Discount Formula

- Discount = Listed Price - Selling Price From this formula we can also find out the listed price and the selling price by using the following formulas:

- Selling Price = Listed Price − Discount

- Listed Price = Selling Price + Discount Discount is usually expressed as a percentage ( rate ). ...

- Discount = Listed Price × Discount Rate Discount Rate/Percentage Formula ...

How do you calculate a discount formula?

The second formula for discount can be computed by using the following steps:

- Firstly, figure out the listed price of the product.

- Now, determine the discount rate offered on the product as part of the sales promotion initiatives.

- Finally, the formula for discount can be derived by multiplying the offered discount rate (step 2) and the listed price (step 1) of the product as shown below.

What is the formula for calculating discount?

- Input the pre-sale price (for example into cell A1).

- Input the post-sale price (for example into cell B1).

- Subtract the post-sale price from the pre-sale price (In C1, input =A1-B1) and label it “discount amount”.

- Divide the new number by the pre-sale price and multiply it by 100 (In D1, input = (C1/A1)*100) and label it “discount rate”.

What is a discount rate and how to calculate it?

Discount Rate Formula. Discount = Marked price – Selling price. Where M.P (Marked Price) is the actual price of the product without discount. S.P (Selling Price) is what customers pay for the product. Discount is a percentage of the market price.

How to calculate the discount factor?

Discount Factor Formula. Mathematically, it is represented as below, DF = (1 + (i/n) )-n*t. where, i = Discount rate. t = Number of years. n = number of compounding periods of a discount rate per year. You are free to use this image on your website, templates etc, Please provide us with an attribution link.

What is the discounting method?

Discounting is the process of determining the present value of a payment or a stream of payments that is to be received in the future. Given the time value of money, a dollar is worth more today than it would be worth tomorrow. Discounting is the primary factor used in pricing a stream of tomorrow's cash flows.

What is the formula for discounting interest rates?

There are two primary discount rate formulas - the weighted average cost of capital (WACC) and adjusted present value (APV). The WACC discount formula is: WACC = E/V x Ce + D/V x Cd x (1-T), and the APV discount formula is: APV = NPV + PV of the impact of financing.

What is a discounting factor?

What is a “Discount Factor”? The term “discount factor” in financial modeling is most commonly used to compute the present value of future cash flows values. It is a weighting factor (or a decimal number) that is multiplied by the future cash flow to discount it to the present value.

What is discounted rate?

The discount rate is the interest rate charged to commercial banks and other financial institutions for short-term loans they take from the Federal Reserve Bank. The discount rate refers to the interest rate used in discounted cash flow (DCF) analysis to determine the present value of future cash flows.

How do I calculate a discount rate in Excel?

What Is the Formula for the Discount Rate? The formula for calculating the discount rate in Excel is =RATE (nper, pmt, pv, [fv], [type], [guess]).

How do you calculate discount factor in NPV?

0:060:54How to Calculate Discounting Factors? - Financial ManagementYouTubeStart of suggested clipEnd of suggested clipBut now in some exams what they do is they give you discounting tables. Yes if they provide you thatMoreBut now in some exams what they do is they give you discounting tables. Yes if they provide you that then that's better but if they don't then you have to calculate it by the calculator. How do you

What is discount formula?

The discount formula is used to determine the amount of discount acquired for a buyer to buy that particular product. A seller uses discounts to make sure the products are sold and in a quick manner. The discount formula can be calculated when the listed price i.e. the actual price of the product is mentioned along with the selling price ...

What is listed price?

Listed price is the actual price of the product without a discount

What is discounting in finance?

What is Discounting? In relation to the time value of money, which argues that a dollar today is worth more than a dollar tomorrow, discounting can be defined as the act of estimating the present value of a future payment or a series of cash flows that are to be received in the future. Discounting is a key element in valuing future cash flows.

What does discounting mean in business?

When it comes to business ventures and investments, assets are considered to not carry value unless they come with cash flow generation potential. It means that they can produce cash flows that allow the business owner or investor a return. Examples of such cash flows can be interest received from a bond ...

What is discount rate?

A discount rate (also referred to as the discount yield) is the rate used to discount future cash flows back to their present value. When discounting the cash flows of investments or business ventures, it is vital to note that the discount rates used will vary depending on various elements.

How much is a start up's cash flow discounted?

The projected cash flows for start-ups that are seeking money can be discounted at any rate between 40% to 100%, early-stage start-ups can be discounted at any rate between 40% to 60%, late start-ups can be discounted at 30% to 50%, and mature company cash flows can be discounted at 10% to 25%.

Why are mature companies discounted?

Start-ups tend to be discounted at relatively higher rates to account for the risk associated with the investment and uncertainties on the guarantee of the future cash flows.

What is the time value of money?

Time Value of Money The time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future. This is true because money that you have right now can be invested and earn a return, thus creating a larger amount of money in the future. (Also, with future

What is weighted average cost of capital?

Weighted Average Cost of Capital (WACC): Normally used to compute a company’s enterprise value.

What is discount formula?

What is the Discount Formula? The term “discount” refers to the pricing system wherein the price of a commodity is lower than its listed price. In other words, a discount is a type of price deduction of a product that is mostly seen in consumer transactions, where the consumers are offered discounts on various products to boost sales.

How to calculate discount?

The first formula for discount can be computed by using the following steps: Step 1: Firstly, figure out the listed price of the product which is the price printed on it. Step 2: Now, determine the selling price of the product which is the actual price at which the product is being sold.

Why is discount important?

From the point of view of a business, it is very important to understand the concept of discount because it not only impacts the top line of a company but also the profitability and eventually the bottom line too. As such, it is essential that a company plans its sales promotions accordingly to achieve the desired results. In the case of lower than expected sales volume, the sales discount can negatively impact the net income of the company. It is important to note that the original price (not selling price) should be the denominator for calculating the discount percentage. Usually, the discounts are used to drive sales either after opening a new store or during year-end to clear the existing stock.

Does a sales discount affect net income?

In the case of lower than expected sales volume, the sales discount can negatively impact the net income of the company. It is important to note that the original price (not selling price) should be the denominator for calculating the discount percentage.

How to calculate discount rate?

The formula for the discount rate can be derived by using the following steps: Step 1: Firstly, determine the value of the future cash flow under consideration. Step 2: Next, determine the present value of future cash flows.

What is discount rate?

The term “discount rate” refers to the factor used to discount the future cash flows back to the present day. In other words, it is used in the computation of time value of money which is instrumental in NPV (Net Present Value) and IRR (Internal Rate of Return) calculation.

What is discount factor?

What is the Discount Factor? Discount Factor is a weighing factor that is most commonly used to find the present value of future cash flows and is calculated by adding the discount rate to one which is then raised to the negative power of a number of periods.

Why is discount factor important?

Understanding this discount factor is very important because it captures the effects of compounding on each time period, which eventually helps in the calculation of discounted cash flow. The concept is that it decreases over time as the effect of compounding the discount rate builds over time.

What are the variables used in continuous compounding?

The four variables used for its computation are the principal amount, time, interest rate and the number of the compounding period. read more, the equation is modified as below,

What is the time value of money?

It is the decimal representation used in the time value of money Time Value Of Money The Time Value of Money (TVM) principle states that money received in the present is of higher worth than money received in the future because money received now can be invested and used to generate cash flows to the enterprise in the future in the form of interest or from future investment appreciation and reinvestment. read more for cash flow. To determine the discount factor for cash flow, one is required to assess the highest interest rate one can get on investment of a similar nature. Consequently, investors can utilize this factor to translate the value of future investment returns into present value in dollars.

What is the DF for year 1?

DF for Year 1 = (1 + 10% ) -1 =0.9091

What Is Discounting?

Discounting is the process of determining the present value of a payment or a stream of payments that is to be received in the future. Given the time value of money, a dollar is worth more today than it would be worth tomorrow. Discounting is the primary factor used in pricing a stream of tomorrow's cash flows.

What is discounting in finance?

Discounting is the process of determining the present value of a future payment or stream of payments. A dollar is always worth more today than it would be worth tomorrow, according to the concept of the time value of money. A higher discount indicates a greater the level of risk associated with an investment and its future cash flows.

What does it mean to discount a stream of cash flows?

Discounting and Risk. In general, a higher the discount means that there is a greater the level of risk associated with an investment and its future cash flows . Discounting is the primary factor used in pricing a stream of tomorrow's cash flows.

How does discounting work?

For example, the coupon payments found in a regular bond are discounted by a certain interest rate and added together with the discounted par value to determine the bond's current value. From a business perspective, an asset has no value unless it can produce cash flows in the future. Stocks pay dividends.

What does 10% off mean in finance?

When a car is on sale for 10% off, it represents a discount to the price of the car. The same concept of discounting is used to value and price financial assets. For example, the discounted, or present value, is the value of the bond today. The future value is the value of the bond at some time in the future. The difference in value between the future and the present is created by discounting the future back to the present using a discount factor, which is a function of time and interest rates.

What is the value of an asset?

From a business perspective, an asset has no value unless it can produce cash flows in the future. Stocks pay dividends. Bonds pay interest, and projects provide investors with incremental future cash flows. The value of those future cash flows in today's terms is calculated by applying a discount factor to future cash flows.

Do junk bonds have a discount?

Indeed, junk bonds are sold at a deep discount. Likewise, a higher the level of risk associated with a particular stock, represented as beta in the capital asset pricing model, means a higher discount, which lowers the present value of the stock.

What is the Present Discounted Value Formula?

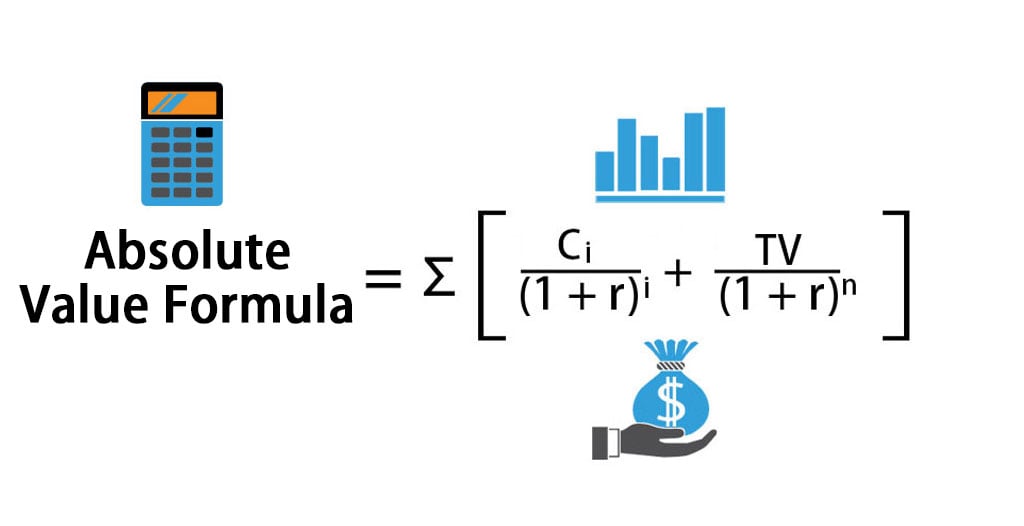

The present discounted value formula is represented in terms of the future value, rate of return, and the number of periods. It is given as:

Examples Using Present Discounted Value Formula

Example 1: What is the present value of $500 received in 3 years if the rate of interest is 10% per annum discounted annually?

What is discount cash flow?

Discounted cash flow (DCF) is a valuation method used to estimate the value of an investment based on its expected future cash flows. DCF analysis attempts to figure out the value of an investment today, based on projections of how much money it will generate in the future. This applies to the decisions of investors in companies or securities, such as acquiring a company or buying a stock, and for business owners and managers looking to make capital budgeting or operating expenditures decisions.

How Do You Calculate DCF?

Calculating the DCF involves three basic steps—one, forecast the expected cash flows from the investment. Two , you select a discount rate, typically based on the cost of financing the investment or the opportunity cost presented by alternative investments. Three, the final step is to discount the forecasted cash flows back to the present day, using a financial calculator, a spreadsheet, or a manual calculation.

What Is an Example of a DCF Calculation?

You have a discount rate of 10% and an investment opportunity that would produce $100 per year for the following three years. Your goal is to calculate the value today—in other words, the “present value”—of this stream of cash flows. Because money in the future is worth less than money today, you reduce the present value of each of these cash flows by your 10% discount rate. Specifically, the first year’s cash flow is worth $90.91 today, the second year’s cash flow is worth $82.64 today, and the third year’s cash flow is worth $75.13 today. Adding up these three cash flows, you conclude that the DCF of the investment is $248.68.

What is the value of money used to determine the future cash flows of an investment?

Investors can use the concept of the present value of money to determine whether the future cash flows of an investment or project are equal to or greater than the value of the initial investment. If the value calculated through DCF is higher than the current cost of the investment, the opportunity should be considered.

How does DCF analysis work?

DCF analysis finds the present value of expected future cash flows using a discount rate. Investors can use the concept of the present value of money to determine whether the future cash flows of an investment or project are equal to or greater than the value of the initial investment. If the value calculated through DCF is higher than the current cost of the investment, the opportunity should be considered.

Why do companies use weighted average cost of capital?

Companies typically use the weighted average cost of capital for the discount rate, because it takes into consideration the rate of return expected by shareholders. The DCF has limitations, primarily in that it relies on estimations of future cash flows, which could prove inaccurate. 1:55.

What happens if DCF is above current cost?

If the DCF is above the current cost of the investment, the opportunity could result in positive returns.