What is current Florida sales tax rate?

The state general sales tax rate of Florida is 6%. Florida cities and/or municipalities don't have a city sales tax. Every 2021 combined rates mentioned above are the results of Florida state rate (6%), the county rate (0% to 2.5%). There is no city sale tax for the Florida cities. There is no special rate for Florida.

Does Florida have local sales tax?

Historically, compliance rates with with the Florida Use Tax have been low. Florida does not allow local jurisdictions like cities or counties to collect a local sales tax. The Florida state sales tax of 6% is applicable statewide. You can view the sales tax rates for various cities in Florida here.

What is the local sales tax in Florida?

The state sales tax rate in Florida is 6.000%. With local taxes, the total sales tax rate is between 6.000% and 7.500%. Florida has recent rate changes (Thu Jul 01 2021). Select the Florida city from the list of popular cities below to see its current sales tax rate.

How much is sales tax in Florida?

Florida Sales Tax. The statewide sales tax rate in Florida is 6%. Additionally, some counties also collect their own sales taxes of up to 1.5%, which means that actual rates paid in Florida may be as high as 7.5%. According to the Tax Foundation, the average sales tax rate in Florida is 7.01%, 23rd-highest in the country.

How long do you have to keep records in Collier County?

What are the penalties for non-compliance?

When are Collier County taxes due?

How many exceptions to the reporting schedule?

What is a tourist tax return?

What is included in a warrant?

Who is responsible for collecting and remitting the tax in Collier County?

See 2 more

What is sales tax Naples Florida 2022?

7%The minimum combined 2022 sales tax rate for Naples, Florida is 7%. This is the total of state, county and city sales tax rates. The Florida sales tax rate is currently 6%.

What is sales tax for Naples FL?

Zip code 34108 is located in Naples, Florida. The 2022 sales tax rate in Naples is 7%, and consists of 6% Florida state sales tax and 1% Collier County sales tax.

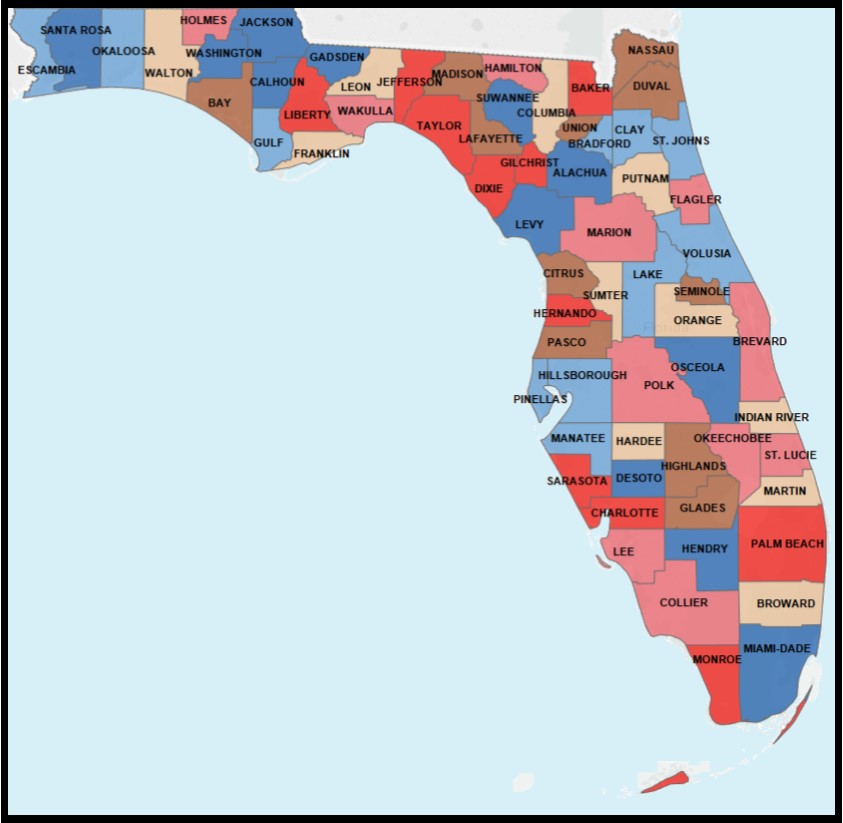

What is the highest taxed county in Florida?

Looking at the average total property tax millage rates in 2021 published by Florida Tax Watch, the highest rates were paid in St. Lucie, Alachua, Broward, and Duval counties. The highest per capita total property tax levies were Monroe ($3,435), Walton ($3,289), and Collier ($3,081) counties.

Is FL sales tax 7%?

The Florida (FL) state sales tax rate is currently 6%. Depending on city, county and local tax jurisdictions, the total rate can be as high as 8%.

What city in Florida has the highest sales tax?

Combined with the state sales tax, the highest sales tax rate in Florida is 7.5% in the cities of Jacksonville, Tampa, Tallahassee, Tampa and Kissimmee (and 94 other cities)....Florida City and Locality Sales Taxes.City NameTax RateMiami, FL7%Orlando, FL6.5%Tallahassee, FL7.5%Fort Lauderdale, FL7%163 more rows

What counties in Florida have the highest property taxes?

Monroe County has the highest per capita property tax levies, totaling $3,435 in tax year 2021.

At what age do you stop paying property taxes in Florida?

Certain property tax benefits are available to persons 65 or older in Florida.

What county is the poorest in Florida?

DeSoto, a landlocked county in south central Florida, ranks as the poorest county in the state....This Is the Poorest County in Florida.StateFloridaPoorest CountyDeSoto CountyLargest Place in CountyArcadiaMedian Household Income$35,438State Median Household Income$55,66041 more columns

What is the healthiest county in Florida?

JOHNS COUNTY IS THE HEALTHIEST IN FLORIDA! In 2022, for the eleventh consecutive year, St. Johns County was ranked the healthiest county in Florida, according to the national County Health Rankings, published by the University of Wisconsin's Population Health Institute and the Robert Wood Johnson Foundation.

When did Florida sales tax go up to 7 %?

January 1, 2016The combined state and local sales and use tax rates are as follows: 7% for the period January 1, 2016 - June 30, 2016 (includes 1% small county surtax). 7.5% for the period July 1, 2016 – December 31, 2025 (includes 1% small county surtax).

Where is the cheapest sales tax in Florida?

Florida Sales Tax Rates By City and County Including these local taxes, the lowest sales tax rate in Florida is 6% in nine cities, including Inverness and Crystal River, and the highest sales tax is 7.5% in 99 cities, including Jacksonville and Tampa.

What items are not taxed in Florida?

What purchases are exempt from the Florida sales tax?Clothing. 6%Groceries. EXEMPT.Prepared Food. 9%Prescription Drugs. EXEMPT.OTC Drugs. 6%

Do tourists pay sales tax in Florida?

According to Florida law, any person who enters into a bona fide written lease, for continuous residence of a transient accommodation for longer than six months, is exempt from Florida sales tax and local tourist development tax.

Can I include sales tax in my price in Florida?

No; The sales tax must be separately stated on all bills, receipts or sale slips issued to customers.

What is FL sales tax on food?

Sales by restaurants, caterers, and similar businesses are generally subject to Florida's state sales tax rate of 6% plus any applicable discretionary sales surtax.

How do you calculate Florida sales tax?

The state general sales tax rate of Florida is 6%. Florida cities and/or municipalities don't have a city sales tax. Every 2022 combined rates mentioned above are the results of Florida state rate (6%), the county rate (0% to 2.5%). There is no city sale tax for the Florida cities.

Collection of Tourist Tax – Collier County Tax Collector

Collection of the Tourist Tax. Every owner of a short-term accommodation is required to register with the Collier County Tax Collector.After completing the registration process, an account number will be assigned and a supply of Tax Return forms will be provided to the account holder.

Tourist Tax FAQ – Collier County Tax Collector

If I use a Rental Agency or Realtor do I need a Tourist Tax account number? Yes, every owner of a short-term accommodation is required to register with the Collier County Tax Collector. if a real estate agent is engaged, the agent has the responsibility of collecting and remitting the taxes to the office of the collier county tax collector in a timely manner. the agent must reference their ...

Collier County Tourist Tax Information http://www.colliertax.com/ttax ...

Fraud is dealt with severely, according to the provisions and the maximum extent of Florida law. Enforcement Procedures In addition to criminal sanctions, the Collier County Tax Collector is empowered, and

Short-Term Vacation Rental Registration | Collier County, FL

Short-Term Vacation Rental. Beginning January 3, 2022, Collier County Ordinance No. 2021-45 requires property owners to register their short-term vacation rental. The intent is to collect current and accurate information regarding short-term vacation rental properties, encourage the appropriate management of these properties, and protect the general health, safety, and welfare of the residents ...

Collier County, Florida Rental Property Tax - Business Licenses

We Make the Process of Getting a Collier County, Florida Rental Property Tax Simple. When you choose to work with Business Licenses, LLC, our experienced professionals can handle even the hardest parts of obtaining a rental property tax for you.

Sales and Use Tax on Rental of Living or Sleeping Accommodations

Florida Department of Revenue, Sales and Use Tax on Rental of Living or Sleeping Accommodations, Page 1 . What is Taxable? Florida’s 6% state sales tax, plus any applicable discretionary sales surtax, applies to rental charges or

How long do you have to keep records in Collier County?

Records must be maintained for a period for three (3) years and made available at the place of business. Any records located outside Collier County must be returned to Collier County prior to the scheduled audit.

What are the penalties for non-compliance?

The following penalties apply if the tax return is delinquent. – A penalty of ten (10%) percent for each thirty (30) days or fraction thereof – up to a maximum of fifty (50%) percent.

When are Collier County taxes due?

Taxes are to be remitted to Collier County monthly. They are due on the first of the month following the collection period. They are delinquent and penalized if not post-marked by the 20th day of that month.

How many exceptions to the reporting schedule?

Three exceptions to this reporting schedule exist.

What is a tourist tax return?

It is the responsibility of owners and rental agents to collect a tourist tax on all accommodations that are rented for six (6) months or less. Not paying or collecting tourist tax is a criminal tax violation.

What is included in a warrant?

The full amount includes interest, penalties, and cost of collections. The warrant is directed to the Sheriff and recorded in county public records.

Who is responsible for collecting and remitting the tax in Collier County?

If a Real Estate Agent is engaged, the AGENT has the responsibility of collecting and remitting the Tax to the office of the Collier County Tax Collector in a timely manner. The Agent must reference their client’s individual account number when remitting their client’s Tourist Development Tax. Click here for more information.

Summary

Collier County is located in Florida and contains around 7 cities, towns, and other locations. As for zip codes, there are around 24 of them. A full list of these can be found below. The average cumulative sales tax rate between all of them is 7%.

Sales Tax Chart For Collier County, Florida

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 7% in Collier County, Florida.

Sales Tax Rates and Calculator Disclaimer

The data here only represents the estimated common sales tax rate in this particular location. There may exist many exceptions depending on the type of business, the type of product sold, and other factors. For the sake of accuracy, please double check the official government websites that we have linked to for more details.

How long do you have to keep records in Collier County?

Records must be maintained for a period for three (3) years and made available at the place of business. Any records located outside Collier County must be returned to Collier County prior to the scheduled audit.

What are the penalties for non-compliance?

The following penalties apply if the tax return is delinquent. – A penalty of ten (10%) percent for each thirty (30) days or fraction thereof – up to a maximum of fifty (50%) percent.

When are Collier County taxes due?

Taxes are to be remitted to Collier County monthly. They are due on the first of the month following the collection period. They are delinquent and penalized if not post-marked by the 20th day of that month.

How many exceptions to the reporting schedule?

Three exceptions to this reporting schedule exist.

What is a tourist tax return?

It is the responsibility of owners and rental agents to collect a tourist tax on all accommodations that are rented for six (6) months or less. Not paying or collecting tourist tax is a criminal tax violation.

What is included in a warrant?

The full amount includes interest, penalties, and cost of collections. The warrant is directed to the Sheriff and recorded in county public records.

Who is responsible for collecting and remitting the tax in Collier County?

If a Real Estate Agent is engaged, the AGENT has the responsibility of collecting and remitting the Tax to the office of the Collier County Tax Collector in a timely manner. The Agent must reference their client’s individual account number when remitting their client’s Tourist Development Tax. Click here for more information.