The first is that one is short run and the other is long run. The short run AS curve is based on the assumption that all of the things that determine aggregate supply are being held constant. In the long run, these determinants of AS are not held constant. That leads to the second difference, which is the shapes of the curves.

Which would increase aggregate supply?

What factors affect aggregate demand?

- Changes in Interest Rates.

- Income and Wealth.

- Changes in Inflation Expectations.

- Currency Exchange Rate Changes.

What is a short run aggregate supply curve?

The short-run aggregate supply curve is upward sloping because the quantity supplied increases when the price rises. In the short-run, firms have one fixed factor of production (usually capital ). When the curve shifts outward the output and real GDP increase at a given price. What happens when aggregate supply decreases?

What is the definition of long run aggregate supply?

The long-run aggregate supply is an economy’s production level (RGDP) when all available resources are used efficiently. It equals the highest level of production an economy can sustain.

What causes aggregate supply to increase?

What are the factors affecting aggregate demand and aggregate supply?

- Net Export Effect. …

- Real Balances. …

- Interest Rate Effect. …

- Inflation Expectations. …

- Supply Shocks. …

- Resource Price Changes. …

- Changes in Expectations for Inflation. …

- Capacity Increase.

What affects short-run and long run aggregate supply?

Changes in prices of factors of production shift the short-run aggregate supply curve. In addition, changes in the capital stock, the stock of natural resources, and the level of technology can also cause the short-run aggregate supply curve to shift.

What is the relationship between aggregate demand and aggregate supply in the short-run?

In the short run, the equilibrium price level and the equilibrium level of total output are determined by the intersection of the aggregate demand and the short-run aggregate supply curves. In the short run, output can be either below or above potential output.

What shifts the short-run aggregate and the long run aggregate supply left?

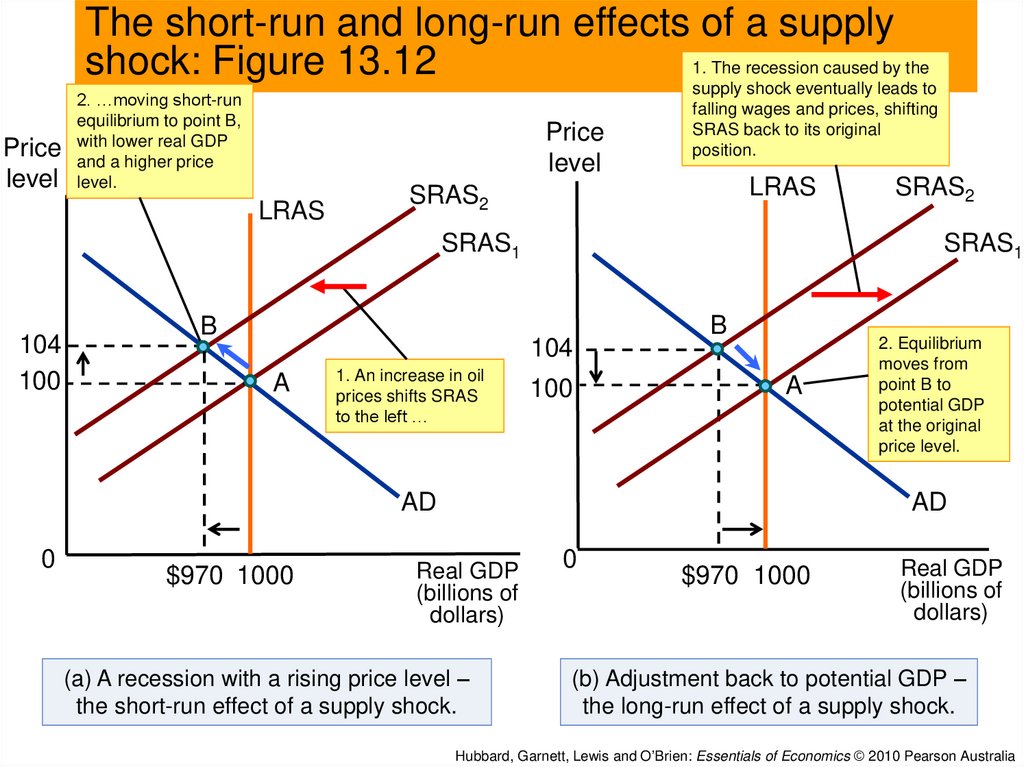

The aggregate supply curve shifts to the left as the price of key inputs rises, making a combination of lower output, higher unemployment, and higher inflation possible. When an economy experiences stagnant growth and high inflation at the same time it is referred to as stagflation.

Why do we need to distinguish sras and LRAS?

If showing a change in wage costs or oil prices, I would use a SRAS. For showing long run economic growth, and an increase in capital stock and investment I would show a shift in LRAS.

What is the relationship between short-run and long run costs?

The main difference between long run and short run costs is that there are no fixed factors in the long run; there are both fixed and variable factors in the short run. In the long run the general price level, contractual wages, and expectations adjust fully to the state of the economy.

What is the relationship between aggregate supply?

Aggregate supply is the relationship between the overall price level in the economy and the amount of output that will be supplied. As output goes up, prices will be higher.

Why does the short run aggregate supply curve shift to the right in the long run following a decrease in aggregate demand?

A decrease in aggregate demand will cause the short-run aggregate supply curve shift to rightward or downward direction because workers and firms will adjust their expectation of wages and prices downwards and they will accept lower wages and prices.

Why does the short run aggregate supply curve slope upwards while in the long run aggregate supply is perfectly inelastic?

For example, the short-run aggregate supply curve slopes upward due to the lag between product prices and resource prices that makes it profitable for firms to increase output when the price level rises. The long-run aggregate supply curve is vertical when a country is at full employment.

What causes an increase in long run aggregate supply?

The long-run aggregate supply curve can shift only when there are changes in factors that affect the potential output of an economy. Factors that shift the long-run aggregate supply include labor, capital, natural resources, and technology changes.

Do LRAS and sras shift together?

Short answer: Yes, the SRAS curve will shift after the LRAS shifts to return the short-run equilibrium (SRAS/AD) back in line with the long-run equilibrium (LRAS/AD).

Can LRAS and sras shift at the same time?

Shifts in both the SRAS and LRAS. Many changes in the determinants of supply can shift both the short and long run curves, including: Increases in the size of the effective labour force - output can be increased in the short run, and the capacity of the economy to produce will increase.

Why is it important to differentiate between the short and long run?

The long run is a period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all costs, whereas in the short run firms are only able to influence prices through adjustments made to production levels.

What is the relationship between aggregate supply and demand?

Aggregate Supply is the total quantity of all goods and services produced in an economy at all possible price levels at a given time. Aggregate Demand is the total quantity of all goods and services consumed in an economy at all possible price levels at a given time.

What is the relationship between supply and aggregate supply and demand and aggregate demand?

The aggregate demand/aggregate supply model is a model that shows what determines total supply or total demand for the economy and how total demand and total supply interact at the macroeconomic level. Aggregate supply is the total quantity of output firms will produce and sell—in other words, the real GDP.

What is the difference between aggregate demand and aggregate supply in short-run?

Aggregate supply is an economy's gross domestic product (GDP), the total amount a nation produces and sells. Aggregate demand is the total amount spent on domestic goods and services in an economy.

What happens to aggregate supply in the short-run?

In the short run, aggregate supply responds to higher demand (and prices) by increasing the use of current inputs in the production process. In the short run, the level of capital is fixed, and a company cannot, for example, erect a new factory or introduce a new technology to increase production efficiency.

How to trace out short run aggregate supply curve?

By examining what happens as aggregate demand shifts over a period when price adjustment is incomplete, we can trace out the short-run aggregate supply curve by drawing a line through points A, B, and C . The short-run aggregate supply (SRAS) curve is a graphical representation of the relationship between production and the price level in the short run. Among the factors held constant in drawing a short-run aggregate supply curve are the capital stock, the stock of natural resources, the level of technology, and the prices of factors of production.

Why is aggregate price adjustment incomplete?

Taken together, these reasons for wage and price stickiness explain why aggregate price adjustment may be incomplete in the sense that the change in the price level is insufficient to maintain real GDP at its potential level. These reasons do not lead to the conclusion that no price adjustments occur. But the adjustments require some time. During this time, the economy may remain above or below its potential level of output.

What is the analysis of the macroeconomy in the short run?

Analysis of the macroeconomy in the short run—a period in which stickiness of wages and prices may prevent the economy from operating at potential output—helps explain how deviations of real GDP from potential output can and do occur. We will explore the effects of changes in aggregate demand and in short-run aggregate supply in this section.

What is the effect of a reduction in aggregate demand?

Consider next the effect of a reduction in aggregate demand (to AD3 ), possibly due to a reduction in investment. As the price level starts to fall, output also falls. The economy finds itself at a price level–output combination at which real GDP is below potential, at point C. Again, price stickiness is to blame. The prices firms receive are falling with the reduction in demand. Without corresponding reductions in nominal wages, there will be an increase in the real wage. Firms will employ less labor and produce less output.

How does rigidity affect output price?

Since wages are a major component of the overall cost of doing business, wage stickiness may lead to output price stickiness. With nominal wages stable, at least some firms can adopt a “wait and see” attitude before adjusting their prices. During this time, they can evaluate information about why sales are rising or falling (Is the change in demand temporary or permanent?) and try to assess likely reactions by consumers or competing firms in the industry to any price changes they might make (Will consumers be angered by a price increase, for example? Will competing firms match price changes?).

What does price stickiness mean?

Wage or price stickiness means that the economy may not always be operating at potential. Rather, the economy may operate either above or below potential output in the short run. Correspondingly, the overall unemployment rate will be below or above the natural level.

Where does long run equilibrium occur?

Long-run equilibrium occurs at the intersection of the aggregate demand curve and the long-run aggregate supply curve. For the three aggregate demand curves shown, long-run equilibrium occurs at three different price levels, but always at an output level of $12,000 billion per year, which corresponds to potential output.

What is the point where aggregate demand crosses SRAS and LRAS?

The point where Aggregate Demand crosses SRAS and LRAS is the equilibrium price level. This is a strange number. It's like the average price of all good and services.

Why is the aggregate demand curve downward sloping?

The first is the wealth effect. The aggregate demand curve is drawn under the assumption that the government holds the supply of money constant. One can think of the supply of money as representing the economy's wealth at any moment in time. As the price level rises, the wealth of the economy, as measured by the supply of money, declines in value because the purchasing power of money falls. As buyers become poorer, they reduce their purchases of all goods and services. On the other hand, as the price level falls, the purchasing power of money rises. Buyers become wealthier and are able to purchase more goods and services than before. The wealth effect, therefore, provides one reason for the inverse relationship between the price level and real GDP that is reflected in the downward‐sloping demand curve.

Why does aggregate demand curve slope downward?

The reasons for the downward‐sloping aggregate demand curve are different from the reasons given for the downward‐sloping demand curves for individual goods and services. The demand curve for an individual good is drawn under the assumption that the prices of other goods remain constant and the assumption that buyers' incomes remain constant. As the price of good X rises, the demand for good X falls because the relative price of other goods is lower and because buyers' real incomes will be reduced if they purchase good X at the higher price. The aggregate demand curve, however, is defined in terms of the price level. A change in the price level implies that many prices are changing, including the wages paid to workers. As wages change, so do incomes. Consequently, it is not possible to assume that prices and incomes remain constant in the construction of the aggregate demand curve. Hence, one cannot explain the downward slope of the aggregate demand curve using the same reasoning given for the downward‐sloping individual product demand curves.

What is the classical view of LRAS?

A further complication is that there are different views of the LRAS. The Classical view is an inelastic LRAS. The Keynesian view suggests it is elastic at a point up to inelastic. In a sense the Keynesian view is a combination of the short run aggregate supply and long run. The Keynesian LRAS shows that there is a point in the economy of spare capacity where firms can use more. There also comes a point where full capacity is reached.

What is the LRAS curve?

The LRAS curve is the quantity of goods the economy has the potential to produce if all the factors of production are being used efficiently. This can also be called Potential GDP. This curve is not sloped. Long term economic growth is illustrated by shifting the LRAS curve to the right.

What affects the short run aggregate supply?

The short run aggregate supply is affected by costs of production. If there is an increase in raw material prices (e.g. higher oil prices), the SRAS will shift to the left. If there is an increase in wages, the SRAS will also shift to the left.

When does a shift in the SRAS curve occur?

A shift in the SRAS curve only occurs when there’s change in the cost of production for firms.

What are the implications of input costs?

What are the implications? Since input costs adjust proportionately, profit margins will not change. Thus, the company has no incentive to increase production or reduce production. As a result, if we plot the relationship between real GDP and the price level, the long-run aggregate supply curve will be vertical.

What is short run aggregate supply?

What’s it: Short-run aggregate supply refers to aggregate output when some costs are variable. However, wages and some other input costs are inflexible and do not fully adapt to the price level changes. When the price level rises, wages and some other input costs remain constant. Therefore, firms can then increase profits by increasing output.

Why does the short run aggregate supply curve shift to the left?

Thus, we can conclude, the short-run aggregate supply curve shifts to the left because of: Increase in input prices.

Why does an increase in price level increase profit margin?

Therefore, an increase in the price level increases the company’s profit margin. This situation encourages them to increase output to obtain higher profits.

What does a change in the price level mean?

Thus, a change in the price level causes output to change and move along the curve. It will not shift the curve right or left.

What is higher future price expectation?

Higher future price expectations. Business expectations show you the optimism (pessimism) of the company in generating future profits. Suppose businesses expect their product’s price to increase in the future, relative to the general price level. In that case, they see a higher profit margin. To get a better profit margin, the company will build up inventory by increasing output. As more firms become optimistic, it will increase aggregate output.

What causes a curve to shift to the right?

And, a curve shift to the right or left occurs when other determinants change. These factors may affect the production cost or affect the availability and quality of the capital or labor (long-run factors). Belo, factors shift the short-run aggregate supply curve:

What Shifts Aggregate Supply?

These include technological innovations, changes in labor size and quality, changes in production costs, availability of resources, subsidies, changes in wages and taxes, and the current inflation level. These factors can either lead to positive or negative shifts in the aggregate supply curve.

What does SRAS mean?

An increase in price level in the short-run aggregate supply (SRAS) means a resulting increase in the total output as companies look to profit from higher prices. This goes back to the notion that the short-run curve is upward sloping. The higher the price, the higher the output due to a company’s desire for profit.

What is the Keynesian LRAS theory?

For instance, the Keynesian LRAS theory asserts that long-run aggregate supply only remains price elastic up to a certain point. After this point, supply essentially becomes uninfluenced by price changes. In other words, there is a point in the economy where producers of goods and services can expand their capacity.

Why is the LRAS curve vertical?

It’s because the real GDP in the long-run is dependent on the supply of capital, labor, raw materials, and other factors outside of price. As such, the quantity produced within that period remains the same regardless of changes in the price level (price inelastic). This is a stark difference from the supply curve for individual goods which are upward sloping. In this case, it’s because the curve has to do with the prices of goods in relation to other goods or services. Businesses can, therefore, take advantage of relative prices to increase output.

How does the aggregate supply curve work in the short run?

In the short run, the aggregate supply curve reacts to the price level. This means it goes upward sloping rather than full vertical. The SRAS curve is also drawn to reflect some variables, such as the nominal wage rate. This nominal wage rate is fixed in the short run so a rise in price implies higher profit potential to justify the increase in production. This differs in the long run where the nominal wage rate is dependent on economic conditions (low unemployment levels lead to higher nominal wages and vice-versa).

Why does the supply curve for individual goods have an upward slope?

The supply curve for an individual good assumes that input prices remain constant. As the price of a product goes up, the sellers’ per-unit costs of providing the product do not change, and so they are willing to crank the supply more . This is why the supply curve for individual goods typically has an upward slope.

Why is the SRAS elastic?

For the SRAS, the number of goods or services supplied increases as the price goes up. Therefore we generally view the SRAS as elastic. Mainly because in the short-run, companies can alter their variable factors of production to increase output.