What are some examples of systematic risks?

- Sweeping changes in government policies

- Changes to Laws

- Natural disasters in a broad geography

Is it possible to minimize systematic risk?

While it is not possible to eliminate systemic risk or the incidence of crises entirely, the objective should be a more resilient financial system that is less prone to disastrous crises while still delivering benefits for the wider economy and society.

How do we measure systematic risk?

- When the β = 1 the systematic risk affects the stock returns as much as it affects the market

- When the β = 0 the systematic risk does not affect the stock returns but affects the market

- When the β < 1 the systematic risk affects the stock returns but less than how much it affects the market

Which of the following would be considered a systematic risk?

Systematic risk is that part of the total risk that is caused by factors beyond the control of a specific company, such as economic, political, and social factors. It can be captured by the sensitivity of a security’s return with respect to the overall market return.

What is systematic & unsystematic risk?

While systematic risk can be thought of as the probability of a loss that is associated with the entire market or a segment thereof, unsystematic risk refers to the probability of a loss within a specific industry or security.

What causes unsystematic risk?

Some of the factors leading to unsystematic risk include: The inefficiency of the management. Flaws in the business model. Liquidity crunch in the business.

What is not an example of unsystematic risk?

The correct answer is c. The national trade deficit is higher than expected. This is a type of market risk. The other options are types of firm-specific or diversifiable risk.

Which one of the following is an example of unsystematic risk?

The correct answer is c. BP's oil tanker runs ground and spills its cargo. Unsystematic risk affects a particular company or an individual industry.

What are the components of unsystematic risk?

Components of The Unsystematic Risk However, the unsystematic risk of investment consists of two major components: credit risk and. sector risk.

What is unsystematic risk quizlet?

Unsystematic Risk. The type of uncertainty that comes with the company or industry you invest in. Diversification.

How do you get rid of unsystematic risk?

The best way to reduce unsystematic risk is to diversify broadly. For example, an investor could invest in securities originating from a number of different industries, as well as by investing in government securities.

Why does diversification reduce unsystematic risk?

The most common sources of unsystematic risk are business risk and financial risk. Because it is diversifiable, investors can reduce their exposure through diversification. Thus, the aim is to invest in various assets so they will not all be affected the same way by market events.

Where have you heard about unsystematic risk?

You may have heard of unsystematic risk, as opposed to systematic risk, which is the danger that a whole market or financial system may collapse. Such references may have been made by your financial adviser in relation to the need to diversify your investments.

What is a synoym in investing?

Synoyms include diversifiable risk, non-systematic risk, residual risk and specific risk.

What happens if you hold only stock from the transport industry?

If someone holds only stock from the transport industry, they would face high unsystematic risk. To prevent this, it is commonly advised to diversify by investing in a range of industries or sectors. Thus unsystematic risk can be reduced, but systematic risk will always be present. New to trading?

What is unsystematic risk?

Unsystematic risk can be termed as the risks generated in a particular company or industry and may not be applicable to other industries or economies as a whole. For example, the telecommunication sector in India is going through disruption; most of the large players are providing low-cost services, which are impacting the profitability of small players with small market share. As telecommunication is a capital-intensive sector, it requires enormous funding. Small players with low profitability and high debt are exiting the business.

How can hazards be controlled?

As the nature of risk is business-oriented, the hazards can be controlled by taking several measures, unlike systematic risks. By diverting the portfolio or the business, one can avoid the risk and does not have the bad effect of the entire economy in systematic risks. Unlike systematic risks, the factors are majorly internal ...

What is liquidity risk?

Liquidity Risk Liquidity risk refers to 'Cash Crunch' for a temporary or short-term period and such situations are generally detrimental to any business or profit-making organization. Consequently, the business house ends up with negative working capital in most of the cases. read more

Why are systematic risks handled?

While in the case of systematic risks, the situations can be handled because of the known challenges associated with it. Policymakers have to implement a large pool of resources to resolve the situation. Sometimes the cost of measures becomes very expensive compared to the matter itself.

Why does private enterprise have to resolve the matter?

Because of its nature, the policymakers neglect the situations and does not comes under the limelight as in case of systematic risks.

What is change of demand?

Change of demand, change in preference of consumer taste may happen when the product is not available to the consumer. For example, lower availability of tea and tea-based products, the consumers might change the preference to coffee and coffee-based products. Thus, the above unsystematic risk can change the preference of the customers, ...

What is financial risk?

Financial Risk Financial risk refers to the risk of losing funds and assets with the possibility of not being able to pay off the debt taken from creditors, banks and financial institutions.

What is Unsystematic Risk?

Unsystematic risk is a risk that is inherent and specific to a company or industry. As we know each and every business has some amount of risk. In the world of business finance, such risks are of two types – systematic and unsystematic. In other words, unsystematic risk affects a company or only one industry. An investor in such a company or industry can avoid or minimize such risks through diversifying his portfolio across multiple industries. Hence, such risks are also known as non-systematic or diversifiable risks.

What is the beta coefficient of a company?

The Beta coefficient of a company is what represents the unsystematic risk. A beta coefficient is the relationship of the change of a stock with a change in the market. In other words, it indicates the extent of the volatility of a stock/security vis-a-vis the market.

What happens when unsystematic risk is present?

At some point, unsystematic risk can lead to a permanent change in the preference of the customers. And, if that happens, such risks could have serious repercussions on the market of such a company or industry.

Why is unsystematic risk dynamic?

The unsystematic risk is dynamic because of the problems that each company or sector faces are unique. It has no correlation with the overall economy, and the scale of the impact is also lower. Therefore, the government usually does not intervene, and private players only need to address the issue at hand.

Why is it important to diversify your portfolio?

Therefore, it is very important for an investor to diversify his or her portfolio across industries and firms in order to reduce his or her risk.

How does diversification work?

Let’s see how diversification works. Suppose the total return of the portfolio was 15%. But the individual return on stock A and B was 1% and 16%, respectively. This means that if an investor had invested only in A, the return would have been only 1%. But, because the investor diversified, the return was higher. Of course, it is lesser than the return of B (16%) if he would have been fully invested in B.

What is the risk of a company's capital structure?

This risk relates to a company’s capital structure. As we know the capital structure of all the companies usually has a mix of debt and equity. Moreover, to derive maximum benefits of the capital structure a company must maintain and strive for achieving an optimal mix of debt and equity. But, if a company fails to maintain a balance between the two, it could affect cash flows and earnings. Therefore, the risk arises from the sub-optimal level of the debt-equity mix.

What is the cure for systematic risk?

Remedy: Cure for systematic risk is asset allocation that is investing or not investing in certain assets, while that for unsystematic risk is making portfolio diversification , that is, adding different securities of the same industry.

What is the risk of investing in a company with a higher debt?

This risk is known as Unsystematic risk .

What are the two types of risks in investing?

There are two kinds of risks pertaining to investment in any security, and these are broadly categorized as Systematic and Unsystematic risks. If the economy as a whole faces recession, then all the companies in the economy face slowing returns or even incur losses. Such a risk is known as the systematic risk, and the same can’t be diversified away.

What is the difference between unsystematic and systematic risk?

Systematic Risk vs Unsystematic Risk 1 Meaning: Unsystematic risk is the risk specific to a particular company or security, such as the risk of the company’s plant being located in an area which experienced a natural calamity such as an earthquake. Other competing companies would not experience the losses experienced by this company due to this natural calamity, while the overall broader market faces systematic risks. 2 Calculation: Systematic risk is measured through the beta of the stock with reference to the market, and this beta is calculated by regression analysis or methods such as the pure-play approach. However, there is no formula for the calculation of unsystematic risk because it can’t be generalized. An only approximate calculation can be done by subtracting the systematic risk from the total risk of the stock. 3 Diversification: Systematic Risk can’t be diversified while Unsystematic risk can be. 4 Factors Affecting: Unsystematic risk is caused by internal or controllable factors, while external non-controllable factors cause systematic risk. 5 Remedy: Cure for systematic risk is asset allocation that is investing or not investing in certain assets, while that for unsystematic risk is making portfolio diversification, that is, adding different securities of the same industry.

How can unsystematic risk be avoided?

Impacted by Controllable Factors: Unsystematic risk can be avoided by improving internal controls such as not blocking enough in the inventory if that is the requirement of the hour or by improving the capital structure, but systematic risk can’t be so easily controlled.

What is unpredictable risk?

Unpredictable: Unsystematic risk is affected by a number of factors, and therefore investors may not be able to predict what can cause the same and which stock will it affect ; therefore, it becomes a barrier in making the investment decision, and ultimately investors will take a judgment call for that.

Why is it so hard to find out about unsystematic risk?

Not Easily Found Out: Unsystematic risk is caused due to internal factors most of the time, and what can cause them cannot always be known through the publicly available information, and therefore, investors may not always be able to quantify as it happened in the case of Enron which committed several accounting frauds which didn’t see the public light till the company finally collapsed. And therefore, it is difficult for a staggered investor to find out such problems till it is too late to repair them.

What is Unsystematic Risk?

Unsystematic risk is a hazard that is specific to a business or industry. The presence of unsystematic risk means that the owner of a company's securities is at risk of adverse changes in the value of those securities because of the risk associated with that organization. An investor may be aware of some of the risks associated with a specific company or industry, but there are always additional risks that will crop up from time to time.

How to reduce unsystematic risk?

The best way to reduce unsystematic risk is to diversify broadly. For example, an investor could invest in securities originating from a number of different industries, as well as by investing in government securities. Examples of unsystematic risk are: A change in regulations that impacts one industry. The entry of a new competitor into a market.

What is a change in regulations that impacts one industry?

A change in regulations that impacts one industry. The entry of a new competitor into a market. A company is forced to recall one of its products. A company is found to have prepared fraudulent financial statements.

Is diversification a systemic risk?

The use of diversification will still subject an investor to systemic risk, which is risks that impact the market as a whole.

How to identify unsystematic risks?

Another way to identify unsystematic risks is to compare the specific instance of a risk with the overall market or industry. If there is little or no substantial correlation, the risk is likely to be unsystematic.

What is unsystematic risk?

In financial lingo, the term "unsystematic" simply refers to a quality that is not commonly shared among many investment opportunities. The most narrow interpretation of an unsystematic risk is a risk unique to the operation of an individual firm. Examples of this can include management risks, location risks, and succession risks.

What happens to production lines after the next year rolls around?

Production lines are altered and capital is devoted toward smaller devices. After the next year rolls around, consumers actually prefer bigger phones and watches. Much of the existing inventory for the aforementioned technology company either goes unsold or sells at a major loss.

Can unsystematic risks occur at one time?

It is not necessarily true that unsystematic risks occur one firm at a time; for example, a terrible manager may only be able to directly affect one firm's stock, but the stocks of many firms might simultaneously suffer from the unsystematic risk of bad management.

Is an unsystematic risk inherent to every security?

What is important is that an unsystematic risk is not inherent to every security or at least not a great majority of securities.

Is the political risk inherent to the industry itself?

Neither of these specific political or legal risks is inherent to the industry itself. Their negative effects are spread among select companies only. If an investor purchased stock in all three firms, they may be able to diversify away losses in Firms B and C via the gains from Firm A.

Does the state government subsidize Firm A?

However, a state government decides to subsidize Firm A or perhaps it prohibits a practice commonly used by Firms B and C that allegedly harms local bird populations. The stock value for Firm A tends to rise, while the stock value for the other two firms tends to fall.

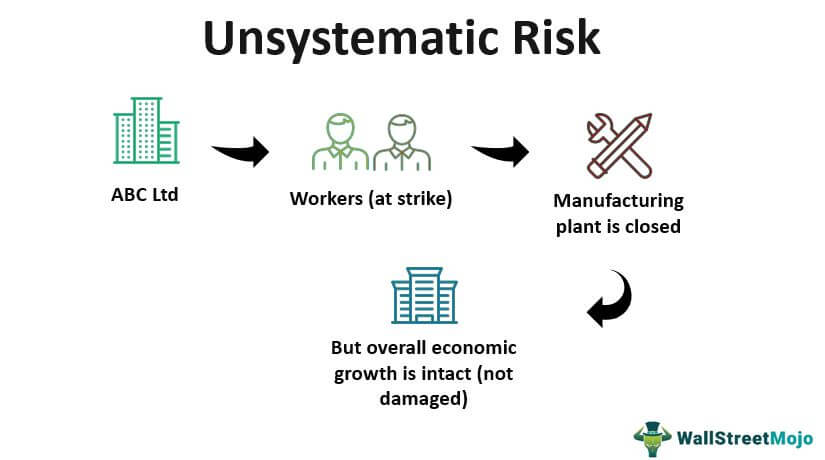

What is Unsystematic Risk?

Also known as Diversifiable or Non-systematic risk, it is the threat related to a specific security or a portfolio of securities. Investors construct these diversified portfolios for allocating risks over various classes of assets. Let us consider an example of a clearer understanding:

How is unsystematic risk measured?

Unsystematic risk is measured and managed through the implementation of various risk management tools, including the derivatives market. Investors can be aware of such risks, but various unknown types of risks can crop up at any time, thereby increasing the level of uncertainty.

What are the two categories of unsystematic risk?

In contrast, Unsystematic risk is bifurcated into two broad categories, namely Business Risk and Financial Risk

How does systemic risk affect securities?

Systematic Risk affects many securities in the market due to widespread impact such as interest rate decreases by the Central Bank of a country. In contrast, Unsystematic risk

What is an employee union tactic?

An employee union tactic for senior management to meet their demands. The existence of unsystematic risks means the owner of a company’s securities is at risk of adverse changes in the value of those securities due to the risk caused by the organization.

What is the risk of a collapse of the entire financial system?

It refers to the risks caused by financial system instability, potentially catastrophic or idiosyncratic events to the interlinkages, and other interdependencies in the overall market.

What is risk in finance?

The risk is the degree of uncertainty in any stage of life. For instance, while crossing the road, there is always a risk of getting hit by a vehicle if precautionary measures are not undertaken. Similarly, in the area of investment and finance, various risks exist since the hard-earned money of individuals and firms are involved in the cycle.