Is the harp program worth it?

The Home Affordable Refinance Program, or HARP, is one of the few financial bailout programs Dave Ramsey says actually works. To understand why HARP is a great option for certain homeowners, we’ll walk you through a closer look at what HARP is, who qualifies to take advantage of it, and what the benefits of this program are.

Is the harp program still available?

Yes, HARP replacement programs FMERR and HIRO are run by legitimate mortgage agencies regulated by the Federal Housing Finance Agency. These programs are available from mortgage lenders nationwide....

What is the harp program and who qualifies?

Program. The Home Affordable Refinance Program (HARP) was created by the Federal Housing Finance Agency in March 2009 to allow those with a loan-to-value ratio exceeding 80% to refinance without also paying for mortgage insurance. Originally, only those with an LTV of 105% could qualify. Later that same year, the program was expanded to include ...

Is the harp program legitimate?

You Must Qualify with a HARP-Approved Lender. Your Loan Must Be Owned By Fannie Mae or Freddie Mac. Your Loan Must Have Originated By May 31, 2009. Is the national home relief program legitimate? Yes, it is a real program offered via local and national. lenders who are Freddie Mac approved. However, be aware of gimmicky advertisements that promise “$3,120 per year savings” and similar claims.

What is the new program that replaced HARP?

Freddie Mac Enhanced Relief RefinanceWhat is the current HARP replacement program? FMERR is the HARP replacement for borrowers with Freddie Mac loans. This stands for 'Freddie Mac Enhanced Relief Refinance. ' HIRO, which stands for 'High LTV Refinance Option,' is the HARP replacement program for borrowers with Fannie Mae loans.

Is HARP a legitimate government program?

HARP is a program created by the Federal Housing Finance Agency to help borrowers who owe too much on their mortgages relative to what their homes are worth. The program was needed after the housing crisis reduced the value of many borrowers' homes, leaving a lot of homeowners underwater or nearly so.

Does the harp program still exist?

While HARP didn't decrease the amount they owed, borrowers benefited from lower interest rates and monthly payments. Although the program no longer exists, Fannie Mae and Freddie Mac continue to offer refinancing options for borrowers.

What is the government HARP program?

The Home Affordable Refinance Program (HARP) was a program offered by the Federal Housing Finance Agency to homeowners who own homes that are worth less than the outstanding balance on the loan. The program has since ended, but it was intended to provide relief after the financial crisis of 2008.

Who is eligible for HARP refinance?

Income limits: This program has no income limits. Credit: The minimum credit score for a one- to four-unit primary resi- dence is 660. Occupancy and ownership of other properties and property type: HARP refinances may be performed on primary residences, investment properties, and second homes (single units only).

Are HARP loans forgiven?

No, HARP does not forgive your mortgage balance, nor does it reduce your principal owed. A HARP loan will refinance your current loan balance only.

How many times can you use the HARP program?

You can use this Freddie Mac program to refinance your mortgage as many times as you want, whereas with HARP, you were limited to only one time. Unfortunately, though, if you were a beneficiary of HARP, you aren't able to refinance again through the Freddie Mac Enhanced Relief Refinance.

Is HARP a Medicare?

HARP is a secure identity management portal provided by the Centers for Medicare & Medicaid Services (CMS). Creating an account via HARP provides users with a user identification (ID) and password that can be used to sign in to many CMS applications.

What does HARP loan mean?

Home Affordability Refinance ProgramThe Home Affordability Refinance Program, better known as HARP, enabled qualified U.S. homeowners with little or no equity in their homes to refinance their mortgages.

Is HARP an FHA loan?

For an adjustable-rate mortgage, you can choose between a five-, seven- or 10-year term. To date, 3.3 million homeowners have refinanced under the HARP program. But HARP refinances only apply to Fannie Mae and Freddie Mac loans closed before June 2009. The program does not apply to FHA, VA, balloon or Ginnie Mae loans.

What is Congress free refinance program?

What is the California Mortgage Relief Program? The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes. The program is absolutely free and the funds do not need to be repaid.

Who created the harp program?

the Federal Housing Finance AgencyThe HARP program (Home Affordable Refinance Program) was created by the Federal Housing Finance Agency in March 2009 to allow those with a loan-to-value ratio exceeding 80% to refinance.

Is the federal government support grant real?

Offers of free money from government grants are scams. Someone might offer you a grant to pay for education, home repairs, home business expenses, or unpaid bills. But they're all scams. Here's how to avoid a government grant scam, and how to report it.

Is HARP an FHA loan?

For an adjustable-rate mortgage, you can choose between a five-, seven- or 10-year term. To date, 3.3 million homeowners have refinanced under the HARP program. But HARP refinances only apply to Fannie Mae and Freddie Mac loans closed before June 2009. The program does not apply to FHA, VA, balloon or Ginnie Mae loans.

Is HARP a Medicare?

HARP is a secure identity management portal provided by the Centers for Medicare & Medicaid Services (CMS). Creating an account via HARP provides users with a user identification (ID) and password that can be used to sign in to many CMS applications.

Is free government grants legit?

The federal government does not offer grants or “free money” to individuals to start a business or cover personal expenses, contrary to what you might see online or in the media. Websites or other publications claiming to offer "free money from the government" are often scams.

How to refinance a home with HARP?

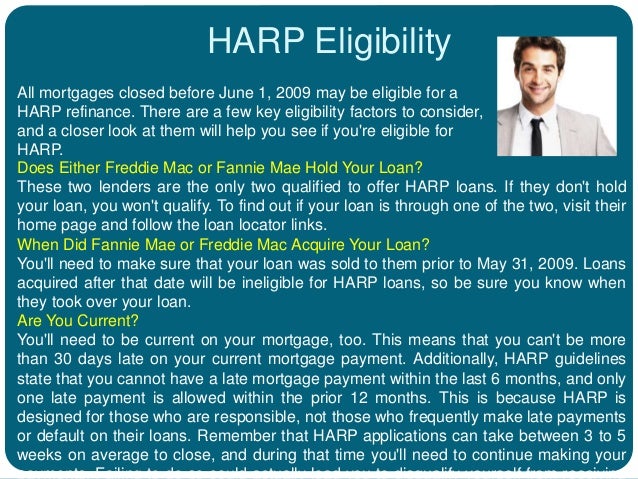

Qualifications for refinancing with HARP can vary greatly depending on your mortgage provider. However, the federal guidelines for eligibility are pretty straightforward: 1 You’re current on your mortgage—no late payments over 30 days in the last six months and no more than one in the past 12 months 2 Your home is your primary residence, a 1-unit second home, or a 1- to 4-unit investment property 3 Your loan is owned by Freddie Mac or Fannie Mae 4 Your loan was originated on or before May 31, 2009 5 Your current loan-to-value (LTV) ratio must be greater than 80%

How to calculate LTV ratio?

Calculating your LTV ratio is easier than it sounds! Just take the current amount you owe on your mortgage and divide that by the value of your home:

What documents do you need to refinance a mortgage?

Once you have your refinancing lender, they’ll ask you for two kinds of documents: your mortgage statements and income verification. In most cases, you’ll just need to show either pay stubs or income tax documents (such as your W2) to confirm your income.

What does it mean when your mortgage is underwater?

An underwater mortgage means you owe more on your home than it's worth. If this happens to you, don't panic. We'll walk you through your options.

When does the HARP mortgage expire?

HARP is set to expire December 31, 2018. If you think you could benefit from HARP, get in touch with the helpful experts at Churchill Mortgage who can determine your eligibility and guide you through the refinancing process. About the author. Ramsey Solutions.

What is the FHFA program?

To help homeowners like you, the Federal Housing Finance Agency (FHFA) established a program so you can take advantage of historically low interest rates and save hundreds (or even thousands) of dollars a year on your mortgage—all while not being required to pay extra to the bank.

How long has Ramsey Solutions been around?

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.