The first is the current value of the option, known as the intrinsic value. The second is the potential increase in value that the option could gain over time, known as the time value. The intrinsic value of an option represents the current value of the option, or in other words how much in the money it is.

What are examples of intrinsic values?

Nov 03, 2020 · The intrinsic value of the option represents what it would be worth if the buyer exercised the option at the current point in time (this is not the same as the profit). The time value represents the possibility that the option will increase in value before its expiration date. These two concepts can help investors understand the risk and reward of an option.

What is an intrinsic value with an example?

Aug 01, 2013 · Extrinsic Value (aka Time Value) Extrinsic value is the amount of the premium that's not comprised of intrinsic value. This part of the premium is said to be your 'time value'. Out-of-the-money...

What are some examples of intrinsic value?

Sep 06, 2021 · Intrinsic value is a measure of an option’s profitability based on the strike price versus the stock’s price in the market. Time value is based on the underlying asset’s expected volatility and time until the option’s expiration. Is time value greater than intrinsic value?

Does Money need to have an intrinsic value?

The Basics of Time Value The price (or cost) of an option is an amount of money known as the premium. The intrinsic value is the difference between the price of the underlying asset (for example, the stock or commodity or whatever the option is being taken out on) and the strike price of the option.

Is time value greater than intrinsic value?

Time value is the amount by which the price of an option exceeds its intrinsic value. Also referred to as extrinsic value, time value decays over time. In other words, the time value of an option is directly related to how much time an option has until expiration.Oct 18, 2006

What is the difference between intrinsic value?

There is a significant difference between intrinsic value and market value, though both are ways of valuing a company. Intrinsic value is an estimate of the actual true value of a company, regardless of market value. Market value is the current value of a company as reflected by the company's stock price.

What is the meaning of intrinsic value?

Intrinsic value is a measure of what an asset is worth. This measure is arrived at by means of an objective calculation or complex financial model, rather than using the currently trading market price of that asset.

What is the difference between intrinsic value and extrinsic value?

The intrinsic value of something is said to be the value that that thing has “in itself,” or “for its own sake,” or “as such,” or “in its own right.” Extrinsic value is value that is not intrinsic. Many philosophers take intrinsic value to be crucial to a variety of moral judgments.Oct 22, 2002

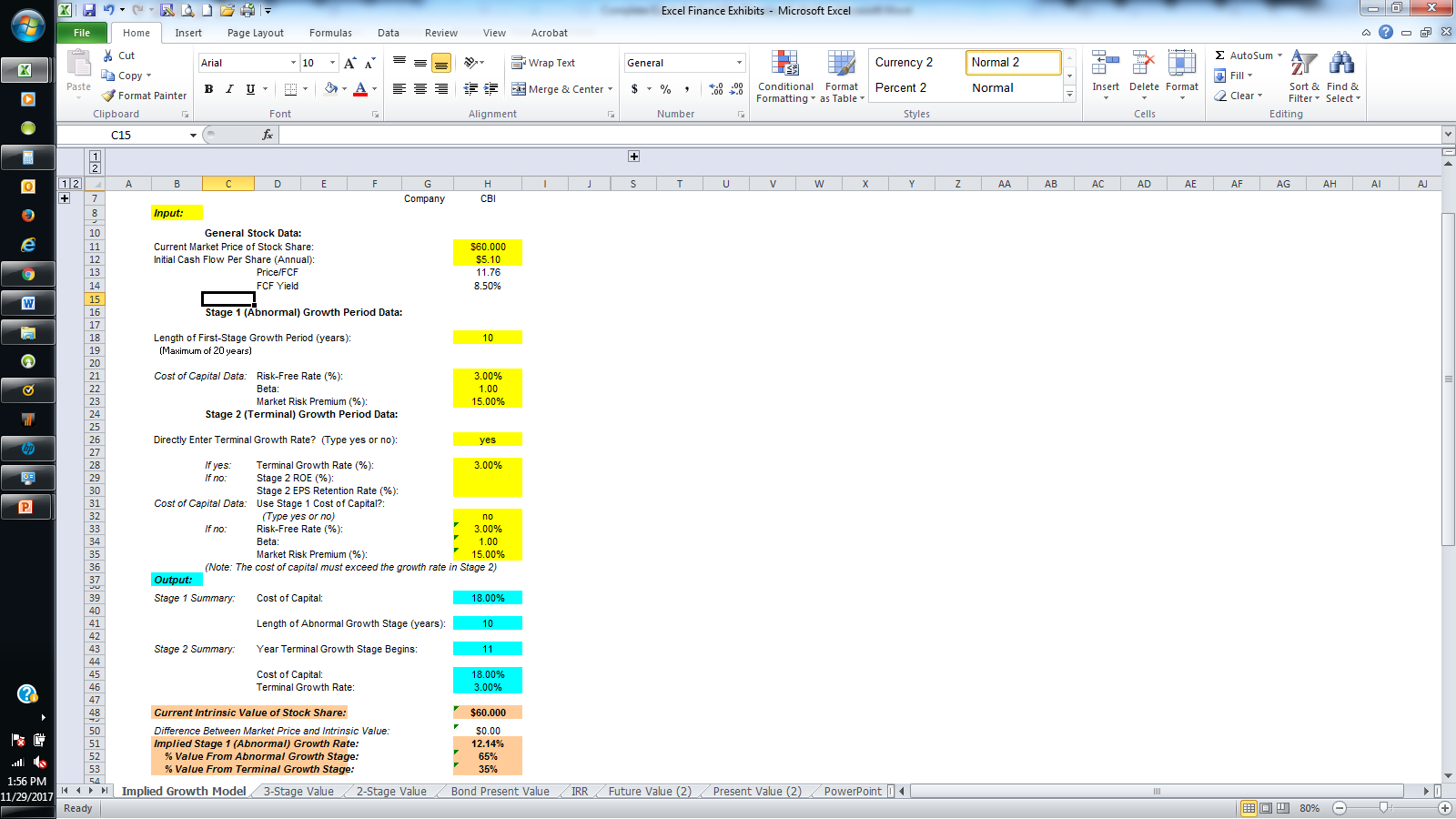

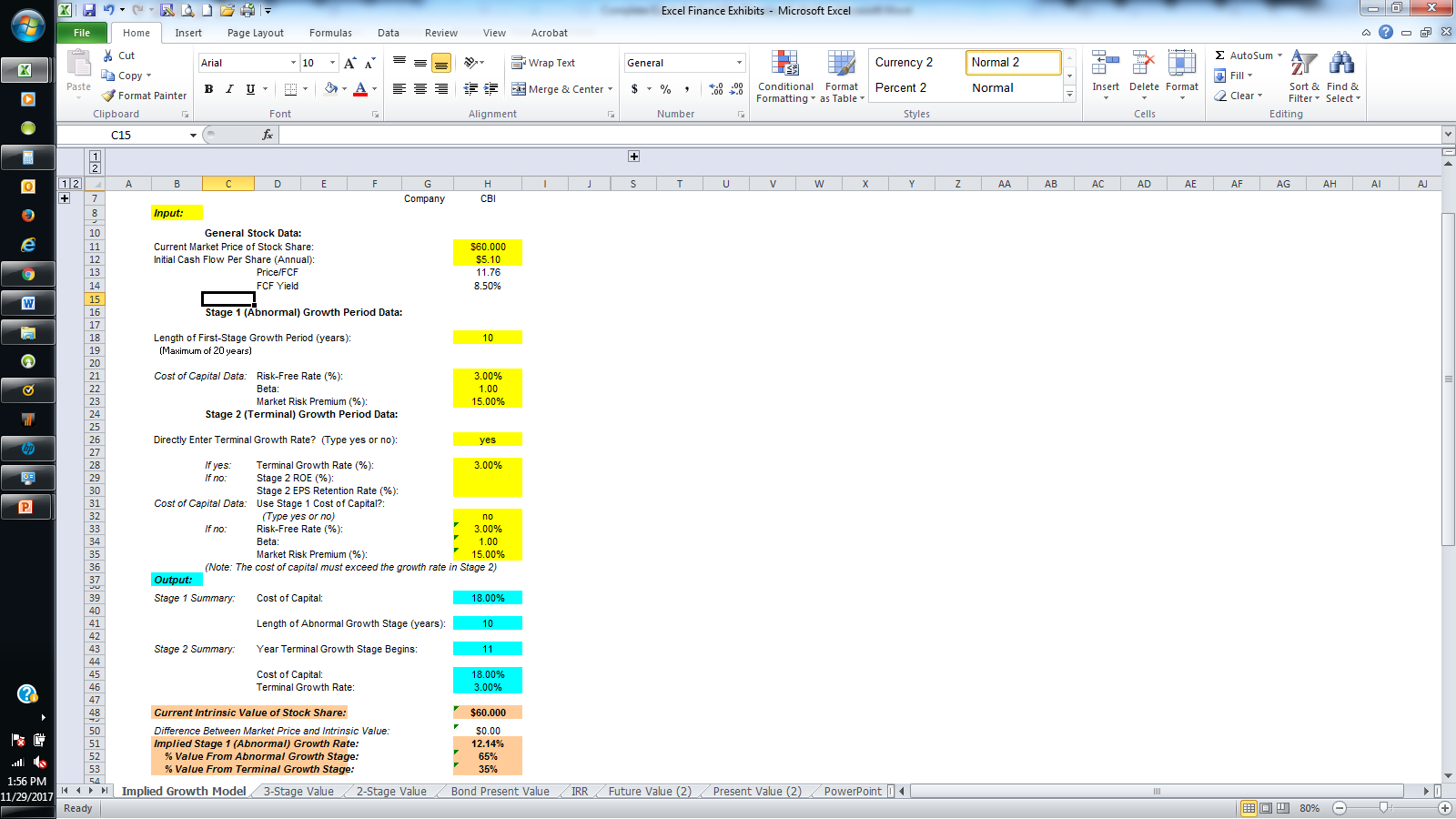

How is intrinsic value calculated?

Estimate all of a company's future cash flows. Calculate the present value of each of these future cash flows. Sum up the present values to obtain the intrinsic value of the stock.Mar 8, 2022

Why intrinsic value is important?

Intrinsic value is an important concept for investors because it allows them to see if a stock is trading below said value. That usually signifies a good investment opportunity.Jan 31, 2020

Is intrinsic value the same as fair value?

The term “market value” simply refers to the current market price of a security. Intrinsic value represents the price at which investors believe the security should be trading at. Intrinsic value is also known as “fair market value” or simply “fair value.”Feb 25, 2021

How do you find the time value of an option?

Time value is calculated by taking the difference between the option's premium and the intrinsic value, and this means that an option's premium is the sum of the intrinsic value and time value: Time Value = Option Premium - Intrinsic Value.Nov 3, 2020

What is intrinsic value of Bitcoin?

no intrinsic valueIt has no intrinsic value and is not backed by anything. Bitcoin devotees will tell you that, like gold, its value comes from its scarcity—Bitcoin's computer algorithm mandates a fixed cap of 21 million digital coins (nearly 19 million have been created so far).Jul 20, 2021

What is the difference between intrinsic value and instrumental value what things have intrinsic value what things have instrumental value does anything have both?

Something with intrinsic value has value in and as itself, for its own sake. Instrumental value is valuable for being useful. Something with instrumental value is valued because it helps one to actualise some other goal or purpose whose value, relative to the instrumental item, is intrinsic.

What is difference between intrinsic and extrinsic?

The main difference between intrinsic and extrinsic motivation is that intrinsic motivation comes from within, and extrinsic motivation comes from outside.Jun 29, 2021

What is the difference between intrinsic values and extrinsic values give examples for each?

For example, if a call option has a strike price of $20, and the underlying stock is trading at $22, that option has $2 of intrinsic value. The actual option may trade at $2.50, so the extra $0.50 is extrinsic value.

What is the universal law of option theory?

A universal law of option theory is that time value of options always approaches zero as option moves closer to zero. All that the option has at expiry is the intrinsic value

What is intrinsic value?

Intrinsic value is the exercise value of an option assuming the expiry date is today. Imagine you move up the option expiry date from 16'th May to 10'th May and exercise the option — value of the option in that imaginary scenario is referred to as ‘intrinsic value’

What is time value?

Markets might move favorably and make the option super valuable by the expiry date — time value is a reflection of probability of such scenario happening in future.

What is intrinsic value?

Intrinsic value is a type of fundamental analysis. Tangible and intangible factors are considered when setting the value, including financial statements, market analysis, and the company's business plan . There is an inherent degree of difficulty in arriving at a company's intrinsic value. Due to all the possible variables involved, such as ...

What is the difference between intrinsic value and market value?

There is a significant difference between intrinsic value and market value, though both are ways of valuing a company. Intrinsic value is an estimate of the actual true value of a company, regardless of market value. Market value is the current value of a company as reflected by the company's stock price.

Why is the market value higher than the intrinsic value?

The market value is usually higher than the intrinsic value if there is strong investment demand, leading to possible overvaluation. The opposite is true if there is weak investment demand, which can result in the undervaluation of the company. Take the Next Step to Invest. Advertiser Disclosure. ×.

What is market value?

Market value is the company's value calculated from its current stock price and rarely reflects the actual current value of a company. Market value is, instead, almost more of a measure of public sentiment about a company.

Is there an inherent difficulty in determining a company's intrinsic value?

There is an inherent degree of difficulty in arriving at a company's intrinsic value. Due to all the possible variables involved, such as the value of the company's intangible assets, estimates of the genuine value of a company can vary greatly between analysts.

Introduction

Intrinsic value and market value are forms of identifying the valuation of the company in real time basis. The major difference between intrinsic value and market value is the driving force behind the valuations.

What is market value

Market value is the real time price as traded on the stock exchange. Thus, this is the value at which the equities of the company are brought and sold. In case of a private company, market value is the price at which the promoter transferred the equity to the investor.

What is intrinsic value

Intrinsic value is termed as the real value of the company. It is the value of the company that is drawn from the assets it owns, its business model, the past revenues and future growth. All these factors determine the intrinsic value of the company.

Here are the five differences between market value and intrinsic value

Valuations tend to change with time. Market values are dynamic in nature. The market value of a company, not only depends on the performance of the company, but the overall economy of the country.

Conclusion

The promoters and stakeholders can manipulate the market value of a firm to some extent. But manipulating the intrinsic value can be difficult.

What is intrinsic value?

Intrinsic Value. Intrinsic value, or book value, is a company's total assets minus its total liabilities. That seems like a fairly straightforward calculation. A company may own a headquarters building, a theme park, or a casino. It probably has borrowed a certain amount of money. Intrinsic value is not an entirely reliable number or, ...

What does it mean when a stock has a lower intrinsic value than its current price?

If a stock has a significantly lower intrinsic value than its current market price, it looks like a red flag that the stock is overvalued. But that's not necessarily the case.

What is the difference between price and book value?

Price is the current value of the stock as set by the market. Book value is the stock's intrinsic value. It is the amount a shareholder would be entitled to receive, in theory, if the company was liquidated. The market price of any stock is almost never the same as its book value.

How is market value determined?

Market value is determined by supply and demand. The price of a stock reflects the current demand for it. If there is a strong demand from investors for a particular stock, its market price will rise above its book value.

Is book value reliable?

Traders are mindful that book value is not a completely reliable number or, for that matter, a stable one. One hot scandal can destroy a lot of goodwill or brand recognition. The value of a company's physical assets can change with the economy, with consumer tastes, or with time.

Is a stock overvalued?

Although a stock may appear to be overvalued, at least temporarily, that does not mean that it should not be purchased or at least considered. Over-valuation and under-valuation are everyday occurrences. The goal for any investor is to buy low and sell high. If an investor believes that a stock can very likely be sold in ...

Is intrinsic value a reliable number?

Intrinsic value is not an entirely reliable number or, for that matter, a stable one. But what are its patents or its copyrights worth, for example? Or its intangible assets like goodwill or brand recognition? Traders are mindful that book value is not a completely reliable number or, for that matter, a stable one.

What is intrinsic valuation?

Intrinsic valuations examine the value of a company based on its projected cash flows without comparing it to any other businesses. While inherently subjective, this valuation method helps investors to gauge how much money they might receive from an investment, adjusted for the time value of money—assuming a dollar invested today is worth more than a dollar tomorrow.

What are the variables used in relative business valuation?

For relative business valuation models, those defined variables are expressed as financial multiples, averages, ratios and benchmarks. The implied assumption: The company that’s being valued should have the same—or at least similar—multipliers as its competitors.

What is relative valuation?

As the name suggests, relative valuation methods use comparative reasoning. They try to establish the value of a business based on the value of its industry peers. This helps investors and transaction advisors establish a company’s current market value.

Intrinsic Value

Time Value

- Time value is difference between option premium & intrinsic value of an option. Time value intuitively can be understood as the probability of favorable market movement happening in the future. Markets might move favorably and make the option super valuable by the expiry date — time value is a reflection of probability of such scenario happening in...

What Impacts Time Value of An Option?

- Two factors impact the time value of an option: 1. Time remaining: Greater the time remaining till option expiry, greater is the likelihood of a favorable scenario. We can get an intuitive sense that all things being equal, longer dated options will be more expensive than short dated options. 2. Volatility of the underlying asset: Volatility is a measure of movement of a stock in either directi…

Universal Law of Options

- A universal law of option theory is that time value of options always approaches zero as option moves closer to zero. All that the option has at expiry is the intrinsic value

Option Value Before Expiry Date

- In previous tutorial we looked at option payout on date of expiry. But that doesn’t mean that you can’t sell an option before date of expiry. So how does an option payout diagram look beforean expiry date In the above illustration, the red line represents the option value before the expiry date and grey line represents option value on the expiry date. The blue dashed line represents the tim…

Time Value Is Higher with More Days to Expiry

- As discussed in previous section, time value is higher when there are more days to expiry. As you come closer time value gradually drops to zero (as per our universal law of options). In the figure below, notice that the blue line (represents option value 5 days before expiry date) is above the red line (represents option value 1 day before expiry date)

Important Properties of Time Value of An Option

- To summarize, here are the key properties about time value we discussed in current tutorial: 1. Time value at expiry for any option is zero 2. Time value is highest for options when stock price equals strike price 3. Time value is higher when you have more days to expiry and time value gradually moves to zero as option approaches expiry 4. Time value goes to zero as stock price i…