What is the principal limit of a reverse mortgage?

What is the Principal Limit on a Reverse Mortgage? The principal limit on a reverse mortgage is the total amount of money that is available to a borrower who has been approved for a reverse mortgage. This amount is decided by a few factors, such as: The appraised value of the home; Amount of equity owned in the home; The age of the borrower; Current reverse mortgage interest rates

Is there a maximum age to qualify for a reverse mortgage?

Minimum Age. To qualify for a reverse mortgage, the homeowner must be at least 62 years of age. If the homeowners are married, both spouses must be 62 years old. There is no maximum age qualification.

Is reverse mortgage better than mortgage?

The answer is that it depends on the situation. They have many similarities, but there are a few key differences that make reverse mortgages a better choice than a traditional mortgage. Or vice versa. This article breaks down the basics of these two types of home loans to give you a general idea of when to choose one over the other.

What are the rules of reverse mortgage?

When you apply for a reverse mortgage, your lender will consider:

- your age, and the age of other individuals registered on the title of your home

- where you live

- your home’s condition, type and appraised value

What is the maximum amount I can get on a reverse mortgage?

2021 Reverse Mortgage Limits Officially $822,375! The U.S. Department of Housing and Urban Development (HUD) just announced that the reverse mortgage lending limit for the Home Equity Conversion Mortgage (HECM) program will be raised from $765,600 to $822,325 effective January 1, 2021.

What is the maximum claim amount?

Maximum Claim Amount means the amount of insurance coverage for a HECM Loan provided by the related HUD/FHA insurance thereon.

How do I calculate my maximum claim?

Maximum claim amount (MCA) The reverse mortgage maximum claim amount (MCA) is used to calculate proceeds and is equal to either the appraised value of the home or the FHA lending limit, whichever is less. For example, if the value of the home is $300,000, the maximum claim amount equals $300,000.

Does a reverse mortgage have a cap?

Although there isn't an exact reverse mortgage maximum loan amount, there is a limit for how much of a home's value a reverse mortgage can borrow against, which will in turn affect the maximum loan amount possible.

What is good claim settlement ratio?

The CSR higher than 80% is a good claim settlement ratio. If a company of more than 90% CSR is offering a great value product, it is more than welcome. Also look at the average claim settlement time taken but the company. This is a great indicator of the process efficiency of the company.

Which insurance company has highest claim settlement ratio?

The highest claim settlement ratio is of the public insurance company LIC at 98.31%.

How do you calculate loss of liability?

The loss ratio formula is insurance claims paid plus adjustment expenses divided by total earned premiums. For example, if a company pays $80 in claims for every $160 in collected premiums, the loss ratio would be 50%.

How long can you collect unemployment?

26 weeksWorkers in most states are eligible for up to 26 weeks of benefits from the regular state-funded unemployment compensation program, although nine states provide fewer weeks, and two provide more. Extended Benefits (EB) are not triggered on in any state.

How is unemployment calculated?

The headline unemployment rate is calculated by dividing the unemployment level for those aged 16 and over by the total number of economically active people aged 16 and over. Economically active is defined as those in employment plus those who are unemployed.

What Suze Orman says about reverse mortgages?

Suze Orman on her CNBC show recently responded to a viewer question by stating that a reverse mortgage is a better option than selling stocks.

Who benefits most from a reverse mortgage?

1. Helps Secure Your Retirement. Reverse mortgages are ideal for retirees who don't have a lot of cash savings or investments but do have a lot of wealth built up in their homes. A reverse mortgage allows you to turn an otherwise illiquid asset into cash that you can use to cover expenses in retirement.

Can you negotiate a reverse mortgage payoff?

Can You Negotiate A Reverse Mortgage Payoff? You might be able to negotiate with your lender to pay off the loan early and avoid foreclosure. Be sure to get everything in writing, including any verbal agreements.

What is the claim amount?

What is Claim Amount. Definition: Claim amount can be defined as the sum payable at the maturity of an insurance policy or upon death of the person insured to the beneficiary or the nominee or the legal heir of the insured.

What is the net claim amount?

The Net Claim is the amount paid to you, minus the deductible. You are responsible for meeting your home insurance deductible prior to any claims being paid out.

What is claim cost?

Claim Costs means the amounts paid out by the insurer to or on behalf of a claimant in relation to a claim or the legal costs (including disbursements) of the claimant relating to the claim as the result of the final settlement or verdict in relation to a claim (not the insurers general administration costs).

What's a claim payment?

Claim Payment means an amount payable to you under the Policy to compensate you for the credit losses you have sustained from unpaid insured receivables.

What is the maximum amount you can claim on a reverse mortgage?

The total appraised value of your home: If your home is worth $250,000 , then the maximum amount that you can claim on your reverse mortgage is $250,000.

Why does the FHA increase the MCA limit?

The FHA increases the limit on their MCA requirements every year to account for inflation and other factors.

How does MCA affect your money?

The precise way that the MCA affects your proceeds will depend, in part, on the method that you choose for receiving funding. If you choose to receive a lump sum, this lump sum will be determined by the maximum amount of equity you are able to claim, minus origination fees and taxes. If you receive monthly payments, the maximum amount you can claim will determine the size of each payment. And if you choose to use a line of credit, the size of your line of credit will be limited by the MCA, at least initially.

What is the maximum amount of unemployment in 2021?

The maximum claim amount in 2021 is $822,375. This is an increase from 2020, when the maximum claim amount was $765,600.

Is a HECM mortgage insured?

The Home Equity Conversion Mortgage (HECM) program is federally insured and regulated , which means that the Federal Housing Administration (FHA) sets limits on the maximum amount that can be claimed through a HECM reverse mortgage.

What is the maximum amount of a reverse mortgage?

The Maximum Claim Amount is actually an insurance term. Thinking of it that way will help in understanding where the number comes from. FHA has a maximum limit (currently $636,150) of home value that it will insure. Put simply, FHA is willing to insure a reverse mortgage for the appraised value of the home up to the maximum claim limit. Therefore, if a home is appraised by an FHA approved appraiser at $400,000, the Maximum Claim Amount will be $400,000. On the other hand, if a home is appraised by an FHA approved appraiser at $700,000, the Maximum Claim Amount will be $636,150 or the current maximum limit that FHA will insure.

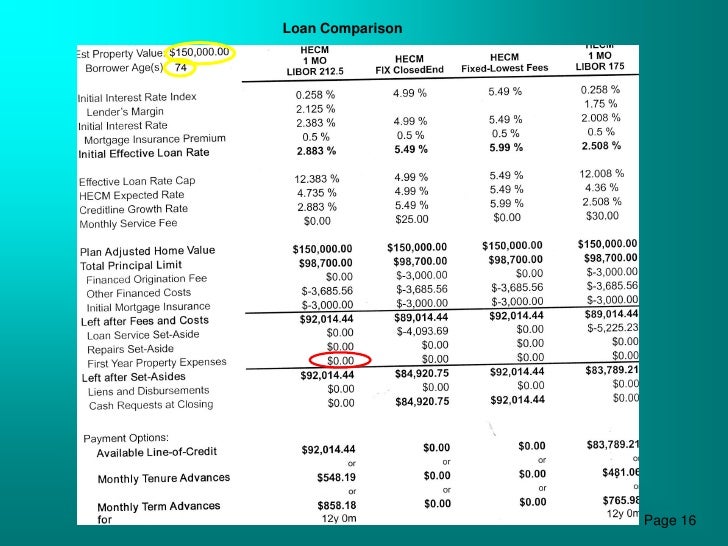

What is reverse mortgage comparison sheet?

In a face to face conversation, a loan officer will usually use a Reverse Mortgage Comparison Sheet to show what proceeds the homeowner can expect to receive. This sheet contains different loan products offered by the lender. Currently, only government insured Home Equity Conversion Mortgages known as HECMs are widely available. The primary differences will be whether the product is a fixed rate or monthly adjustable rate HECM.

Reverse Mortgage Question& Answers

2021 Reverse Mortgage Loan Limits | AKA, What Are the HECM Loan Amount Limits in 2021?

Tax Benefits In Reverse Mortgage Loan

Individuals availing a reverse mortgage loan can enjoy tax benefits under Section 10 of the Income Tax Act, 1961 where the loan amount is exempted from being taxed. Loan amount received by the borrower whether in a lump-sum form or as monthly installment will be exempted from being taxed despite it being a capital gain for the senior citizen.

Types Of Reverse Mortgages

There are three types of reverse mortgages. The most common is the home equity conversion mortgage . The HECM represents almost all of the reverse mortgages that lenders offer on home values below $765,600 and is the type that youre most likely to get, so thats the type that this article will discuss.

Proprietary & Jumbo Loan Limits

If you hope to borrow more than the maximum loan amount of a HECM loan, consider a proprietary or jumbo reverse mortgage. You may be able to borrow more with these reverse mortgages, because private lenders are not subject to HUD rules.

Who Is Responsible For The Reverse Mortgage Balance

Are heirs responsible for the reverse mortgage balance? Heirs inherit the property will need to repay the outstanding reverse mortgage balance by either refinancing into a traditional loan of their own, or by selling the home within 12 months. Any remaining equity in the property will belong to the heirs.

Avoiding Reverse Mortgage Scams

With a product as potentially lucrative as a reverse mortgage and a vulnerable population of borrowers who may either have cognitive impairments or be desperately seeking financial salvation, scams abound.

What An Equity Release Agreement Costs

It’s not a loan, so you don’t pay interest. Instead, you pay fees such as:

What is the maximum amount you can borrow on a reverse mortgage?

The FHA reverse mortgage limit has been increased from $765,600 to $822,375 which is an increase of $56,775. The limit on a reverse mortgage is the maximum home value that the loan to value percentage can be applied to. For example, if your home appraised for $825,000, then the loan to value you can borrow would be applied to $822,375.

What is principal limit on reverse mortgage?

The principal limit is the initial loan amount that is available to a borrower on a reverse mortgage at the time the loan is taken out. It is determined by the age of the youngest borrower/spouse, interest rate and home value or lending limit (whichever is less).

What will affect reverse mortgages in 2021?

Something that has and will continue to affect the prospect of a reverse mortgage in 2021 is the COVID-19 coronavirus pandemic.

When did HUD change condo rules?

HUD made changes to the condominium rules in 2019 allowing for single-unit approvals. At this time, there are no further changes expected or announced by FHA regarding condominiums.

Will HUD change the HECM program?

This is always welcome news for borrowers of higher-priced properties, but HUD has already signaled that the agency may change the HECM program to institute regional limits (akin to what is done for forward FHA loans), so it remains to be seen how long the one national limit will remain in place.

Will the HECM limit be raised in 2021?

But for the time being, borrowers with higher values can take advantage of the raised 2021 HECM limits. Borrowers can also take heart that proprietary programs (often referred to as “jumbo reverse mortgages”) are improving constantly, and their minimum limits have come down substantially.

Can reverse mortgages be closed?

For reverse mortgages, this has translated into the government streamlining certain processes so that reverse mortgage loans can be closed with as little direct human contact as possible, while also making it easier for lenders and borrowers alike to get the approvals they need in the midst of certain business and agency office closures.

How much money can I get with a reverse mortgage or HECM?

If you want a HECM, the maximum amount you can obtain is constrained by the median home price in the area where you live, but the absolute maximum amount you can receive is $970,800. If you have a high-value home in an expensive area and need access to equity amounts above these local limits, you may be better off pursuing a private market reverse mortgage.

What is the principal limit for a loan?

The principal limit that you can borrow is the Maximum Claim Amount for your area multiplied by the youngest borrower's age factor. This is actually the gross amount available for your loan, not the amount of money you can actually utilize.

What is the net principal limit?

The actual, final amount - called the Net Principal Limit (NPL) - includes deductions for Mandatory Obligations, the amount of any required repairs to the home, and possibly a Life Expectancy Set-Aside (LESA) from the proceeds. LESA is the amount of your equity reserved for paying certain future expenses.

Can you borrow all of your MCA?

However, you are not generally permitted to borrow all of it. A percentage factor based on the age of the youngest borrower (or non-borrowing spouse) is applied against the MCA, which reduces the available amount by a given percentage.

Why is reverse mortgage risk higher for younger borrowers?

Higher risk for younger borrowers because the borrower may outlive loan funds. Note: This information only applies to Home Equity Conversion Mortgages (HECMs), which are the most common type of reverse mortgage loan. Read full answer.

What is the principal limit on a mortgage?

Your borrowing limit is called the " principal limit ." It takes into account your age, the interest rate on your loan, and the value of your home. In general, loans with older borrowers, higher-priced homes, and lower interest rates will have higher principal limits than loans with younger borrowers, lower-priced homes, and higher interest rates. If you are married or co-borrowing with another person, the principal limit is based on the age of the youngest co-borrower, or Eligible Non-Borrowing Spouse.

What is the maximum amount of equity for a reverse mortgage?

This is the maximum dollar amount the FHA will insure for a HECM non-recourse loan. This means that even though your home may be appraised above $765,600, that is the maximum cap on the amount of equity that may be considered for a HECM.

What determines reverse mortgage limits?

The figures for HUD’s nationwide HECM limit are calculated by 150 percent of the FHA conforming loan limits for Fannie Mae and Freddie Mac, which were recently raised to $484,350.

What is a reverse mortgage principal limit?

Also known as a borrowing limit, the principal limit refers to how much money you may be able to receive from a HECM loan. It’s important to note that the HECM FHA mortgage limit for lenders is not the same as an individual principal limit for borrowers.

How much of my reserve mortgage limit may I access?

Prior to 2013, borrowers could take out 100 percent of their net principal balance in one lump sum. However, new safety measures now restrict the amount of proceeds borrowers may take out in the first year. As of 2020, the amount a borrower may access in the first year is limited to:

What is net principal limit on reverse mortgage?

The reverse mortgage net principal limit refers to the amount of money a borrower may receive once all HECM closing costs are covered. Many borrowers choose to pay the HECM closing costs with proceeds from their principal balance, and the remaining proceeds are considered the “net” amount.

What is mortgage insurance premium?

Mortgage Insurance Premium —Borrowers incur an upfront cost for FHA mortgage insurance, which guarantees that you will receive expected loan advances. It also ensures borrowers will never be forced to pay more than the appraised value of the home or the outstanding loan balance, whichever is less.

How old do you have to be to get a reverse mortgage?

If you’re not sure how a reverse mortgage works, we can help. The HECM program allows eligible borrowers (ages 62 and older) to tap into a portion of their home equity without having to sell their home or move out of the property.