What is the average fed funds rate?

Interest Rate in the United States is expected to be 0.25 percent by the end of this quarter, according to Trading Economics global macro models and analysts expectations. In the long-term, the United States Fed Funds Rate is projected to trend around 0.75 percent in 2022 and 1.00 percent in 2023, according to our econometric models. 1Y. 5Y. 10Y.

What is the current US federal funds rate?

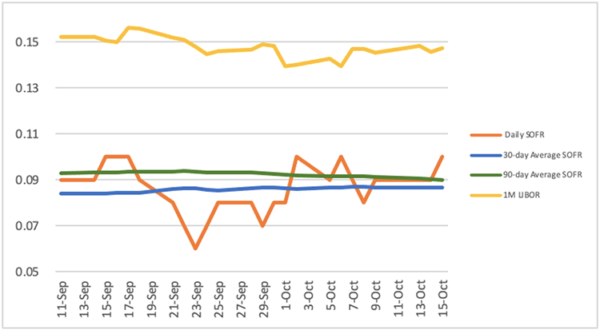

Federal Funds Effective Rate (DFF) Federal Funds Effective Rate. (DFF) 2021-12-28: 0.08 | Percent | Daily, 7-Day | Updated: 3:17 PM CST. Observation: 2021-12-28: 0.08 (+ more) Updated: 3:17 PM CST. 2021-12-28:

What is the current effective fed funds rate?

Effective Federal Funds Rate (DFF) Effective Federal Funds Rate. (DFF) 2021-04-27: 0.07 | Percent | Daily, 7-Day | Updated: 4:47 PM CDT. Observation: 2021-04-27: 0.07 (+ more) Updated: 4:47 PM CDT. 2021-04-27:

What is fed funds prime rate?

The “prime rate” is the interest rate offered by commercial banks to its most valued corporate customers. But in reality, it just serves as a benchmark for lending rates. The prime rate always adjusts based on how the Fed moves the discount rate. If the discount rate is increased, the prime rate will follow suit. And vice versa.

What tends to be the relationship between the prime rate and the federal funds rate in the US?

What tends to be the relationship between the prime rate and the federal funds rate in the United States? a)The prime rate tends to be one percentage point higher than the federal funds rate.

What is the relationship between the Federal Reserve and interest rates?

When the Fed makes it more expensive for banks to borrow by targeting a higher federal funds rate, the banks in turn pass on the higher costs to their customers. Interest rates on consumer borrowing, including mortgage rates, tend to go up.

What is the difference between the discount rate the federal funds rate and the prime rate?

The discount rate is not an index, so for loans that they make to each other banks use the federal funds rate, without adding a margin. The prime rate is a short-term rate; but not as short as the discount rate, which is typically an overnight lending rate.

How do federal rates influence prime rates?

The federal funds rate influences the prime rate, which influences all other interest rates, such as the rates on mortgages and personal loans. But if interest rates fall, the same home for the same purchase price will result in lower monthly payments and less total interest paid over the life of the mortgage.

How does the federal funds rate influence other interest rates?

The Federal Reserve's main instrument for achieving stable prices and maximum employment is the target for the federal funds rate. The idea is that by affecting the rate at which banks lend to each other overnight, other interest rates may be affected.

What happens when the Federal Reserve raises interest rates?

A Fed rate increase can slow the economy by pushing up borrowing rates and raising the annual percentage rate on savings. If rates rise, it becomes more costly to borrow money. When the Fed boosts its lending rate, consumers and businesses can see increased costs for borrowing, which can discourage spending.

What is the difference between the federal funds rate and the discount rate quizlet?

Federal funds rate is the interest banks charge each other for loans. Discount rate is the Federal Reserve charges for loans to commercial banks.

Why is federal funds rate lower than discount rate?

The discount rate is typically set higher than the federal funds rate target, usually by 100 basis points (1 percentage point), because the central bank prefers that banks borrow from each other so that they continually monitor each other for credit risk and liquidity.

What are the discount rate the federal funds rate and the prime rate Why are they important?

The Federal Reserve uses the prime rate as an index for various types of loans such as home equity lines, mortgages and more. The discount rate is the interest rate that banks in the U.S. banking system, or Federal Reserve system, use to make loans to other banks within the system.

What happens when prime rate increases?

If the prime rate rises, the interest rates on your loans and adjustable-rate credit cards will rise as well. Second, the prime rate affects liquidity in the financial markets. When the rate is low, liquidity increases.

How does the federal funds rate work?

How Does the Federal Funds Rate Work? The federal funds rate is the interest rate that banks charge each other to borrow or lend excess reserves overnight. 9 Law requires that banks must have a minimum reserve level in proportion to their deposits. This reserve requirement is held at a Federal Reserve Bank.

What part of the economy does the prime rate most directly influence?

The prime most directly affects adjustable-rate mortgages. As it fluctuates, so should your adjustable rate at the annual reset. The impact is greatest on shorter-term loans; if you have a 30-year mortgage, it might not move much when the prime decreases.

What is federal funds rate?

The federal funds rate is the interest rate that banks charge each other for overnight loans. When a bank has too much money out on loans and doesn't have enough cash to meet the Federal Reserve Bank's reserve requirements, it can borrow money from a colleague bank. While banks are free to charge each other whatever rate they want, ...

What is prime rate?

Prime Rate. At one time, the prime rate was the rate that banks charged their best customers. However, during the latter half of the 1980s, banks started making loans to particularly large and stable clients at rates below the prime rate. Once that happened, the banking industry started calling their prime rate their corporate base rate ...

How much higher was the prime rate in the 1980s?

The prime rate used to fluctuate a bit against the federal funds rate. In the 1980s, it was 187 basis points, or 1.87 percent, higher than the federal funds rate. Through the 1990s, it was 281 basis points higher. When the Federal Reserve started specifying a range for the federal funds rate, the prime rate became set to be 300 points above ...

Does the Fed rate affect HELOC?

The prime rate, though, may have a more direct relationship to your mortgage. Some adjustable rate mortgages use the prime rate as an index and home equity lines of credit are frequently tied to prime. This means that moves in the prime rate, or in the linked federal funds rate, could directly impact your HELOC.

Does the Fed have a discount rate?

While banks are free to charge each other whatever rate they want, the Fed sets a target for what it would like to see them use. It also has its own discount rate, set above the federal funds rate, that provides an alternative for banks and helps to set a ceiling for the federal funds rate.

Is the Federal Funds Rate the same as the Bank Prime Rate?

The federal funds rate and the bank prime rate are similar, since banks generally set the prime rate to track the federal funds rate. However, they serve different purposes. They're also both only tangentially related to mortgages.

What is the Federal Reserve's main instrument for achieving stable prices and maximum employment?

The Federal Reserve’s main instrument for achieving stable prices and maximum employment is the target for the federal funds rate. The idea is that by affecting the rate at which banks lend to each other overnight, other interest rates may be affected. In turn, this would also affect nominal variables (such as inflation) and real variables ...

When did the Fed end its near zero policy?

In December 2015, the Fed ended seven years of near-zero policy rates. Through a series of increases since then, the target rate has been gradually raised by one percentage point. The current monetary policy outlook, as stated recently by Fed Chair Janet Yellen, is to continue increasing the target rate due to worries that a strong labor market may ...

Is the Fed letting inflation stray away from its annual target?

These observations rely on the Fed not letting inflation stray significantly away from its annual target, which has been set at 2 percent. It is thus likely that, despite the continuing rate hikes, the government, firms and households will all continue to enjoy historically low interest rates on their long-term liabilities.

What is prime rate?

The prime rate is an interest rate determined by individual banks. It is often used as a reference rate (also called the base rate) for many types of loans, including loans to small businesses and credit card loans.

Does the Federal Reserve set the prime rate?

Although the Federal Reserve has no direct role in setting the prime rate, many banks choose to set their prime rates based partly on the target level of the federal funds rate--the rate that banks charge each other for short-term loans--established by the Federal Open Market Committee.