How to find principal in simple interest?

Simple Interest Formulas and Calculations:

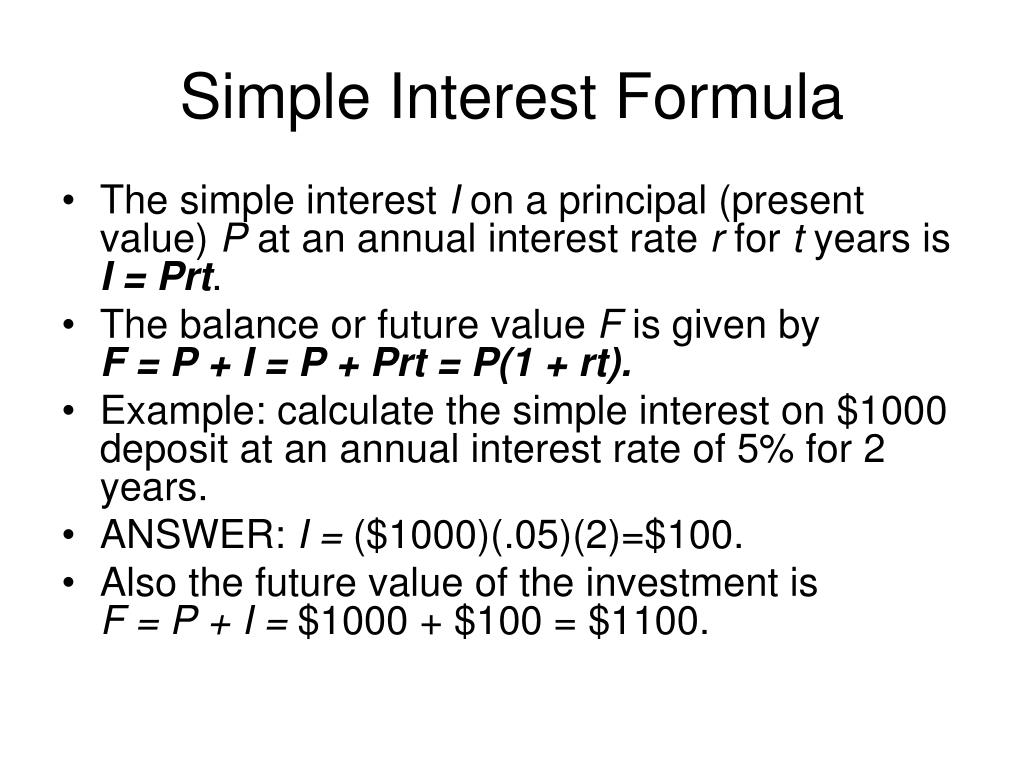

- Calculate Total Amount Accrued (Principal + Interest), solve for A A = P (1 + rt)

- Calculate Principal Amount, solve for P P = A / (1 + rt)

- Calculate rate of interest in decimal, solve for r r = (1/t) (A/P - 1)

- Calculate rate of interest in percent R = r * 100

- Calculate time, solve for t t = (1/r) (A/P - 1)

How do you calculate principal interest?

Simple Interest Equation (Principal + Interest)

- A = Total Accrued Amount (principal + interest)

- P = Principal Amount

- I = Interest Amount

- r = Rate of Interest per year in decimal; r = R/100

- R = Rate of Interest per year as a percent; R = r * 100

- t = Time Period involved in months or years

What is the formula for calculating simple interest?

- Simple Interest = INR 100,000 * (1 + 8% * 2)

- Simple Interest = INR 100,000 * 1.16

- Simple Interest = INR 116,000

How do you calculate interest on a principal?

You can calculate Interest on your loans and investments by using the following formula for calculating simple interest: Simple Interest= P x R x T ÷ 100, where P = Principal, R = Rate of Interest and T = Time Period of the Loan/Deposit in years.

How do you find the principal in simple interest?

The formula for calculating Principal amount would be P = I / (RT) where Interest is Interest Amount, R is Rate of Interest and T is Time Period.

What is principal in simple interest?

SI = Simple interest. P = Principal (sum of money borrowed) R = Rate of interest p.a.

How do you calculate principal and rate?

Simple Interest Formulas and Calculations:Calculate Total Amount Accrued (Principal + Interest), solve for A. A = P(1 + rt)Calculate Principal Amount, solve for P. P = A / (1 + rt)Calculate rate of interest in decimal, solve for r. r = (1/t)(A/P - 1)Calculate rate of interest in percent. ... Calculate time, solve for t.

What is the formula of principal when interest and amount is given?

It plays an important role in determining the amount of interest on a loan or investment. The formulas for both the compound and simple interest are given below....Interest Formulas for SI and CI.Formulas for Interests (Simple and Compound)SI FormulaS.I. = Principal × Rate × TimeCI FormulaC.I. = Principal (1 + Rate)Time − Principal

What is the principal formula?

The formula for calculating the principal amount when there is simple interest is P = I / (RT), which is the interest amount divided by the interest rate times the amount of time.

How do you solve principal?

To find the principal, divide the amount of interest by the product of the interest rate and the time of the loan in years.

What is the principal amount?

Principal is the money that you originally agreed to pay back. Interest is the cost of borrowing the principal. Generally, any payment made on an auto loan will be applied first to any fees that are due (for example, late fees).

How do you find the principal of a Class 7?

We can find the principal amount by using the formula of compound interest . C. I=P{(1+r100)n−1}.

What is the principal?

Definition of principal (Entry 2 of 2) 1 : a person who has controlling authority or is in a leading position: such as. a : a chief or head man or woman. b : the chief executive officer of an educational institution.

What is principal in math?

The total amount of money borrowed (or invested), not including any interest or dividends. Example: Alex borrows $1,000 from the bank. The Principal of the loan is $1,000. See: Interest.

What is principal amount?

Principal amount of a Home Loan The home loan principal amount is the amount of money initially borrowed from the lender, and as the loan is repaid, it can also refer to the amount of money still owed. If you avail a home loan of Rs. 50 lakhs, the principal is Rs. 50 lakhs.

What is the principal in compound interest?

P = principal amount (the initial amount you borrow or deposit) r = annual rate of interest (as a decimal) t = number of years the amount is deposited or borrowed for. A = amount of money accumulated after n years, including interest.

What is principal rate and time?

The principal is denoted by P. Rate: Rate is the rate of interest at which the principal amount is given to someone for a certain time, the rate of interest can be 5%, 10%, or 13%, etc. The rate of interest is denoted by R. Time: Time is the duration for which the principal amount is given to someone.

What is simple interest and example?

Simple Interest (S.I.) is the method of calculating the interest amount for a particular principal amount of money at some rate of interest. For ex...

What is simple interest and compound interest?

By definition, simple interest is the interest amount for a particular principal amount of money at some rate of interest. In contrast, compound in...

What are the types of simple interest?

Simple interest can be considered as two categories when the time is considered in terms of days. They are ordinary and exact simple interests. Ord...

What are the 2 types of interest?

In our daily lives, the two types of interest we generally deal with are simple interest and compound interest.

How do I calculate S.I.?

To calculate the SI for a certain amount of money (P), rate of interest (R) and time (T), the formula is: SI = (PTR)/100 Here, SI = Simple inter...

1. What Does an Interest in Mathematics Signify?

Interest typically denotes a change in principal or the primary sum of money one has. That said, if you hold a savings account, the interest is bou...

2. What is a Compound Interest? How Does it Differ from Simple Interest?

A key difference between compound Interest and simple interest lies in the way their respective interest is calculated. While a Compound interest i...

3. Can We Compound Interest Rates Only Annually?

No, we can have interest rates compounded half yearly or quarterly as well. The time after which the interest is supplemented each time to create a...

What is Simple Interest?

Simple Interest (S.I) is the method of calculating the interest amount for some principal amount of money. Have you ever borrowed money from your siblings when your pocket money is exhausted? Or lent him maybe? What happens when you borrow money? You use that money for the purpose you had borrowed it in the first place. After that, you return the money whenever you get the next month’s pocket money from your parents. This is how borrowing and lending work at home.

How many days does simple interest take?

They are ordinary and exact simple interests. Ordinary simple interest is a SI that takes only 360 days as the equivalent number of days in a year. On the other hand, Exact simple interest is a SI that takes exact days in 365 for a normal year ...

What is the difference between compound interest and simple interest?

The major difference between simple and compound interest is that simple interest is based on the principal amount of a deposit or a loan whereas the compound interest is based on the principal amount and interest that accumulates in every period of time.

What are the two types of interest?

In our daily lives, the two types of interest we generally deal with are simple interest and compound interest.

How to calculate simple interest?

While computing the time period in order to calculate simple interest we need to take into account the following: 1 We do not count the day on which the money is borrowed but we count the day for which the money is returned. 2 When the sum is borrowed in terms of years, we always convert the number of days into a year and thus divide the number of days by 365, whether it is a leap year or a standard year.

How is compound interest calculated?

While a Compound interest is computed on the principal amount plus the interest for the previous time period. The principal amount is increased with every time period, since the interest payable for the previous period is added to the principal of the following period. This also suggests that interest is not only gained on the principal, but also on the interest of the previous time periods. Thus, it also brings to the declaration that the compound interest calculated will always be more than the simple interest on the same amount of money borrowed/lent.

What does interest mean in savings?

That said, if you hold a savings account, the interest is bound to increase your bank account balance based upon the interest rate received from the bank. On the other hand, if you raised a loan, the interest is bound to increase the amount you owe based upon the rate of interest charged by the bank.

What is interest in finance?

Interest is the extra money that the borrower pays for using the lender’s money

When the sum is borrowed in terms of years, we always convert the number of days into a year?

When the sum is borrowed in terms of years, we always convert the number of days into a year and thus divide the number of days by 365, whether it is a leap year or a standard year.

Can interest rates be compounded quarterly?

No, we can have interest rates compounded half yearly or quarterly as well. The time after which the interest is supplemented each time to create a new principal is the conversion period. For example, when the interest is compounded half yearly, there will be two conversion periods in a year each after 6 months and for quarterly there will be 4 conversion periods in a year each after 3 months.

How to calculate simple interest?

Simple Interest (SI) is a way of calculating the amount of interest that is to be paid on the principal and is calculated by an easy formula, which is by multiplying the principal amount with the rate of interest and the number of periods for which the interest has to be paid. How to Provide Attribution?

How to calculate equated monthly amount in Excel?

We can calculate the equated monthly amount in excel using the PMT function Using The PMT Function The PPMT function in Excel is a financial function that calculates the payment for a given principal and returns an integer result. This function can be used to calculate the principal amount of an installment for any period. read more.

Is compound interest less than simple interest?

Returns calculated under simple interest will always be less than returns calculated under compound interest as it ignores the concept of compounding.

Is interest paid on savings bank accounts based on simple interest?

Also, the interest paid on savings bank accounts and term deposits by banks is also based on simple interest.

What is simple interest?

Simple interest is a calculation of interest that doesn’t take into account the effect of compounding. In many cases, interest compounds with each designated period of a loan, but in the case of simple interest, it does not. The calculation of simple interest is equal to the principal amount multiplied by the interest rate, ...

What is the basis point of interest rate?

Basis Points (BPS) Basis Points (BPS) are the commonly used metric to gauge changes in interest rates. A basis point is 1 hundredth of one percent. (BPS). It may be worth your while, as a financial professional, to learn how to convert BPS into interest rates.

What is the effective annual interest rate?

Effective Annual Interest Rate The Effective Annual Interest Rate (EAR) is the interest rate that is adjusted for compounding over a given period. Simply put, the effective

How much does Sara want to borrow from her mother?

Sara wants to borrow money from her mother, and she is offered a five-year, non-compounding loan of $7,000, with a 3% annual interest rate. What is Sara’s total interest expense?

Is compound interest better than simple interest?

For a borrower, simple interest is advantageous, since the total interest expense will be less without the effect of compounding. For a lender, compound interest is advantageous, as the total interest expense over the life of the loan will be greater.

Is a mortgage based on compounding?

It may be surprising to learn that most mortgages are based on non-compounding interest. Even though the principal payments vary, the interest is always considered as currently paid in full, and thus there is no compounding effect on the interest itself.

How to calculate simple interest?

Simple interest is calculated by multiplying the daily interest rate by the principal, by the number of days that elapse between payments. Simple interest benefits consumers who pay their loans on time or early each month. Auto loans and short-term personal loans are usually simple interest loans. 1:42.

How does simple interest work?

To understand how simple interest works, consider an automobile loan that has a $15,000 principal balance and an annual 5% simple interest rate. If your payment is due on May 1 and you pay it precisely on the due date, the finance company calculates your interest on the 30 days in April. Your interest for 30 days is $61.64 under this scenario. However, if you make the payment on April 21, the finance company charges you interest for only 20 days in April, dropping your interest payment to $41.09, a $20 savings.

Who Benefits From a Simple Interest Loan?

Because simple interest is often calculated on a daily basis, it mostly benefits consumers who pay their bills or loans on time or early each month.

What Types of Loans Use Simple Interest?

Simple interest usually applies to automobile loans or short-term personal loans. In the U.S., most mortgages on an amortization schedule are also simple interest loans, although they can certainly feel like compound interest ones .

Why is Simple Interest "Simple"?

"Simple" interest refers to the straightforward crediting of cash flows associated with some investment or deposit. For instance, 1% annual simple interest would credit $1 for every $100 invested, year after year. Simple interest does not, however, take into account the power of compounding, or interest-on-interest, where after the first year the 1% would actually be earned on the $101 balance—adding up to $1.01. The next year, the 1% would be earned on $102.01, amounting to $1.02. And so one.

What Are Some Financial Instruments That Use Simple Interest?

Most coupon-paying bonds utilize simple interest. So do most personal loans, including student loans and auto loans, and home mortgages.

What happens when you make a payment on a simple interest loan?

When you make a payment on a simple interest loan, the payment first goes toward that month’s interest, and the remainder goes toward the principal. Each month’s interest is paid in full so it never accrues. In contrast, compound interest adds some of the monthly interest back onto the loan; in each succeeding month, you pay new interest on old interest.

What is Simple Interest ?

Simple interest is interest calculated on the principal portion of a loan or the original contribution to a savings account. Simple interest does not compound, meaning that an account holder will only gain interest on the principal, and a borrower will never have to pay interest on interest already accrued.

How to Calculate Principal amount for Simple Interest?

Principal amount for Simple Interest calculator uses Principal Investment Amount = (Simple Interest*100)/ (Rate of Interest*Time) to calculate the Principal Investment Amount, Principal amount for Simple Interest, is the money borrowed from a lender at given simple interest rate for the specified time.

What is the formula for simple interest?from vertex42.com

"Simple Interest" is different than "Compound Interest". You don't earn interest on interest, and you don't pay interest on interest. The formula is indeed simple because it only involves multiplication: Formula #1. I = Prn.

How to calculate interest rate on a loan?from vertex42.com

Example 1: You take out a loan of $10,000 that charges a annual rate of 6%. Using formula #1, the interest you pay on your first monthly payment is $10000* (6/100)/12*1=$50. Using formula #2 and the calculator, enter P=10000, r=6, and 1 month.

What is my interest rate?from thecalculatorsite.com

An interest rate is a percentage that is charged by a lender to a borrower for an amount of money. This translates as a cost of borrowing. You may be borrowing the money from someone (loan) or lending it to them (savings or investment).

What interest rate am I receiving on my investment/savings?from thecalculatorsite.com

To calculate the rate of return on an investment or savings balance, we use an adapted version of the compound interest formula used in our calculators. We enter into the formula your current balance, original principal amount, number of compounds per year and time period and the formula gives us a resulting balance figure.

What is floating interest rate?from calculator.net

The interest rate of a loan or savings can be "fixed" or "floating". Floating rate loans or savings are normally based on some reference rate, such as the U.S. Federal Reserve (Fed) funds rate or the LIBOR (London Interbank Offered Rate). Normally, the loan rate is a little higher and the savings rate is a little lower than the reference rate. The difference goes to the profit of the bank. Both the Fed rate and LIBOR are short-term inter-bank interest rates, but the Fed rate is the main tool that the Federal Reserve uses to influence the supply of money in the U.S. economy. LIBOR is a commercial rate calculated from prevailing interest rates between highly credit-worthy institutions. Our Interest Calculator deals with fixed interest rates only.

Why do borrowers want the lowest interest rates?from calculator.net

Generally, borrowers want the lowest possible interest rates because it will cost less to borrow ; conversely, lenders (or investors) seek high interest rates for larger profits. Interest rates are usually expressed annually, but rates can also be expressed as monthly, daily, or any other period.

What is the most important determinant of the favorability of the interest rates borrowers receive?from calculator.net

Although individual credit standing is one of the most important determinants of the favorability of the interest rates borrowers receive, there are other considerations they can take note of.

What is the total amount accrued, principal plus interest, from simple interest on a principal of $10,000.00?

The total amount accrued, principal plus interest, from simple interest on a principal of $10,000.00 at a rate of 3.875% per year for 5 years is $11,937.50.

How to find the final investment value?

Use this simple interest calculator to find A, the Final Investment Value, using the simple interest formula: A = P (1 + rt) where P is the Principal amount of money to be invested at an Interest Rate R% per period for t Number of Time Periods. Where r is in decimal form; r=R/100; r and t are in the same units of time.

What is the accrued amount of an investment?

The accrued amount of an investment is the original principal P plus the accumulated simple interest, I = Prt, therefore we have:

This is Expert Verified Answer

the formula for calculating simple interest is Simple interest = Principal - Rate + Time

What is simple interest?

Simple interest is a calculation of interest that doesn’t take into account the effect of compounding. In many cases, interest compounds with each designated period of a loan, but in the case of simple interest, it does not.

What is principal?

Principal is most commonly used to refer to the original sum of money borrowed in a loan or put into an investment. It can also refer to the face value of a bond, the owner of a private company, or the chief participant in a transaction.