing each departments performance with a fixed budget, identifying and analysingvariations, reasons for variations helps the organisation to achieve their financial goals in the long run. A fixed budget may be used by management like managers, chief financial officers and accountants in order to analyse and develop financial controls. It act as a system check tool that blocks overspending and tallies expenditure with revenue being generated from sales. A well-controlled fixed budget also aids in developing cash flow projections. In simple words, it can be said that a fixed budget is a planning tool that helps the organisation to monitor all the revenue being generated and all the expenses being incurred and thus helps in achieving its financial goals.

Why do managers use fixed budgets?

A fixed budget may be used by management like managers, chief financial officers and accountants in order to analyse and develop financial controls. It act as a system check tool that blocks overspending and tallies expenditure with revenue being generated from sales.

Why are variations identified and analysed with the help of flexible budget more important?

Variations identified and analysed with the help of flexible budget are more important as they provide details of operating efficiency/ inefficiency based on actual output.

What is the objective of a flexible budget?

Basic objective of flexible budget is to develop a standard level of costs which should be incurred for actual manufacturing outputs. A flexible budget is prepared taking into considerations nature of various cost incurred as like fixed or variable.

What is a well controlled fixed budget?

In simple words, it can be said that a fixed budget is a planning tool that helps the organisation to monitor all the revenue being generated and all the expenses being incurred and thus helps in achieving its financial goals.

What is a budget drawn based on?

Budget drawn based on historical data and management future assumptions which provides set guidelines for operations during the budgeted period.

What is the difference between a fixed budget and a flexible budget?

A flexible budget gives specifics of the typical cost of operations at various capacity utilization levels, whereas a fixed budget provides a roadmap on which the organization operates for the defined period. The fundamental differences between a fixed budget and a flexible budget are outlined below.

What is fixed budget?

Differences based on Definition: A fixed budget, also known as a static budget, is a financial plan based on the assumption that particular amounts of commodities will be sold during a specific period. Fixed budgets, in other words, are dependent on a predetermined volume of sales or revenue. When management assumes that sales volume and total revenues will be a fixed amount during a time, this is a simple approach for them to plan expenses and operations.

Why is a fixed budget model important?

Moreover, when a corporation has highly predictable revenues & expenses that do not change greatly during the budgetary term, a fixed budget model is most useful (such as in a monopoly situation).

What are the three parts of a budget?

The cost is split firstly into three primary parts while producing the flexible budget, i.e., fixed, variable, and semi-variable, in which semi-variable expenses are then categorized in fixed and variable costs and the budget is then developed appropriately. Some budgets are made to show the amount of expenditure to be met at each level of activities

Is static budget strong?

It is also its greatest drawback that a static budget is strong. The absence of mobility in your budget lines means that you are not able to distribute resources to support your business’ poor performance, offer more cash for equipment failure, or capture a new market opportunity. This may cause your firm to lose the year in a drag on your revenue stream.

Is a fixed budget good?

Therefore a fixed budget can only be beneficial if the actual level of activity is equivalent to the estimated level of activity. The flexible budget is a financial plan for varying levels of activity. On the basis of the output created, it can be freely adapted or re-casted. It is reasonable and practical as the cost can be established quickly at different degrees of activity.

Which is better: fixed or flexible budget?

Fixed budgets are more suitable for businesses that operate in a less dynamic business environment, whereas flexible budget are best for firms that operate in a turbulent market.

What is flexible budget?

Flexible budgets are, as their names suggest variable and flexible depending on the variability in the results expected in the future. Such budgets are most useful for businesses that operate in an ever changing business environment, and have the need to prepare budgets that are able to reflect the many outcomes that are possible.

Why are flexible budgets preferred?

Flexible budgets are mostly preferred by firms because they allow the firm to conduct scenario planning and better adjust for unexpected situations.

Why use a fixed budget?

Fixed budgets are used in situations where the future income and expenditure can be known, with a higher degree of certainty, and have been quite predictable over time. These types of budgets are commonly used by organisations that do not expect much variability in the business or economic environment. Fixed budgets are simpler to prepare and less complicated. In addition, keeping track is easier with fixed budgets, since the budget will not vary from time to time. One significant disadvantage of using a fixed budget is that it does not account for changes in expenditure and income over time. Thus, during times of unexpected economic changes the actual scenario may turn out to be different from what is laid out in a fixed budget.

Why is budgeting important?

The preparation of a budget is essential for any business that wishes to keep its costs under control. Budgets also assist firms in planning business ventures, coordinating business activities and communicating information to the company’s stakeholders. Fixed budgets and flexible budgets are different from each other in terms of the complexity in preparation, and business scenario that is mostly suited for each. Since many find it difficult to distinguish them, this article attempts to explain these two budgets by clearly showing their differentiating features and what type of businesses find these budgets appropriate.

Is it easier to keep track of a fixed budget?

In addition, keeping track is easier with fixed budgets, since the budget will not vary from time to time. One significant disadvantage of using a fixed budget is that it does not account for changes in expenditure and income over time. Thus, during times of unexpected economic changes the actual scenario may turn out to be different from ...

What is flexible budget?

By identifying the distinction between fixed, semi-fixed, and variable cost, a flexible budget is designed to change in relation to the activity attained. It is a budget prepared in such a way that it provides the budgeted cost for any level of activity.

What is fixed budgeting?

Both fixed and flexible budgeting are ways to prepare a budget for your business or division. While one is rigid, the other is adjustable to your business’s output level (be it sales, units produced, or some other activity).

What is the purpose of preparing a flexible budget?

To prepare a flexible budget, categories of cost must be examined individually in order to determine how different categories of cost respond to changes in volume. ( source)

What is the difference between fixed and flexible budget accounting?

Consequently, the difference between fixed and flexible budget accounting is that fixed budgeting remains the same no matter what, and variable budgeting can be shifted with the changing needs of the business. Both budgeting styles have their place.

What is a fixed budget?

A fixed budget, also called a static budget, is set up in advance and remains constant, no matter how the activities and needs of a company shift. Flexible budget accounting is meant to shift with the activity needs of the business. The most important features of a flexible budget are that it is dynamic and easily adjustable.

How does zero based budgeting work?

Zero-based budgeting is different from traditional budgeting, where incremental increases are added to the budget each period regardless of performance. Therefore, under a traditional method, you might add 2 percent to your sales budget each year. However, under a zero-based budget, you would start your sales budget from scratch, assessing each aspect of your sales strategy. Then you would decide how much money should be allocated to each part based on your assessment. Because of this attention to detail, a zero-based budget often carries less waste. However, the downfall of the zero budgeting model is that it can prioritize short-term gain over long-term growth.

Why is flexible budget accounting important?

This type of budgeting is seen as more useful than fixed budgeting because it factors in the actual costs of operation and then adjusts as necessary.

Why do companies use fixed budgets?

In many cases, it can be difficult to fully anticipate your company’s needs because it’s impossible to predict the future. For this reason, fixed budgeting is usually recommended for shorter-term use, or for businesses that have highly predictable operations. For example, if you have been producing and selling approximately 10,000 units of your product each quarter for the past 10 quarters, it stands to reason that you will likely continue to do so. In this case, it might make sense to use a quarterly fixed budget for certain aspects of your business, unless your needs drastically change.

Why is budgeting important?

Budgeting is extremely important in running a business. Your budget determines how much money you can spend on each aspect of your business and ultimately dictates your business's plan of action . Another function of a budget is that it helps you assess how efficiently your business is spending its money. Deciding how to build your company’s budget ...

How to write a sales commission budget?

With flexible budgeting, your sales commission budget would be written as “10 percent of sales.” That means if you sell $10,000 worth of product, your sales commission budget ends up being $1,000. If you sell $20,000 worth of product, your sales commission budget changes to $2,000. Ultimately, the budget is contingent upon the actual activities of your business. Compare this to a fixed budget in which you set the sales commission budget at $1,000. Now, if you happen to sell $20,000 of product, your sales commission budget is way off, and you have no flexibility to change it.