Gross Profit is the income left after deducting direct expenses; Operating Profit is the income remained after deducting indirect expenses from gross profit and Net Profit is the net of all expenses, interest, and taxes.

Can operating profit be more than gross profit?

Very large provision for doubtful debts could be reversed when those debts are recovered. In such cases operating profit could be higher than gross profit. Very rare occurrence but possible, not on a regular basis. Generally speaking, No. The only way net profit can exceed gross profit, is if your administrative expenses are negative.

Does sales minus operating expenses equals gross profit?

Sales revenue minus operating expenses equals gross profit. Sales revenues are only earned during the period cash is collected from the buyer. Under the perpetual inventory system, purchases of merchandise for sale are recorded in the Inventory account. Merchandise is sold for $5,000 with terms 1/10, n/30.

What is the formula for operating profit?

The operating profit would be = (Gross profit – Labour expenses – General and Administration expenses) = ($270,000 – $43,000 – $57,000) = $170,000 Using the operating margin formula, we get – Operating Profit Margin formula = Operating Profit / Net Sales * 100 Or, Operating Margin = $170,000 / $510,000 * 100 = 1/3 * 100 = 33.33%. Colgate Example

Does gross profit minus operating expenses equal net income?

net sales minus cost of goods sold equals gross profit minus operating expenses equals net income before taxes

What are the similarities of gross profit operating profit and net profit?

Gross Profit is the income left after deducting direct expenses; Operating Profit is the income remained after deducting indirect expenses from gross profit and Net Profit is the net of all expenses, interest, and taxes.

What are the differences between gross profit margin Operating profit margin and net profit margin?

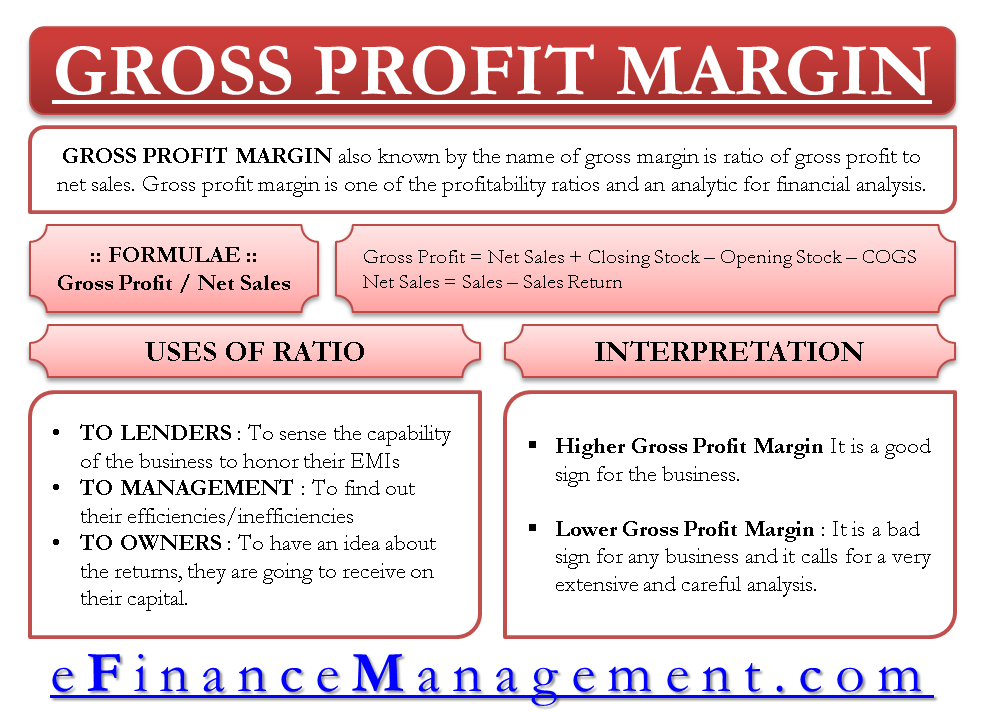

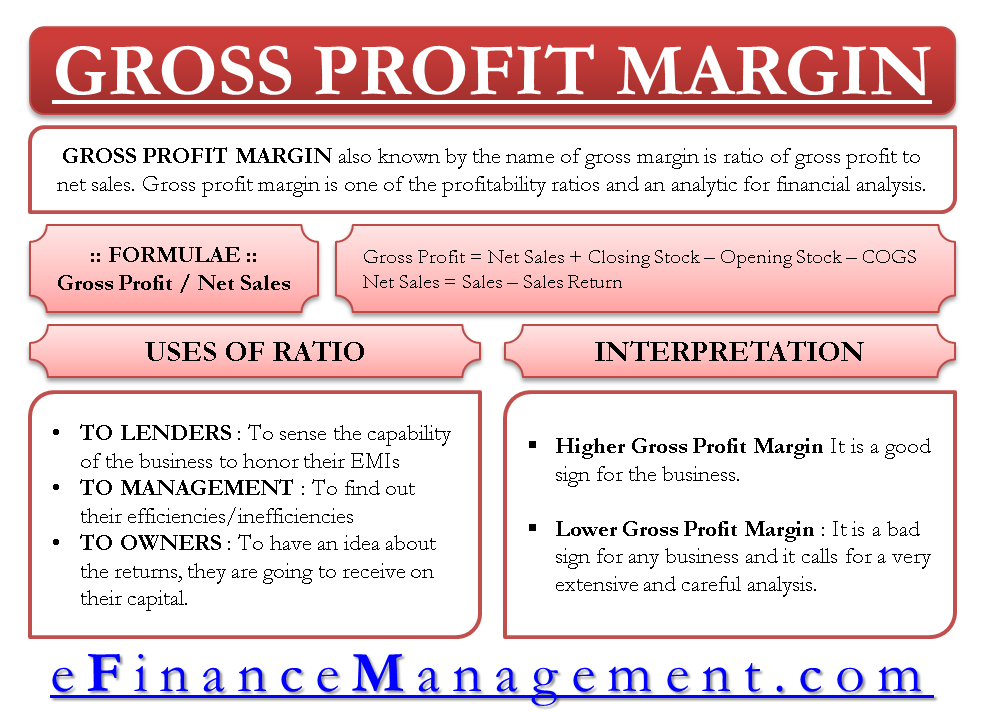

The three main profit margin metrics are gross profit margin (total revenue minus cost of goods sold (COGS) ), operating profit margin (revenue minus COGS and operating expenses), and net profit margin (revenue minus all expenses, including interest and taxes).

What is meant by net profit?

The Net Profit of a company is the amount of money a business earns after deducting interest, operating expenses, and tax over a defined period. Net Profit is also called Profit After Tax (PAT). Net Profit determines the financial health of the business. It shows if a company makes more money than it spends.

How do you calculate gross operating profit?

The formula for calculating operating profit is Operating Profit = Revenue - Operational Expenses - Cost of Goods Sold - Day-to-Day Costs (like depreciation and amortization). Operating profit is important because it helps businesses assess their financial performance.

What is difference between gross margin and net margin?

Gross margin is the total percentage of gross income that is generated from the company's revenue. Net margin is the total percentage of net income that is generated from the company's revenue. The gross margin is larger in scope than the net margin because it does not account for administrative and selling expenses.

What is the difference between operating profit and operating margin?

Operating profit is obtained by subtracting operating expenses from gross profit. The operating profit margin is then calculated by dividing the operating profit by total revenue.

What is the difference between gross profit and net profit quizlet?

Sales revenue less cost of goods sold equals gross profit. Sales revenue less cost of goods sold less operating expenses equals net income. Net income plus operating expenses equals gross profit.

What is a difference between the profit margin and the gross profit rate quizlet?

Terms in this set (16) What is a difference between the profit margin and the gross profit rate? A profit margin of 7% means that 7 cents of each net sales dollar ends up in net income and a gross profit rate of 7% means that the cost of the goods were 7% of the selling price.

What is the difference between gross and operating profit?

Key Differences Between Gross Profit, Operating Profit and Net Profit. Gross Profit is the income left after deducting direct expenses; Operating Profit is the income remained after deducting indirect expenses from gross profit and Net Profit is the net of all expenses, interest, and taxes.

What is operating profit?

Operating Profit is the profit earned from the regular business activities of the enterprise. After we arrive at the Gross Profit, when operating expenses (indirect expenses) like depreciation, salary, insurance, rent, electricity and telephone expenses are subtracted from it, then Operating Profit arises.

What is net profit?

Definition of Net Profit. Net Profit is the surplus (positive value) remained with the company after deducting all expenses, interest, and taxes. After we arrive at the Operating Profit, then the interest on long-term debt and taxes are deducted from it, which results in Net Profit.

What are the three types of profit?

The meaning of the three is very clear as well as there is no contradiction in understanding them. At the fundamental level gross profit exists which is followed by operating profit at the middle level and finally the net profit at the bottom level which is the finest form of profit as it arises after deducting all expenses, taxes, and interest.

What is the difference between net profit and gross profit?

The net profit, on the other hand, is the profit after all expenses have been considered.

What is operating profit?

Your operating profit tells you the amount that your company is making from its business operations. In other words, it’s your profitability. Operating profit does not take into consideration interest and taxes.

What is gross profit?

Gross profit is the amount that remains after you deduct the cost of goods sold from your revenue. Alternatively, if you don’t make any goods, it’s what remains after you subtract the costs associated with providing services.

How to calculate net sales?

Net sales are calculated by deducting discounts from the sales amount. You also need to reduce the sales amount if customers have returned any goods. To calculate your gross profit, you also need to know the cost of goods sold. These are the costs that are directly incurred for producing sold products.

Why is gross profit important?

A higher gross profit provides your company with more money to meet its other expenses.

What are the three profit figures in financial statements?

The picture becomes even hazier when you consider that your financial statements provide you with three different profit figures – gross profit, operating profit, and net profit.

What are the costs of a business?

All costs that are incurred for your business activities must be taken into account. Here are some of these costs: 1 The rent that you pay for your office premises. 2 Your utility costs. 3 Advertising and marketing costs. 4 Depreciation and amortization. **

Why is it important to know the difference between gross and net profit?

A business can analyze aspects of its gross profit and net profit to aid in making important financial decisions that help move it toward its overall goals. However, the difference between gross profit and net profit can be important to know when calculating a business' overall financial health. This is because each profit type is calculated ...

Why do companies use gross profit and net profit?

A company may use gross profit and net profit to evaluate its overall financial health and standing. Knowing the difference between calculating gross profit and net profit can be essential in situations where a business is reviewing its financial performance. A business can use its net profit to determine whether it has incurred a loss ...

What is gross profit?

A business's gross profit is the total revenue minus the cost of making a product or providing a service. Gross profit is also referred to as gross income. Total revenue is the sales price of each item or service multiplied by how many of each item or service is sold. Gross profit can be calculated by subtracting the business's cost of goods sold from the total revenue. The cost of goods sold refers to the amount of money that is spent on the costs of producing products or providing services. However, calculating gross profit does not take additional expenses into account. For this reason, gross profit provides only a rough estimate of how much profit a business has actually made.

How to calculate net profit?

To calculate your net profit, you must first know what your gross profit is. After calculating your gross profit, you can calculate the rest of the formula. 2. Calculate your total expenses.

How to find the gross profit from the revenue?

After calculating your revenue and the total value of your operational expenses, use the formula (gross profit = revenue - COGS) to subtract the costs from the revenue. The resulting amount is your gross profit.

What expenses are included in gross profit?

These are the expenses outside of your costs of goods sold and will include expenses like income taxes, marketing, administrative costs, depreciation and other expenses that are not directly related to production costs.

How to calculate total earnings?

Calculate your total earnings by adding all the revenue obtained through your sales during the time period you want to track. For example, you can add all credit and cash sales, online or offline sales and any earnings obtained through providing services or selling products. To calculate revenue, take the sales price of the item or service multiplied by the quantity sold. Add up all of this revenue.

How does gross profit compare to operating profit?

Gross profit measures profitability by subtracting cost of goods sold (COGS) from revenue. Operating profit measures profitability by subtracting operating expenses, depreciation, and amortization from gross profit. Gross profit does not take into account all of a company's expenses and income sources, but it does show how efficiently ...

What is operating profit?

Operating profit —also called operating income—refers to the total income a company earns from its core business activities before taxes and interest are deducted. The operating profit metric represents income that remains after direct and indirect costs from sales revenue is deducted.

What is gross profit?

Gross profit: Gross profit is the amount of income left over after subtracting the cost of goods sold (COGS) from the total sales revenue. This metric indicates whether a company’s production process needs to be more or less cost-effective in comparison to its revenue.

What is EBIT in business?

While the terms “operating profit” and “EBIT” (earnings before interest and taxes) are often used interchangeably, a company's EBIT technically includes non-operating income—any income from activities not related to its core business operations, such as income generated by selling assets or through investments in other companies. If a business does not have non-operating income, its operating profit and EBIT will be the same.

Does gross profit take into account all expenses?

Gross profit does not take into account all of a company's expenses and income sources, but it does show how efficiently a company operates based on the direct costs involved in producing its products. Operating profit factors in indirect costs such as depreciation, amortization, utilities, rent, insurance, marketing, office supplies, ...

What is the difference between gross and operating profit?

One of the main points of difference between gross profit and operating profit is that gross profit takes into account earnings from all sources whereas operating profit only considers profits earned from operations.

What is operating profit?

Operating Profit. The profit earned from a firm’s core business operations is called Operating profit. So, a shoe company’s operating profit will be the profit earned from only selling shoes. The Operating profit doesn’t include any profits earned from investments and interests. It is also known as “Operating Income”, ...

What is gross profit?

Gross Profit. The word Gross means “before any deductions”. This implies that profit before any deductions is called Gross profit. It is also called “Sales Profit”. Difference between gross profit and operating profit can be understood from their point of origin, deductions (if any), etc. It is the difference between total revenue earned ...

What is PBIT in accounting?

It is also known as “Operating Income”, “PBIT” (Profit before Interest and Taxes) and “EBIT” (Earnings before Interest and Taxes). It is the excess of Gross Profit over Operating Expenses.

What is the difference between net profit and operating profit?

One of the main points of difference between net profit and operating profit is that net profit takes into account earnings from all sources & all sorts of deductions whereas operating profit only considers profits earned from operations.

What is net profit?

Net Profit. The word Net means “after all deductions”. Accordingly, profit earned after all deductions is called Net Profit. It is also called Net Income or Net Earnings. It is the difference between “total revenue earned” and “total cost incurred”. Deductions include adjustments related to the cost of doing business such as taxes, ...

What is operating profit in shoes?

So a shoe company’s operating profit will be the profit earned only from selling shoes. Operating profit doesn’t include any profits earned from investments and interests. It is also known as Operating Income, PBIT and EBIT (Earnings before Interest and Taxes). It is the excess of Gross Profit over Operating Expenses.

What is the profit after deductions?

Profit earned after all deductions is called net profit.

What are the most common forms of profit?

Some of the most common forms of profit that can be found in the financial statements are gross profit, net profit, operating profit, etc. All of them calculated for different reasons and each plays a diverse role in their journey through the accounting cycle.

Where is net profit transferred?

Net profit is transferred to the organization’s balance sheet.

Where is net profit found?

Net profit can be found on a company’s income statement & it is further transferred to the organization’s balance sheet. (Add to capital) Net Profit Shown on the Income Statement.