The key difference between current and long term liabilities is that while current liabilities are the liabilities due within the prevailing financial year, long term liabilities are liabilities that take longer than one financial year to be settled.

What is the difference between current and long-term liabilities?

Long-term liabilities are usually recorded in separate formal documents that include the important details such as the principal amount, interest, and due date. What, then, is the difference between current and long-term liabilities? Current liabilities are those that are payable within one year or one operating cycle.

What are long-term liabilities on a balance sheet?

When the terms of a loan — or any other legally binding financial obligation — give you more than one year to repay it, it’s considered a long-term liability. As with current liabilities, long-term liabilities are also recorded on your business’s balance sheet.

What is an example of a long term liability?

Long Term Liabilities are liabilities that take longer than one financial year to be settled. Examples. Accrued expenses, accounts payable and interest payable are common examples of current liabilities. Long term loans, bond payables and capital leases are types of long term liabilities.

What are the different types of liabilities?

There are two main types of liabilities: current liabilities and long-term liabilities. A current liability is one the company expects to pay in the short term using assets noted on the present balance sheet.

What is the difference between current liabilities and long-term liabilities 4 marks?

The only real difference is that current liabilities have a repayment rate of less than one year, whereas long-term liabilities have a repayment date of longer than one year. Common examples of long-term liabilities include: Long-term loans.

What is the difference between current and long term assets and liabilities?

After listing the assets, you then have to account for the liabilities of your business. Like assets, liabilities are classified as current or long term. Debts that are due in one year or less are classified as current liabilities. If they're due in more than one year, they're long-term liabilities.

Why is the distinction between current and long-term liabilities important?

The current portion of long-term debt is listed separately to provide a more accurate view of a company's current liquidity and the company's ability to pay current liabilities as they become due. Long-term liabilities are also called long-term debt or noncurrent liabilities.

What are current liabilities and long-term liabilities provide two examples for each?

Long-term liabilities include mortgage loans, debentures, long-term bonds issued to investors, pension obligations and any deferred tax liabilities for the company. Keep in mind that a portion of all long-term liabilities is counted in current liabilities, namely the next 12 months of payments.

Which are examples of current liabilities?

Some examples of current liabilities that appear on the balance sheet include accounts payable, payroll due, payroll taxes, accrued expenses, short-term notes payable, income taxes, interest payable, accrued interest, utilities, rental fees, and other short-term debts.

What are long-term liabilities examples?

Examples of long-term liabilities are bonds payable, long-term loans, capital leases, pension liabilities, post-retirement healthcare liabilities, deferred compensation, deferred revenues, deferred income taxes, and derivative liabilities.

What are the major differences between current and long-term liabilities which one is more important why and why not?

Thus, they may be short term or long term. The key difference between current and long term liabilities is that while current liabilities are the liabilities due within the prevailing financial year, long term liabilities are liabilities that take longer than one financial year to be settled.

What is meant by current liability?

Current liabilities are a company's short-term financial obligations that are due within one year or within a normal operating cycle. An operating cycle, also referred to as the cash conversion cycle, is the time it takes a company to purchase inventory and convert it to cash from sales.

Is a loan a current or long-term liability?

Typical long-term liabilities include bank loans, notes payable, bonds payable and mortgages.

What is the difference between a current and a long-term liability and provide a list of three current liabilities?

Current liabilities (short-term liabilities) are liabilities that are due and payable within one year. Non-current liabilities (long-term liabilities) are liabilities that are due after a year or more. Contingent liabilities are liabilities that may or may not arise, depending on a certain event.

Which of the following is a difference between current assets and long term assets?

Current assets are short-term assets that are typically used up in less than one year. Current assets are used in the day-to-day operations of a business to keep it running. Fixed assets are long-term, physical assets, such as property, plant, and equipment (PP&E). Fixed assets have a useful life of more than one year.

What is the difference between a current and a long-term liability and provide a list of three current liabilities?

Current liabilities (short-term liabilities) are liabilities that are due and payable within one year. Non-current liabilities (long-term liabilities) are liabilities that are due after a year or more. Contingent liabilities are liabilities that may or may not arise, depending on a certain event.

What are long term assets examples?

Examples of long-term assets include: Long-term investments to include the company's investments in stocks and bonds, any property it's waiting to sell, and its bond sinking fund. Long-term investments can also include the value of the company's life insurance policy.

What is the difference between short term and long-term liabilities?

Short-term liabilities – short term liabilities (also known as current liabilities) are any debts that will be paid within a year. Long-term liabilities – long term liabilities (also known as non-current liabilities) are any debts that will take more than a year to be paid.

What are current liabilities?

Current liabilities are liabilities that business owners must settle within twelve months or one operating cycle of the balance sheet date. These include: Accounts payable (owed to vendors) Notes payable. Deferred revenues (goods that have been paid for but not delivered) Wages and salaries. Property taxes.

What is a long term liability?

On the contrary, long-term liabilities are those that are payable beyond one year or one operating cycle. These liabilities are written in separate formal documents which include the important details. Examples of long-term liabilities include leases, a mortgage, bonds payable, bank notes, bank loans, pension obligations, etc.

Where are current liabilities recorded?

Current liabilities are recorded in the balance sheet in the order of their due dates.

How long does it take for a business to settle liabilities?

Liabilities that business owners must settle within twelve months or one operating cycle of the balance sheet date. Payables that are due beyond twelve months or one operating cycle; also called “non-current liabilities” or “long term debt”.

What is the difference between current liabilities and long term liabilities?

The only real difference is that current liabilities have a repayment rate of less than one year, whereas long-term liabilities have a repayment date of longer than one year.

What Are Current Liabilities?

A current liability is money owed that’s due within one year. Any money owed by your business that requires a complete repayment within a period of 12 months is considered a current liability.

How does current liabilities affect cash flow?

With that said, current liabilities will have the biggest impact on your business’s cash flow. With their shorter repayment date, you’ll have to spend your business’s cash on hand to satisfy current obligations. As a result, too many current liabilities can disrupt your business’s cash flow.

What is liability in accounting?

In business accounting, a liability is any legally binding obligation to pay money or assets to another party. In other words, it’s a debt. If your business owes money to a vendor or lender, the money owed is considered a liability and, thus, should be recorded on your business’s sheet.

What is a long term liability?

A long-term liability, on the other hand, is money owed with a due date that’s longer than one year. When the terms of a loan — or any other legally binding financial obligation — give you more than one year to repay it, it’s considered a long-term liability. As with current liabilities, long-term liabilities are also recorded on your business’s ...

Do you have to have capital to run a business?

As a business owner, you’ll probably incur some liabilities when running your business. Regardless what your business sells or does, you’ll need capital to perform its operations . You may already have some capital available, but in many instances, you’ll have to secure financing from an outside source, such as a bank or lender. With that said, not all liabilities are the same. There are both current and long-term liabilities, and it’s important that you familiarize yourself with these two primary types.

What is long term liabilities?

Where current liabilities are those financial commitments that must be satisfied within 12 months of the balance sheet date, long-term liabilities are those that extend beyond that 12-month period. These numbers are especially important to report to your sell side advisory or business broker.

What is a current liability?

A current liability is formally defined as any amount of money a business owner must pay to a creditor within 12 months of the balance sheet date. The balance sheet will also include current assets such as cash and accounts receivable, which should outweigh short-term liabilities like payroll and notes payable.

What is financing liability?

Financing Liabilities. These liabilities typically include debt issued to a sole investor, bonds payable, and convertible bonds. So if your company has taken out a loan from an investor or bank, it would be considered a financing liability.

What are current liabilities?

Typical current liabilities include accounts payable, salaries, taxes and deferred revenues (services or products yet to be delivered but for which money has already been received).

What are the two types of liabilities?

There are two main types of liabilities: current liabilities and long-term liabilities. Current liabilities. A current liability is one the company expects to pay in the short term using assets noted on the present balance sheet.

What is a liability on a balance sheet?

A liability is an obligation to pay or provide future services for something that has been in turn provided or agreed upon in the past. There are two main types of liabilities: current liabilities and long-term liabilities. Current liabilities.

What Are Current and Long-Term Liabilities?

They would like to expand within a year and get a few more contracts with other small grocery store chains. Another, loftier goal of Jim's Trucking is to own 10 big rigs and start delivering inventory for one of the largest grocery store chains in the Midwest. However, the owner believes it may take 5 to 7 years to achieve this goal.

What is a long term liability?

Long-term liabilities are obligations that will be paid in more than a year. For example, Jim's Trucking's car and truck loans may last for 5 to 7 years. Long-term liabilities can also include a mortgage loan, where a business is making payments toward owning a building, which can last 15 to 30 years. A last example of a long-term liability is a long-term loan, where a business borrows money from a bank and agrees to pay the money back in longer than a year, depending on the size of the loan and payments.

What is a current liability?

Current liabilities represent obligations that are due within a year. Examples include salaries and accounts payable. Accounts payable are small credit accounts where a business has allowed a customer to take possession of supplies or other items for a monthly payment and usually require full repayment of the total within a year.

Why is it important to categorize liabilities?

It's important for a business to understand who they owe now and later, hence the importance of categorizing liabilities as current and long-term. Liabilities are obligations that are owed and can be found on the balance sheet.

What is a long term liability for Jim's Trucking?

Another long-term liability for Jim's Trucking could be a long-term loan to help finance truck repairs. These payments are due monthly, but the total loan may not be due for a few years. This type of loan would be listed as notes payable.

What is a long term liability?

Long Term Obligations Long Term Liabilities, also known as Non-Current Liabilities, refer to a Company’s financial obligations that are due for over a year (from its operating cycle or the Balance Sheet Date). read more. , as mentioned above, like accrued wages, income tax, etc. ...

What is the difference between debt and liability?

The primary difference between Liability and Debt is that Liability is a wide term which includes all the money or financial obligations which the company owes to the other party, whereas, the debt is the narrow term and is part of the liability which arises when the funds are raised by the company by borrowing money from the other party.

Why do companies have liabilities?

Liabilities of a company arise due to its financial obligations that occur while conducting business. 2. Businesses have to raise funds to buy assets , and liabilities are a result of a business’ fundraising activities. 1. The debt arises when a company raises funds by borrowing from another party.

What is debt in accounting?

1. The debt arises when a company raises funds by borrowing from another party. This debt is to be paid back at a future date, along with an interest amount. 2. Hence, debt can also be defined as a type of liability.

What is debt in business?

Debt. Definition. Any money or service that the company owes to another individual or party. Similar to liabilities, the term debt also refers to an amount of money that a company owes to another party.

Where are liabilities recorded?

Liabilities are recorded on the right-hand side of the balance sheet and include various elements under it. They are future obligations on the part of the company that will be settled through transfer money, goods, and/or services. Debt is a type of liability.

Is debt a liability?

Liabilities are a broader term, and debt is a type of liability. Liabilities arising out of the daily operations of the company, which results in an expense or obligation to be fulfilled in the future. Whereas debt only arises when a company borrows money from another party.

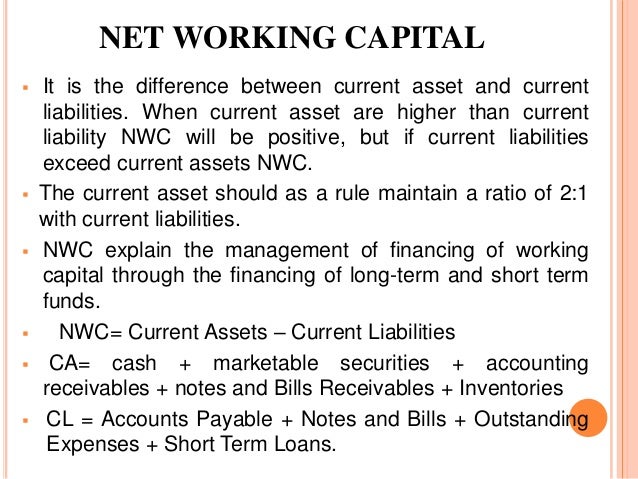

What Are Current Liabilities

- Current Liabilities are short-term financial obligations whose settlement is due within the accounting period, most commonly one year.

What Are Long Term Liabilities?

- These refer to long-term financial obligations that do not mature within the accounting period (one year). For most type of long term liabilities, collateral (a real asset that the borrower pledges as security, like real estate or savings) is needed to obtain debt. This is to safeguard the interests of the party providing the debt since the assetcan be sold to cover the funds in case the borrowe…

Summary – Current vs Long Term Liabilities

- The decision as to whether short term or long term debt should be considered depends on the nature of the business requirement. For example, if the company plans to construct a new building then applying for a short term debt is not practical. Long-term investments should be financed through long term debt, and short term investments should be financed through short-t…