What is measured by current assets minus current liabilities?

The standard formula for working capital is current assets minus current liabilities. A company has negative working capital if its ratio of current assets to liabilities is less than one. In the corporate finance world, “current” refers to a time period of one year or less. What is current assets minus total liabilities?

Can current assets be more than total liabilities?

Yes definitely they can. Theoretically the liabilities can be zero where the whole of assets is funded by equity and hence by extension current assets exceed total liabilities. It is also very normal that a company has very low leverage and the current assets are financed not only by liabilities but to some part by equity.

Are accrued taxes current assets or current liabilities?

Accrued liabilities and accounts payable are both current liabilities. However, the difference between them is that accrued liabilities have not been billed, while accounts payable Accounts Payable Accounts payable is a liability incurred when an organization receives goods or services from its suppliers on credit.

What can increase current liability and use assets?

Current liabilities are typically settled using current assets, which are assets that are used up within one year. Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income taxes owed.

What is the relationship between current assets and current liabilities in a healthy firm?

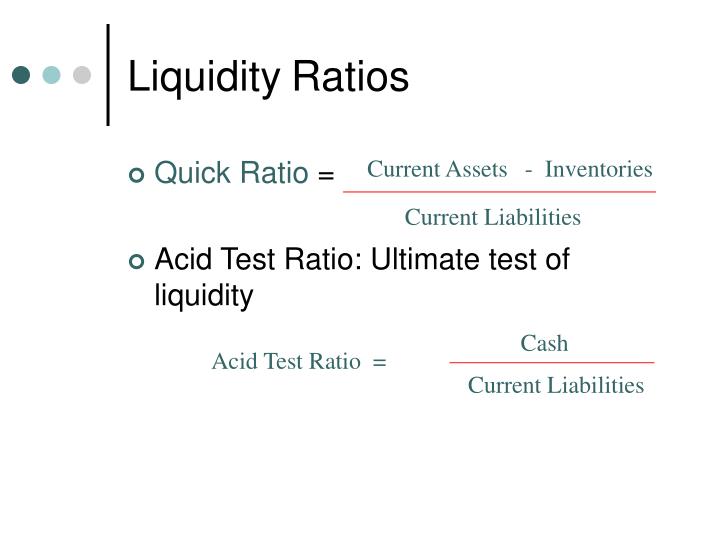

Key Takeaways The current ratio divides current assets by current liabilities. The quick ratio only considers highly-liquid assets or cash equivalents as part of current assets.

What is the relationship between assets and liabilities?

Liabilities. Assets add value to your company and increase your company's equity, while liabilities decrease your company's value and equity. The more your assets outweigh your liabilities, the stronger the financial health of your business.

What difference between current assets and current liabilities?

Working capital is the difference between current assets and current liabilities. Working Capital is the money used to pay short term debts. Working capital calculated by subtracting current assets from liabilities.

What is the relationship between assets liabilities and equity?

Equity is also referred to as net worth or capital and shareholders equity. This equity becomes an asset as it is something that a homeowner can borrow against if need be. You can calculate it by deducting all liabilities from the total value of an asset: (Equity = Assets – Liabilities).

Why do assets and liabilities have to balance?

The two halves must balance because the total value of the business's Assets will ALL have been funded through Liabilities and Equity. If they aren't balancing, it can only mean that something has been missed or an error has been made.

What is current assets divided by current liabilities?

Current Ratio - A firm's total current assets are divided by its total current liabilities. It shows the ability of a firm to meets its current liabilities with current assets.

What is the difference between current assets and current liabilities?

A major difference between current assets and current liabilities is that more current assets mean high working capital which in turn means high liquidity for the business.

What is current liabilities?

Current liabilities are paid in cash/bank (settled by current assets) or by the introduction of new current liabilities.

What is current asset?

Current assets are short-term assets either in form of cash or a cash equivalent which can be liquidated within 12 months or within an accounting period. They are short-term resources of a business and are also known as circulating or floating assets. Current assets are realized in cash or consumed during the accounting period.

How long does it take for a business to settle current liabilities?

Current Liabilities are short-term liabilities of a business which are expected to be settled within 12 months or within an accounting period.

Where are notes payable placed on a balance sheet?

They are placed on the liabilities side of a balance sheet, usually, the principal portion of notes payable is shown first, accounts payable next and remaining current liabilities in the end.