Fundamentals of Accounting: Meaning, Principles, Categories, and Statements

- Fundamentals of Accounting Accounting is the procedure of data entry, recording, summarizing, analyzing, and then reporting the data related to financial transactions of businesses and corporations. ...

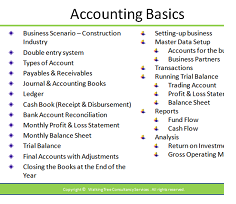

- Accounting Categories There are five types of accounts category in this system: ...

- Journal and Ledger in Accounting ...

- Double Entry System ...

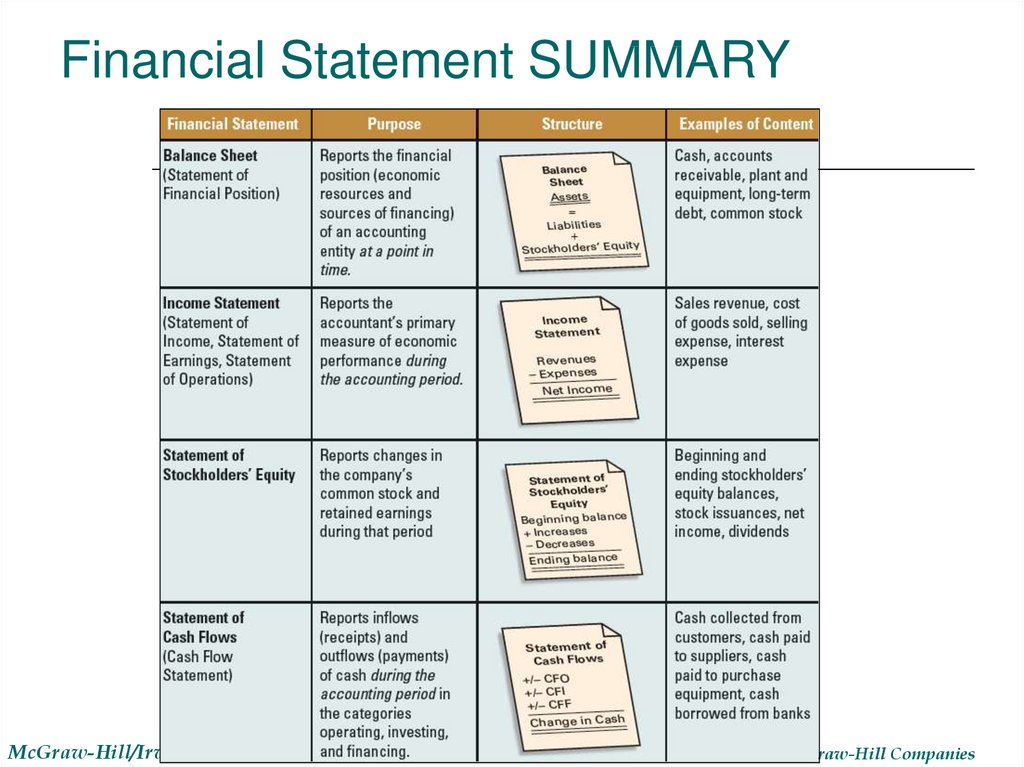

- Financial Statements ...

- Fields of Accounting ...

How to prepare for fundamentals of accounting?

Part 3 Part 3 of 4: Learning Financial Statements

- Know how financial statements are created. Financial statements reflect the current financial health of the business and its financial performance over the last accounting period.

- Learn how to create an income statement. An income statement is the most basic principle of accounting.

- Create a balance sheet. ...

- Generate a statement of cash flows. ...

What are the fundamentals of the accounting process?

Summary: Fundamental accounting concepts

- A. Basic Accounting Principles. Accounting assumptions and principles provide the bases in preparing, presenting and interpreting general-purpose financial statements.

- B. Elements of Accounting. The elements of accounting pertain to assets, liabilities, and capital. ...

- C. Accounting Equation. ...

- D. Double Entry Accounting System. ...

- E. The Accounting Cycle. ...

What are the basic concepts of accounting?

What are the three fundamental concepts of accounting?

- Accruals concept. The accruals concept states that revenues can be recognised only when they are earned, and expenses, when assets are used.

- Going concern concept. In accounting, it is always assumed that a business remains in operation in future time periods. ...

- Economic entity concept. ...

How to learn basic accounting?

Part – 2 – Learn Basic Accounting – Balance Sheet

- A Typical Balance Sheet

- Assets –. Assets are a firm’s economic resources. ...

- Current Assets and Long Term Assets. ...

- Liabilities –. ...

- Shareholder’s Equity –. ...

- A = L + E

- Common Stock and Retained Earnings.

- Common Stock. ...

- This is the most crucial LINK between the Balance Sheet and the Income Statement. ...

What are the five fundamentals of accounting?

The revised Code establishes a conceptual framework for all professional accountants to ensure compliance with the five fundamental principles of ethics:Integrity.Objectivity.Professional Competence and Due Care.Confidentiality.Professional Behavior.

Why is fundamentals of accounting important?

Why Is Accounting Important? Accounting plays a vital role in running a business because it helps you track income and expenditures, ensure statutory compliance, and provide investors, management, and government with quantitative financial information which can be used in making business decisions.

What are the 3 fundamentals of accounting?

So, here the students are going to learn about these 3 fundamental accounting assumptions which are known as Going Concern, Consistency, and Accrual.

What are the 4 fundamental concepts of accounting?

There are four main conventions in practice in accounting: conservatism; consistency; full disclosure; and materiality.

What is accounting in your own words?

Accounting is how your business records, organizes, and understands its financial information. You can think of accounting as a big machine that you put raw financial information into—records of all your business transactions, taxes, projections, etc.

Is fundamentals of accounting hard?

While accounting does require a complex set of skills and abilities, as well as excellent attention to detail, it really isn't any more difficult than many of the other popular fields of study that lead to excellent lifelong career opportunities.

What is golden rule of accounting?

Rule 1: Debit all expenses and losses, credit all incomes and gains. This golden accounting rule is applicable to nominal accounts. It considers a company's capital as a liability and thus has a credit balance. As a result, the capital will increase when gains and income get credited.

What are the 4 stages of accounting?

The first four steps in the accounting cycle are (1) identify and analyze transactions, (2) record transactions to a journal, (3) post journal information to a ledger, and (4) prepare an unadjusted trial balance.

What are 3 types of accounts?

3 Different types of accounts in accounting are Real, Personal and Nominal Account. Real account is then classified in two subcategories – Intangible real account, Tangible real account. Also, three different sub-types of Personal account are Natural, Representative and Artificial.

What are the 7 principles of accounting?

What Are the Basic Accounting Principles?Accrual principle.Conservatism principle.Consistency principle.Cost principle.Economic entity principle.Full disclosure principle.Going concern principle.Matching principle.More items...

What are the 6 golden rules of accounting?

The Golden Rules of AccountingDebit The Receiver, Credit The Giver. This principle is used in the case of personal accounts. ... Debit What Comes In, Credit What Goes Out. This principle is applied in case of real accounts. ... Debit All Expenses And Losses, Credit All Incomes And Gains.

What are the 7 basic accounting categories?

7 basic accounting conceptsRevenue. For a business, the total amount of money the company receives for selling services and products is its revenue. ... Expenses. Expenses are the costs a business incurs to generate revenue. ... Assets. ... Liabilities. ... Capital. ... Accounts. ... Financial statements.

What are the fundamentals of accounting?

Fundamentals of Accounting: Meaning, Principles, Categories, and Statements. Accounting is the procedure of data entry and recording, summarising, analyzing, and then reporting. This data relates to financial transactions of businesses and corporations. Operations of a business entity over an accounting period, generally a year, ...

Why is managerial accounting important?

Managerial Accounting is useful to prepare reports for internal use and hence is critical for decision making and control.

What is the principle of income earned during an accounting period?

This principle directs that income earned during an accounting period is compared with corresponding expenditure. Similarly, all the costs related to the sale or revenue reported in a particular period be taken into account in that period only.

How many sides does each financial transaction have?

Thereby each transaction will have: two sides for every financial transaction; the entries will be under any of the five categories of accounts; every account “Debited” shall have a corresponding “Credit” entry in other reports. That’s how the sum of all debits will always be equal to the amount of all credits.

How many areas of accounting are there?

There are three main areas or fields of Accounting.

Why do companies use accounts?

A company uses accounts to measure where it stands in the economic sense. They help in decision making as well as cost planning and assessment. Above all, accounting reports are of utmost importance to outside entities as well- namely the investors, creditors, and regulatory bodies.

What is the principle of books of accounts?

This principle states that an entity’s books of accounts should fully disclose all the relevant information to its users. Also, there should be no deliberate concealment of information. The idea and objective are that concerned people should be able to make proper and well-informed decisions based on the reports.

Course content

This free course, Fundamentals of accounting, will introduce you to the essential concepts and skills of bookkeeping and accounting in four weeks.

Course content

In this week you will learn about the key differences between bookkeeping and accounting and how accounting gives answers to four fundamental financial questions. You will also learn how a business can make a profit yet have negative cash flow.

Take your learning further

Making the decision to study can be a big step, which is why you'll want a trusted University. The Open University has 50 years’ experience delivering flexible learning and 170,000 students are studying with us right now. Take a look at all Open University courses.

How to increase an asset?

The general rules are: to increase an asset, you debit it; to decrease an asset, you credit it. The opposite applies to liabilities and capital: to increase a liability or a capital account, you credit it; to decrease a liability or a capital account, you debit it. Expenses are debited when incurred, and income is credited when earned. See Full Tutorial

What are the elements of accounting?

The elements of accounting pertain to assets, liabilities, and capital. Assets are resources owned by a company; liabilities are obligations to creditors and lenders; and capital refers to the interest of the owners in the business after deducting all liabilities from all assets (or, what is left for the owners after all company obligations are ...

What is capital in business?

Capital. Capital refers to the interest of the owner/s of the business. The owner's interest is the value of total assets left after all liabilities to creditors and lenders are settled. Capital is increased by contributions by the owner/s and income.

What are non-current liabilities?

Non-current liabilities include those that do not meet the above criteria. Examples of non-current liabilities are: Loans Payable and Bonds Payable which are long-term in nature, and Deferred Tax Liabilities.

What are the steps of the accounting cycle?

The accounting cycle is a sequence of steps in the collection, processing, and presentation of accounting information. It is made up of the following steps: 1 Identifying and analyzing business transactions and events 2 Recording transactions in the journals 3 Posting journal entries to the ledger 4 Preparing an unadjusted trial balance 5 Recording and posting adjusting entries 6 Preparing an adjusted trial balance 7 Preparing the financial statements 8 Recording and posting closing entries 9 Preparing a post-closing trial balance

Why does the balance of the equation always stay in balance?

Nonetheless, the equation always stays in balance. This is due to the two-fold effect of transactions. The total change on the left side is always equal to the total change on the right. Thus, the resulting balances of both sides will always be equal.

What is the time period assumption?

Time Period Assumption – The indefinite life of an enterprise is subdivided into time periods or accounting periods which are usually of equal length for the purpose of preparing financial reports.

Accounting Principles

- The rules and procedures that businesses ought to obey in reporting financial information are accounting standards. The FASB publishes a formal collection of accounting standards in the U.S. that are known as GAAP. The ultimate objective of all accounting standards is to ensure the completeness, consistency, and comparability of an organization’s f...

GAAP

- Publically listed stock market companies in the US must annually submit commonly recognized accounting standards or GAAP-compliant financial statements to stay listed on the stock exchange. CEOs and their independent auditors in publicly listed firms have to report the financial statements and associated notes that have been prepared according to the GAAP. The standard…

IFRS

- Accounting rules vary in various countries. The IASB issued International Financial Reporting Standards (IFRS). These principles are applied in more than 120 countries, including the EU. The US government body for protecting customers and keeping order in financial markets, the Securities and Exchange Commission (SEC), has stated that the US is going to not turn to IFRS s…

Five Accounting Heads

- The five main accounting heads or categories are; 1. Assets 2. Liabilities 3. Equity 4. Income 5. Expense These heads are used as the basis for debiting and crediting accounts. The main accounting equation used as the basis of accounting is; “Assets = Liabilities + Equity” A journal entry for a corporate organization is the foundation of all accounts. On each account, it consists …

Conclusion

- These above-mentioned principles are just the basics of accounting. Accounting goes beyond the principles and rules of accounting and steps into ethical boundaries where the real challenge begins. As accounting practices vary in other countries around the world, analysts should be careful to compare firms’ financial statements from various countries. In more developed countr…