The rules for encashment are:

- For government employee: leave encashment can take place during the service or at the time of retirement. ...

- For non government employee: if they opt for leave encashment at the time of retirement the amount will be partially exempted from the tax.

- For both employee: if they en-cash their leaves during their service the amount will be fully taxed.

What are the rules of leave encashment for government employees?

As per the rules a government employee or a non government employee both can take the facility of leave encashment. The rules for encashment are: For government employee: leave encashment can take place during the service or at the time of retirement. If they en-cash their leave at the time of retirement, the amount will be exempted from the tax.

Do I have to pay tax on leave encashment?

The leave encashment amount received at retirement is exempt from taxation. The value of leave encashment is viewed as income from payroll and taxed at the employee's specific tax slab rate under income tax rules. An individual worker should not utilise all the leave he is entitled to avail in a year.

How is the leave encashment made?

The leave encashment is made on the last basic pay and dearness allowance (DA). Leave encashment that employees receive when they retire from their job: If any leave is left for an employee to use, he shall be allowed to encash the unveiled portion of the earned leave.

What is the formula for annual leave encashment?

Leave Encashment Formula The formula for the calculation annual leave encashment is: Annual leave encashment = (no of leave x 12) x (gross monthly salary x 12 / 365) Leave Encashment Exemption, limit under Income Tax

What is leave encashment rules in India?

Therefore, members of the All India Services are entitled for encashment, of earned leave for 10 days each subject to the maximum of 60 days in the entire career; and a maximum of 300 days of earned leave on retirement/death under rule 20A of the All India Services(Leave) Rules, 1955.

What is provision for leave encashment?

Leave encashed at the time of retirement or resignation Leave encashment received by legal heirs of deceased employee is fully exempt. Leave encashment received by Non-Government employee is exempt based on the computation provided under Section 10(10AA)(ii) and balance amount if any is taxable as 'income from salary'

How leave encashment is calculated in India?

Leave encashment is calculated with the following formula. = [(Basic Salary + Dearness Allowance) / 30] * No of EL Here, EL= Earned leave.

What is the maximum limit of leave encashment?

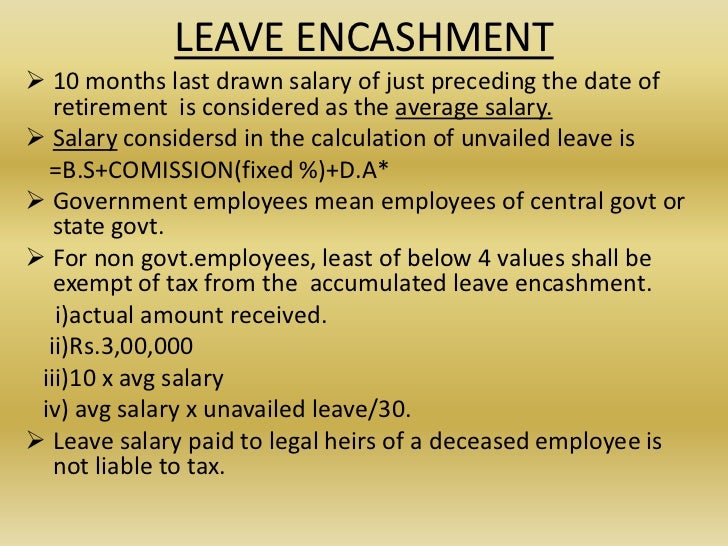

Amount received as leave encashment. The maximum limit as stated by government is Rs 3 Lakhs. Last 10 months average basic salary and dearness allowance before leaving the job. For each completed year of service, the cash equivalent of the leave balance is limited to 30 days.

How do I calculate my leave pay?

An employee has to work for a minimum of 240 days in a year to be eligible for an earned leave. But in case an employee joins mid-year then his total working days should be two-thirds of the total number of office days. One year is taken as 1st January to 31st December for earned leave calculation.

How is leave encashment salary calculated?

(ii) Actual Leave encashment received. (iii) Average salary of last 10 months * 10 months. (iv) Cash equivalent of unavailed leave [unutilised leave in months (considering maximum 30 days leave per year) * Average salary of last 10 months]

How do you encash annual leave?

Step 1: Since annual leave is based on a per year basis and not per month, you will need to find out the per day working rate of the employee. Step 2: Find out the leave balance and multiply the daily rate with the leave days meant to be encashed.

How is PL encashment calculated?

If PL is 21 working days a yr., then the calculation should be , (basic+d.a.)/26*no. of days to be encashed. Basic+DA/26 = amount payable for one day PL/EL to be encashed i.e. Rs. 00000 x No.

Is provision for leave encashment mandatory?

Earned leaves and sick leaves are mandatory in most of the state labor laws, however, the minimum number of leaves vary. For instance, the Factories Act and Karnataka Shops & Establishments law requires a minimum of one day for every 20 days worked is to be provided as earned leave.

Is leave encashment is taxable?

Any leave encashed during service is fully taxable and forms part of 'income from Salary'. However, relief under Section 89 can be claimed. Leave encashment received at the time of retirement / resignation is fully exempt for Central or State Government employee.

What is leave encashment exemption?

Exemption under Section 10(10AA) A part of the leave encashment income at the time of superannuation or resignation is exempt from income tax payment. This exemption is applicable to the lowest of the below amounts: Rs. 3 lakh.

How is leave encashment exemption calculated?

Solution:Leave encashment actually received i.e. Rs. 10,00,000.10 months average salary @ (50,000+20,000) i.e. 70,000 PM x 10 months = 7,00,000.Cash equivalent of unavailed leave on the basis of 30 days leave for every completed year of service = 30 days x 30 years = 900. Less: Already availed = 600. ... Rs. 3,00,000.

Q: What is the maximum limit of leave encashment?

Ans: 300 days is the maximum limit of leaves that an employee can take in their service duration and the maximum of leaves applicable for encashment.

Q: Can casual leaves be included in leave encashment?

Ans: No, casual leaves expire when the year ends. Casual leaves cannot be clubbed with earned leaves or sick leaves. Unlike earned and privileged l...

Q: Is the leave encashment taxable?

Ans: It is exempted from taxation for government employees, but if you are a non-government employee, it may be partially exempted from taxes as pe...

Q: What is the concept of paid leave?

Ans: The leaves that are allowed to an employee in their term of service. Generally, they are allowed to have 1 day of leave for every 20 days they...

What is leave encashment?

Leave encashment is the amount of money that an employee will get against his / her leave. The employees can convert their leaves into cash by not taking them during their services. Governmental as well as non-government employees can opt for leave encashment. There are three ways to receive the money, during the service or at the time of retirement, or at the time of resigning/termination. There is also tax exemption on the leave encashment. In 7 th pay commission the rules have changed a little regarding leave encashment. Here in this article we will discuss the rules and how leave encashment gets calculated in detail.

How many days can you take for leave encashment?

Under section 79 (5) of the mentioned Act, the maximum numbers of days are said to be 30 days and if that exceeds the leave encashment will be nullified automatically. After 6 th pay commission the number of days has been increased to 60 days. Some of the companies give away the leave encashment amount to their employees every year to lowering the liabilities.

How many days can you encash a factory?

As per the Factories Act, the leave encashment must not exceed 60 days in a year. As per the act and policy of the encashment of the leave, the employee will receive the amount at the time of retirement or at the time of resignation/termination from the job.

How many days can you have earned leave in the 7th pay commission?

The maximum number of days for earned leave in service is 300 days at the time of retirement. 300 days excluding the 60 days earned leave encashment during LTC.

How long can you encash your leave?

For both employee: if they en-cash their leaves during their service the amount will be fully taxed. The maximum limit of leaves for encashment is 60 days. These 60 days are excluded from the maximum numbers of leaves in a year for any employee.

How many days can you have in retirement?

The maximum number of days for earned leave in service is 300 days at the time of retirement.

Is encashment considered income?

Leave encashment is considered as a part of income. It is said to be income from the salary. Those who don’t take leaves instead encashing them need to pay income tax on the amount they receive. A portion of the amount is deducted from the annual leave encashment before the income tax is been imposed.

What is encashment of leave?

Leave Encashment: Calculation & Taxation. All salaried have different type of leaves namely: Sick Leave, Casual Leave, Earned/Privilege leave, etc. If employees take lesser leaves than they are eligible for, most employers encash the left over leaves either annually or at the time of leaving the company.

How many leaves can be carried forward every year?

There is no fixed rule as how much leaves can be carried forward every year or how many leaves can be encashed. Most employers have their own rules. Usually the basic salary and dearness allowance is taken in consideration for calculation of the amount.

Is encashment of leave taxable?

There are differences between tax experts on the tax treatment of leave encashment at the time of resignation. Some consider it as taxable while others other consider the tax treatment same as at the time of retirement. We support the later:

Is there a statutory compulsion to have leave encashment?

There is no statutory compulsion to have Leave Encashment Policy. So your employer may or may not have leave encashment at their discretion.

Is encashment tax dependent on retirement?

The tax of leave encashment is dependent on if you are government or private sector employee, or if you are encashing it at the time of retirement or mid-way. We take each case separately.

What is the definition of a termination?

1) during the period of employment or. 2) at the time of retirement (including separation on account of resignation, retrenchment, VRS etc other than termination) of the employee or. 3) at the time of Termination of the employee.

Can Relief u/s 89 be claimed?

iii. Relief u/s 89 read with Rule 21A can be claimed by the employee in cases where the amount of leave encashment is fully taxable.