How do I make an expense entry?

- Dashboard > Overview > highlight a Matter's row in the list

- Click the black down arrow that appears to the right of the row and select "Add Expense Entry" in the list drop-down menu.

- In general whenever you see lists in Time and Billing, you can highlight them, and click the black down arrow to reveal a list drop-down menu that gives you quick ...

When does an accrued expense have to be paid?

On the balance day, the accrued expense of utility is treated as a current liability (Utility Payable) owed to the utility company, and an expense (Utility Expense) incurred by the company in February. In the reporting period of March, the company should record its cash payment on March 25 for its utility bill.

Are accrued expenses assets or liabilities?

Where accrued expenses are debts that have not been paid and are recorded in payable accounts, accrued revenues are income that have been earned but have not been paid to the company and are recorded in receivable accounts. Accrued expenses are liabilities, whereas both prepaid expenses and accrued revenues are assets.

What are the examples of accrued expenses?

Primary examples of accrued expenses are salaries payable and interest payable. Salaries payable are wages earned by employees in one accounting period but not paid until the next, while interest payable is interest expense that has been incurred but not yet paid.

What is accrual entry example?

Any expense you record now but plan to pay for at a later date creates an accrued expense account in your books. An example of an accrued expense might include: Bonuses, salaries, or wages payable. Unused vacation or sick days.

What is the journal entry for accrued liabilities?

The journal entry for an accrued liability is typically a debit to an expense account and a credit to an accrued liabilities account. At the beginning of the next accounting period, the entry is reversed.

Is accrued expense a debit or credit?

Accrued expenses are recognized by debiting the appropriate expense account and crediting an accrued liability account. A second journal entry must then be prepared in the following period to reverse the entry.

Where is accrued expense recorded?

balance sheetAccrued expenses are listed on a company's balance sheet. They should appear at the end of the company's accounting period. Adjustments are made using journal entries that are entered into the company's general ledger.

How do I clear accrued expenses?

Reversing Accrued Expenses When you reverse an accrual, you debit accrued expenses and credit the expense account to which you recorded the accrual. When you post the invoice in the new month, you typically debit expenses and credit accounts payable.

What is the adjustment for accrued expenses?

Accruals When the cash is received at a later time, an adjusting journal entry is made to record the payment for the receivable account. An accrued expense is the expense that has been incurred (goods or services have been consumed) before the cash payment has been made.

How do you record accrued expenses on a balance sheet?

Accrued Expenses on Balance Sheet Accordingly, it should be recorded by debiting Wages and Salaries Expenses, crediting Accrued Expenses, and making an offsetting entry by debiting these expenses and crediting cash when payment is made.

How do you record accrued?

In order to record accrued revenue, you should create a journal entry that debits the accrued billings account (an asset) and credits a revenue account. This results in revenue being recognized in the current period.

How do you accrue expenses?

You accrue expenses by recording an adjusting entry to the general ledger. Adjusting entries occur at the end of the accounting period and affect one balance sheet account (an accrued liability) and one income statement account (an expense).

How do you account for accrued liability?

Accounting for accrued liabilities requires a debit to an expense account and a credit to the accrued liability account, which is then reversed upon payment with a credit to the cash or expense account and a debit to the accrued liability account. Examples of accrued liabilities can include payroll and payroll taxes.

How do you record accrued journal entries?

Journal Entry For Accrued Expenses. An accrued expense journal entry is passed on recording the expenses incurred over one accounting period by the company but not paid actually in that accounting period. The expenditure account is debited here, and the accrued liabilities account is credited.

What accounts are in accrued liabilities?

Examples of accrued liabilities are future salaries (accrued wages), future interest payments (accrued interest), future taxes (accrued taxes), services to be performed in the future (accrued services), and future lease payments (accrued real estate costs).

What account type is accrued liabilities?

Accrued liabilities, also referred to as accrued expenses, are expenses that businesses have incurred, but haven't yet been billed for. These expenses are listed on the balance sheet as a current liability, until they're reversed and eliminated from the balance sheet entirely.

Q: What is accrued expense adjusting entry?

Ans: Once you pay the cash, an adjustment is created to eliminate the account payable, included with the accrued expense earlier.

Q: What does accrued expense journal entry reversing mean?

Ans: Reversing entries usually occur at the start of the accounting period. You will generally use it when you incur revenues or expenses in the pr...

Q: What is an accrued expense journal entry example?

Ans: Accrued utilities are a great example of using utility services for your business but have not paid yet.

Q: What is an accrued expense journal entry?

Ans: Accrued expense journals are recorded to document costs incurred in one accounting period of the company. However, they are not paid in that f...

What is accrued expense journal entry?

Accrued expense journal entry is passed to record the expenses which are incurred over one accounting period by the company but not paid actually in that accounting period. Here the expenditure account is debited and the accrued liabilities account is credited. When the company settles its obligation with cash, ...

Why is expense recognized in financial statements?

In short, this journal entry recognized in the financial statements enhances the accuracy of the statements. The expense matches the revenue with which it is associated.

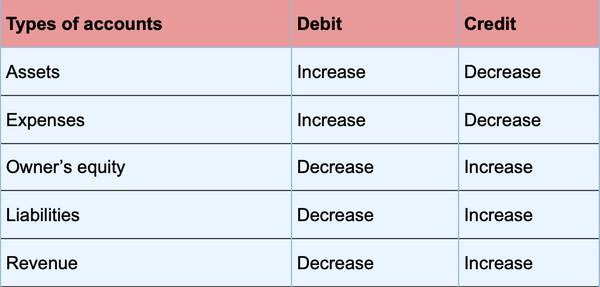

What is a debit in accounting?

Debit Debit is an entry in the books of accounts, which either increases the assets or decreases the liabilities. According to the double-entry system, the total debits should always be equal to the total credits. read more.

What is accounts payable?

Accounts Payable Accounts payable is the amount due by a business to its suppliers or vendors for the purchase of products or services. It is categorized as current liabilities on the balance sheet and must be satisfied within an accounting period. read more. on a later date.

When a company settles its obligation with cash, is the accrued liability account debited?

When the company settles its obligation with cash, the accrued liabilities account is debited and the accrued expense account is credited. Accrued expense refers to the expense that has already incurred but for which the payment is not made. This term comes into play when in place of the expense documentation, a journal entry is made ...

What happens if a journal entry is not created?

If the journal entry is not created, then the expense will not at all appear in the financial statements of the company in the period of occurrence, which will result in a higher reported profit in that period. In short, this journal entry recognized in the financial statements enhances the accuracy of the statements.

What is accounting system?

Accounting System Accounting systems are used by organizations to record financial information such as income, expenses, and other accounting activities . They serve as a key tool for monitoring and tracking the company's performance and ensuring the smooth operation of the firm. read more.

What Is an Accrued Expense?

An accrued expense, also known as accrued liabilities, is an accounting term that refers to an expense that is recognized on the books before it has been paid. The expense is recorded in the accounting period in which it is incurred.

How Are Accrued Expenses Accounted for?

An accrued expense, also known as an accrued liability, is an accounting term that refers to an expense that is recognized on the books before it has been paid. The expense is recorded in the accounting period in which it is incurred. Since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as current liabilities.

What Are Some Examples of Accrued Expenses?

An example of an accrued expense is when a company purchases supplies from a vendor but has not yet received an invoice for the purchase. Other forms of accrued expenses include interest payments on loans, warranties on products or services received, and taxes—all of which have been incurred or obtained, but for which no invoices have been received nor payments made. Employee commissions, wages, and bonuses are accrued in the period they occur although the actual payment is made in the following period.

What is the difference between prepaid and accrued expenses?

Accrued expenses are the opposite of prepaid expenses. Prepaid expenses are payments made in advance for goods and services that are expected to be provided or used in the future. While accrued expenses represent liabilities, prepaid expenses are recognized as assets on the balance sheet.

What is accrual accounting?

Accrual accounting measures a company's performance and position by recognizing economic events regardless of when cash transactions occur, whereas cash accounting only records transactions when payment occurs.

Why is accrual accounting labor intensive?

Although the accrual method of accounting is labor-intensive because it requires extensive journaling, it is a more accurate measure of a company's transactions and events for each period. This more complete picture helps users of financial statements to better understand a company's present financial health and predict its future financial position.

When are expenses recognized?

Following the accrual method of accounting, expenses are recognized when they are incurred, not necessarily when they are paid. Unless an expense is substantial, it is generally not accrued because accrual accounting requires the work of multiple journal entries.

What Is an Accrued Expense?

Accrued expenses are expenses a company needs to account for, but for which no invoices have been received and no payments have been made.

Where are accrued expenses recorded?

Accrued expenses would be recorded under the section “Liabilities”. It would look something like this:

What Are Accrued Expenses on a Balance Sheet?

A balance sheet shows what a company owns (its “assets”) and owes (its “liabilities”) as of a particular date , along with its shareholders’ equity .

What Is the Difference Between Accrued Expenses and Accounts Payable?

Accrued expenses are expenses a company knows it must pay, but cannot do so because it has not yet been billed for them. The company accounts for these costs anyway so that the management has a better indication of what its total liabilities really are. This will allow the company to make better decisions on how to spend its money.

What is an account payable?

Accounts payable are debts for which invoices have been received, but have not yet been paid. Both accrued expenses and accounts payable are accounted for under “Current Liabilities” on a company’s balance sheet. Once an accrued expense receives an invoice, the amount is moved into accounts payable.

What is accrual method?

Accrued expenses are expenses a company accounts for when they happen, as opposed to when they are actually invoiced or paid for. An accrual method allows a company’s financial statements, such as the balance sheet and income statement, to be more accurate. Here’s What We’ll Cover:

Why are debits and credits used in accounting?

Debits and credits are used in a company’s bookkeeping in order for its books to balance. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. Credits do the reverse.

What is accrued expense?

Thus, these accruals are called accrued expenses. Therefore, we can basically define the accrued expenses as the liability which results from the goods or services that have been received ; however, the payment has not been made. In real practice, we often see various expenses incurred and considered as accrued expenses.

What is journal entry for accrued expenses?

The journal entry for accrued expenses is straightforward. It is part of the adjusting entries in the accounting cycle that each accountant shall be carried out as part of their closing process.

Why is accrued expense journal entry important?

The accrued expenses journal entry is very important as part of the adjusting entries in the accounting cycle of the closing process. Such accrued expenses are considered as liabilities and shall be presented in the balance sheet as part of the liabilities section.

When is accrued expense presented on the balance sheet?

The accrued expenses account is presented in the Balance Sheet under current liabilities if the payment term is within a twelve-month period; however, if the payment is more than the twelve-month period, such accruals shall be presented as long-term liabilities.

When a company incurs expenses, it creates an obligation in order to make the payment for such expenses?

This obligation is the liability that the company possesses and shall be treated and recorded as accrued expenses regardless of payment has not been made. The accrued expenses account is presented in the Balance Sheet under current liabilities ...

Is interest expense accrued or not?

In real practice, we often see various expenses incurred and considered as accrued expenses. For example, interest expenses incurred not yet paid, salary expense not yet paid or salary payable, accrued bonus, utility expenses, etc…

Is debit entry an expense?

Please note that, at the time of payment, the debit entry is not an expense. It is the offset against the accrued expense (liability) that the company has recorded as an accrual. Therefore, at the time of payment, nothing impacts the income statement.

What is accrual expense?

Accrued expenses sometimes referred to as accruals, are expenses which has been incurred but at the end of the accounting period not yet recorded in the accounting ledgers by the normal transaction process.

When do you accrue rent?

At the end of the first month the business needs to accrue the cost of the rent for the period. The accrued expense is calculated as follows.

What is the accounting equation for assets?

The Accounting Equation, Assets = Liabilities + Owners Equity means that the total assets of the business are always equal to the total liabilities plus the owners equity of the business. This is true at any time and applies to each transaction.

What Is an Accrued Expense?

- An accrued expense, also known as accrued liabilities, is an accounting term that refers to an ex…

Accrued expenses are recognized on the books when they are incurred, not when they are paid. - Accrual accounting requires more journal entries than simple cash balance accounting.

Accrual accounting provides a more accurate financial picture than cash basis accounting.

Understanding Accrued Expenses

- Since accrued expenses represent a company's obligation to make future cash payments, they …

An example of an accrued expense is when a company purchases supplies from a vendor but has not yet received an invoice for the purchase. Other forms of accrued expenses include interest payments on loans, warranties on products or services received, and taxes—all of which have b…

Accrual v Cash Basis Accounting

- Accrual accounting differs from cash basis accounting, which records financial events and trans…

Although the accrual method of accounting is labor-intensive because it requires extensive journaling, it is a more accurate measure of a company's transactions and events for each period. This more complete picture helps users of financial statements to better understand a company'…

Accrued Expenses v Prepaid Expenses

- Accrued expenses are the opposite of prepaid expenses. Prepaid expenses are payments mad…

On the other hand, an accrued expense is an event that has already occurred in which cash has not been a factor. Not only has the company already received the benefit, it still needs to remit payment. Therefore, it is literally the opposite of a prepayment; an accrual is the recognition of s…

Advantages and Disadvantages of Accrued Expenses

- Accrued expenses theoretically make a company’s financial statements more accurate. While th…

Accrued expenses also may make it easier for companies to plan and strategize. Accrued expenses often yield more consistent financial results as companies can include recurring transactions in their financial reports that may not yet have been paid. In addition, accrued expe…

Special Considerations

- A critical component to accrued expenses is reversing entries, journal entries that back out a tra…

Accrued expenses are not meant to be permanent; they are meant to be temporary records that take the place of a true transaction in the short-term. Every accrued expense must have a reversing entry; without the reversing entry, a company risks duplicating transactions by recordi… - Many accounting software systems can auto-generate reversing entries when prompted.

Accrued expenses are prevalent during the end of an accounting period. A company often attempts to book as many actual invoices it can during an accounting period before closing its accounts payable ledger. Then, supporting accounting staff analyze what transactions/invoices …

Example of Accrued Expense

- A company pays its employees' salaries on the first day of the following month for services recei…

Because the company actually incurred 12 months’ worth of salary expenses, an adjusting journal entry is recorded at the end of the accounting period for the last month’s expense. The adjusting entry will be dated Dec. 31 and will have a debit to the salary expenses account on the income s…

How Are Accrued Expenses Accounted for?

- An accrued expense, also known as an accrued liability, is an accounting term that refers to an expense that is recognized on the books before it has been paid. The expense is recorded in the accounting period in which it is incurred. Since accrued expenses represent a company's obligation to make future cash payments, they are shown on a company's balance sheet as curr…

What Are Some Examples of Accrued Expenses?

- An example of an accrued expense is when a company purchases supplies from a vendor but has not yet received an invoice for the purchase. Other forms of accrued expenses include interest payments on loans, warranties on products or services received, and taxes—all of which have been incurred or obtained, but for which no invoices have been received nor payments made. E…

How Does Accrual Accounting Differ From Cash Basis Accounting?

- Accrual accounting measures a company's performance and position by recognizing economic events regardless of when cash transactions occur, whereas cash accounting only records transactions when payment occurs. Accrual accounting presents a more accurate measure of a company's transactions and events for each period. Cash basis accounting often results in the o…

What Is a Prepaid Expense?

- A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Unlike conventional expenses, the business will receive something of value from the prepaid ex…

What Is the Journal Entry for Accrued Expenses?

- Accrued expenses are recognized by debiting the appropriate expense account and crediting a…

For example, a company wants to accrue a $10,000 utility invoice to have the expense hit in June. The company’s June journal entry will be a debit to Utility Expense and a credit to Accrued Payables. On July 1st, the company will reverse this entry (debit to Accrued Payables, credit to …

The Bottom Line

- Companies using the accrual method of accounting recognize accrued expenses, costs that hav…

An adjusting journal entry occurs at the end of a reporting period to record any unrecognized income or expenses for the period. - What Is Accrual Accounting, and How Does It Work?

Accrual accounting is where a business records revenue or expenses when a transaction occurs using the double-entry accounting method.