The Homeownership Voucher Program is for families who currently have a Section 8 Voucher (Housing Choice Voucher, HCV) from a participating Housing Authority. The Housing Authority can use that voucher to pay for monthly homeownership expenses. The PHA may make the HAP payment directly to the family or to the lender.

What to know about renting with vouchers?

Why Should I Become a Section 8/Housing Choice Voucher Landlord?

- Guaranteed rent. Renting to a Section 8 tenant means that property owners can count on consistently receiving a rental payment each month. ...

- Free Marketing. ...

- Free property inspections. ...

- Lower Vacancy Rates and Tenant Stability. ...

- Service to the Community. ...

How much do Housing Choice Vouchers pay?

Under the Section 8 Housing Choice Voucher program, most tenants will pay 30% of their monthly income. The Public Housing Authority that issued and approved the voucher will pay the landlord the remainder of the rent and utility costs. In cases where the market rate rent of a unit exceeds the payment standard set by the Public Housing Authority, tenants may be required to pay up to 40% of their monthly income.

What kind of home can youbuy with homeownership programs?

- New or existing homes

- Unit in a condo, townhome or PUD

- An entire duplex, triplex, or fourplex (must put down 5% or more and one unit must be owner-occupied)

What is the Housing Choice Voucher Program?

The housing choice voucher program is a program available through the U.S. Department of Housing and Development. Formerly, the program was known as Section 8. Housing choice vouchers assist very low-income families in choosing and leasing or purchasing safe, decent, sanitary and affordable housing in the private market.

How do I get a housing voucher in Washington state?

Public Housing and Housing Choice Vouchers (Section 8) To apply for either type of help, visit your local Public Housing Agency (PHA). Some PHAs have long waiting lists, so you may want to apply at more than one PHA. Your PHA can also give you a list of locations at which your voucher can be used.

Can I use my Section 8 voucher to buy a house in Florida?

Qualified THA applicants and program participants are now able to use their Section 8 Housing Choice Vouchers toward mortgages for their own homes.

What is the most Section 8 will pay?

The payments cover some or all of the voucher holder's rent. On average, each household will pay somewhere between 30% and 40% of its income on rent.

Can you buy a house on Section 8 in Washington state?

Housing Opportunities of SW Washington (HOSWWA) gives eligible participants in the Section 8 Housing Choice Voucher (HCV) program the option of purchasing a home with their Section 8 assistance rather than renting.

What qualifies as a first time home buyer in Florida?

To qualify for assistance, you generally must meet the following criteria:Be a first-time homebuyer.Have a credit score of at least 640.Take a homebuyer education course.Qualify for a loan with a participating lender.Fall below income limits in your area.

Can you use a Section 8 voucher anywhere in the United States?

If you have a Section 8 Voucher you can use it anywhere in the United States that has a public housing authority. Your program representative will contact any appropriate housing agency to arrange for your transfer.

What is the most HUD will pay for rent?

The maximum housing assistance is generally the lesser of the payment standard minus 30% of the family's monthly adjusted income or the gross rent for the unit minus 30% of monthly adjusted income.

How much is a Section 8 voucher for a 2 bedroom in California?

$2,452The Section 8 Voucher Payment Standard is the most the Housing Authority can pay to help a family with rent. The family's voucher will show the number of bedrooms authorized by the Housing Authority, based on the number of persons in the family....Voucher Payment Standards (VPS)Bedroom SizePayment Standard0$1,6601$1,9242$2,4523$3,2314 more rows

How much is a 3 bedroom voucher in California?

Voucher Payment StandardsBedroomsHousing Choice Voucher Payment Standard2$1,8103$2,4784$3,0505$3,5073 more rows

What is the income limit for Section 8 in Washington state?

To qualify for the Low Income Housing Program, a household's income must not exceed 80 percent of Area Median Income (AMI)...Income level - Low Income Public Housing.Number in Household30% AMI80% AMI1$27,200$66,7502$31,050$76,2503$34,950$85,8004$38,800$95,3006 more rows

Who qualifies for housing assistance in Washington State?

Households with income at or below 30% of the area median income will qualify to receive rental assistance through Section 8 program. If funds are available, PHAs can issue vouchers to households with income up to 50% of the area median income.

Do I have to accept Section 8 in Washington state?

WA landlords continue to turn away applicants with Section 8 vouchers, despite new law. The rules kicked in last September, but the state does not provide any enforcement on violators.

What is the maximum income for Section 8 in Florida?

Section 8/Housing Choice Voucher EligibilityMiami-Dade County, FL HMFA MFI: $59,100Extremely Low Income Limit 30% of MedianLow Income Limit 80% of Median1 Person$19,200$51,2002 Person$21,950$58,5003 Person$24,700$65,8004 Person$27,400$73,1004 more rows

Can I transfer my Section 8 to Florida?

Section 8(r) of The United States Housing Act of 1937 provides that Section 8/housing choice voucher participants may transfer to housing authority anywhere in the United States, Puerto Rico and U.S. Virgin Islands provided the housing authority administering the tenant-based program has jurisdiction over the area ...

How does Section 8 work in Florida for landlords?

Direct Payments To Landlord Generally, Section 8 vouchers pay for approximately 70% of the tenant's rent and utilities. These costs are tied directly to the landlord's bank account. The tenant then covers the remaining 30% of expenses using their own income. There is a higher rent limit, though.

What qualifies as low income in Florida?

As of 2022, the federal poverty line, which applies to Florida, is $13,590 for one person. That number increases by $4,720 for each additional family member, making $27,750 the 2022 federal poverty line for a family of four, according to HealthCare.gov.

Who is responsible for HAP payments?

The homeowner is responsible for all homeowner expenses not covered by the HAP payment. For instance, if the monthly homeownership expenses exceed the payment standard, the family is responsible for paying the difference in addition to the required family share. Continued Assistance.

What are the criteria for a family to qualify for housing choice?

In order to be eligible a family must meet the following criteria: The family must be a current voucher program participant or eligible for admission to the housing choice voucher program . The family must qualify as a first-time homeowner and have no ownership interest in a residential property.

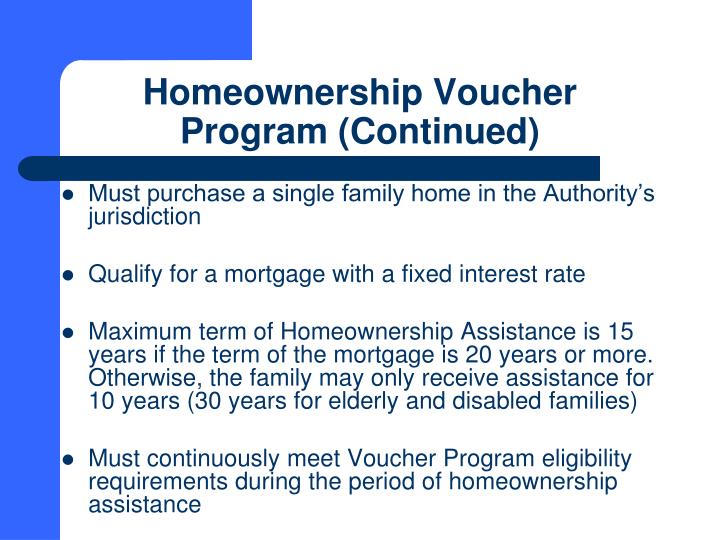

How long can you get Section 8 assistance?

Except for elderly and disabled families, Section 8 homeownership assistance may only be paid for a period of 10 to 15 years. There is no time limit on homeownership assistance for elderly and disabled families.

Is there a time limit on homeownership assistance?

There is no time limit on homeownership assistance for elderly and disabled families. Termination of Assistance. Reasons that NHA may deny or terminate homeownership assistance: The family does not comply with voucher program requirements at 24CFR 982.552 or for criminal activity as defined by 24CFR 982.553.

What is a Section 8 voucher?

The Homeownership Voucher Program is for families who currently have a Section 8 Voucher (Housing Choice Voucher, HCV) from a participating Housing Authority . The Housing Authority can use that voucher to pay for monthly homeownership expenses. You must call your local Housing Authority to see if they participate.

How long do you have to be employed to qualify for homeownership?

Except in the case of elderly and disabled families, one or more adults in the family who will own the home is currently employed on a full-time basis and has been continuously employed on a full-time basis for at least one year before commencement of homeownership assistance.

What is a PHA mortgage?

You must meet income, other eligibility requirements and must be able to obtain a mortgage from a lender. The PHA (Public Housing Authority ) uses its normal voucher program payment standard schedule to determine the amount of subsidy for the homeownership program.

How long does a family member have to own a home?

First-time homeowner or cooperative member. No family member has owned or had ownership interest in their residence for at least three years. Except for cooperative members, no member of the family has any ownership interest in any residential property. Minimum income requirement.

What is the minimum income required for a disabled person to own a home?

Except in the case of disabled families, the qualified annual income of the adult family members who will own the home must not be less than the Federal minimum hourly wage multiplied by 2,000 hours.

What is a housing voucher?

The Housing Choice Voucher Homeownership Program is a federally funded, locally administered homeownership assistance program that helps families, the elderly and persons with disabilities afford to purchase decent, safe housing in the private market.

How long can you get a mortgage on a home?

There is no time limit for the elderly or person with a disability. For all other families , there is a mandatory term limit of 15 years if the initial mortgage incurred to finance purchase of the home has a term that is 20 years or longer, and for all other cases the maximum term of homeownership assistance is 10 years.

Do you have to be a housing voucher holder to participate in the Housing Choice program?

Furthermore, all Housing Choice Voucher holders may not qualify or be deemed eligible to participate in the program.

Does welfare assistance count as income?

Except in the case of the elderly or persons with disabilities, welfare assistance is not counted in determining whether the family meets the minimum income requirement.

Is HCVHP mandatory?

Please be advised that this is an optional program for Housing Choice Voucher (HCV) holders. Housing Choice Voucher holders are not mandated nor are they required to participate in this program. Furthermore, all Housing Choice Voucher holders may not qualify or be deemed eligible to participate in the program.

How long does housing assistance last?

The assistance from the Housing Authority lasts for a maximum of 15 years (except elderly /disabled)

Is welfare assistance considered income?

Welfare assistance is not accepted as income , but would be used in calculating rent. Must have at least enough for DOWN PAYMENT and CLOSING costs (closing costs are approximately 6% of purchase price; 20% of the purchase price for down & closing is realistic )

Can HAP be used for mortgage?

Below is general information about the federal program that allows the HAP (Housing Assistance Payment) Subsidy to be used for a mortgage payment instead of rental assistance.

What is the Section 8 Homeownership Voucher Program?

Families who have been determined eligible for voucher assistance have the option—if they meet certain additional criteria—to look for a home to buy, rather than lease.

Who is eligible

BRHA may provide homeownership assistance to a family if it determines that the family satisfies all of the following initial requirements at commencement of homeownership assistance for the family:

When should Section 8 Housing Choice Voucher holder apply for homeownership voucher?

After one year in the Boca Raton Housing Authority Section 8 Housing Choice Voucher Program

Homeownership Regulations and Forms

Reports

- HCV homeownership enrollments report: this report shows the number of HCV families that have been assisted under the PHA’s HCV homeownership program in the past 5 years, as reported by the PHA in HUD’s IMS/PIC system. The report shows all new and current HCV homeownership families per year.

Resources For Implementation

- HCV Homeownership Webinar- In this one-hour webinar, housing industry panelists provide information to assist PHAs in developing successful relationships with lenders, utilizing down payment assistance and other financial resources for home buyers, and addressing the affordability gap to maintain and expand the HCV homeownership program.

Related Programs and Notices

- Housing counseling: the law requires that housing counseling required under or provided in connection with all HUD programs is provided by HUD Certified Housing Counselors. This statutory requirem...

- Homeownership fees: HUD provides a special $200 fee for every homeownership closing. More information may be found in the yearly notices implementing the funding provi…

- Housing counseling: the law requires that housing counseling required under or provided in connection with all HUD programs is provided by HUD Certified Housing Counselors. This statutory requirem...

- Homeownership fees: HUD provides a special $200 fee for every homeownership closing. More information may be found in the yearly notices implementing the funding provisions for the HCV program.

- Homebuying programs by State: provides more information about homebuying programs, other than the HCV homeownership program, in your State.