How much does unemployment pay in Nevada?

How much does unemployment pay in Nevada? ELIGIBILITY FOR UNEMPLOYMENT ASSISTANCE The maximum benefit is set at $469 per week for up to 26 weeks, unless extended by law. Further eligibility information can be found in the Nevada Unemployment Insurance Facts for Claimants handbook (available in English and Spanish).

What is the current unemployment rate in Nevada?

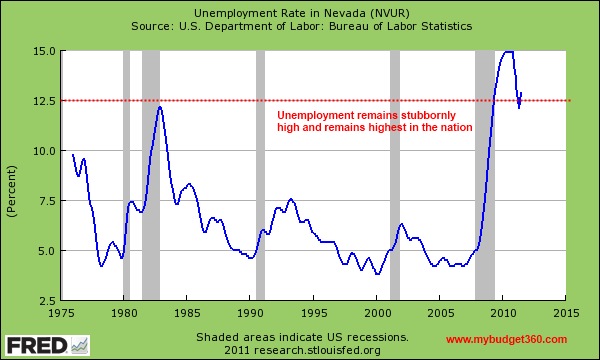

Nevada Unemployment. According to the BLS current population survey (CPS), the unemployment rate for Nevada fell 0.1 percentage points in February 2022 to 5.1%.The state unemployment rate was 1.3 percentage points higher than the national rate for the month. The unemployment rate in Nevada peaked in April 2020 at 28.5% and is now 23.4 percentage points lower.

What is the maximum weekly unemployment benefit in Nevada?

Maximum Weekly benefit amount in Nevada: $469 Additional benefits through the CARES Act: Effective through July 31, 2020, unemployed workers will receive an additional $600 per week, on top of the benefits a person would normally receive in their state, which is a maximum of $469 per week for Nevadans.

How much is payroll tax in Nevada?

How much is the payroll tax in Nevada? As of 2020, Nevada’s General Business tax is 1.475% for businesses with quarterly gross payrolls in excess of $62,500. In addition, employers face an unemployment insurance (UI) tax that ranges from 0.3% to 5.40% for gross annual wages greater than $32,500.

How much is unemployment taxed in Nevada?

Employing Units in Nevada, who meet registration requirements, must pay unemployment insurance (UI) tax at a rate of 2.95 percent (. 0295) of wages paid to each employee up to the taxable wage limit.

What is Nevada employment tax?

As of 2020, Nevada's General Business tax is 1.475% for businesses with quarterly gross payrolls in excess of $62,500. In addition, employers face an unemployment insurance (UI) tax that ranges from 0.3% to 5.40% for gross annual wages greater than $32,500.

How is unemployment rate calculated in Nevada?

If you are eligible to receive unemployment, your weekly benefit rate (WBR) will be 4% of your total earnings during the highest paid quarter of the base period, subject to a maximum of $469 per week (starting mid-September 2021).

How do you calculate SUTA tax?

How do you calculate SUTA tax? To calculate your SUTA tax as a new employer, multiply your state's new employer tax rate by the wage base. For example, if you own a non-construction business in California in 2021, the SUTA new employer tax rate is 3.4%, and the taxable wage base per worker is $7,000.

What is the state withholding tax in Nevada?

Nevada Withholding Forms Nevada does not use a state withholding form because there is no personal income tax in Nevada.

How much is Nevada withholding?

It is a quarterly payroll tax that you have to pay if your total gross wages less employee health care benefits are $50,000 or more in a quarter. The tax rate is 1.475% if you own a general business, but financial institutions pay a higher rate.

What's the max unemployment in Nevada?

There is no minimum weekly payment, but the maximum you can receive in unemployment benefits in Nevada per week is $469. The state of Nevada restricts the length of unemployment benefits to 26 weeks per calendar year.

What is the base period for unemployment in Nevada?

A base period is the twelve-month period established by law during which the claimant has been paid wages in covered employment in order to establish a claim. In Nevada, the base period is usually the first 4 of the last 5 calendar quarters completed immediately preceding the first day of the benefit year.

Does Nevada have unemployment benefits?

PUA provides up to 79 weeks of benefits to qualifying individuals who do not have regular UI, Pandemic Emergency Unemployment Compensation (PEUC) or State Extended Benefits (SEB) eligibility, and are otherwise able to work and available for work within the meaning of applicable state UI law, except they are unemployed, ...

What is SUTA wage base?

What is SUTA? State unemployment tax assessment (SUTA) is based on a percentage of the taxable wages an employer pays. Some states apply various formulas to determine the taxable wage base, others use a percentage of the state's average annual wage, and many simply follow the FUTA wage base.

What is the FUTA and SUTA tax rates?

The FUTA tax rate is 6.0%. Generally, if you paid wages subject to state unemployment tax, you may receive a credit of up to 5.4% of FUTA taxable wages when you file your Form 940. If you're entitled to the maximum 5.4% credit, the FUTA tax rate after the credit is 0.6%.

How do you calculate FUTA and SUTA?

How to calculate FUTA Tax?FUTA Tax per employee = (Taxable Wage Base Limit) x (FUTA Tax Rate).With the Taxable Wage Base Limit at $7,000,FUTA Tax per employee = $7,000 x 6% (0.06) = $420.

How does payroll tax work in Nevada?

The tax rate for new employers is 2.95% of taxable wages. After that, the state determines your rate for you and sends it to you on your preprinted Form NUCS 4072. Nevada has 18 tax rates ranging from 0.25% to 5.4% of employee wages up to $33,400 for 2021.

How do I pay my Nevada unemployment tax?

You can pay electronically using Automated Clearing House (ACH) credit or debit. To file on paper, use Form NUCS 4072,Employer's Quarterly Contribution and Wage Report. You can pay by check if the amount due is less than $10,000. You must file quarterly returns even if you didn't pay any wages.

Does Nevada have payroll withholding tax?

While there is no state withholding tax in Nevada, employers do need to pay state unemployment insurance taxes. Check the website for the Department of Employment, Training and Rehabilitation Employment Security Division for more details.

Who pays Nevada modified business tax?

employerEvery employer who is subject to Nevada Unemployment Compensation Law (NRS 612) is also subject to the Modified Business Tax.