2022 Capital Gains Tax Rate Thresholds

| Capital Gains Tax Rate | Taxable Income (Single) | Taxable Income (Married Filing Separate) | Taxable Income (Head of Household) | Taxable Income (Married Filing Jointly) |

| 0% | Up to $41,675 | Up to $41,675 | Up to $55,800 | Up to $83,350 |

| 15% | $41,675 to $459,750 | $41,675 to $258,600 | $55,800 to $488,500 | $83,350 to $517,200 |

| 20% | Over $459,750 | Over $258,600 | Over $488,500 | Over $517,200 |

How do you calculate long term capital gains tax?

You can also make a loss on an investment and claim it as a tax loss:

- Capital gains tax applies to all types of investment – stocks, bonds, properties, cars, and many other tangible items.

- The profit you make from selling an item at a higher price is your capital gain. ...

- You can reduce your total tax bill by claiming capital losses against capital gains. ...

How do you calculate long term capital gains?

The four allowable accounting methods are:

- Actual cost basis using specific identification

- Actual cost basis using first-in, first-out identification

- Average cost basis, single-category method

- Average cost basis, double-category method 3

Can capital gains push me into a higher tax bracket?

No – Capital Gains are taxed separately from Ordinary Income. It will not push you into a higher tax bracket (assuming Long-Term Capital Gains). Note: A Short-Term Capital Gain doesn’t qualify for preferential tax treatment and is taxed as Ordinary Income. However, when you realize a Capital Gain, it impacts your adjusted gross income.

What can I deduct from capital gains?

- Stamp Duty paid when buying the property.

- Estate agents' fees.

- Solicitors' fees.

- Costs for improvements to the property - e.g. an extension, kitchen upgrade, etc.

What is the tax rate for long term capital gains in 2020?

Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. The long-term capital gains tax rate is 0%, 15% or 20% depending on your taxable income and filing status.

What is the limit for long term capital gains tax free?

The exemption limit is Rs. 2,50,000 for resident individual of the age below 60 years. The exemption limit is Rs. 2,50,000 for non-resident individual regardless of the age of the individual.

Are long term capital gains always taxed at 15%?

2022 Capital Gains Tax Brackets Short-term capital gains are taxed at your ordinary income tax rate. Long-term capital gains are taxed at only three rates: 0%, 15%, and 20%.

What is the tax rate for long term capital gains in 2021?

2021 Long-Term Capital Gains Tax RatesTax Rate0%15%Filing StatusTaxable IncomeSingleUp to $40,400$40,401 to $445,850Head of householdUp to $54,100$54,101 to $473,750Married filing jointlyUp to $80,800$80,801 to $501,6001 more row•Feb 17, 2022

What is the capital gains exemption for 2021?

For example, in 2021, individual filers won't pay any capital gains tax if their total taxable income is $40,400 or below. However, they'll pay 15 percent on capital gains if their income is $40,401 to $445,850. Above that income level, the rate jumps to 20 percent.

How do I avoid long-term capital gains tax?

How to avoid capital gains taxes on stocksWork your tax bracket. ... Use tax-loss harvesting. ... Donate stocks to charity. ... Buy and hold qualified small business stocks. ... Reinvest in an Opportunity Fund. ... Hold onto it until you die. ... Use tax-advantaged retirement accounts.

What would capital gains tax be on $50 000?

If the capital gain is $50,000, this amount may push the taxpayer into the 25 percent marginal tax bracket. In this instance, the taxpayer would pay 0 percent of capital gains tax on the amount of capital gain that fit into the 15 percent marginal tax bracket.

Will capital gains put me in a higher tax bracket?

The tax that you'll pay on short-term capital gains follows the same tax brackets as ordinary income. Ordinary income is taxed at graduated rates depending on your income. It's possible that a short-term capital gain (or at least part of it) might be taxed at a higher rate than your regular earnings.

Do you have to pay capital gains after age 70?

Residential Indians between 60 to 80 years of age will be exempted from long-term capital gains tax in 2021 if they earn Rs. 3,00,000 per annum. For individuals of 60 years or younger, the exempted limit is Rs. 2,50,000 every year.

Are capital gains taxed twice?

The capital gains tax is a form of double taxation, which means after the profits from selling the asset are taxed once; a double tax is imposed on those same profits. While it may seem unfair that your earnings from investments are taxed twice, there are many reasons for doing so.

How do you calculate long term capital gain?

In case of long-term capital gain, capital gain = final sale price – (transfer cost + indexed acquisition cost + indexed house improvement cost).

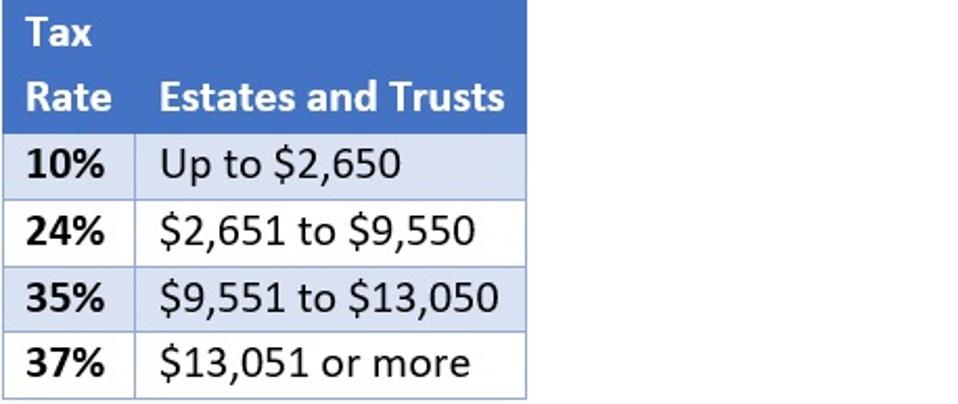

Long-Term Capital Gains Taxes

Long-term capital gains are taxed at lower rates than ordinary income, and how much you owe depends on your annual taxable income.

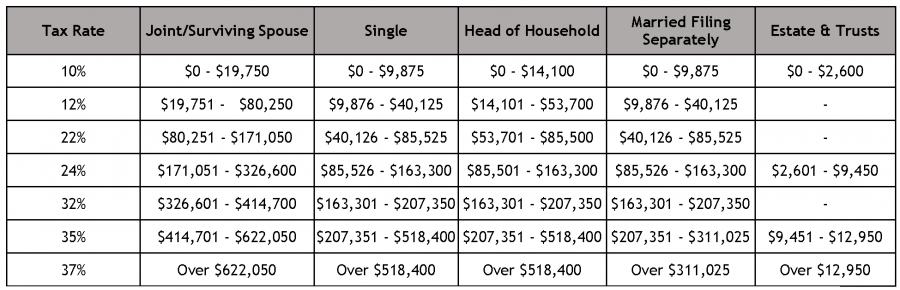

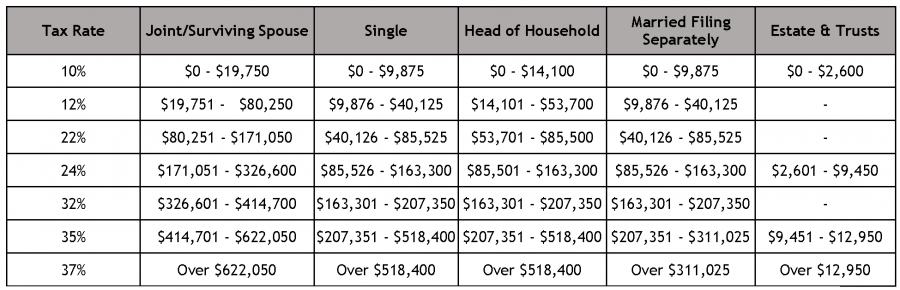

Short-Term Capital Gains Taxes

If you’ve held an asset or investment for one year or less before you sell it for a gain, that’s considered a short-term capital gain. In the U.S., short-term capital gains are taxed as ordinary income. That means you could pay up to 37% income tax, depending on your federal income tax bracket.

What Is a Capital Gain?

A capital gain happens when you sell or exchange a capital asset for a higher price than its basis. The “basis” is what you paid for the asset, plus commissions and the cost of improvements, minus depreciation.

Exceptions to Capital Gains Taxes

For some kinds of capital gains, different rules apply. These include capital gains from the sale of collectibles (like art, antiques and precious metals) and owner-occupied real estate.

What Is the Net Investment Income Tax?

For people earning income from investments above certain annual thresholds, the net investment income tax comes into play. Net investment income includes capital gains from the sale of investments that haven’t been offset by capital losses—as well as income from dividends and interest, among other sources.

What is long term capital gains tax?

What is long-term capital gains tax? Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. The long-term capital gains tax rate is 0%, 15% or 20% depending on your taxable income and filing status. They are generally lower than short-term capital gains tax rates.

What is the capital gains tax rate?

The capital gains tax rates in the tables above apply to most assets, but there are some noteworthy exceptions. Long-term capital gains on so-called “collectible assets” are generally taxed at 28%; these are things like coins, precious metals, antiques and fine art. Short-term gains on such assets are taxed at the ordinary income tax rate.

How long can you hold an asset?

Whenever possible, hold an asset for a year or longer so you can qualify for the long-term capital gains tax rate, since it's significantly lower than the short-term capital gains rate for most assets. Our capital gains tax calculator shows how much that could save.

How long do you have to own a home to qualify for a home equity loan?

Exclude home sales. To qualify, you must have owned your home and used it as your main residence for at least two years in the five-year period before you sell it. You also must not have excluded another home from capital gains in the two-year period before the home sale.

Do you pay taxes on 529s?

Roth IRAs and 529s in particular have big tax advantages. Qualified distributions from those are tax-free; in other words, you don’t pay any taxes on investment earnings. With traditional IRAs and 401 (k)s, you’ll pay taxes when you take distributions from the accounts in retirement.

Can you deduct capital loss on your taxes?

If your net capital loss exceeds the limit you can deduct for the year, the IRS allows you to carry the excess into the next year, deducting it on that year’s return.

Do you have to pay capital gains tax on 529?

That means you don’t have to pay capital gains tax if you sell investments within these accounts.

How much tax do you pay on capital gains?

Depending on your income level you can pay anywhere from $0 to 20 percent tax on your long-term capital gain. Additionally, capital gains are subject to the net investment tax of 3.8 percent when the income is above certain amounts. With the Tax Cuts and Jobs Act signed into law in December 2017, long-term capital gains rates are applied based ...

What is short term capital gain?

A short-term capital gain includes the profits of an item you sold that you owned for less than one year. That gain is taxed at the same rate as your ordinary income. Here’s what else you need to know to manage your long-term capital gains.

How to reduce investment income?

You can reduce your investment income for that tax by deducting investment interest expenses, advisory and brokerage fees, rental and royalty expenses, and state and local income taxes allocated to your investment income.

What is the 3.8 percent tax rate?

The 3.8 percent tax applies to investment income, such as interest, dividends, capital gains, rental, and royalties It’s paid in addition to the tax you already pay on investment income.

How long to hold assets for long term gain?

Make sure to hold the asset long enough to qualify for long-term status. For most assets, that’s more than one year. Don’t be too hasty to sell when the year is up.

How long can you keep an asset?

kept the asset for longer than one year. Note: Gains on certain types of assets, such as collectibles and property for which you have taken depreciation deductions, are subject to special rules. Here are 7 ways investment gains and losses affect your taxes.

Do you have to pay capital gains tax on stock donations?

If you donate stock to charity, you get a tax deduction for the amount it’s worth now. Also, you don’t have to pay capital gains tax on it. Don’t sell all at once. Even if you’re not normally in the higher income tax bracket, one large sale can place you there for the year if you’re not careful.

What is short term capital gains tax?

Short-term capital gains tax is what you pay on assets that you sell within a year of acquiring them. If you bought a share of Tesla ( NASDAQ:TSLA) and sold it for a profit six months later, you would pay short-term capital gains tax. This type of capital gain is taxed as ordinary taxable income on your federal taxes.

What is capital gains tax?

Capital gains tax is the tax you pay after selling an asset that has increased in value. Assets subject to capital gains tax include stocks, real estate, cryptocurrency, and businesses. You pay capital gains tax on the profit you made from the sale. Most investment income is considered a capital gain, but there are some exceptions.

What is the capital gains tax rate in Montana?

Montana taxes capital gains as income, but it has a 2% capital gains credit. Since its highest income tax rate is 6.9%, its highest capital gains tax rate is 4.9%. Tax rates are the same for every filing status.

How long can you hold capital gains in Vermont?

Vermont. Vermont taxes short-term capital gains and long-term capital gains held for up to three years as income. Taxpayers are allowed to exclude up to 40% of capital gains on assets held longer than three years. This exclusion amount is capped at $350,000 and cannot exceed 40% of federal taxable income.

How much can you deduct on a farm in Wisconsin?

Wisconsin taxes capital gains as income. On long-term capital gains, taxpayers are allowed a deduction of 30%, or 60% if the capital gain resulted from the sale of farm assets.

How long should you hold assets for capital gains?

Federal tax rates are lower for long-term capital gains, which is why it's generally recommended to hold assets for at least a year to minimize your tax liability. If you're generating capital gains, tax planning is extra-important.

Does Washington state tax capital gains?

Washington doesn't tax personal income or capital gains. There is currently a proposed bill that would tax long-term capital gains earnings above $25,000 for individual filers and above $50,000 for joint filers.

How much is the standard deduction for married filing jointly?

For married, filing jointly it's $78,750 of taxable income, which means to get to your gross income, you can add back your standard deductions. Brokamp: So the standard deduction for married filing jointly for 2019 is over $24,000. Brinsfield: Yes, $24,400.

Do you have to pay taxes on capital gains?

You owe no taxes on the capital gains. You can buy it back immediately. There's no 30-day waiting rule like there is for losses and you set a new cost basis. It's a perfectly fine idea. Just don't do it all and then all of a sudden you have a $400,000 income and then you will pay long-term capital gains on most of those.

Best Covid-19 Travel Insurance Plans

Let’s take a look at how your long-term capital gains are actually taxed at the federal level. Generally, long-term capital gains will have favorable tax treatments when compared to the taxes owed on short-term capital gains.

Medicare Surtax on Capital Gains Income

There may be additional taxes on investment income or lost tax deductions for people with higher incomes. For example, married taxpayers with incomes of more than $250,000 will also be required to pay an additional 3.8% net-investment surtax.

Pay Fewer Taxes with Tax-Loss Harvesting

The soaring stock market of the past few years doesn’t mean all investments have seen large increases in value. This is especially true with the recent volatility we have seen so far in 2022.

Taxes on Investment Gains in Retirement Accounts

Gains in your 401 (k), traditional IRA, Defined-Benefit Pension Plan, 403 (b), and tax-sheltered annuities (TSA) will be tax-deferred. You won’t owe any taxes on the gains in your retirement accounts until you make a withdrawal.

What is the 0% capital gains tax rate?

The 0% tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to $80,000, and to single tax filers with taxable incomes up to $40,000 as of 2020. 3 . There can be years when you'll have less taxable income than in others. You can sometimes make a low-tax year occur on purpose in retirement by choosing ...

How long do you have to hold assets to get capital gains tax?

These tax rates apply only to long-term capital gains on assets you've held for more than one year. Short-term rates would apply if you hold assets for one year or less. These are taxed according to your ordinary income tax bracket.

When do mutual funds distribute capital gains?

Mutual funds distribute capital gains by the end of each year. 5 The gains will likely be minimal if you own tax-managed funds or index funds, but funds that aren't managed with taxes in mind can generate large gains. You should find out what this gain will be before you intentionally realize additional gains.

Can you carry forward past losses?

Check with a tax professional if you're not sure or can't tell. Past losses can carry forward indefinitely. They're first used to offset gains, then $3,000 of a capital loss can be used to offset ordinary income if you have no gains. 4 Your gains will first use up all your old losses if you have capital losses that are being carried forward ...

Is harvesting gains tax free?

Benefits of Harvesting Gains for Retirees. Gain harvesting can be an effective way to realize tax-free gains, but you must build a habit of projecting taxes and looking for tax opportunities by the end of each year to make it work.