What is the federal unemployment tax?

Does the employer pay FUTA?

About this website

How do you calculate federal unemployment tax?

How to calculate FUTA Tax?FUTA Tax per employee = (Taxable Wage Base Limit) x (FUTA Tax Rate).With the Taxable Wage Base Limit at $7,000,FUTA Tax per employee = $7,000 x 6% (0.06) = $420.

What is the federal FUTA rate for 2021?

6%The Federal Unemployment Tax Act (FUTA) is legislation that imposes a payroll tax on any business with employees; the revenue raised is used to fund unemployment benefits. As of 2021, the FUTA tax rate is 6% of the first $7,000 paid to each employee annually.

When was the FUTA rate changed?

January 1, 2016The Federal Unemployment Tax Act (FUTA) tax rate may surge in several states starting January 1, 2016. This change may catch more than one employer off guard when filing their first Form 940 in 2016.

How are SUTA and FUTA taxes calculated?

How do you calculate SUTA tax? To calculate your SUTA tax as a new employer, multiply your state's new employer tax rate by the wage base. For example, if you own a non-construction business in California in 2021, the SUTA new employer tax rate is 3.4%, and the taxable wage base per worker is $7,000.

What is FUTA and SUTA tax?

Employers pay for unemployment insurance through both federal and state payroll taxes. The federal tax is called FUTA (Federal Unemployment Tax Act) and the state tax is called SUTA (State Unemployment Tax Act).

How is FUTA calculated 2022?

For 2022, the FUTA tax rate is 6%, per the IRS. The FUTA tax applies to the first $7,000 in wages you pay an employee throughout the calendar year. This $7,000 is known as the taxable wage base.

What is the FUTA tax rate for 2020?

6.0%FUTA tax rate: The FUTA tax rate is 6.0%. The tax applies to the first $7,000 you paid to each employee as wages during the year. The $7,000 is often referred to as the federal or FUTA wage base.

What is the FUTA tax rate for 2022?

6.0%Under the Federal Unemployment Insurance Tax Act (FUTA), the 2022 federal unemployment insurance wage base is $7,000, the maximum tax is 6.0% and the maximum credit reduction is 5.4%, for a net FUTA deposit rate of 0.6%.

What was the maximum amount of tax for each employee before and after the FUTA tax rate change?

That makes the FUTA tax cap $420 for each employee; in other words, $420 is the greatest amount most businesses should pay per employee. However, many businesses qualify for a maximum tax credit of 5.4%, which reduces their FUTA liability to 0.6%.

What is the difference between SUTA and FUTA?

SUTA refers to the taxes paid at the state level, but there is also a federal equivalent paid at the federal level, called the Federal Unemployment Tax Act, or FUTA. FUTA taxes go into a fund that covers the federal government's oversight of the states' individual unemployment insurance programs.

What is included in FUTA wages?

All wages paid to any individual employee up to $7,000 in a calendar tax year are counted as FUTA wages and subject to the tax. Any wages over the $7,000 maximum are not subject to FUTA.

Who is exempt from FUTA and SUTA?

Who is exempt from FUTA and SUTA tax? Some government entities, nonprofit institutions, religious, charitable, and educational organizations may be exempt from paying FUTA and SUTA taxes. However, most businesses are required to pay FUTA and SUTA taxes if they run payroll.

What is the net FUTA rate?

FUTA tax rate: The FUTA tax rate is 6.0%. The tax applies to the first $7,000 you paid to each employee as wages during the year.

What is the FUTA rate for 2022 in Texas?

6%2022 FUTA tax rate The standard FUTA rate in 2022 is 6%, with a taxable wage base of $7,000 (per employee) or taxable wages up to $7,000. This means that an employer's federal unemployment payroll tax liability is equal to 0.6 % on the first $7,000 paid per worker; however, state unemployment taxes are due as well.

How is FUTA credit reduction calculated?

These employers report the FUTA taxable wages and multiply by the credit reduction rate (0.3%, 0.6%, 0.9%, etc.) to calculate the total credit reduction, which the employer carries forward to Form 940.

What is FUTA on my paycheck?

The Federal Unemployment Tax Act (FUTA), with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both a Federal and a state unemployment tax.

Will Your Federal Unemployment Tax go up in 2022? | Tricom

Since these states had an outstanding balance on January 1, 2021, employers with employment in these states may be subject to an increase in Federal Unemployment Tax for 2022 if the loan amount remains outstanding as of January 1, 2022 and is not repaid in full by November 10, 2022.

2021 Instructions for Form 940

Internal Revenue Service! • • •

About Form 940, Employer's Annual Federal Unemployment (FUTA) Tax ...

Information about Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, including recent updates, related forms and instructions on how to file. Form 940 (or Form 940-EZ) is used by employers to file annual Federal Unemployment Tax Act (FUTA) tax.

FUTA Tax - Overview, How It Works, How To Calculate

What is FUTA Tax? FUTA is an abbreviation for Federal Unemployment Tax Act. FUTA Tax is a United States federal tax imposed on employers to help fund unemployment payments.The tax is imposed solely on employers who pay wages to employees.. FUTA Tax is used to pay employees who leave employment involuntarily and are eligible to claim unemployment insurance.

What is the FUTA rate for 2019?

Federal Unemployment Tax Act (FUTA) Updates for 2019. For budgeting purposes, you should assume a 0.6% FUTA rate on the first $7,000 in wages for all states unless you will be working in the U.S. Virgin Islands (USVI), in which case, you should assume a 3.3% rate. Why?

Which states have a 2.4% credit reduction?

In 2018, the U.S. Virgin Islands (USVI) was the only jurisdiction still behind in its federal loan and was thus subject to a 2.4% credit reduction. California was able to pay off its loan balance, so its long-standing credit reduction was eliminated.

Access the essential federal and state employment tax rates and limits for 2019 in one place

Get the essential federal and state employment tax rates and limits for 2019 in one place with this publication. Topics include:

Download PDF

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

What is the effective tax rate for 2019?

The effective tax rate for 2019 is 0.6%.

What is the tax rate for Medicare?

(Maximum Social Security tax withheld from wages is $8,239.80 in 2019). For Medicare, the rate remains unchanged at 1.45% for both employers and employees.

What is EFTPS in tax?

Electronic Federal Tax Payment System (EFTPS) Employers must pay their Federal Tax Liabilities through the Electronic Federal Tax Payment System unless they pay less than $2,500 in quarterly payroll tax liabilities and pay their liability when filing their employment tax returns (Forms 941 and 944).

What is the maximum 401(k) contribution?

401 (K) Plan Limits. The maximum employee pretax contribution increases to $19,000 in 2019. The “catch-up” contribution limit remains at $6,000 for individuals who are age 50 or older.

How much FICA do you have to pay for a domestic worker?

Household employers are required to withhold and pay FICA for domestic workers (age 18 and older) if paid cash wages of $2,100 or more in 2019. The $1,000 per calendar quarter threshold continues to apply for FUTA.

How to contact NJ unemployment?

For further information contact us or call the State of New Jersey at 1-877-654-4737 (NJ-HIRES) or Pennsylvania at 1-888-724-4737 (PA-HIRES).

When are W-2s due for 2018?

The due date for filing 2018 Form W-2 with the Social Security Administration is January 31, 2019. This also applies to Form 1099-MISC reporting for non-employee compensation such as payments to independent contractors.

Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

Add Futa Taxes To Employee Pay Stubs

You may choose to add FUTA taxes paid for an employee in their pay stubs. With 123PayStubs, you can easily add the employer-paid taxes such as FUTA, SUTA, and other state-specific employer-paid taxes to the pay stubs, along with accurate tax calculations. to know how to add FUTA taxes to pay stubs..

What Is The Maximum Unemployment Benefit In Texas 2020

Amount and Duration of Unemployment Benefits in Texas As explained above, the Texas Workforce Commission determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 25, up to a maximum of $535 per week. Benefits are available for up to 26 weeks.

Futa Tax Rate For 2020

If youre obligated to pay federal unemployment taxes as a business owner, the next thing youll likely want to know is how much you have to pay. Overall, both FUTA and SUTA tax rates are calculated based on the amount of an employeeâs wages, up to a certain limit. These business tax rates and wage limits can change periodically.

Do You Have To Pay Taxes On Unemployment Benefits

The American Rescue Plan Act of 2021 changed federal tax requirements on 2020 unemployment benefits. For the latest information, see How Unemployment Benefits Are Changing in 2021.

Who Needs To Pay For Futa

Every employer pays FUTA nothing is taken from the employees pay. However, there are a few more standards to complete in order to be considered.

Calculating Your Futa Tax Liability

Gov. Ige signs bill aimed at rolling back employers unemployment tax rate

What is the maximum FUTA tax rate?

If you're entitled to the maximum 5.4% credit, the FUTA tax rate after credit is 0.6%. Generally, you're entitled to the maximum credit if you paid your state unemployment taxes in full, on time, and the state isn't determined to be a credit reduction state. See the Instructions for Form 940 to determine the credit.

How much is the FUTA tax credit?

Your state wage base may be different based on the respective state’s rules. Generally, if you paid wages subject to state unemployment tax, you may receive a credit of up to 5.4% of FUTA taxable wages when you file your Form 940. If you're entitled to the maximum 5.4% credit, the FUTA tax rate after credit is 0.6%.

What is the form 940 for 2020?

Under the general test, you're subject to FUTA tax on the wages you pay employees who aren't household or agricultural employees and must file Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return for 2020 if: You paid wages of $1,500 or more to employees in any calendar quarter during 2019 or 2020, or.

When is the 940 due?

The due date for filing the Form 940 is January 31. However, if you deposited all FUTA tax when due, you have until February 10 to file. If the due date for filing a return falls on a Saturday, Sunday, or legal holiday, you may file the return on the next business day. The term legal holiday means any legal holiday in the District of Columbia. For a list of legal holidays, see Chapter 11 in Publication 15, (Circular E), Employer's Tax Guide.

Do you have to include a 940 if you are a successor employer?

However, don't include any wages paid by the predecessor employer on your Form 940 unless you're a successor employer. For details, see "Successor employer" in the Instructions for Form 940. If you won't be liable for filing Form 940 in the future, see "Final: Business closed or stopped paying wages" under Type of Return in the Instructions for Form 940.

How are unemployment taxes paid?

The state tax is payable on the first $14,100 in wages paid to each employee during a calendar year. Federal unemployment taxes are paid to the Internal Revenue Service and are used to pay for the cost of administration of the state programs, the federal cost of extended benefits, and to make loans when state unemployment trust funds experience shortfalls and have to borrow to pay benefits. The federal tax is payable on the first $7,000 of wages paid to each employee during each calendar year. On an annual basis, the department and IRS conduct a cross match to ensure that employers are paying both taxes. Provided the state does not have any outstanding Title XII loans, payment of state unemployment taxes in a timely manner reduces the federal unemployment tax rate from 6.0% to .6%, so it is important to pay your state unemployment taxes on time.

How long does an employer have to pay unemployment tax?

Because tax rates are recalculated only on an annual basis, most employers pay unemployment insurance taxes at the new employer rate for at least two years before getting an experience rating. Without exception the tax rate of an employer that has had three calendar years of benefit liability will be based on experience during the last three years. ...

What is the lowest benefit ratio?

The lowest possible benefit ratio is .00000 – no benefits were charged to that employer’s account over the last three years. Employers with a zero benefit ratio are assigned the lowest tax rate in effect for that year (rate class 0). Rate class “0” is assigned the lowest rate in each schedule (see below). All other employers are then placed in the 20 tax rate classes. No employer is assigned to a higher class than any other employer with the same benefit ratio. Rate Class 1 is made up of employers with the lowest benefit ratios above zero and Rate Class 20 is made up of those with the highest benefit ratios. Your rate depends upon two factors: (1) How your benefit ratio compares with other employers’ benefit ratios, and, (2) Which rate schedule is in effect.

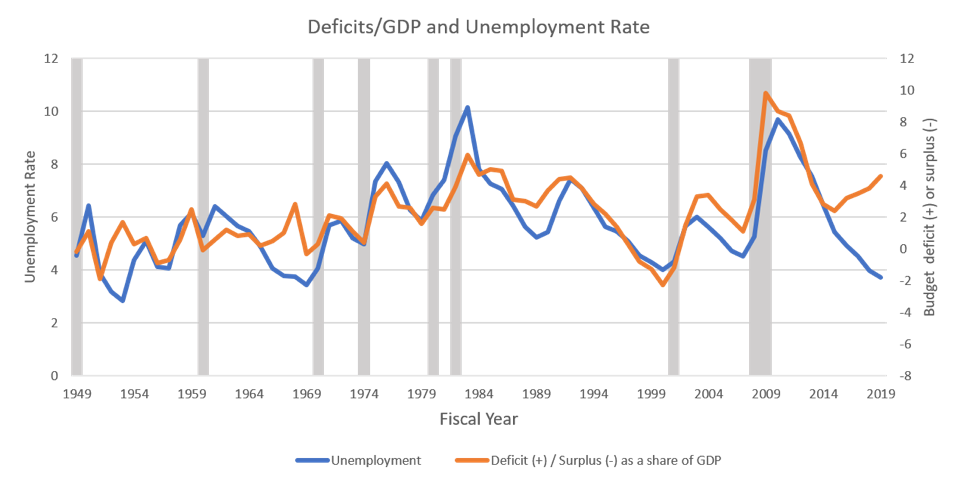

What is forward funded unemployment?

The unemployment trust fund is “forward funded”, which means that the tax schedules are designed to raise funding during good economic times to ensure that there is adequate funding during recessions. The U. S. Department of Labor suggests that a state trust fund be maintained at a sufficient level such that if no additional taxes were paid, ...

Who pays unemployment taxes?

Federal unemployment taxes are paid to the Internal Revenue Service and are used to pay for the cost of administration of the state programs, the federal cost of extended benefits, and to make loans when state unemployment trust funds experience shortfalls and have to borrow to pay benefits.

How to calculate benefit ratio?

To compute a benefit ratio, the Department divides the total amount of benefits charged to your record during the last calendar year (or last two or three calendar years if you have been liable for benefits that long) by the total taxable wages you reported for that same period. This ratio is used to set your tax rate.

How much is the state unemployment tax?

Many states collect an additional unemployment tax from employers, known as state unemployment taxes (SUTA). These range from 2% to 5% of an employee's wages. Paying SUTA taxes can lessen the burden of FUTA taxes. Employers can take a tax credit of up to 5.4% of taxable income if they pay state unemployment taxes in full and on time.

What Is the Federal Unemployment Tax Act (FUTA)?

The Federal Unemployment Tax Act (FUTA) is a piece of legislation that imposes a payroll tax on any business with employees. The revenue it generates is allocated to state unemployment insurance agencies and used to fund unemployment benefits for people who are out of work.

What is the FUTA rate?

The Federal Unemployment Tax Act (FUTA) is legislation that imposes a payroll tax on any business with employees; the revenue raised is used to fund unemployment benefits. As of 2021, the FUTA tax rate is 6% of the first $7,000 paid to each employee annually. Though FUTA payroll tax is based on employees' wages, it is imposed on employers only, ...

What is the minimum amount an employer can pay in FUTA?

Thus, the minimum amount an employer can pay in FUTA tax is $42 per employee. However, companies that are exempt from state unemployment taxes do not qualify for the FUTA credit.

Is a FUTA tax based on wages?

Although the amount of the FUTA payroll tax is based on employees' wages, it is imposed on employers only, not their employees. In other words, it is not deducted from a worker's wages. In this way, FUTA tax differs from other payroll taxes, such as Social Security tax, which applies to both employers and employees.

Does a child's wages count as a FUTA?

Wages that an employer pays to their spouse, a child under the age of 21, or parents do not count as FUTA wages. Furthermore, payments such as fringe benefits, group term life insurance benefits, and employer contributions to employee retirement accounts are not included in the tax calculation for the federal unemployment tax.

For Wages Employers Paid in 2021

California employers fund regular Unemployment Insurance (UI) benefits through contributions to the state’s UI Trust Fund on behalf of each employee. They also pay Federal Unemployment Tax Act (FUTA) taxes to the federal government to help pay for:

FUTA Recertification

The IRS uses the FUTA recertification process to make sure the total taxable wages you claimed on the Employer’s Annual Federal Unemployment (FUTA) Tax Return (Form 940) or the federal Household Employment Taxes (Form 1040, Schedule H) were paid to the state. You must meet both the state and federal payroll tax requirements.

What is state unemployment tax?

State unemployment tax is a percentage of an employee’s wages. Each state sets a different range of tax rates. Your tax rate might be based on factors like your industry, how many former employees received unemployment benefits, and experience. You pay SUTA tax to the state where the work is taking place. If your employees all work in the state ...

How long does it take for a state to change the unemployment rate?

The amount of time depends on the state. You may receive an updated SUTA tax rate within one year or a few years. Most states send employers a new SUTA tax rate each year. Generally, states have a range of unemployment tax rates for established employers.

How to get SUTA tax rate?

How to get your SUTA tax rate. When you become an employer, you need to begin paying state unemployment tax. To do so, sign up for a SUTA tax account with your state. You can register as an employer online using your state’s government website.

Where do you pay suta tax?

You pay SUTA tax to the state where the work is taking place. If your employees all work in the state your business is located in, you will pay SUTA tax to the state your business is located in. But if your employees work in different states, you will pay SUTA tax to each state an employee works in. States also set wage bases for unemployment tax.

Does Suta include taxes?

For some states, this SUTA tax rate includes other taxes. Contact your state for more information.

Will Texas release unemployment tax information in 2021?

** Some states are still finalizing their SUI tax information for 2021 (as indicated with a blank). For example, Texas will not release 2021 information until June due to COVID-19. We will update this information as the states do. State.

Do you have to pay unemployment taxes?

When you have employees, you must pay federal and state unemployment taxes. These taxes fund unemployment programs and pay out benefits to employees who lose their jobs through no fault of their own. Generally, unemployment taxes are employer-only taxes, meaning you do not withhold the tax from employee wages.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA), with state unemployment systems, provides for payments of unemployment compensation to workers who have lost their jobs. Most employers pay both a Federal and a state unemployment tax.

Does the employer pay FUTA?

Only the employer pays FUTA tax; it is not deducted from the employee's wages. For more information, refer to the Instructions for Form 940. U.S. Citizens and Resident Aliens Employed Abroad - FUTA. Aliens Employed in the U.S. - FUTA. Persons Employed in U.S. Possessions - FUTA.