Full Answer

What is the double entry bookkeeping entry for discount allowed?

An invoice is issued to a customer for 700, and after payment is made, the business agrees to give a discount of 150 to the customer. To allow for the discount, the business issues a credit note to the customer for the difference of 150. The double entry bookkeeping journal entry to show the credit note for discount allowed is as follows:

Which entry is required to record the cash discount?

Following double entry is required to record the cash discount: Debiting discount allowed ledger has the effect of reducing gross sales revenue by the amount of cash discount allowed. Consequently, receivables are credited to reduce their balance to the amount that is expected to be recovered from them, i.e. net of cash discount.

What are the different types of discounts allowed by the seller?

There are two types of discounts allowed by the seller. First is a Trade discount and another is Cash discount. Trade discount not recorded in the books of accounts. Instead, it is generally given at sales, like on bulk purchases. Hence, the Sales amount shows a net trade discount in the books.

What is the difference between discount allowed and discount received?

Discount allowed ↑ increases the expense for a seller, on the other hand, it ↓ reduces the actual amount to be received from sales. Discount allowed by a seller is discount received for the buyer. The following examples explain the use of journal entry for discount allowed in the real world events.

What is the journal entry for discount allowed?

Discount Allowed: When at the time of sales or receiving cash, any concession is given to the customers, it is called discount allowed. Journal Entry: Example: Goods sold ₹50,000 for cash, discount allowed @ 10%.

How do you account for discounts allowed?

The discount allowed is accounted for as an expense of the seller. Hence, it is debited while making accounting entries. It has 3 major types, i.e., Transaction Entry, Adjusting Entry, & Closing Entry.

Where discount allowed will be recorded?

Cash discount allowed is recorded on the debit side of cash book.

Is discounts allowed a debit or credit?

Another difference between the two lies in how they are recorded in the financial statements. Discounts allowed represent a debit or expense, while discount received are registered as a credit or income.

What is the journal entry for discount on sales?

If a customer takes advantage of these terms and pays less than the full amount of an invoice, the seller records the discount as a debit to the sales discounts account and a credit to the accounts receivable account.

Is discount allowed an expense or loss?

Ans: A discount allowed by the seller is accounted for as an expense. As a result, it is debited when making accounting entries.

Is discount allowed a debit or credit in trial balance?

debit sideDiscount allowed is the part of income which is sacrificed by the firm. It is the incentive given to the debtors for early payments. Since it is a reduction in the revenue of the year, it is shown on the debit side of the profit and loss account.

Why is discount allowed an expense?

Definition of Sales Discounts Sales discounts (along with sales returns and allowances) are deducted from gross sales to arrive at the company's net sales. Hence, the general ledger account Sales Discounts is a contra revenue account. Sales discounts are not reported as an expense.

Why do we debit discount allowed?

Discounts. 'Discounts allowed' to customers reduce the actual income received and will reduce the profit of the business. They are therefore an expense of the business so would go on the debit side of the trial balance.

Is discount allowed a direct expense?

If a customer is making the payment within the specified period, a certain percentage is allowed on the the payment made by the customer. Cash discount is an indirect expense and to be debited to profit & loss account.

How do you Journalize discounts on purchases?

Under periodic inventory system, the company needs to make the purchase discount journal entry by debiting accounts payable and crediting cash account and purchase discounts. In this journal entry, the purchase discounts is a temporary account which will be cleared to zero at the end of the period.

How do you record cash discount in accounting?

To record a payment from the buyer to the seller that involves a cash discount, debit the cash account for the amount paid, debit a sales discounts expense account for the amount of the discount, and credit the accounts receivable account for the full amount of the invoice being paid.

How do you treat discount allowed in financial statements?

Accounting for the Discount Allowed and Discount Received When the seller allows a discount, this is recorded as a reduction of revenues, and is typically a debit to a contra revenue account. For example, the seller allows a $50 discount from the billed price of $1,000 in services that it has provided to a customer.

Is discount allowed an asset or liability?

Discount allowed is an expense/loss for the company as its settling the accounts of the debtors at lesser price. Hence, it will debited in the P & L A/c as all expenses and losses are debited.

Why is discounts allowed a credit?

'Discounts received' from suppliers will reduce the expense suffered for purchases and will increase the profit of the business. This reduction to an expense would therefore go on the credit side of the trial balance.

How do you record trade discount journal entry?

In the case of Trade discounts, there is no entry made in the books of accounts of the buyer and seller. It is always deducted before any type of exchange takes place. Hence, it does not form part of the books of business accounts. It is usually allowed at the time of purchase.

What is a discount on an invoice?

An invoice is issued to a customer for 700, and after payment is made, the business agrees to give a discount of 150 to the customer. To allow for the discount, the business issues a credit note to the customer for the difference of 150.

What is debit to discount in income statement?

The debit to discount allowed in the income statement is an expense (reduction in revenue), and reduces the profit which in turn reduces the retained earnings and therefore the owners equity in the business.

Can you use a discount on a 700 invoice?

As the original invoice for 700 has already been paid, the discount allowed cannot be allocated to the invoice, and will remain as a credit balance on the account and will either be allocated against a different invoice or repaid in cash to the customer.

What is discount allowed?

Discount allowed is a contra account to the sales revenue which its normal balance is on the debit side. This journal entry will reduce both total assets on the balance sheet and the net sales revenue on the income statement by the amount of discount allowed.

What is discount allowed journal entry?

Discount allowed is a contra account to the sales revenue which its normal balance is on the debit side.

Why is the net balance of sales reduced by $75?

In this journal entry, the net balance of sales is reduced by $75 due to the customer took the early payment discount that the company ABC has provided.

When can a company take a discount?

In business, the company may allow the customers to take the discount if they make the payment early (e.g. within 10 days of the credit purchase). Likewise, the company needs to account for the discount allowed with a proper journal entry when the customers take the discount by making the early payment. As the company records the full price as the ...

Does a company direct debit sales revenue?

However, the company usually does not direct debit the sales revenue account. It usually records such a discount in the discount allowed account in order to keep track ...

What is discount allowed?

Discount Allowed. Discounts may be offered on sales of goods to attract buyers. Discounts may be classified into two types: Trade Discounts: offered at the time of purchase for example when goods are purchased in bulk or to retain loyal customers.

Why are trade discounts ignored?

Trade discounts are generally ignored for accounting purposes in that they are omitted from accounting records.

How much discount does bike LTD give?

Bike LTD as part of its sales promotion campaign has offered to sell their bikes at a 10% discount on their listed price of $100. If customers pay within 10 days from the date of purchase, they get a further $5 cash discount. Bike LTD sells a bike to XYZ who pays within 10 days.

What is discount allowed and received?

What is Discount Allowed and Discount Received? Discount allowed is a reduction in price of goods or services allowed by a seller to a buyer and is an expense for the seller. However, Discount received is the concession in price received by the buyer of the goods and services from the seller and is an income for the buyer .

What are the two types of discounts allowed by the seller?

Journal Entries. There are two types of discounts allowed by the seller. First is a Trade discount and another is Cash discount. Trade discount is not recorded in the books of accounts. It is generally given at the time of sales, like on bulk purchase. Hence, the Sales amount is shown net of trade discount in the books.

What is the difference between a discount and a buyer's expense?

For the buyer, the discount received is an income of the buyer, and the discount allowed is the seller’s expense.

Where is discount recorded in cash book?

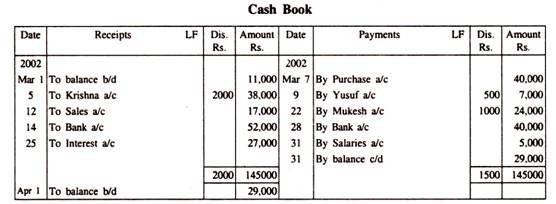

The discount allowed by the seller is recorded on the debit side of the cash book.

Which side of the cash book is discount recorded?

are recorded on the debit side, and cash payments are recorded on the credit side. The discount allowed by the seller is recorded on the debit side of the cash book. Here is the format of the cash book –.

Why is offering discounts important?

Increased Sales – Offering discounts helps increase sales and attract new customers. As paying lesser money is an incentive for the buyer.

Is the debit and credit side of a trial balance equal?

The debit and credit side of the trial balance should be equal. The discount received is an income for the buyer. Hence, the balance of the discount received account is shown on the credit side.

What is cash discount?

A cash discount is a type of sales discount, sometimes called an early settlement discount, and is recorded in the accounting records using two journals. The first journal is to record the cash being received from the customer. The second journal records the cash discount to clear the remaining balance on the customers account.

What is debit N?

Debit#N#The discount allowed given to the customer is an expense for the business and appears on the income statement under the heading the discounts allowed thereby reducing the net sales amount shown.

How many journal entries are required for sales discounts?

Accounting for sales discounts requires two journal entries.

What is sales discount?

The sales discount is based on the sales price of the goods and is sometimes referred to as a cash discount on sales, settlement discount, or discount allowed.

What happens if a customer does not pay within the discount period?

If the customer does not pay within the discount period and does not take the sales discount the business will receive the full invoice amount of 2,000 and the discount is ignored.

Why do businesses offer discounts?

The purpose of a business offering sales discounts is to encourage the customer to settle their account earlier (10 days instead of 30 days in the above example). By receiving payment earlier the business now has use of the cash for an extra 20 days and reduces the chances that the customer will eventually default.

What is sales discount normal balance?

The sales discount normal balance is a debit, a cost to the business. The discount is recorded in a contra revenue account which is offset against the revenue account in the income statement.

What is the downside of offering a discount?

The downside of offering a discount is that the business now has an extra cost. If we use the example above, the cost to the business of receiving 1,950 20 days earlier than expected was the sales discount of 50. The ‘interest rate’ for the 20 days is calculated as follows.

When a business sells goods on credit to a customer, what is the term?

When a business sells goods on credit to a customer the terms will stipulate the date on which the amount outstanding is to be paid. In addition the terms will often allow a sales discount to be taken if the invoice is settled at an earlier date. The sales discount is based on the sales price of the goods and is sometimes referred ...

What is trade discount?

The trade discount is simply used to calculate the net price for the customer. As the trade-discount is deducted before any exchange takes place, it does not form part of the accounting transaction, and is not entered into the accounting records of the business. For example, suppose a business sells a product with a list price ...

What is the cash discount based on?

It should be noted that the cash discount is based on the customers invoiced price of 840 (after the trade discount) and not on the original list price of 1,200.

Why do businesses quote singe list prices?

To avoid having to publish numerous different price lists, it is common for a business to quote a singe list price for each of its products and then offer customers a reduction in the price by way of a trade discount. By varying the level of trade discount the business can change the price given to different customers.

Is a trade discount entered into the accounting records?

A trade discount is deducted before any exchange takes place with the customer and therefore does not form part of the accounting transaction, and is not entered into the accounting records.