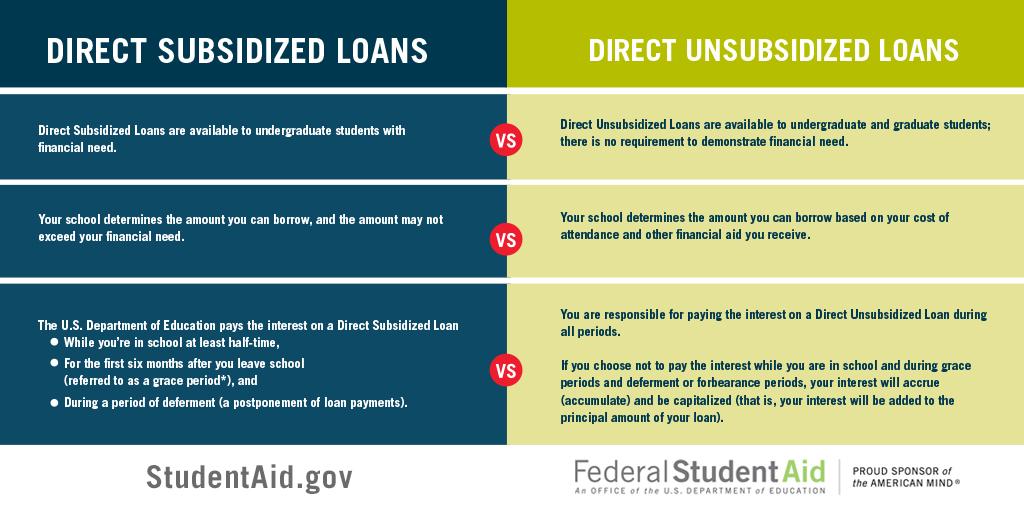

- Subsidized loans can only be used for undergraduate studies.

- You must demonstrate a financial need for a subsidized loan.

- The government does not pay any interest accrued on an unsubsidized loan.

- Unsubsidized loans have a higher interest rate than subsidized ones.

Which loan should you pay off first unsubsidized or subsidized?

Strategy 3: Start With Your Unsubsidized Loans. A subsidized loan doesn’t start accruing interest until you’ve graduated and you’re out of deferment. Unsubsidized loans, on the other hand, start gathering interest as soon as you borrow them. It makes sense, then, to work on paying off these loans first.

Is it better to get subsidized or unsubsidized loans?

Unsubsidized loans do accrue interest during deferment, so deferring unsubsidized student loans can end up being quite costly. If you have to borrow student loans, subsidized federal student loans are the best deal. Unfortunately, they don’t always cover your total cost of college. That’s where unsubsidized federal student loans come in.

What are the pros and cons of an unsubsidized loan?

Pros and Cons of Unsubsidized Loans The good characteristic here is it can be applied for an undergraduate or a graduate student. Since there is no need of showing financial requirements, students who want to fund their own education even after coming from a wealthy family can apply for this.

Should you choose a subsidized or unsubsidized student loan?

When choosing a federal student loan to pay for college, the type of loan you take out — either subsidized or unsubsidized — will affect how much you owe after graduation. If you qualify, you’ll save more money in interest with subsidized loans. Both subsidized and unsubsidized loans are distributed as part of the federal direct loan program.

What is better subsidized or unsubsidized loans?

When it comes to subsidized and unsubsidized loans, subsidized loans are the clear winner. If you can qualify for them, you'll pay less money in interest charges with a subsidized loan, and you'll save money over the life of your loan. But not everyone will qualify for a subsidized loan.

Do you have to pay back unsubsidized and subsidized loans?

Interest on unsubsidized student loans begins to accrue right away, and it is not covered by the federal government. Subsidized loans are awarded based on a student's financial need, unsubsidized loans are not. So, you do have to pay back some types of FAFSA, but not all types of FAFSA.

What are the 3 main difference between subsidized and unsubsidized loans?

Subsidized: Interest is paid by the Education Department while you're enrolled at least half time in college. Unsubsidized: Interest begins accruing as soon as the loan is disbursed, including while students are enrolled in school. Subsidized: No payments are due in the first six months after you leave school.

Should I take out an unsubsidized student loan?

When you're deciding which student loans to pay off first, consider prioritizing your unsubsidized student loans over any subsidized loans. Again, interest on unsubsidized loans is always accruing, which means these student loans carry higher costs and therefore more financial risk.

Can you pay off a subsidized loan early?

Direct Subsidized Loans and Perkins Loans do not accrue any interest while you are enrolled in school at least half-time and during the grace period. If you pay off the balance before the grace period ends, you'll repay just the amount borrowed, plus any loan fees. That would make the loan interest-free!

What type of loan is best for college students?

A subsidized loan is your best option. With these loans, the federal government pays the interest charges for you while you're in college.

Can you pay subsidized loans while in school?

You won't face any extra charges for starting your repayment before you graduate college. If you have not graduated, your Direct Subsidized Loans are not accruing interest. It's important to note that the federal government pays the interest for your Direct Subsidized loans while you're in college or in deferment.

Will unsubsidized loans be forgiven?

Will my student loans be forgiven? All federally owned student loans are eligible for forgiveness. If you have Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, Direct Consolidation Loans or FFEL Loans owned by the U.S. Department of Education, they're all included in the forgiveness plan.

Which loans do you not have to pay back?

If you've already graduated and put your loans into deferment or forbearance, the government also covers interest on your subsidized loans. While students are not required to pay interest on a direct loan while in school, interest begins to accrue immediately.

Do you have to pay unsubsidized loans while in school?

If you have a Direct Unsubsidized Loan, you have the option to pay interest while you are in school, or you can wait until you are no longer enrolled. Our office recommends that you pay the interest to minimize your loan debt.

How long do you have to pay back unsubsidized loans?

10 to 25 yearsGenerally, you'll have 10 to 25 years to repay your loan, depending on the repayment plan that you choose.

How can I avoid paying back student loans?

Options to Get Out of Repaying Student Loans LegallyLoan Forgiveness Programs. ... Income-Driven Repayment Plans. ... Disability Discharge. ... Temporary Relief: Deferment or Forbearance. ... Student Loan Refinancing. ... Filing for Bankruptcy: A Last Resort.

How long does a student loan have to be subsidized?

Subsidized loans are loans in which the U.S. Department of Education pays (or subsidizes) the interest while you are enrolled, at minimum half-time status, in an undergraduate program, and for the 6 months following the conclusion of the academic program. You, the student loan borrower, are responsible for paying back the principal amount of the loan and any interest that accrues after the 6 month grace period — or 6 months after ceasing to maintain a half-time status as a student. Subsidized loans are available to students that demonstrate financial need.

What are the two types of student loans?

There are two main types of direct loans (also called Stafford Loans or Direct Stafford Loans) available through the federal government’s student loan program: Subsidized and unsubsidized.

How Much Can I Borrow?

With direct student loans, the maximum amount you can borrow as an undergraduate student is $12,500 per year, and only up to $5,500 of that amount may be subsidized. However, the maximum amount may be lower than that based on factors such as what year you are in school and your dependency status. The U.S Department of Education outlines in detail the annual and aggregate limits for subsidized and unsubsidized loans.

What is private loan?

Private loans are any loans in which another entity other than the federal government is the lender. This usually involves taking out a loan from a bank or credit union. Private loans typically have much higher interest rates than federal loans. They also don’t have the same protections that federal loans do, such as the option to defer payment until after you are done with culinary school or the ability to consolidate your loans.

Do you need a credit check to get a federal student loan?

Plus, you don’t need a credit check or a cosigner to obtain most federal student loans. The U.S. Department of Education lists the current year’s interest rates.

Do PLUS loans have a credit check?

PLUS loans have a relatively low fixed interest rate and are not subsidized. They also require a credit check, and the applicant must not have an adverse credit history to receive this type of loan.

Is a direct PLUS loan a federal loan?

As mentioned above, Direct PLUS loans (Parent Loan for Undergraduate Students) are another Federal Direct loan option. While these are still considered a direct loan, they differ from the subsidized and unsubsidized student loans described above because one or both parents of the student take out this type of loan to help finance their child’s education, rather than the students themselves.

What is a subsidized student loan?

There are two main types of federal direct student loans -- subsidized and unsubsidized. And the simple version is that subsidized loans are better. While both types of loans charge interest, the government pays the interest on subsidized student loans (officially known as Direct Subsidized Loans) during certain times, specifically:

How long does a subsidized loan last?

In other words, if you're enrolled in a four-year bachelor's degree program, your eligibility for subsidized loans expires after six years, regardless of your academic standing or financial need.

What happens to your student loan when you graduate?

When your loans are on a deferment. This means that when you graduate and start making loan payments, your loan balance will be the same as the amount of money you initially borrowed. For example, if you obtain a $2,000 subsidized student loan during your freshman year and graduate four years later, that loan's balance will still be $2,000.

How long can you get a federal student loan?

While you can receive federal student loans for as long as you're in school, assuming you haven't hit the aggregate borrowing limit (see below), there's a time limit on when you can receive subsidized student loans. Specifically, you can only receive subsidized loans for up to 150% of the published length of your degree program.

What is the downside of a federal direct loan?

The other type of federal direct loan is the Direct Unsubsidized Loan. The downside of these is that the government never pays the interest on unsubsidized loans. Borrowers are responsible for the interest that accrues on these loans at all times, even when they aren't required to make payments.

What are the different types of student loans?

There are two main types of federal direct student loans -- subsidized and unsubsidized. And the simple version is that subsidized loans are better. While both types of loans charge interest, the government pays the interest on subsidized student loans (officially known as Direct Subsidized Loans) during certain times, specifically: 1 While you're enrolled in school on at least a half-time basis. 2 While you're in the six-month grace period after leaving school. 3 When your loans are on a deferment.

Is a federal student loan better than a private student loan?

However, it's still a smart idea to use your federal student loan borrowing ability before exploring private options. Federal student loans -- even unsubsidized -- are generally superior to even the best private student loans.

Which is better, subsidized or unsubsidized?

What is better, subsidized or unsubsidized loans? Subsidized loans are better than unsubsidized loans because you don’t have to pay for any interest that accrues during your enrollment plus the 6-month grace period after finishing.

What are the repayment plans for subsidized loans?

Both subsidized and unsubsidized loans are eligible for all federal repayment plans, including IBR, PAYE, and REPAYE.

How long does interest accrue on a loan?

For unsubsidized loans, interest accrues on your loan during periods of enrollment, deferment, and forbearance. There is no grace period of interest accrual. However, you may choose not to pay the interest during your enrollment plus a six-month grace period.

How long does interest on subsidized loans accrue?

Interest on subsidized loans does not accrue during enrollment plus six months afterward. Interest on unsubsidized loans accrues during enrollment, but you don’t have to pay it until later.

How much is the origination fee for student loans?

Both subsidized and unsubsidized student loans have a loan fee. This origination fee for new loans is currently 1.057%, which is deducted from each loan disbursement.

What happens if you don't pay interest on a loan?

This means the interest will be added to the principal amount, and then interest will accrue on that interest.

What was the name of the federal loan program that was subsidized?

Before the federal Direct Loan program, the government used to give out Stafford Loans. These loans (named after Robert Stafford) were available as subsidized or unsubsidized. Ten years ago, Congress replaced this Stafford Program with the Federal Direct Student Loan Program.

What Is the Difference Between Federal Direct Subsidized and Unsubsidized Loans?

However, the government will make some of the interest payments on subsidized loans. 2

What are the requirements for a federal subsidized loan?

For both federal subsidized and unsubsidized loans, borrowers must meet the following requirements: Enrollment at least half-time at a school that participates in the Federal Direct Loan program. A U.S. citizen or eligible non-citizen. Possession of a valid Social Security number. Satisfactory academic progress.

Are Subsidized Loans Better Than Unsubsidized Ones?

Subsidized loans offer many benefits if you qualify for them. While these loans are not necessarily better than unsubsidized ones, they do offer borrowers a lower interest rate than their unsubsidized counterparts. The government pays the interest on them while a student is in school and during the six-month grace period after graduation. However, subsidized loans are only available to undergraduate students who demonstrate financial need. 2

How Do You Pay Back Subsidized Loans?

You can pay back your subsidized loan at any time. Most students begin paying their loans back after they graduate, and the loan payment is required six months after graduation , known as the "grace period" when the government continues to pay the interest due on the loans. 2

What is the maximum amount of subsidized loans?

The borrowing limit increases for each subsequent year of enrollment. The total aggregate subsidized loan limit is $23,000 for dependent students with another $8,000 allowed in unsubsidized loans. For independent students, the aggregate limit is raised to $57,500, with the same $23,000 cap on subsidized loans. 3

How long do you have to pay interest on a subsidized loan?

If you qualify for a subsidized loan, the government will pay your loan interest while you're in school at least half-time and continue to pay it during a six-month grace period after you leave school. The government will also pay your loan during a period of deferment .

What is the APR on a student loan?

The APR on unsubsidized loans for graduate and professional students is 5.28%. And unlike some private student loans, those rates are fixed, meaning they don’t change over the life of the loan. 3

What is the difference between subsidized and unsubsidized student loans?

What’s the difference between unsubsidized and subsidized student loans? 1 Available for online or on-campus study 2 Competitive fixed and variable rates 3 No origination fee or prepayment penalty 4 Multi-Year Advantage: Returning undergraduate students have a 95% approval rate with a cosigner 1

What is a subsidized loan?

A subsidized loan is a type of federal student loan. With a subsidized direct loan, the bank, or the government (for Federal Direct Subsidized Loans, also known as Subsidized Stafford Loans) is paying the interest for you while you’re in school (a minimum of half time), during your post-graduation grace period, and if you need a loan deferment. ...

What happens when you start repaying a loan?

So, when you start repaying, you’re paying on the original amount and the interest that accrued since the loan was paid to you . This can, of course, add up to thousands of dollars more to repay over the life of the loan.

How to get a subsidized loan?

To receive your subsidized or unsubsidized loan, you’ll submit a Master Promissory Note (MPN) and complete entrance counseling. Once the MPN has been signed and the entrance counseling completed, the college will apply the funds to any outstanding tuition, room and board, and other fees.

What is a need based scholarship?

Need-based scholarships require that applicants demonstrate a financial need, determined by the organization.

How do colleges determine how much financial aid to offer?

When determining how much financial aid to offer you, colleges usually subtract your EFC from the COA. The difference will dictate the amount of your award.

Why are government loans attractive?

These government loans can be attractive to students and their families because: Interest rates are fixed and do not change over the life of the loan. Eligibility is not credit-based; every approved borrower receives the same limits, rates, and terms.

Do scholarships require students to apply?

Scholarships usually require students to apply and meet specific requirements to be considered. For example:

Who can make a private loan?

Private student loans are made to a student, their parents or guardians, or both by a non-government lender, such as a bank, credit union, state agency, or school . Students applying for a private loan often require a cosigner (usually a parent or guardian) due to the student’s minimal credit history.

Do you have to pay interest on a loan while in school?

Unlike subsidized loans, you’re responsible for paying interest during all periods, including while you’re enrolled in school. If you choose not to pay interest while in school or during grace or deferment periods, the interest accumulates and is added to the principle amount of your loan.

What is the difference between subsidized and unsubsidized loans?

Both loans are available to undergraduate students, but the key difference is that direct subsidized loans are awarded based on need — and do not accrue interest while the student is in school or when loans are deferred after graduation. Unsubsidized loans, on the other hand, immediately and continuously accrue interest, so you’ll face a larger balance than what you borrowed if you skip in-school payments.

What is a direct subsidized loan?

Direct subsidized loans are designed for lower-income, undergraduate borrowers. According to the Department of Education, your school determines the amount of direct subsidized loans you’re eligible for, and the amount borrowed via a subsidized loan cannot exceed financial need.

What is the APR for a student loan?

UNDERGRADUATE LOANS: Fixed rates from 4.13% to 10.66% annual percentage rate (“APR”) (with autopay), variable rates from 1.12% to 11.23% APR (with autopay). GRADUATE LOANS: Fixed rates from 4.13% to 10.90% APR (with autopay), variable rates from 1.10% to 11.34% APR (with autopay). MBA AND LAW SCHOOL LOANS: Fixed rates from 4.08% to 10.86% APR (with autopay), variable rates from 1.05% to 11.29% APR (with autopay). PARENT LOANS: Fixed rates from 4.23% to 10.66% APR (with autopay), variable rates from 1.20% to 11.23% APR (with autopay). For variable rate loans, the variable interest rate is derived from the one-month LIBOR rate plus a margin and your APR may increase after origination if the LIBOR increases. Changes in the one-month LIBOR rate may cause your monthly payment to increase or decrease. Interest rates for variable rate loans are capped at 13.95%, unless required to be lower to comply with applicable law. Lowest rates are reserved for the most creditworthy borrowers. If approved for a loan, the interest rate offered will depend on your creditworthiness, the repayment option you select, the term and amount of the loan and other factors, and will be within the ranges of rates listed above. The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Information current as of 4/1/2021. Enrolling in autopay is not required to receive a loan from SoFi. SoFi Lending Corp., licensed by the Department of Business Oversight under the California Financing Law License No. 6054612. NMLS #1121636 (>www.nmlsconsumeraccess.org).

What is the APR for undergraduate loans?

The current APR for undergraduate subsidized and unsubsidized loans is 2.75% (between July 2020 and July 2021), according to the Department of Education. The unsubsidized graduate degree loan interest rate is 4.30%. Loan fees. Both loans have the same fee.

What happens if you don't pay interest on a student loan?

If you don’t make interest payments, the unpaid interest is added to your loan balance, making repayment more costly. “With an unsubsidized loan, the student is responsible for making the interest payments the moment the loan is taken out,” said Bielagus.

Why has the situation for student loans changed?

Note that the situation for student loans has changed due to the impact of the coronavirus outbreak and relief efforts from the government, student loan lenders and others. Check out our Student Loan Hero Coronavirus Information Center for additional news and details.

Does the government pay interest on subsidized loans?

The government pays interest on a subsidized loan while you’re enrolled in school at least half time. If you’ve already graduated and put your loans into deferment or forbearance, the government also covers interest on your subsidized loans.

Why are Stafford loans cheaper than private loans?

government, so if a student defaults, the government guarantees repayment to the lender. That is the reason Stafford loans offer lower rates than private loans.

How is financial aid disbursed?

Financial aid is disbursed in two installments, typically at the beginning of each semester. First, the school will apply the funds to your school account balance. This covers tuition, fees, room and board and any other school charges. The remaining money is returned to you either by check or direct deposit.

What are the different types of Stafford loans?

Types of Stafford Student Loans. There are two types of Stafford loans — subsidized and unsubsidized — and each type has different financial-need requirements and benefits.

Do you have to pay interest on unsubsidized Stafford loans?

Unsubsidized Stafford loans accrue interest while in school, during grace periods and deferment periods. Students are not required to pay the accumulating interest during these periods, but if you choose not to pay, it will be added to the principle amount of your loan.

Do you have to repay a loan while in school?

Low interest rates. Credit history isn’t a factor. You won’t have to repay the loans while in school. Six-month grace period starting the day you graduate or leave school. Flexible repayment plans that can be based on income and could include loan forgiveness programs.

Can you get a parent plus loan if you are financially dependent?

If you are financially dependent and your parents were denied a Parent PLUS loan, you are eligible for the same loan limits as an independent student.

Is Stafford loan a good student loan?

All in all, Stafford loans are the safest, most affordable student loans out there, but there are a few disadvantages: You must fill out FAFSA forms and demonstrate financial need to receive subsidized Stafford loans. Subsidized Stafford loans are not available to graduate students. There are strict limits on the annual ...