Key Takeaways

- Under the indirect method, the cash flow statement begins with net income on an accrual basis and subsequently adds and subtracts non-cash items to reconcile to actual cash flows from operations.

- The indirect method is often easier to use than the direct method since most larger businesses already use accrual accounting.

What is the difference between direct and indirect cash flow?

What’s the Difference Between Direct and Indirect Cash Flow Methods?

- Direct Cash Flow Statement. Companies applying the Direct method disclose major classes of gross cash receipts and cash payments.

- Indirect Cash Flow Statement. The Indirect method focuses on net income and non-cash adjustments. ...

- The Bottom Line. ...

What is direct statement of cash flows?

Key Takeaways

- A cash flow statement (CFS) is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company.

- The CFS measures how well a company manages its cash position, meaning how well the company generates cash.

- The CFS complements the balance sheet and the income statement.

How to make a cash flow statement in Microsoft Excel?

- Hold the shift key to select all the cells from Cash Ending all the way to Net Cash Flow.

- Once done, type ctrl + c to copy them.

- Then, click on the corresponding cell for Cash Ending for the following month and type ctrl + v.

- Excel will automatically adjust these formulas to reflect the correct corresponding column.

What is personal cash flow?

The personal cash flow statement measures your cash inflows (money you earn) and your cash outflows (money you spend) to determine if you have a positive or negative net cash flow. A personal balance sheet summarizes your assets and liabilities in order to calculate your net worth.

What is the indirect method of cash flows?

The indirect method of cash flow uses accrual accounting, which is when you record revenue and expenses at the time a transaction occurs, rather than when you actually lose or receive the money. Using your income statement, you start with your company's net income as a base.

What is the indirect method of reporting cash flows from operating activities?

Under the indirect method, cash flow from operating activities is calculated by first taking the net income from a company's income statement. Because a company's income statement is prepared on an accrual basis, revenue is only recognized when it is earned and not when it is received.

What are the direct and indirect methods of reporting cash flows?

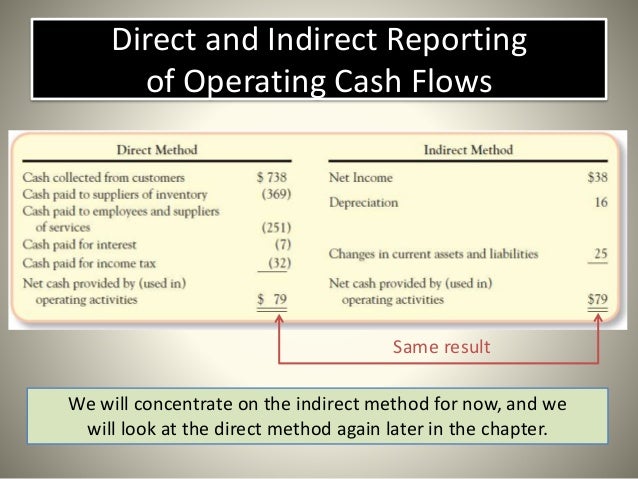

The cash flow direct method determines changes in cash receipts and payments, which are reported in the cash flow from the operations section. The indirect method takes the net income generated in a period and adds or subtracts changes in the asset and liability accounts to determine the implied cash flow.

What is the indirect method?

What is the Indirect Method? The indirect method is a method used in financial reporting in which the statement of cash flows begins with the net income before it is adjusted for the cash operating activities before an ending cash balance is achieved.

What is the difference between direct method and indirect method?

While both are ways of calculating your net cash flow from operating activities, the main distinction is the starting point and types of calculations each uses. The indirect method begins with your net income. Alternatively, the direct method begins with the cash amounts received and paid out by your business.

When using the indirect method to calculate and report the net cash provided or used?

When using the indirect method to calculate and report net cash provided or used by operating activities, which of the following is subtracted from net income? The first line item in the operating activities section of a spreadsheet for a statement of cash flows prepared using the indirect method.

What is the direct method of cash flows?

Under the direct cash flow method, you subtract cash payments—e.g., payments to suppliers, employees, operations—from cash receipts—e.g., receipt from customers—during the accounting period. This results in the computation of the net cash flow from the company's operating expenses.

Why most companies use the indirect method?

Many accountants prefer the indirect method because it is simple to prepare the cash flow statement using information from the other two common financial statements, the income statement and balance sheet.

Which is better direct or indirect cash flow?

Direct cashflow statement is broadly accurate as it does not rely on adjustments and hence it takes less to time prepare cashflows statements. The indirect cashflow method cannot be regarded as accurate as it accounts for adjustments and it generally requires more time in preparation.

Why is it called the indirect method?

The indirect method, as the name implies, looks at cash flow indirectly. This means that it uses increases and decreases in balance sheet accounts. Using the balance sheet changes, the indirect method modifies the operating section of the cash flow statement.

What is indirect method in statistics?

Indirect methods of data collection involve sourcing and accessing existing data that were not originally collected for the purpose of the study. This type of data is known as secondary data.

How do you calculate income tax paid in cash flow statement using indirect method?

How is Cash Tax Paid calculated?Summary. Cash Tax Paid is an estimate of the tax amount actually paid in a given period. ... Cash Tax Paid = Tax Expense. ... Net Interest (after tax) = Interest Expense - Interest Income - (Net Interest * (Tax Rate/100))

What is the cash flow from operating activities?

Cash flow from operating activities (CFO) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a service to customers. It is the first section depicted on a company's cash flow statement.

When using the indirect method to determine cash flows from operating activities Adjustments to net income should not include?

In determining cash flows from operating activities (indirect method), adjustments to net income should not include: An addition for a gain on sale of equipment.

How do you calculate cash flow from operating activities?

Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital.

What is indirect method in statistics?

Indirect methods of data collection involve sourcing and accessing existing data that were not originally collected for the purpose of the study. This type of data is known as secondary data.

What is the indirect method for a cash flow statement?

The indirect method for a cash flow statement is a way to present data that shows how much money a company spent or made during a certain period and from what sources. It takes the company's net income and adds or deducts balance sheet items to determine cash flow. Cash flow statements include three sections:

Where to put net income on cash flow statement?

Place the net income for the current financial period on the first line of the cash flow statement. You can list gains or losses on each line below this figure, adding or subtracting their totals from the net income as you go. Show deductions by placing them in parentheses.

Who monitors cash flow?

Business owners, investors, creditors and stakeholders monitor cash flow statements to assess a company's performance. An organization might prepare cash flow statements monthly, quarterly and/or annually.

How to use indirect cash flow method?

The indirect method starts with net income and then adjusts for all the sources and uses of cash that aren’t part of the income calculation. Results should be the same for either direct or indirect.

What is indirect cash flow?

This article looks at an alternative cash flow method, often called the indirect cash flow method, which projects cash flow by starting with net income and adding back depreciation and other noncash expenses, then accounting for the changes in assets and liabilities that aren’t recorded in the income statement.

What is the Statement of Cash Flows Indirect Method?

The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. In other words, changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to arrive at the operating cash flow.

What is the difference between direct and indirect methods?

The operating activities section is the only difference between the direct and indirect methods. The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows. This is not only difficult to create; it also requires a completely separate reconciliation that looks very similar to the indirect method to prove the operating activities section is accurate.

Which section of operating activities adjusts net income for changes in liability accounts affected by cash during the year?

The last section of the operating activities adjusts net income for changes in liability accounts affected by cash during the year. Here are some of the accounts that usually are used:

Why do companies prefer indirect or direct?

Companies tend to prefer the indirect presentation to the direct method because the information needed to create this report is readily available in any accounting system. In fact, you don’t even need to go into the bookkeeping software to create this report. All you need is a comparative income statement. Let’s take a look at the format and how to prepare an indirect method cash flow statement.

Why do standard setting bodies prefer direct reporting?

Standard setting bodies prefer the direct because it provides more information for the external users, but companies don’t like it because it requires an additional reconciliation be included in the report.

Do you add non cash expenses back in?

The non-cash expenses and losses must be added back in and the gains must be subtracted.

What is the difference between direct and indirect method?

In the indirect method, they are both physically removed from income by reversing their effect. The impact is the same in the indirect method as in the direct method.

How to remove negatives in indirect method?

In applying the indirect method, a negative is removed by addition; a positive is removed by subtraction.

What happens after all noncash items are removed from net income?

Question: After all noncash and nonoperating items are removed from net income, only the changes in the balance sheet connector accounts must be utilized to complete the conversion to cash. For Liberto, those balances were shown previously.

How much was EMC's inflow in 2008?

Question: When reporting cash flows from operating activities for the year ended December 31, 2008, EMC Corporation listed an inflow of over $240 million labeled as “dividends and interest received” as well as an outflow of nearly $74 million shown as “interest paid. ”

Is indirect method the same as direct method?

Answer: The indirect method actually follows the same set of procedures as the direct method except that it begins with net income rather than the business’s entire income statement. After that, the three steps demonstrated previously are followed although the mechanical process here is different.

Do organizations use the direct or indirect method to report operating activity cash flows?

Question: As mentioned, most organizations do not choose to present their operating activity cash flows using the direct method despite preference by FASB. Instead, this information is shown within a statement of cash flows by means of the indirect method. How does the indirect method of reporting operating activity cash flows differ from the direct method?

Is the gain on sale of equipment reported income?

The gain on sale of equipment also exists within reported income but as a positive figure. It helped increase profits this period. To eliminate this gain, the $40,000 amount must be subtracted. The cash flows resulting from this transaction came from an investing activity and not an operating activity.

What is indirect method of cash flow?

It makes the adjustments needed, i.e., adding and subtracting the variables to convert the total net income to cash amount from operations .

What is direct and indirect cash flow?

Direct and indirect are the two different methods used for the preparation of the cash flow statement of the companies with the main difference relates to the cash flows from the operating activities where in case of direct cash flow method changes in the cash receipts and the cash payments are reported in cash flows from the operating activities section whereas in case of indirect cash flow method changes in assets and liabilities accounts is adjusted in the net income to arrive cash flows from the operating activities.

What is cash flow from operations?

Cash Flow From Operational Activity Cash flow from Operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating business in an accounting year. Operating Activities includes cash received from Sales, cash expenses paid for direct costs as well as payment is done for funding working capital. read more

What is indirect method?

Definition. The indirect method uses net income as a base and adds non-cash expenses. Non-cash Expenses Non-cash expenses are those expenses recorded in the firm's income statement for the period under consideration; such costs are not paid or dealt with in cash by the firm.

What are the three sets of activities in a cash flow statement?

The cash flow statement contains three sets of activities, namely operating, investing, and financing . Usually, the investing and financing sections are calculated similarly. But when it comes to calculating cash flow from operational activity.

Which is more accurate, cash flow direct or indirect?

The accuracy of the cash flow indirect method is a little less as it uses adjustments. Comparatively, the cash flow direct method is more accurate as adjustments are not used here.

Which method makes sure to convert the net income in terms of cash flow automatically?

The cash flow indirect method makes sure to convert the net income in terms of cash flow automatically. The cash flow direct method, on the other hand, records the cash transactions separately and then produces the cash flow statement.

What's The Indirect Accounting Method?

- The indirect method for a cash flow statement is a way to present data that shows how much money a company spent or made during a certain period and from what sources. It takes the company's net income and adds or deducts balance sheet items to determine cash flow. Cash flow statementsinclude three sections: 1. Operating activities,such as sales of...

Indirect Accounting Method Template

- Input your company's information into this template to calculate cash flow through the indirect method: [Company name] Statement of Cash Flows For the [time period] ended [date] Cash flows from operating activities Net income: [Amount] Adjustments for: [Noncash activity]: [Amount] [Asset]: [Amount] [Asset]: [Amount] [Asset]: [Amount] [Liability]: [Amount] [Liability]: [Amount] Ne…

Indirect Accounting Method Example

- Here's an example of the indirect method for a cash flow statement: Hallmarq FeedsStatement of Cash FlowsFor the year ended Dec. 31, 2020 Cash flows from operating activitiesNet income: $25,000 Adjustments for: Depreciation on assets: $2,000 Accounts receivable: ($500) Inventory: ($20,000) Prepaid expenses: ($4,000) Accounts payable: $56,000 Net cash from operating activ…

What Is The Cash Flow Statement?

- The cash flow statement is one of the crucial financial statements prepared by companies. It provides details of cash transactions during a financial period. However, it does not report on profitability or other aspects of finances. While the income statement provides that information, it uses the accrual principle. On the other hand, the cash flow statement does not follow the same …

What Is The Indirect Method of Cash Flow Statement?

- The indirect method of cash flow statement is a format used to report cash transactions. This format starts with net profits or losses obtained from the income statement. Then, it adjusts for non-cash transactions and other items to that amount. Subsequently, it involves reporting cash flows in three areas. These include operating, investing, and f...

Conclusion

- The cash flow statement is one of the financial statements that reports cash activities. Companies use the indirect method, which reconciles accrual and cash accounting records. On the other hand, the direct approach does not have the same format. The indirect method is also a requirement under accounting standards.

Further Questions

- What's your question? Ask it in the discussion forum Have an answer to the questions below? Post it here or in the forum